Lower For (No) Longer

Posted On Wednesday, Mar 17, 2021

The legendary investor Warren Buffet in his annual letter to shareholders wrote – “...bonds are not the place to be these days”. This may be true for many parts of the world where bond yields are near or below zero and investors are not being rewarded for being in fixed income.

Does this mean investors should stay away from Fixed Income? The answer is plain simple ‘NO’. Fixed income plays an important role in one’s asset allocation.

Fixed income as an asset class play a number of roles in one’s portfolio. It is meant to generate regular income and provide liquidity to one’s portfolio. It acts as a portfolio stabilizer and provides diversification from other growth assets like equities.

Thus yields or returns should not be the only criteria while allocating to this asset class. Nevertheless one needs to understand the various risks involved in fixed income investments.

The Bond Rout

Last few months have been difficult for the fixed income market. Bond yields moved up sharply causing steep drop in bond prices. This was caused by confluence of factors both from global and domestic markets. Some of the factors are as follows:

Table 1: Best of Bond markets behind us?

| Index | CY 2019 | CY 2020 |

| CRISIL Liquid Fund Index | 4.6% | 5.7% |

| CRISIL Short Term Bond Fund Index | 10.4% | 10.0% |

| CRISIL 10 Year Gilt Index | 9.2% | 9.9% |

| CRISIL Composite Bond Fund Index | 12.3% | 11.5% |

Past performance may or may not sustain in future

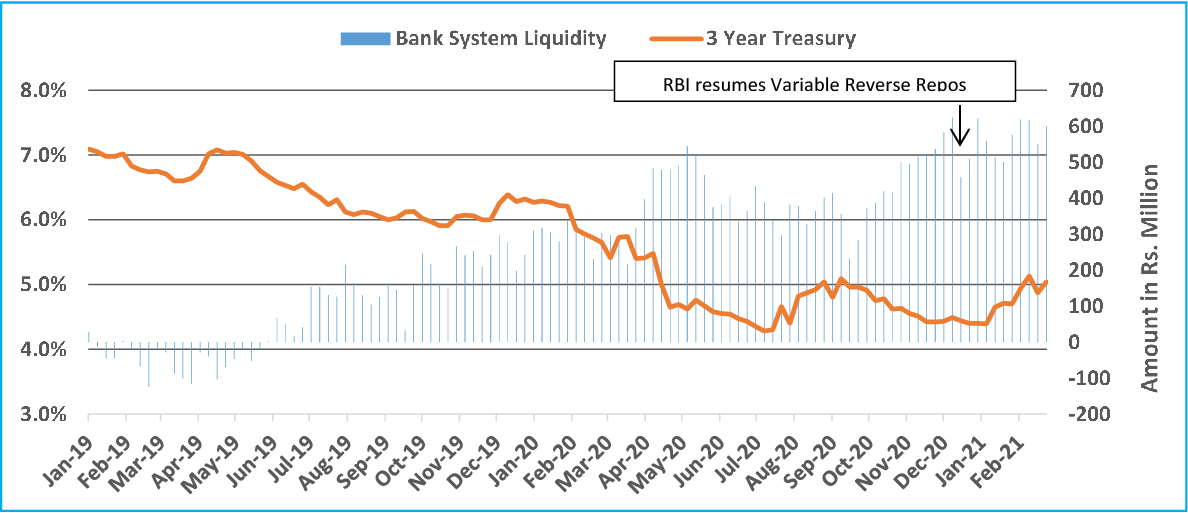

• Normalisation fears gets short term bond yields higher: The RBI restarted its variable rate term reverse repo operations to absorb the excess liquidity for longer period. This was seen as a move towards normalization of liquidity conditions and yields on short term bonds jumped immediately after the announcement.

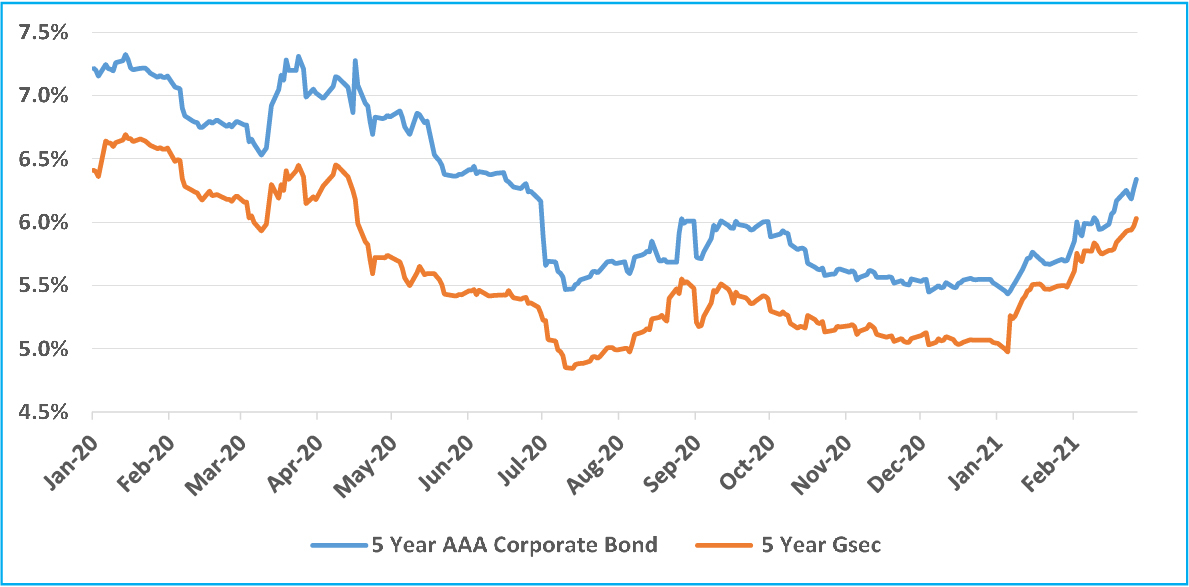

Chart – I: Short term bond yields surged on potential liquidity withdrawal

Source: RBI, Quantum Research

Past performance may or may not sustain in future

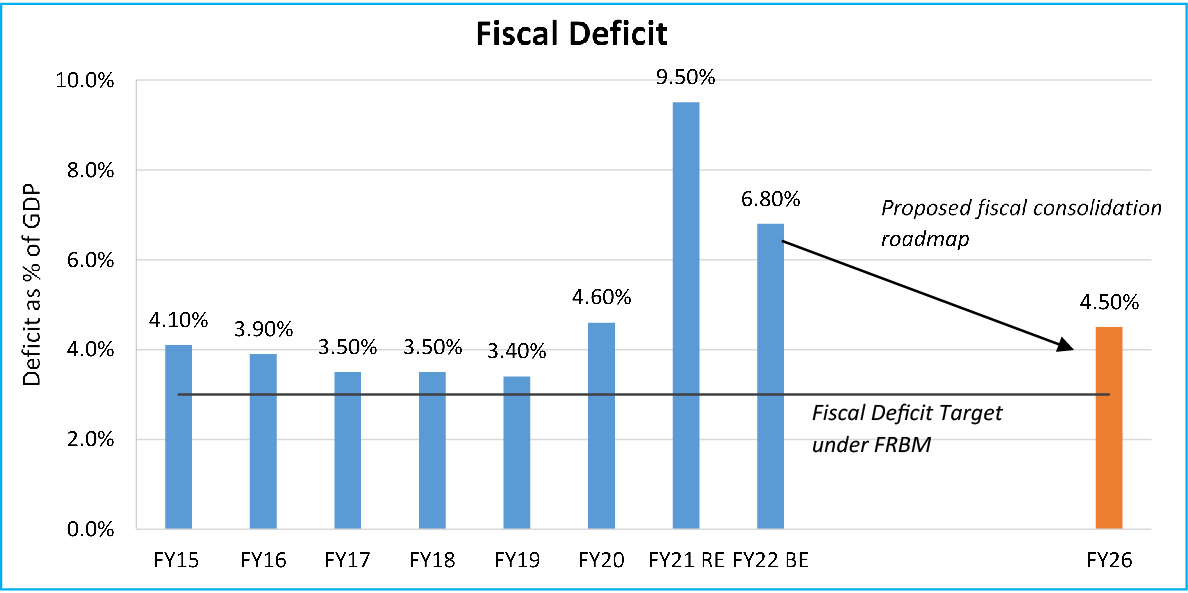

• Fiscal Worries impacts the longer end: In the union budget, the finance minister raised the fiscal deficit for FY21 to 9.5% of GDP and set the target for FY22 at 6.8% of GDP. The government also extended the fiscal consolidation roadmap to aim 4.5% of fiscal deficit by FY2026. Bond markets fear that Larger than expected fiscal deficit & increased market borrowing will create a demand supply imbalance and thus pushed long term bond yields higher.

Chart – II: Fiscal Deficit to remain elevated for long; No guidance to get to 3%

Source: CMIE, Indiabudget.gov.in, Quantum Research

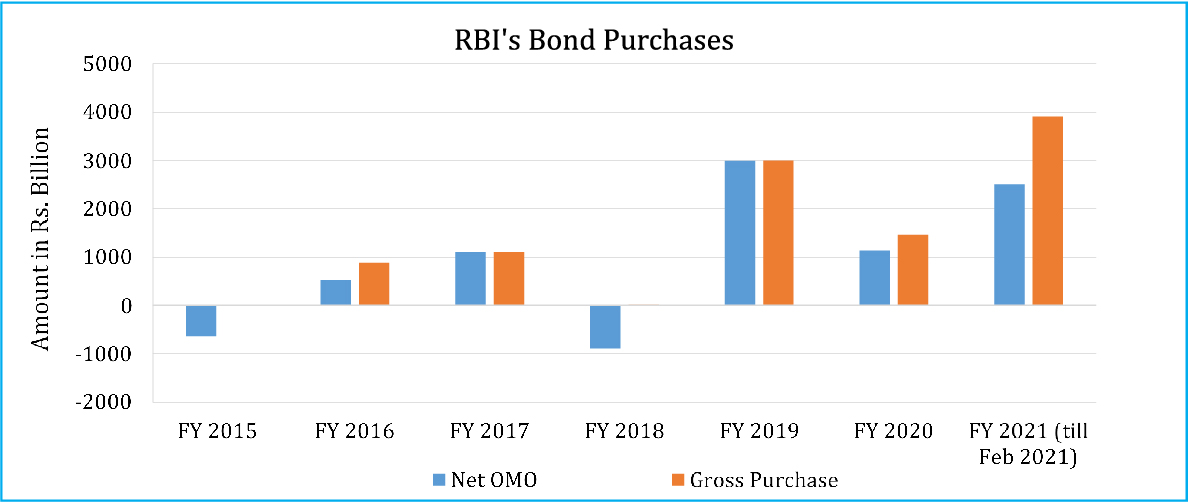

• Stronger commitment from the RBI: The RBI has been extremely supportive for the bond markets in the past two years. They have conducted record amount of bond purchases and cut the policy rates to decadal lows. However after the announcement of an increased market borrowing by the government there was a hope of a more aggressive intervention by the RBI. The RBI extended its support through words, but failed to give any outright commitment in the form of OMO schedule or quantum of bond purchases which was desired by the market.

Chart – III: Das PUT in action

Source: RBI, Quantum Research

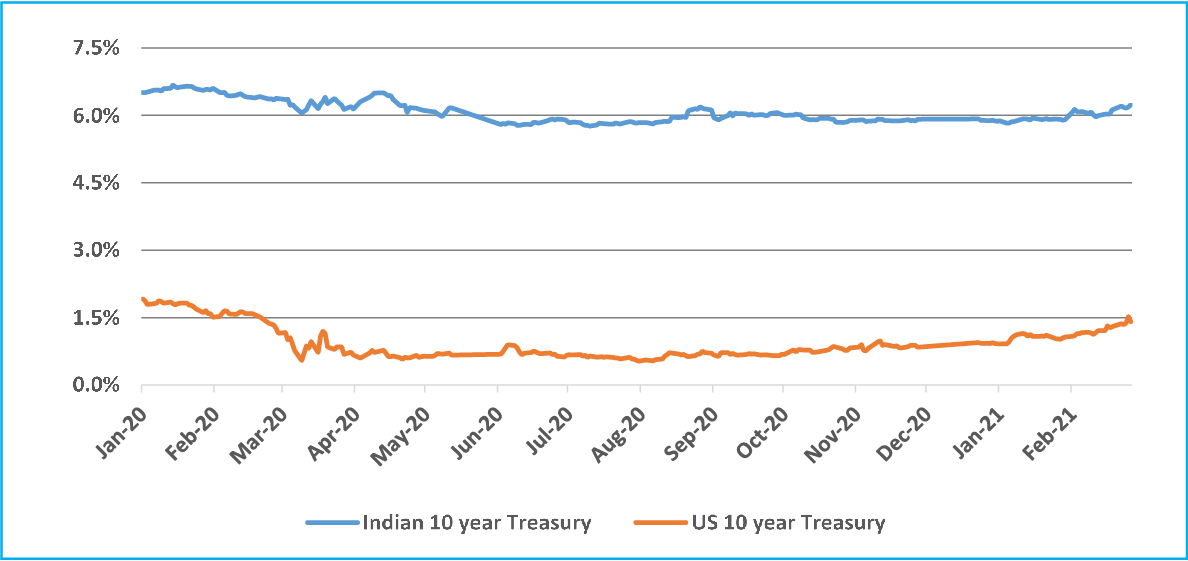

• The Global Reflation Trade: There is a renewed optimism over economic growth prospects in the US and across many economies. This led to substantial increase in global commodities prices causing a fear of faster pickup in inflation. Global bond yields have thus moved up on growth optimisms and inflation fears. The move was extremely sharp towards the end of the last month causing rise in volatility across all financial and currency markets. Emerging market bonds including India sold off following the rise in developed market bond yields.

Chart – IV: Global Reflation Trade drives up bond yields

Source: RBI, Quantum Research

Past performance may or may not sustain in future

India swinging to global tunes: Global yields and crude oil prices have been the major drivers of the Indian bond market over the last month. The 10 year US treasury yield surged over 65 basis point since start to the year from 0.91% (31st December 2020) to around 1.57% (8th March 2021).

Indian bond markets mirrored the move in the US treasury. Since the start of new calendar, Indian bond yields have moved up by 30-80 basis points across the maturity curve. The 10 year Indian government bond yield rose by about 35 basis points from 5.87% on 31st Dec 2020 to around 6.22% now. In the same period the 5 year government bond yield moved up by 76 basis points from 5.09% to 5.85%.

Corporate bonds also witnessed steep selling pressure. Spreads of 10year AAA rated PSU bonds over same maturity G-sec rose from 84 basis points at December 2020 to 96 basis points on 8th March 2021.

Chart - V: India Inc sees higher borrowing costs

Source: RBI, Quantum Research

Prisoners of own device: “You can check out any time you like, but you can never leave".

Global economy has been running on steroids of low interest rates and easy liquidity since the global financial crisis of 2008-09. Central banks deployed numerous tools like QEs (quantitative easing), LTROs (long term repo operations); even experimented with negative interest rates to fuel economic engine.

One can debate about the success or failure of the ultra-easy monetary policy. But one aspect of it is fairly clear that it’s easy to deploy but hard to roll back. For investors, any signal, no matter how small, that policymakers are preparing to reverse crisis-era stimulus can have an outsized impact.

In the last decade, few central banks mainly the US Federal reserve made many attempts to roll back the easy money policy but every time it ended up causing turmoil in the financial markets and slowing down the economy. Memories of the disastrous 2013 taper tantrum and the market sell off of 2018 are still fresh in everybody’s mind.

An economic correspondent once described this situation in words of The Eagles from ‘Hotel California’: “You can check out any time you like, but you can never leave". Central banks are now prisoners of their own device. If they try to withdraw these crisis times measures it could cause severe damage to the financial markets and could derail the entire economic recovery.

Some may argue ‘this time it’s different’. This time central banks are not fighting alone; governments also pumped in a lot of fiscal stimulus. This would create inflation and push back central banks. This argument does carry some substance. But, can economies sustain high interest rates given we are sitting on an unprecedented levels of debt? Can central banks prioritize inflation over growth? These questions remain unanswered at this point.

Based on our past experience it seems to us that the easy money policy is here to stay. This will keep a tap on the long term bond yields though some more increase in yields cannot be ruled out.

In the Indian context, the RBI will also have to be patient in rolling back the easy monetary policy. The economic recovery is hinging on the low interest rates. Quicker withdrawal of liquidity or sharp rise in interest rates could hamper the economic recovery which is at nascent stage. The RBI Governor Shaktikanta Das, at many occasions, has guided that the RBI will continue to conduct more OMOs/twists to contain long term bond yields from rising sharply. This would put a lid on the long term yields or at least moderate the momentum going forward.

Outlook – Hold the Range

In near term global bond yields, crude oil prices and RBI’s market intervention will continue to drive the bond markets. However, given the sharp pace of rise in yields, there is fair possibility of some reversal or consolidation around current levels.

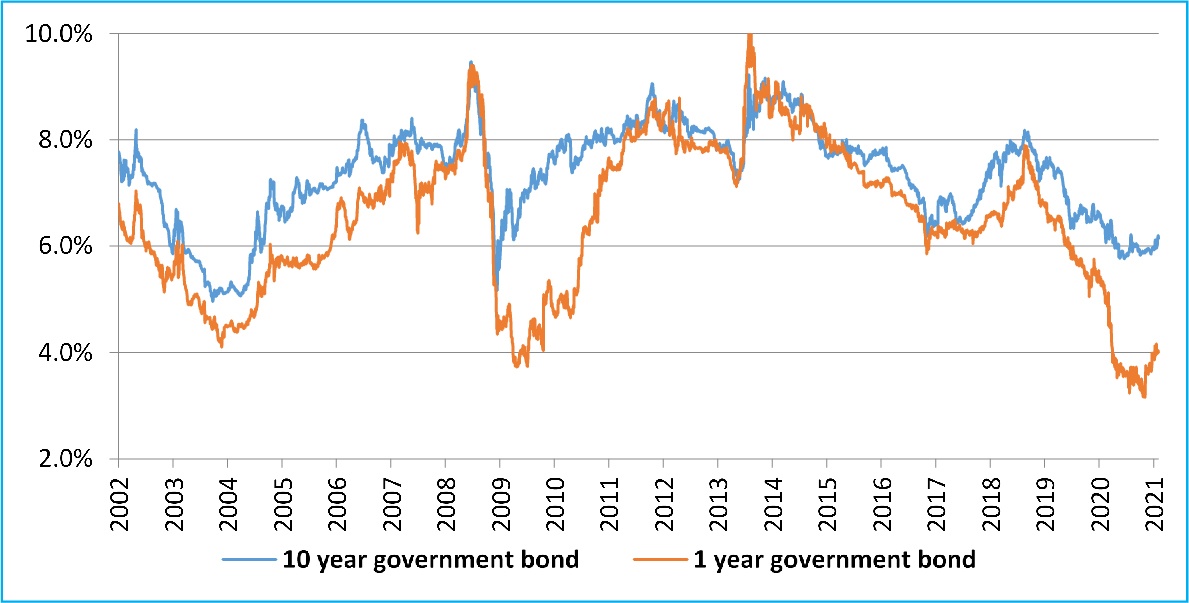

RBI’s regular intervention will likely keep bond yields in the range over coming months. For medium term, we maintain our earlier view that bond yields have already seen their bottom in this cycle and are likely to move higher gradually over next 1-2 years.

Chart – VI: Bond yields bounced back from decade lows

Source: RBI, Quantum Research

Past performance may or may not sustain in future

Apart from the domestic fiscal and monetary policy, we would be watching the following to get cues about future direction of bond yields:

1. development around India’s inclusion into the global bond indices,

2. movement in commodity prices particularly the crude oil,

3. actions of developed market central banks and

4. actions of rating agencies about India’s sovereign rating.

• Portfolio Strategy and Recommendation

In the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on tactical trading opportunities within a narrow range. QDBF does not take any credit risks and invests only in sovereigns and top-rated PSU bonds, but it does take high-interest rate risk from time to time.

In Quantum Dynamic Bond Fund portfolio, we were holding higher cash at the start of the month which we deployed later as valuations improved after selloff. Currently the portfolio is focused on the 5-15 year segment of the government bond curve.

This is a tactical position that can change based on market developments and new information flows. Given the objective of the fund stated in the name itself – we retain our right to remain dynamic in our portfolio construction as we remain cognizant of the risks on the horizon.

In the Quantum Liquid Fund, we continue to focus on short term treasury bills and good quality PSU debt securities.

Investors should acknowledge that the best of bond market rally is now behind us. At this time it would be prudent to lower the return expectations from fixed income products– as money market yields, fixed deposits rates will remain low and potential capital gains from long bond funds will be muted.

Conservative investors should remain invested in categories like liquid fund where impact of interest rate rise would be favorable. However, while selecting a liquid fund be cautious of the credit quality and liquidity of the underlying portfolio.

At this point where fixed deposit rates have come down to historical lows, liquid funds could be better alternative in comparison to locking in long term fixed deposits. Liquid Funds invest in upto 91 day maturity debt securities which get re-priced higher when interest rates rise. Fixed deposits interest rates remain fixed for the entire tenor thus lose out during rising interest rate cycle.

Investors with higher risk appetite and longer holding period can look at dynamic bond funds where the fund manager has flexibility to change the portfolio when market views change. These funds are best suited for long term fixed income allocation goals. However, do remember that bond funds are not fixed deposits and their returns could be highly volatile and even negative in short period of time.

For any further queries you can write to us at [email protected] / [email protected] or call us on Tel: 9870458160

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More -

Inevitable Pivot: Resetting Market Expectations

Posted On Tuesday, Apr 26, 2022

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation.

Read More