Liquid Funds vs Bank FD

Posted On Tuesday, Jun 14, 2022

We all know that we cannot put all our savings into one asset class as this may tends to be more vulnerable to market fluctuations, making it inherently a riskier investment option.

To diversify the portfolio, we need to allocate a portion of our portfolio to debt, based on our investment objectives and risk appetite. Although most of us are aware of the significance of debt investment, choosing a suitable debt product from a plethora of available options can be overwhelming.

Two of the most preferred debt investment options are liquid funds and bank Fixed Deposits, which make most investors perplexed when choosing between them. This article compares Liquid Funds vs Bank FD so that you can make an informed decision about your debt investment.

Liquid Funds & Bank FDs:

There are times when you have surplus funds available for a short duration, or you want to invest money to achieve your short-term goals like buying furniture or electronic appliances for the house, family vacations, family functions or parties, home improvements, and building contingency funds, etc.

When we think of these short-term goals, one of the option that comes to our mind is Fixed Deposits. It lets you deposit the money in a lump sum for a certain period of time generally at a higher rate of interest than a regular Savings Account. The Bank FD interest rate is fixed and does not fluctuate with market conditions. Even if the bank changes the interest rate in future, they are bound to pay you the same rate they had offered at the time of making an FD. Hence, it is considered the safest investment option. To avail of the tax benefits, you have the option to invest in a Tax-Saver Fixed Deposit that comes with a lock-in period of 5 years.

On the other hand, Liquid Funds are a type of debt mutual fund that invests in short-term fixed income instruments, such as treasury bills, commercial papers, certificates of deposit, high-rated corporate or government bonds with lower maturity, etc. These money market instruments typically mature within a tenor of 91 days.

Liquid Funds vs Bank FD:

1. Risk Factor:

FDs have been a popular investment option amongst conservative investors for a long time because they comprise low to no risk. As stated earlier, the FD interest rate is fixed, not market-linked. Besides, even if the interest rate changes after you book an FD, you are entitled to receive the same interest rate at the time you booked it.

Moreover, each depositor in a bank FD is insured up to a maximum of Rs 5 lakhs for both principal and interest amount held by him under the Deposit Insurance Credit Guarantee Corporation (DICGC). In case of default or shut down of the bank, the deposits held in different branches of a bank are aggregated for insurance cover and a maximum amount of up to Rs 5 lakhs is paid to the depositor.

Liquid Funds generally involve low to moderate risk depending upon the underlying assets held by the Liquid Fund, the fund’s performance depends upon the market dynamics and interest rates prevailing at the shorter end of the maturity curve. Liquid Funds may holds CP, and CDs, issued by private issuers, which may be exposed to some degree of credit risk.

2. Returns:

The FD interest rates are guaranteed and subject to the policy rate actions of the RBI. The returns are generally higher than on a savings bank account and are fixed depending upon the tenure and the bank you choose. If you are a senior citizen, you may get a slightly higher interest rate.

On the other hand, Liquid Funds do not offer fixed or guaranteed returns, it is market-linked.

3. Investment Horizon:

The FD tenure ranges from 7 days to as long as 10 years. You can choose the FD term as per your investment objective and time horizon.

In the case of Liquid Funds, since they typically hold instruments with a short duration of up to 91 days, it is suitable for a shorter time horizon – for a few weeks to a year. It is usually suitable to park short term surplus money or to maintain contingency reserves.

4. Liquidity:

FDs like liquid funds too are liquid. Although you can prematurely withdraw the FD, a penalty may be levied, which generally is 1% of the applicable interest rate.

You can withdraw Liquid Mutual Funds without any exit load unless they are withdrawn within 7 days from the date of investment. Usually, there is no exit load on liquid funds if withdrawn after holding them for a minimum of 7 days.

5. Taxation:

If it is a tax-saver bank FD, you can claim a deduction of up to Rs 1.50 lakh per financial year under Section 80C of the Income Tax Act for the investment made. But if it is any other FD, no deduction is provided. Further, the interest earned on FD is taxable as per your applicable tax slab. The tax is deducted at source if the aggregate interest income on all fixed deposits exceeds Rs 40,000 per financial year in the case of non-senior citizens and Rs 50,000 for senior citizens.

On the other hand, in the case of Liquid funds taxation, the capital gains made are subject to Capital Gains Tax. For the units sold within a period of 3 years, the Short Term Capital Gains are taxed as per your income-tax slab.

But if the units of a Liquid Fund were held for more than 3 years, Long Term Capital Gain Tax is levied @ 20% with indexation benefit.

To Conclude:

As you see, both the options have their pros and cons. FDs are ideal for investors with low to zero risk tolerance, expecting returns slightly higher than Savings Accounts. On the other hand, Liquid Funds are ideal for short-term investors with low to medium risk tolerance who are okay with the idea of earning market-linked returns. Quantum Liquid Fund is one such liquid fund scheme that invests in money market instruments such as Government securities and AAA rated PSU/PFI bonds with a maturity not exceeding 91 days. The scheme has minimal interest and credit risk and forms as an option to an FD.

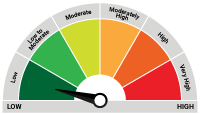

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk.) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More