Looking Beyond Covid

Posted On Friday, Nov 13, 2020

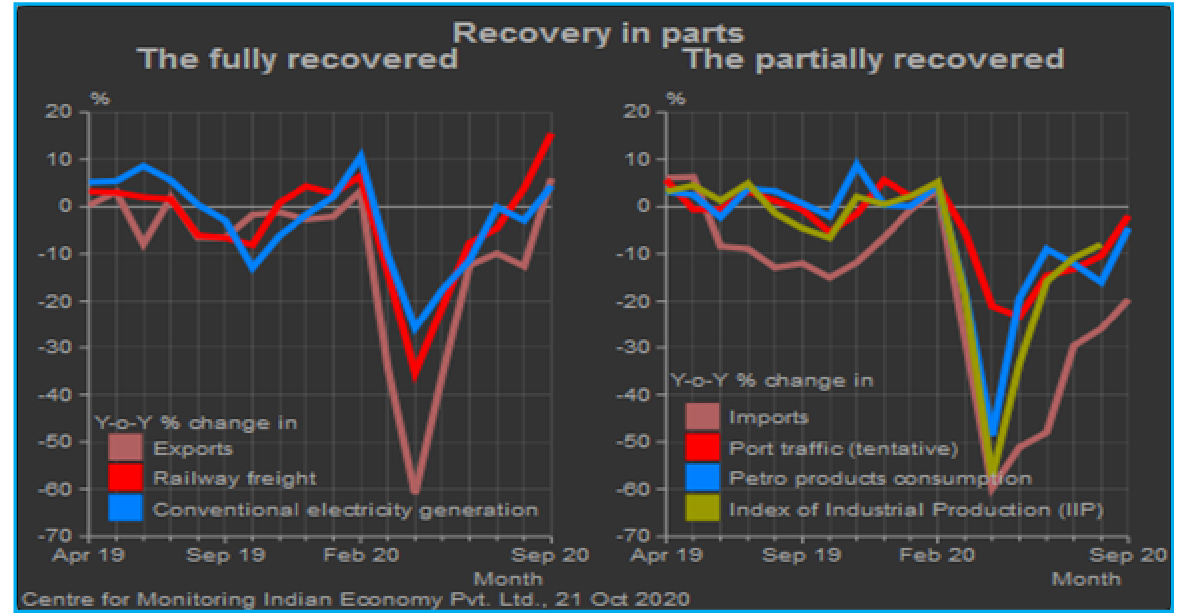

India has finally bent the Covid curve. The number of daily new cases of Covid-19 has come down from a peak of ~97000 in mid-September to about ~45000 now. The economy is also recovering at a faster than anticipated pace. Most of the high-frequency data indicate that the economic activities have rebounded and now are closer to the pre-Covid levels.

Chart – I : The two-part recovery

Source – CMIE Analysis

At this juncture, it is imperative to evaluate what lies ahead for the economy and how that would impact the fixed income markets.

All is not well

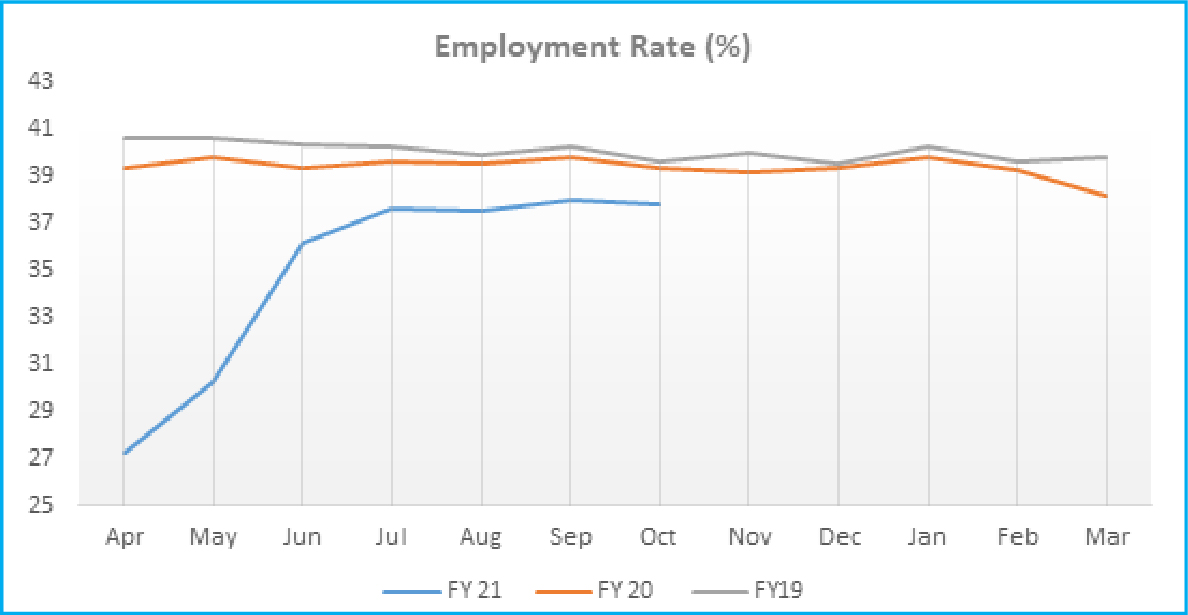

Although the recent pickup in economic activity looks encouraging, there are doubts about its sustainability. The job market remains under stress and there has been a significant hit to household income. Under these circumstances, recovery in consumer demand may not sustain in the future. Capital investments are not showing any signs of recovery and the global environment doesn’t seem conducive for export gains.

Chart – II : Employment rate still below last years’

Source –CMIE, Quantum Research

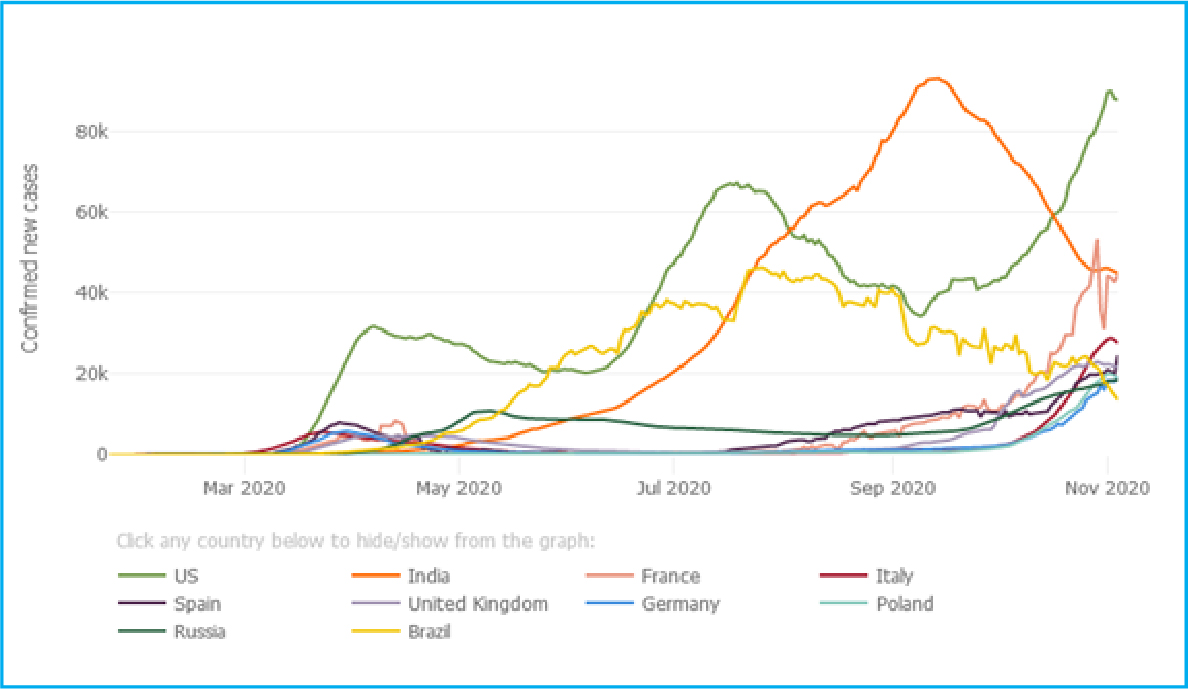

The bigger threat to economic recovery is the second wave of Covid infections. Many countries are already witnessing the second wave of Covid-19 infections. India also runs this risk going into the festival season.

Chart – III : Daily confirmed new cases (7-day moving average)

Source – Johns Hopkins University (https://coronavirus.jhu.edu/data/new-cases)

A Self-fulfilling Prophecy

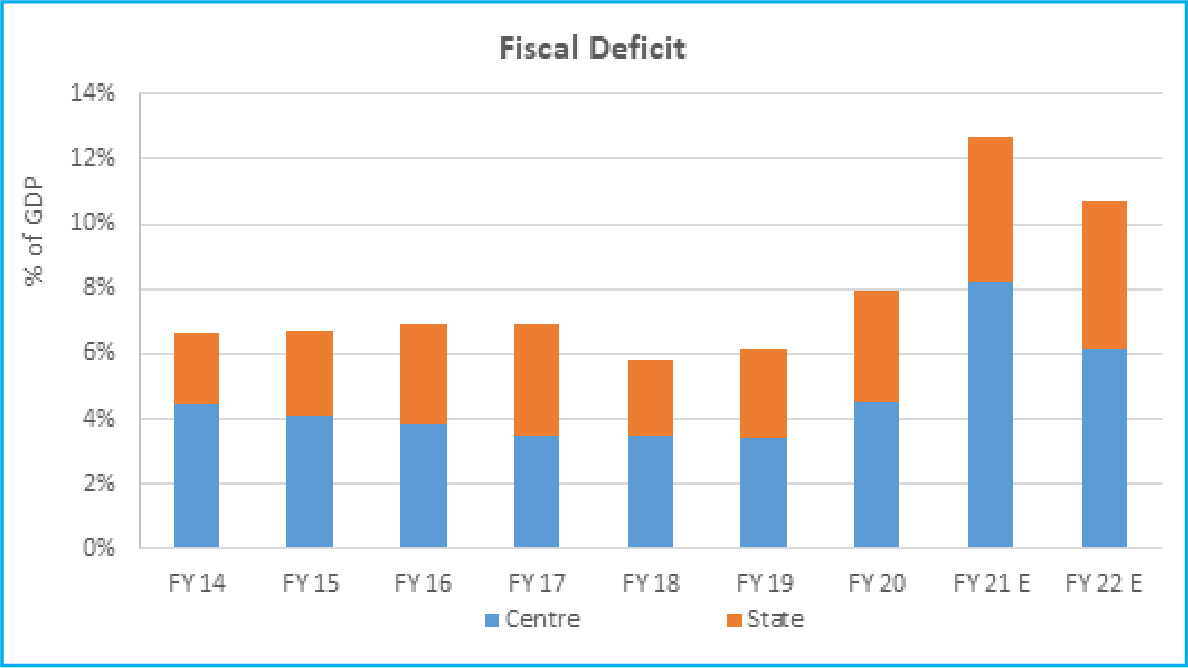

Irrespective of the probability of the second wave, the economy will continue to need support from both the RBI and the government to come out of the Covid shock. The Government’s fiscal position has been stretched for many years, and there is limited headroom to provide any fiscal boost. In the current fiscal year the combined fiscal deficit of centre and state governments combined could jump to 12%-13% of GDP. Even in the next financial year, it would be difficult for the government to cut back on its expenditure in any material way.

Thus, the fiscal consolidation will be a long drawn process with very slow progress. From the bond markets perspective there will be elevated levels of debt issuances in the next year and beyond. This will be unfavorable for long-maturity bonds. |

Investors will look at the RBI to fill the demand-supply gap emanating from the excessive supply of government bonds.

Chart – IV : Fiscal Consolidation to take time

Source – CMIE, Quantum Research

FY21 and FY22 Fiscal Deficit numbers are as per Quantum Estimates

Table – I : Government bonds supply to stay elevated in post COVID world

| Government Market Borrowings | ||||

| (INR Trillion) | FY19 | FY20 | FY21E | FY22E |

| Centre | 5.7 | 7.1 | 14.1 | 10.9 |

| States | 4.8 | 6.4 | 8.1 | 8.0 |

| Total | 10.5 | 13.5 | 22.2 | 18.9 |

| % of GDP | 5.5% | 6.6% | 11.3% | 8.6% |

Source – CMIE, Quantum Research

FY21 and FY22 borrowing numbers are as per Quantum Estimates

On the other side, the RBI has been extremely supportive of growth in the last two years. It used all conventional and unconventional tools to keep monetary conditions easy and the financial system running. The policy repo rate has been lowered by 250 basis points (100 basis overnight rate has been cut by 290 basis points. The banking system has been flooded with liquidity.

Moving a step further, the RBI in its last monetary policy, committed to staying “accommodative” in the current financial year and into the next financial year. This kind of expectation setting could become a self-fulfilling prophecy.

It would be difficult for the RBI to go back on its commitment without hurting market sentiment. Given that the economic recovery is still very fragile, any market turbulence could be destabilizing and could take away all the gains accrued by easy monetary conditions of the past. Given the fact that the RBI has already cut the policy rates to historical levels and inflation has been stubbornly high, the room for a further rate cut is limited. However, the RBI may continue to support the economy beyond monetary policy measures. Liquidity may remain in surplus for an extended periods and bond purchases may continue beyond this year. |

What complicates the matter is the fact that the RBI is an inflation-targeting central bank. They are bound to react if inflation remains above their threshold level for a prolonged period. The RBI targets to keep CPI inflation between 2% to 6% band.

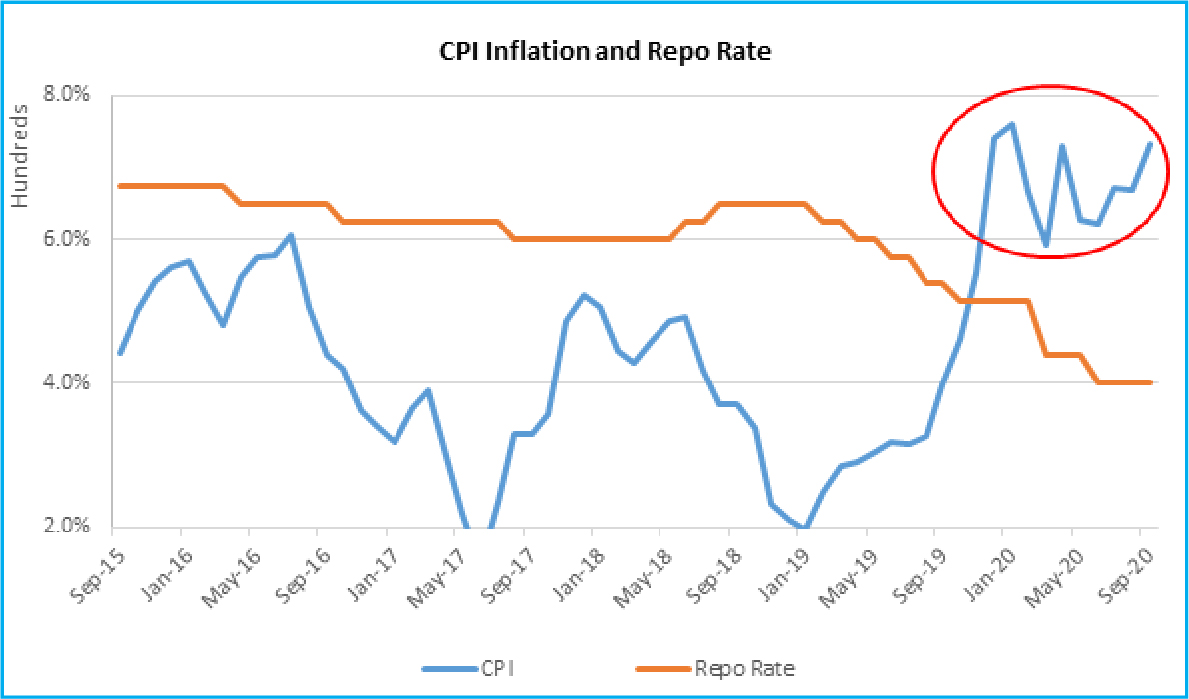

Chart – V : Will the RBI tolerate higher Inflation?

Source – MOSPI, RBI, Quantum Research

If inflation remains elevated near 6%, the RBI will be forced to reverse the easy liquidity conditions and change the monetary policy stance to move out of monetary accommodation. They could even stop their bond purchases. If this happens, this would be extremely negative for the bond market. |

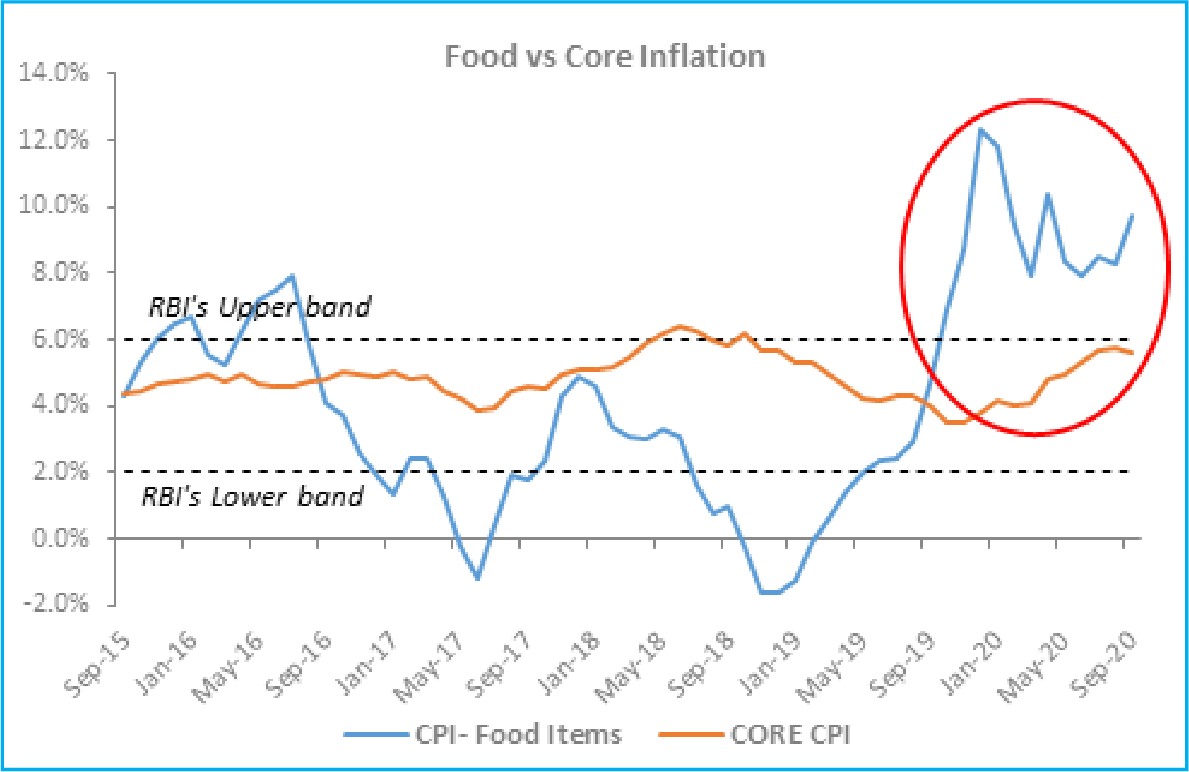

Inflation – ‘going down’ or ‘firming up’

In the post-Covid world, out of all the macro variables, inflation is the trickiest to forecast. Households have suffered a significant loss in their income and purchasing power. In theory, it should create a dis-inflationary impulse and bring the inflation down. But CPI inflation has moved up in the last six months. The headline CPI inflation has averaged at 6.8%, well above the RBI’s upper threshold.

Much of this jump in inflation is attributed to a sharp rise in food prices and adverse base effects from the last year. Within the food basket, the main driver of inflation has been vegetables which carries a strong seasonal impact.

Chart – VI : Food prices are driving Inflation higher

Source – MOSPI, RBI, Quantum Research

Vegetable prices may come down with the arrival of a new crop in coming months. The adverse base effect will also dissipate in next 2-3 months. This is the reason why the RBI is going soft on inflation and forecasts inflation to come down closer to its target level of 4% by the year end.

Although RBI’s inflation outlook looks reasonable, there are concern areas in overall inflation dynamics. We are particularly concerned about the following three factors- (1) Elevated fuel prices and resulting increase in cost of transportation, (2) increase in import duties and inward-looking trade policies, and (3) increased government procurement of food grains keeping cereal prices high.

Apart from the above three, loose monetary and fiscal policy can also cause serious inflationary pressures when the economy revives.

So, the RBI will have to be proactive in reversing the monetary accommodation when the economy starts getting back to normal and inflation starts firming up. |

However, at this juncture, the RBI is focused on reviving growth and seems ready to tolerate some inflation risks in the process.

What’s in store for bond investors?

The bond market is currently dealing with a problem of excesses. There is an excessive supply of bonds and there is are excessive interventions by the RBI to manage that supply. The RBI has been pretty successful in keeping market expectations and bond yields anchored. Nevertheless, it seems they are juggling with too many crystal balls at the same time.

In the last 2-3 months, the RBI has been extremely active in the debt markets, giving guiding signals to the broader markets. They are conducting OMOs and twists in government securities, OMOs in State Development Loans (SDLs), LTROs (long-term Repo operations) and not to forget out-of-way auction cutoffs and green shoes allocations. They have even resorted to anonymous buying of government bonds to align yields during the week.

Many of these measures are losing their effectiveness in terms of guiding market expectations and may become redundant over time. Additionally, it also runs a risk of giving wrong signals to the market.

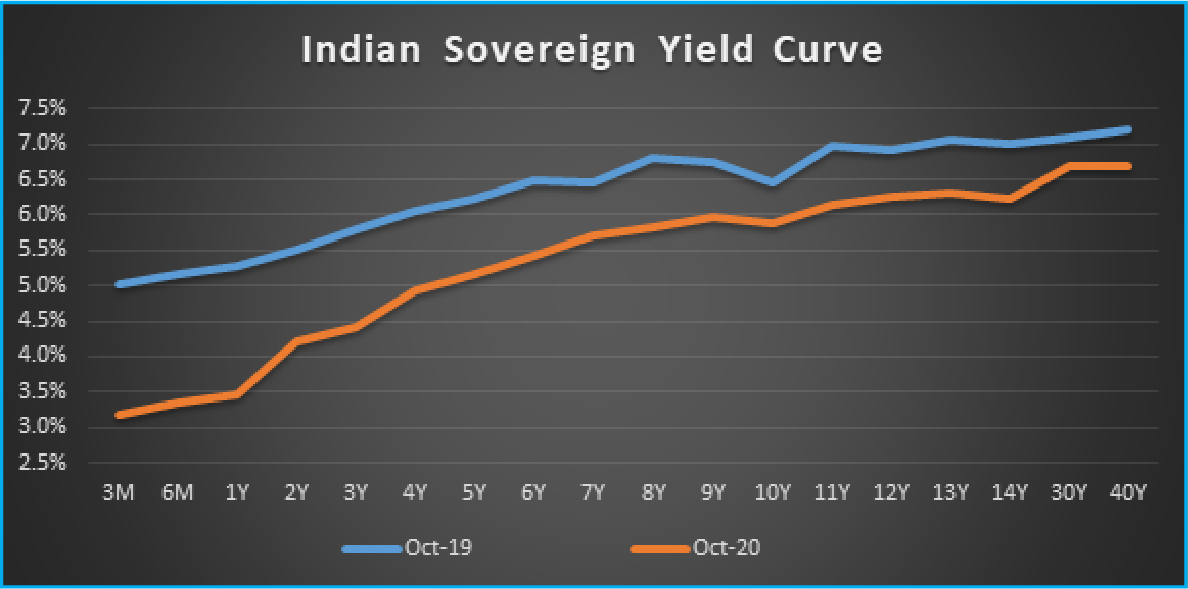

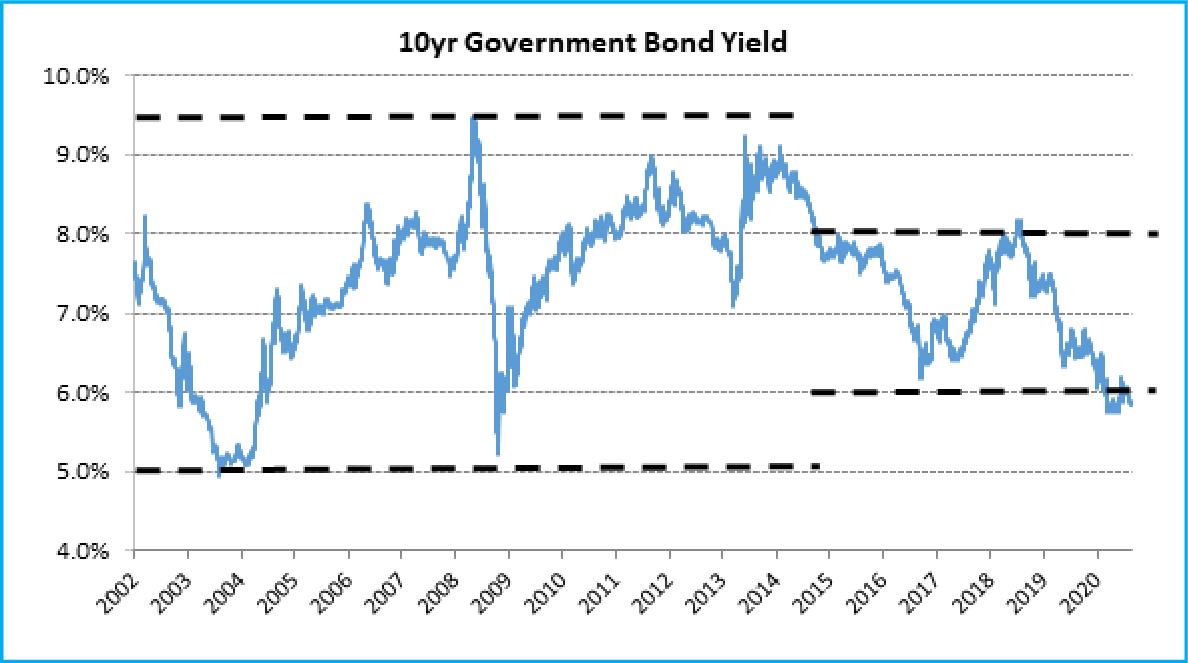

In many segments of the Bond markets, yields are very close to their historical lows. The 10-year government bond yield has been below the 6% mark since the last RBI policy. As on November 12, 2020, it is trading close to 5.9%. There is scope for yields to go down from current levels somewhat. But this has to be a tactical position only.

Chart – VII : Long term bond yields are still elevated

Source – Bloomberg, Quantum Research

Over the medium-term, the outlook will depend upon – (1) economic recovery prospects (2) inflation trajectory and (3) fiscal risks. The combination of these factors will determine the RBI’s response and the future trajectory of bond yields.

The monetary easing cycle is near its end and the fiscal situation has worsened to unprecedented levels. History suggests that Indian bond yields (10-year benchmark government bond) generally do not sustain below the 6% level for too long. The average yield for the last 20 year period is about 7.6%. The chart below shows that it is also volatile and broadly ranges between 5% and 9%. Currently, yields are closer to their long-term lower bound.

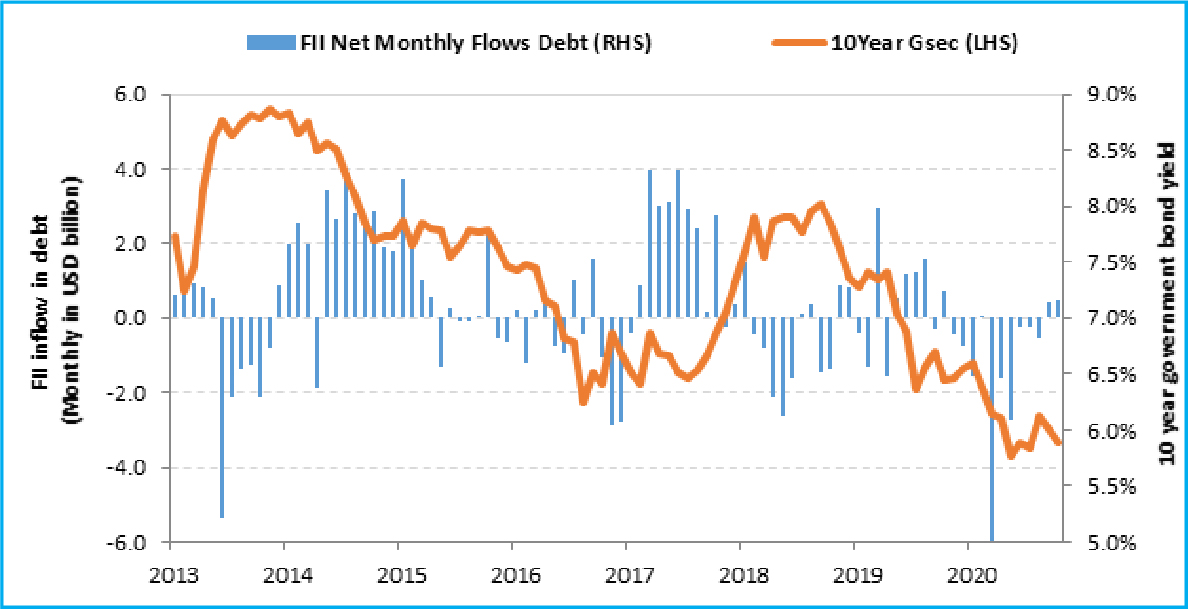

Chart – VIII : India yields do not sustain below 6% for long

Source – Bloomberg, Quantum Research

Past Performance May or May not sustained in Future

One factor which can drive bond yields lower is foreign capital inflows. Globally, bond yields have come down. In most of the developed economies yields are close to zero or even negative. Compared to this, the yield on Indian bonds looks attractive even after adjusting for potential INR depreciation.

Government is also keen on attracting foreign capital into Indian debt. They have made necessary changes in the rules for foreign investments to get into global bond indices. Given the high global liquidity and low yields in developed economies, India could attract sizeable foreign inflows in domestic bond markets.

Chart – IX : Foreign inflows can drive yields lower

Source – Bloomberg, Quantum Research

Portfolio Positioning – Tactical vs Structural Trade

In the Quantum Dynamic Bond Fund (QDBF) portfolio, we continue to focus on tactical trading opportunities within a narrow range. QDBF does not take any credit risks and invests only in sovereigns and top-rated PSU bonds, but it does take high-interest rate risk from time to time.

Given the yield curve is already very steep (Chart – VII ) and the RBI is actively intervening in the market to protect long bond yields from rising, we are positioned at the longer end of the maturity curve which is offering better accrual yield.

This is a tactical position that can change based on market developments and new information flows. Given the objective of our fund stated in the name itself – we retain our right to remain dynamic in our portfolio construction as we remain cognizant of these risks on the horizon.

We understand the economy and markets are currently adjusting to an unprecedented shock. There are too many moving parts and things are still evolving. Thus, any forecast about the future is susceptible to change based on policy responses from the government and the RBI and the changes in global markets. We stand vigilant to review our outlook as and when new information comes. Nevertheless, it would be prudent for investors to be conservative at times of heightened uncertainty.

Investors should lower their return expectations from fixed income – as money market yields, fixed deposits will remain low, and potential capital gains from long bond funds will be muted.

Credit Crisis is not over yet

We reiterate our view that the credit crisis in the bond market is not over yet. The Indian economy has faced a severe jolt due to a national lockdown. This has significantly weakened the debt servicing capacity of many companies and individuals. This could create a negative spiral in the economy and hence in the loan and bond markets. We see a high risk of rating downgrades and defaults in the next two years.

In this scenario, it would be prudent for investors to avoid excessive credit risk in their debt exposure.

Editor's Note: For any further queries you can write to us at [email protected] / [email protected]. or call us on Tel: 9870458160 / 8689961495

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More