Investment Principles to Help You Keep a Check on Inflation

Posted On Wednesday, Aug 18, 2021

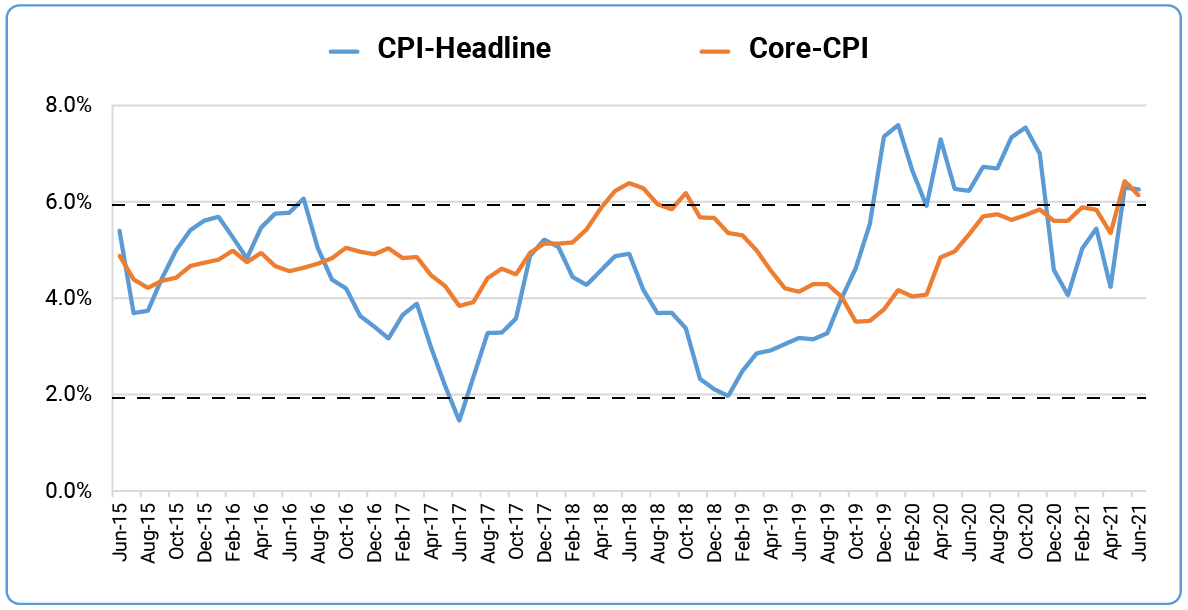

India's retail inflation, measured by the Consumer Price Index, was higher than the RBI threshold for two consecutive months (Ref: Chart 1: Inflation breached the 6% Laxman Rekha). In July, the CPI inflation eased relatively to 5.59%. However, this time, inflation might not be transitory and be more structural. In tandem, RBI increased the CPI forecast from 5.1% to 5.7% for FY 22. What are the investment principles you need to follow to keep a check on Inflation?

Chart 1: Inflation breached the 6% Laxman Rekha

Source: MOSPI, Quantum Research, data as of July 2021

✅ Learn more: Difference between Headline CPI & Core CPI • Headline inflation refers to the change in the value of all goods in the basket and fluctuates widely. • Core inflation excludes food and fuel items from headline inflation and does not fluctuate widely. |

Step 1: Focus on the real return:

Inflation has a significant impact on the real return of your investments.

To simply put, real return = return - inflation.

It is because inflation erodes the pricing power of your investments.

As a result, traditional investments like FDs have not kept pace with inflation and you lose money on a real basis. For instance, when your bank savings account gives a nominal return of 4%, the real return is negative as average inflation has been at ~6%, significantly higher than the 4% bank yield.

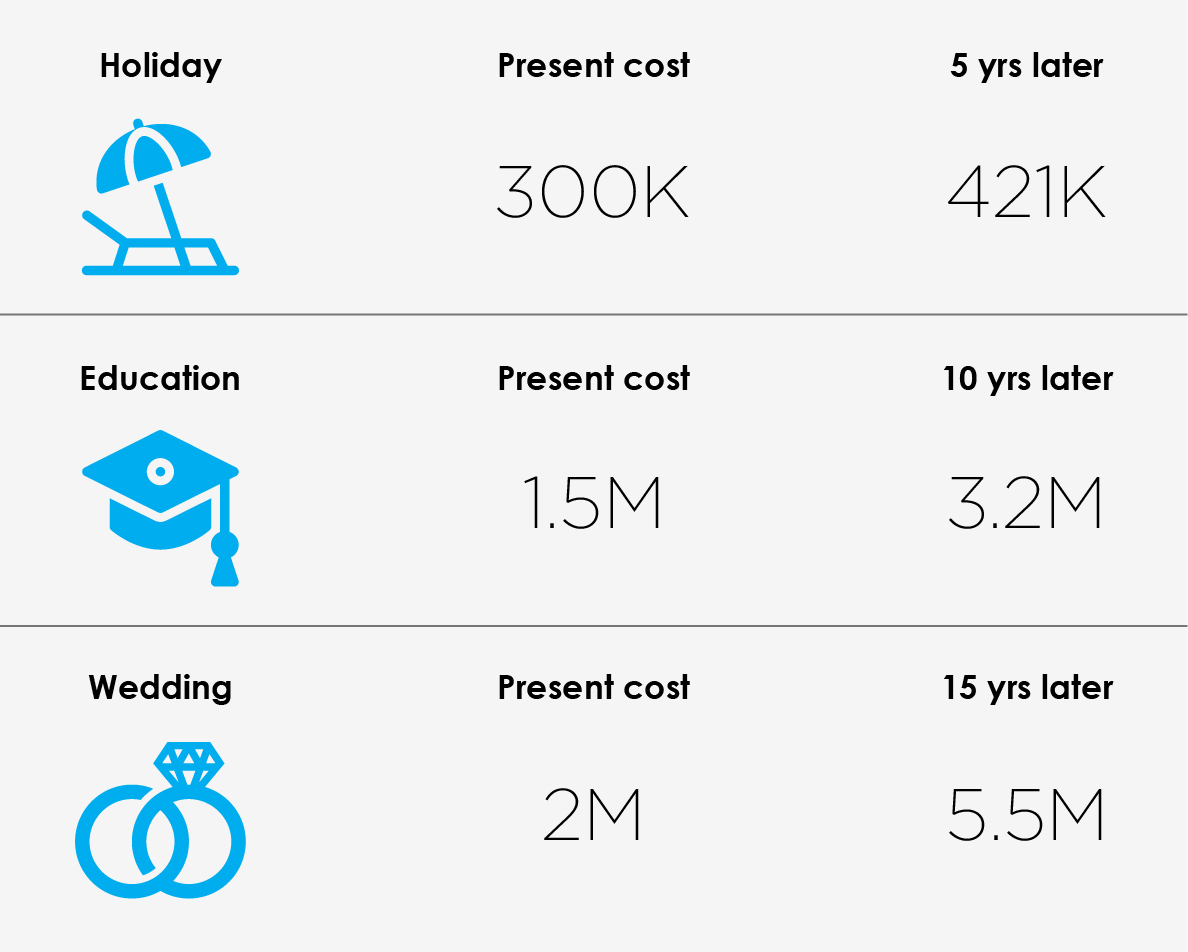

Illustration 1: Impact of inflation

The above image is illustrative purpose considering inflation rate of 7% for Holiday and Wedding and 8% for Education. Assumed rate of return is 10% p.a.

Step 2: Start Early & Invest Consistently:

The earlier you start, the greater the possibility of earning more and reaching your goals faster. Starting early & investing consistently gives you the flexibility to invest with a small amount and reach your goals faster. Equity mutual funds tend to generate better returns over a period of time, hence the earlier you start investing, the more potential your money has to grow. Time in the market makes a huge difference over timing the market. This means the longer you keep your money uninterrupted; it has the potential to provide long-term risk-adjusted returns. It also saves you from the hassle of predicting the market and trying to analyze and assess the macro-economic indicators such as inflation.

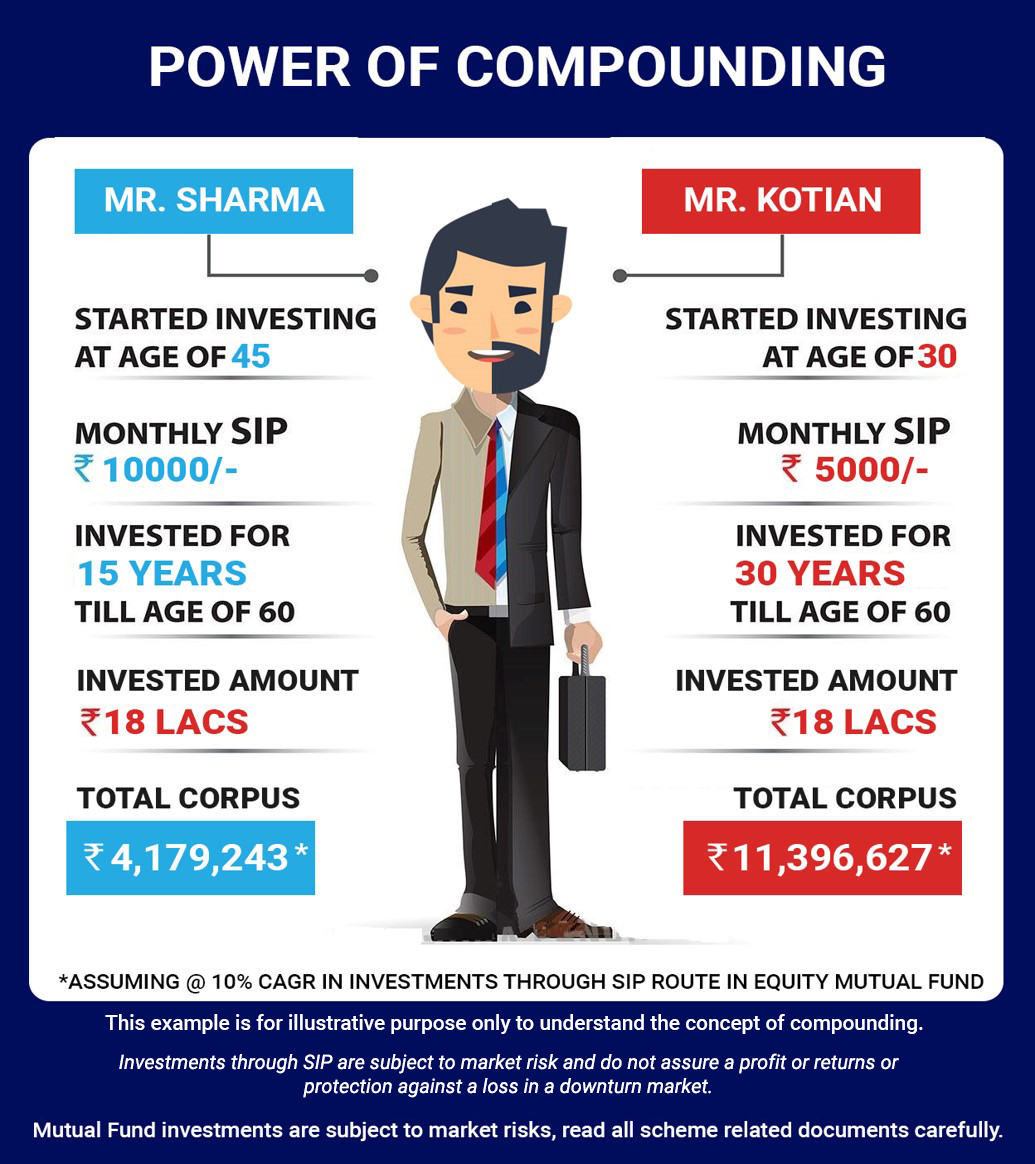

Let’s see an example of two investors Mr. Sharma and Mr. Kotian, who want to start planning for their investment at different ages, 45 & 30 respectively. The investor who started early at age 30 can accumulate more than double the size vs. an investor aged 45 years. The illustration assumes a 10% rate of return for a monthly SIP of Rs. 10,000 & Rs. 5000 respectively. This illustrates the power of compounding through your returns reinvested and adding to your corpus over the long term.

Illustration 2: Power of compounding

Step 3: Align Your Portfolio with Your Risk Profile:

Consider your risk appetite, risk tolerance, and risk capacity carefully in this exercise. When you begin your mutual fund journey, you find that a solution that has worked for you may not work for another investor. This is because different investors have different risk profiles.

Illustration 3: Risk profiling

• Risk Capacity is your ability to take financial risks based on age, income, etc.

• On the other hand, Risk Tolerance refers to an investor’s willingness to take or ‘tolerate’ risks or the level of volatility in returns one is ready to deal with.

• Risk Appetite refers to the maximum amount of risk that you are willing to take as an investor.

You have to be well-acquainted with your goals and the timeframe to assess the risk level you are comfortable with taking on.

Read our article on Key Risk-Reward Metrics to Assess Your Portfolio.

It is imperative to understand that asset-classes that are traditionally known to hedge inflation have also been worst performers conversely asset classes believed to be weaker performers might have remarkably held-up well under certain scenarios. Thus, we believe a thoughtful, well-diversified approach is the most-effective way to prepare your portfolio to fight against inflation.

|

|

|---|

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More