Mastering the Art of Attracting New Clients in Mutual Fund Distribution

Posted On Monday, Apr 08, 2024

In this day and age of fintech or financial technology, many robo-investment platforms are emerging. They perform risk profiling of investors online, suggest an asset allocation to follow, recommend mutual funds (and some other investment avenues), and even execute transactions.

But despite the pivotal role technology is playing, the services of human Independent Financial Advisors (IFAs) or Mutual Fund Distributors (MFDs) cannot be ignored.

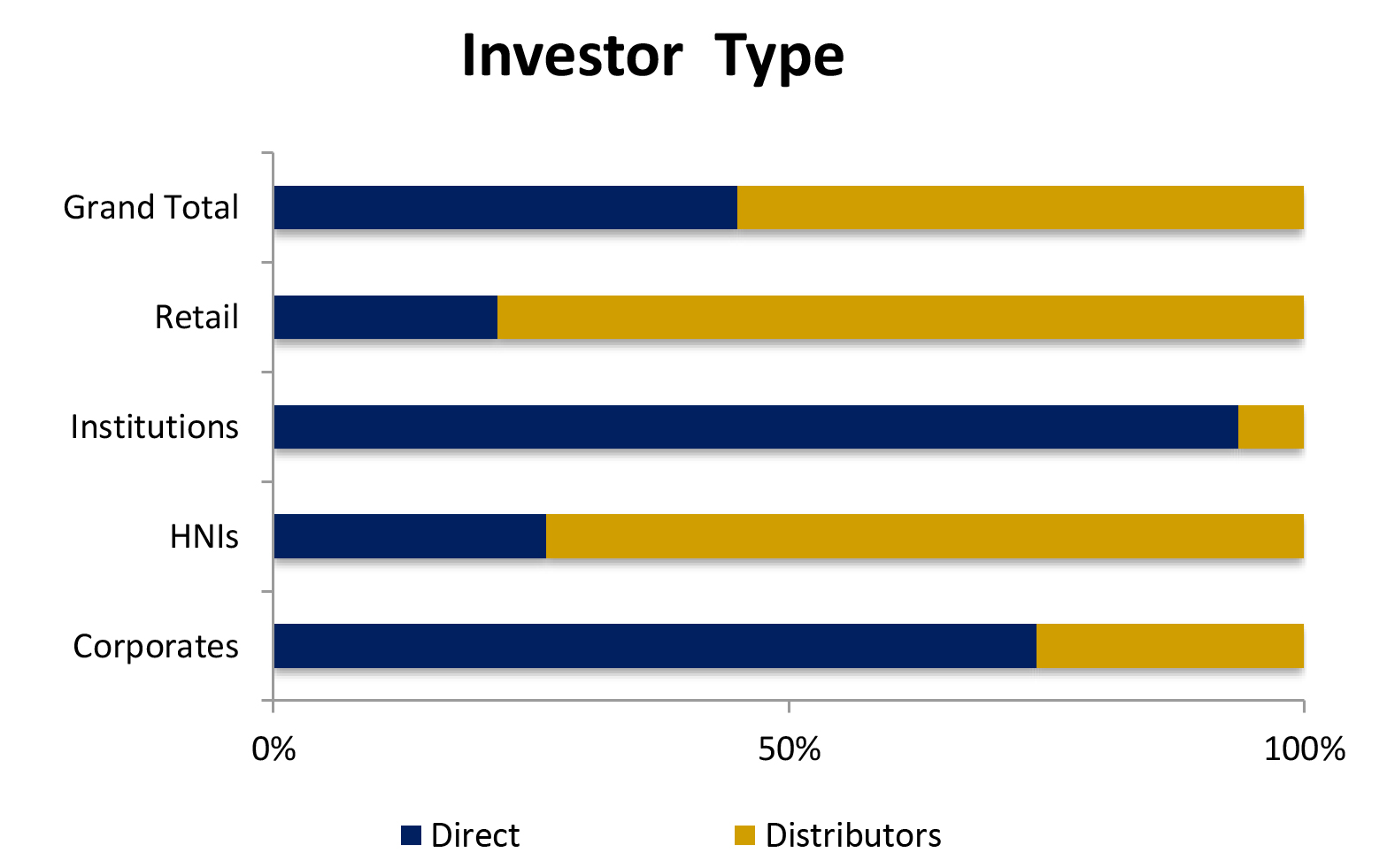

The AMFI data suggests that a significant number of investors, both retail and High Net Worth Individuals (HNIs), still depend on MFDs or IFAs to invest their hard-earned money.

Distributor v/s Direct

Data as of Nov 30, 2023

(Source: AMFI)

Distributors (including banks) account for 57% of the Indian mutual fund industry’s assets as of October 2023. This goes to say that MFDs and IFAs have an important role to play.

Having said that, the competition in the financial product distribution space is intensifying. In the first seven months of FY 2023-24, the Indian mutual fund industry has onboarded 11,600 individual distributors as per the data from the Association of Mutual Funds in India. Thanks to the growing interest of individual investors in mutual funds for wealth creation and to the MFD Karien Shuru campaign launched by AMFI in July 2022.

As the mutual fund distribution space gets crowded going forward, IFAs or distributors need to distinguish themselves from the crowd by rendering honest, ethical, and prudent advice. Doing so shall you, as a distributor, earn the trust, respect, and confidence of millions of investors.

Earning trust is not easy and cannot be done in one day, particularly in a world where investors have often been mis-sold financial products and felt betrayed. Building trust is a time-taking task and thus as IFAs and distributors you need to work towards building it consciously and constantly. One needs to go the extra mile, beyond the purview of the law and always act morally in the best interest of investors/clients (whereby it adds to goodwill).

Communicate empathically, effectively, transparently with investors/clients, follow the best reporting standards and disclosure norms (on the commission you receive), have checks and balances in place when the team size increases, and shape the culture of transparency and openness, and offer sensible investment solutions as you distribute financial products.

The needs and preferences of the investor/ potential client must be assessed.

“When it comes to investing, there is no such thing as a one-size-fits-all portfolio.” – Barry Ritholtz. Investing is an individualistic exercise. Thus understand the needs or requirements of the investor:

- The risk-taking ability

- Broader investment objective (whether capital appreciation or capital preservation)

- Envisioned financial goals

- Time in hand to achieve those envisioned goals.

Moreover, show compassion and care when sharing many of their personal details, such as their financial circumstances and envisioned goals. When offering investment solutions, ensure that they align well with the investor/client needs.

When recommending mutual funds, back it with thorough research (a host of quantitative and qualitative factors). Avoid just looking at only the past returns and/or mutual star ratings given on historical performance, which are in no way indicative of future returns.

When investors/clients expect unrealistic returns, explain that for every level of high return they seek, there is an element of risk. “The essence of investment management is the management of risks, not the management of returns," --- share this pearl of wisdom by Benjamin Graham, the father of value investing, with investors/clients.

Help investors/clients choose schemes from mutual fund houses that follow robust investment processes and systems and that have displayed a consistent performance track record, rather than on only star fund managers and star ratings.

To service clients effectively, adopt technology be it data software, practice management software, CRM, online calculators etc. Investors/clients are pretty impressed by it.

Furthermore, given that we all live in a ‘knowledge economy’, make sure to keep abreast with the latest developments in the world, be it the economy, industry, the world of finance, new products, and rules & regulations. Also, books on investing/finance, op-ed columns, blogs, etc. will ultimately help render valuable advice and service to investors/clients. Also, provide your existing clients with updates on the markets and their portfolio performance.

“In today’s environment, hoarding knowledge ultimately erodes your power. If you know something very important, the way to get power is by actually sharing it,” saysJoseph Badaracco, an American author and Professor of Ethics at Harvard Business School. So, share your knowledge and case studies with fellow colleagues in the industry and investors. This could be done at certain offline professional forums/platforms and even online.

Today to grow a business or professional practice, networking is important. Thus, ensure you do so at parties or get-togethers with friends and families, and other professional seminars attended by investors. Also, in the online world we live in, have a sensible presence on social media (WhatsApp, Telegram, Facebook, X, YouTube, etc.) by propagating pragmatic saving and investment ideas. It could help in reaching a wider targeted audience and grow business exponentially.

Consider Becoming a Mutual Fund Distributor with Quantum Mutual Fund

Quantum Mutual Fund helps investors achieve their financial goals with simple solutions across three key asset classes - equity, debt, and gold. Plus, we have ELSS for tax saving and ESG Fund for socially responsible investors.

For mutual fund distributors, Quantum Mutual Fund provides all the marketing collateral, access to our DIT (Distributor Initiated Transaction) platform, fund manager insights (through webinars and articles), and facilitates learning and educating your customer on the concepts of investing.

To know more visit- https://www.quantumamc.com/partner-corner

Quantum Mutual Fund has delivered good returns relative to the risk associated in the long term with robust investment processes and systems with an investor-first approach.

Empanel with us today and act as a ‘Financial Guardian’ to your investors while you aim to grow your mutual fund distribution business.

Build and grow your financial product distribution business righteously by having an enduring relationship with your investors.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Choosing the Right Mutual Fund for your Client?

Posted On Thursday, Jan 30, 2025

Choosing the right mutual fund can be a pivotal step towards building a secure financial future for your clients.

Read More -

The Importance of Regular Portfolio Reviews

Posted On Thursday, Jan 30, 2025

While managing a portfolio involves what one thinks will be suitable investments...

Read More