Monthly SIP Vs. Lumpsum, Which One is Better?

Posted On Monday, Sep 26, 2022

Over the last decade, mutual funds have gained traction among retail investors looking for an efficient and hassle-free investment avenue. Mutual funds are known to offer two modes of investment to investors i.e. Lumpsum / One-time Investment Plan and the Systematic Investment Plan (SIP). However, when deciding to invest in mutual funds, many novice mutual fund investors are often confused about whether they should opt for SIP or a one-time investment, which one will be beneficial for them? Nevertheless, one can make the right decision of investing via One-time investment or SIP after considering several factors elucidated in this article.

Before jumping to the comparison of these two modes of investing in mutual funds, let’s first understand the basics clearly. The path may be different but the objective is to help build a substantial corpus for investors.

What is a Systematic Investment Plan (SIP)?

A regular investment of small amounts over an extended period of time in a mutual fund scheme of your choice is known as a Systematic Investment Plan (SIP). SIPs have a variety of benefits, such as rupee cost averaging, compounding, lighter on the wallet, convenience, no timing the markets, and instils the good habit of investing regularly to accomplish the desired financial goals.

Whereas, with a one-time investment plan in a mutual fund, the investor parks a large lump sum amount for a specific time. The one-time would yield good returns when invested at market lows. But the real question is how many of us would have that large one-time investment amount to invest keeping the financial goals in mind. Mutual Fund SIP route allows investors to invest as low as Rs 500/-, which encourages many novice investors to begin their journey toward wealth creation.

In fact, mutual fund SIP is the way to gradually invest in mutual funds at a predetermined interval, such as on a monthly or quarterly basis. Depending on the scheme, some fund houses also offer SIP frequency of daily, weekly, half-yearly, etc. However, the most popular one is the monthly SIP.

Why investors should opt for Monthly SIP?

Monthly SIP lets you allocate a fixed sum of funds in a periodic manner. In simple words, you can allocate a small amount regularly every month in your preferred mutual fund scheme.

Once you activate a Monthly SIP, the specified amount gets deducted from your savings bank account every month at a pre-defined date and is invested in the selected mutual fund scheme in a steady manner. Since the investment via SIP is done on a periodic basis, the investor does not need to have substantial funds to start investing in mutual funds. This systematic route of investment also injects financial discipline into the investors in the long run.

Investing via monthly SIP provides investors with the benefit of power of compounding. The returns earned on every SIP transaction remain invested in the fund for a long time and keep on compounding, thus, potentially generating higher returns for the SIP investors.

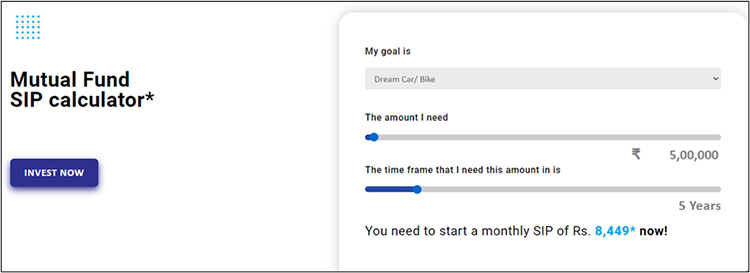

You can experience the power of compounding effect yourself by using an online SIP calculator, a tool available on several financial websites. Investors can use a free and easy-to-access online Mutual Fund SIP Calculator provided by Quantum Mutual Fund.

Calculate the value of your monthly SIP by entering a few details and the expected compounded returns on your SIP investments.

(Source: www.quantumamc.com)

Monthly SIP offers convenience by helping you set your SIPs towards your envisioned long-term financial goals and managing your monthly budget and cashflows accordingly. For salaried individuals who get a fixed income, monthly SIP plans would be preferable. Setting up an auto-debit facility for monthly SIP also prevents missing any instalment and maintains the financial discipline of investing regularly. And for those with irregular cashflows, like someone who has a business income and finds it tough to manage monthly SIP, they can even go for a quarterly SIP instead of a monthly one.

Benefits of investing in equity mutual funds via the SIP route:

If you want to invest in a mutual fund scheme with a high return potential, you can consider investing in equity mutual funds. Over the long term, equities have a greater potential to deliver a real rate of return. As a result, investors who need to achieve long-term goals may consider investing in equity mutual funds.

As equities are risky, investing through monthly SIP in equity mutual funds will help you mitigate risk better and negotiate the market volatility. If the market turns volatile or corrects from the present level, the inherent rupee-cost averaging feature of SIPs would take care of the intermittent volatility. You will automatically buy more mutual fund units when the market is in a correction phase. This will, in turn, help compound wealth when the market begins to rise again. However, investments through SIP is subject to market risk and do not assure a profit or returns or protection against a loss in downturn market.

A monthly SIP remains to be one of the wisest ways to invest in the equity markets to average out the cost of investing over various market phases. When compared to the one-time investment, which carries a significant risk to the investment amount, SIPs will be a better option for investors to enter the equity markets during uncertain market conditions.

What happens if the monthly SIP instalment is missed?

There might be a situation when you are unable to pay your SIP instalments in mutual funds. Insufficient balance in the bank account is one of the prime reasons that many investors miss their instalments of monthly SIP. Missing 1 or 2 instalments will not harm your corpus. Investors should ensure they maintain the required balance amount to honour the upcoming SIP instalment.

However, there are two things that you must keep in mind regarding missing your SIP instalments:

• If an investor misses 3 consecutive SIP instalments, the SIP investment is terminated by the mutual fund house.

• The bank may charge the investor a penalty at the time when the bank account balance is low and the investor misses out on a SIP payment. This is referred to as dishonouring the auto-debit payment. A charge is involved in such cases.

In case, you wish to skip a few SIP instalments due to any financial trouble or crunch. You can stop your SIP by sending a SIP Stop Request to the mutual fund house at least 30 days in advance. You can submit the request online or offline through the service request form. Pausing and resuming your monthly SIP does not have any additional charge.

Final words...

A basic rule of investing is that all of the investments you intend to make should be aligned with your risk tolerance, investment horizon, and financial goals. Investors can gain from potential wealth-building benefits through mutual funds with both SIP and one-time investments. However, the cash flows are the primary distinction between the two options. There is no rule prohibiting a SIP investor from making a one-time investment if the investible surplus funds are available. Ensure to make wise investment decisions as per your suitability

Whatever mode of investment you decide, whether SIP or one-time investment remember that holding back from making mutual fund investments or waiting for a correction may not be a wise move. You may miss out on the opportunity to generate wealth. You should begin investing in worthy mutual fund schemes as soon as possible so that you have more years to build a wealthy corpus.

Happy Investing!

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |