No Reason to Doubt – Investing in a Mutual fund That You can Trust

Posted On Monday, Jun 27, 2022

Mutual funds have not garnered the same trust as conventional investments such as Fixed Deposits, because many people believe they could lose money as returns are not guaranteed.

Moreover, the way mutual funds in India are launched, marketed and (mis)sold has always led to a crisis for investors as we have seen in the recent past. Several AMCs have converted the profession of asset management to asset gathering - multiplying the wealth of the fund managers and CEOs,

However, you should not take these instances to generalize misconceptions about the industry.

Mutual funds are regulated by SEBI. They are transparent – unlike a Bank FD where you are not aware where your bank is putting your money, with a mutual fund, you can see where the fund house invests – you get daily NAV updates and monthly portfolio updates. Moreover, they are better positioned to potentially give you better inflation-beating returns than conventional investments like Bank Fixed Deposits. If you align your investments depending on your financial goals & risk profile and diversify using a prudent asset allocation strategy, there’s no reason to doubt Mutual Funds as a qualified avenue to build and grow your investments and achieve your goals.

There are many easily available indicators that help you to decide if the mutual fund is worth your trust:

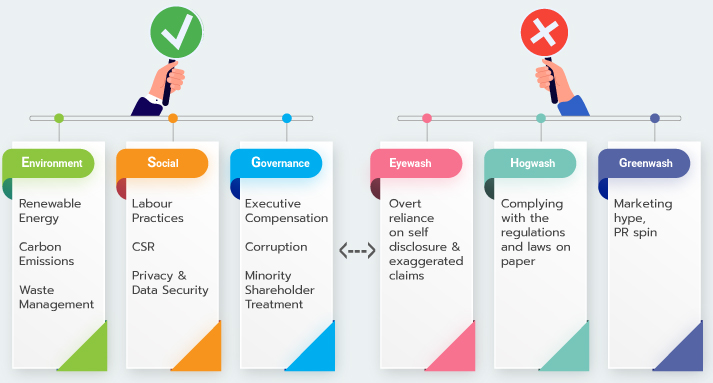

1. Focuses on sustainability and not greenwashing: Many AMCs have hopped on the sustainability bandwagon with little or no regard to whether the underlying companies follow ESG parameters (Environmental, Social and Governance) in letter and spirit, instead of resorting to ‘Greenwashing’ practices solely to gain market share. At Quantum, we are of the view that verification of ESG credentials still warrants a detective’s lens, and therefore, you cannot and must not rely solely on funds that rely solely on self-disclosures. The following infographic clarifies how Quantum prioritizes ESG to EHG (Eyewash, Hogwash and Greenwash)

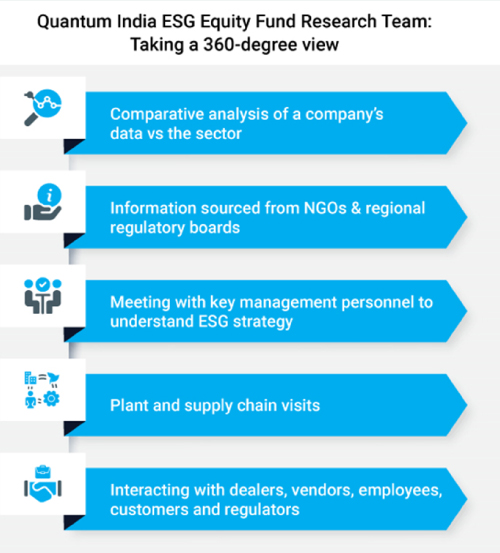

Quantum is one of the first AMCs to introduce ESG as a fund in India. What's unique about Quantum is that it banks on its own proprietary research, which has evolved through the years going through our own learning curve in the ESG space.

While screening companies, we subjectively evaluate more than 200 parameters across the Environment, Social and Governance domains. What our investors get is the result of a thorough & on-ground 360-degree view of the companies we invest in. Apart from company disclosures, we also use information sourced from NGOs & regional regulatory boards, data gathered from plant & supply visits, and our interaction with key management personnel, dealers, vendors, customers & regulatory & lots more.

2. Consistent performance, not significant outperformance. While consistent returns are an indicator to judge fund performance, if there is a significant outperformance against peers, assess the underlying fund portfolio exposure. Does it invest in safe and liquid instruments? For instance, both debt investments in the Quantum Mutual Fund Family – Quantum Liquid Fund and Quantum Dynamic Bond Fund limit credit and liquidity risk by choosing to NOT invest in private papers. They follow prudent risk management and team-driven portfolio investment processes based on funds’ objectives. They invest in government securities and T-bills and AAA rated PSU bonds prioritizing safety and liquidity over returns. Liquid Funds also qualify to be a valid source for building your emergency corpus. As investors, your focus is to assess the quality of the underlying investments and whether they cater to the liquidity and safety angle so that you can withdraw from your investments during times of emergencies.

3. Staying true to the investment mandate: Assess if the fund manager frequently changes the investment mandate depending on the market environment. For instance, during the 2016-2019 period, the market environment was more in favour of growth-oriented investments over value due to concentrated rally and polarization in the market. During these times, Quantum Value Fund Managers have been walking the talk on integrity and embraced the underperformance rather than covering up by leaning towards growth to gain returns and exposing investors to higher risk. Now, during periods of high inflation and rising interest rates, value funds are coming into vogue again due to the lower risk of downside as compared to growth-oriented funds. This is when sticking to the investment mandate will likely pay off!

4. Going above and beyond with purity: When it comes to purity in your gold investments, Quantum Mutual Fund goes above and beyond through frequent audits of the underlying gold bars and conducting independent purity tests to ensure all gold bars underlying Quantum Gold Fund ETF are 99.5% pure 24 K Gold. It aids convenience and ease of investing through SIP in Gold investments with Quantum Gold Savings Fund with underlying investment in Gold.

5. Investor First Approach instead of Garnering Higher AUMs: Many fund houses have introduced NFOs in an attempt to benefit from the growing retail investor participation and garner higher AUM. Do not get lured by popular NFOs (New Fund Offers), market caps, and themes. Remember, your goals are different from other investors. At Quantum, we have been very clear in our approach to introducing funds. We have launched funds whenever we feel there is a gap in the investor basket from a diversification and convenience standpoint.

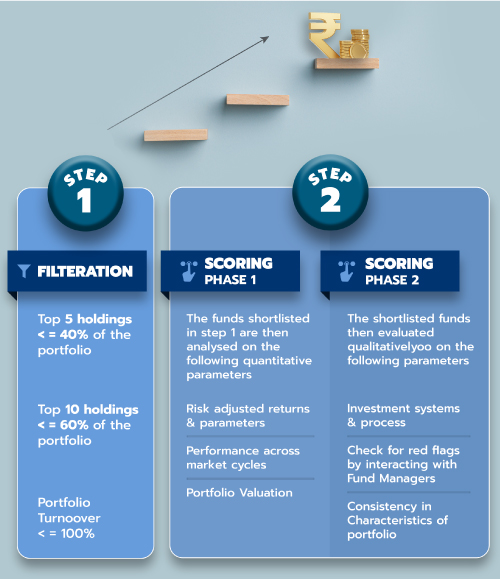

For instance, when we introduced the Quantum Equity Fund of Funds, our intention was to offer a portfolio comprising of well-researched third-party funds. We look for possible red flags through regular interaction with the fund managers of the underlying funds – A step ahead from what would conventionally be possible if you were to evaluate the fund on your own.

Overall, you have access to 10 simple products across asset classes of equity, fixed income and gold meticulously launched with an intention to serve as building blocks to create the perfect Asset Allocation Strategy that meets your needs.

Know more about 12:20:80 Asset Allocation Strategy

Don’t limit your options because of your limited exposure to mutual fund investments. Trust the data and numbers, and look at the track record of the fund house and its consistency to build your future goals.

|

|

| Related Articles | ||

| Keep CALM and INVEST On | ||

| Beat Inflation: Time to Move Beyond Bank Deposits | ||

| Is Your Portfolio in a Free fall? Or Are You on Your Dream Vacation |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk. |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds Tier I Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme Tier I Benchmark: NIFTY100 ESG TRI | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund Tier I Benchmark: Domestic Price of Physical Gold | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on May 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on May 31, 2022

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More