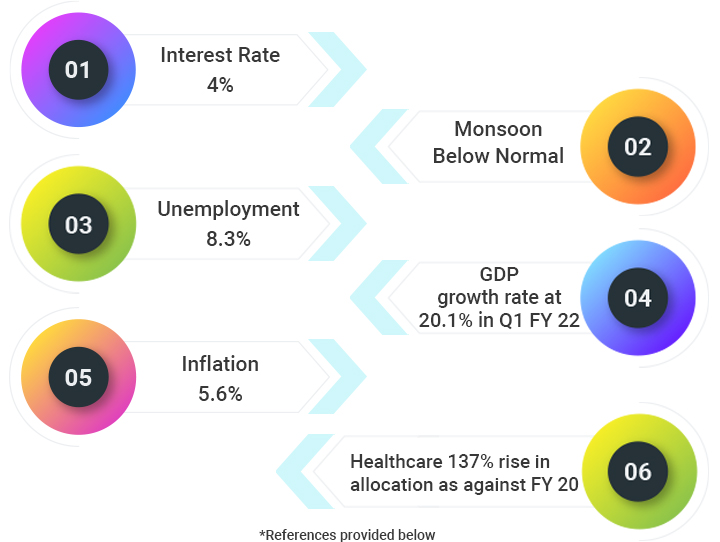

6 Indicators That Will Determine India’s Economic Growth

Posted On Tuesday, Sep 14, 2021

While the Equity market is on a bull run, you may be concerned about the rich valuations. It’s therefore important to evaluate the underlying economic indicators that determine the growth of your investments.

The economy is dependent on some key factors and any change or movement in these parameters has a direct impact on the financial health of the nation. The stock market reaction is the outcome of these critical economic indicators. Investment experts lookout for these headwinds to prepare their analysis. Moreover, it is important for you, the thoughtful investor, to understand these financial concepts that will not only help you comprehend critical financial events but also interpret their impact on your investments.

Our Fund Managers at Quantum Mutual Fund have put together what are considered as the top few economic parameters*, to study the overall health of the economy -.

1. Monsoon

By mid-May or early June, the forecast of monsoon’s arrival in India takes headline space. It states if its going to get delayed or whether we are expecting a good rainfall in the coming season. The influence of monsoon plays an important part in not just the farm production, but also impacts other related sectors such as automotives, real estate, etc.

With significant control on the agricultural output, rains have a ripple effect on the demand and supply chain of India. Good rainfall paves way for a self-reliant economy. When monsoons are good it means agriculture production is good, that means that the farmers have a good income which means that rural India demand picks up in sectors such as FMCG, automotive, etc. A good monsoon & bumper farm production also leads to controlled food prices, which further helps to keep a tap on the CPI inflation since food accounts for 50% of our country’s consumer price index. It also encourages demand for water conservation and electricity generations. The vulnerability of the southwest monsoon winds and their substantial impact near-term impact on the economy is tracked by economists, investors, and government agencies.

2. Unemployment rate

In simple words, it denotes the underutilization of the labor supply. The economy's efficiency and effectiveness to absorb its labor force is understood from this statistical figure. The cascading effect of the virus-induced lockdown, that led to disrupting businesses and thus increasing the unemployment rate is still hovering around. Businesses are slowly catching up and allowing the job market to see the light of the day. Low workforce turnout directly means less productivity in the economy which again disturbs the consumption story. As we have often said, job creation is India’s biggest long-term socio-economic challenge.

3. Healthcare Infrastructure

The Pandemic has highlighted the importance of healthcare infrastructure across the globe. The industry in India is now growing at a brisk pace to strengthen and tackle any future emergencies. In the Union Budget 2021-22, this year, Health & wellbeing were announced as one of the 6 pillars of the session. We would like to see more spending on improving basic health infrastructure in rural India.

While some might argue this to be more of a short-term economic parameter, its lack of access to the common man during the peak of COVID-19 in both the first and second waves has made it one of the biggest challenges the country is aiming to overcome in near future. So clearly there is still a long way to go. Prepare a financial backup plan comprising of liquid funds to serve as a emergency backup to cope with uncertainties.

4. GDP

Also known as ‘the Economy’s All’, GDP – Gross Domestic Production is basically the size of the economy and represents its performance. It is an indicator of the value of all goods and services produced over a certain period of time. This is the main metric for any economy and not just India. As per National Statistical Office (NSO), India’s GDP contracted by approximately 7.3% in FY 20-21. However, Real GDP growth rate is at 20.1% in Q1 of 2021-22 as of Aug 31, 2021.

At Quantum, we anticipate a long term GDP estimate of 6.5%. Adding inflation to this figure will give nominal GDP of 11.5%. The returns of companies is likely to grow on par or at higher rate than the nominal GDP, thereby offering you the potential for risk-adjusted returns over the long term. This basic math is the key behind investing in the equity mutual funds in India over the long-term.

5. Inflation

Rising inflation can impact and reduce the value of the currency. A pizza that costs Rs. 400/- around 3-years back is now priced at Rs. 500/-, this is inflation. The pizza is the same but the purchasing power of the currency has gone down. Over time due to the rise in inflation each monetary unit can buy fewer items. This impacts almost all daily or commonly used items and services. Thus it impacts our earnings and returns on investments.

Post lockdown India's economy stumbled due to high inflation and rising food prices. Shortage of job creation and health crisis added to the woes. High inflation does impact consumption. India now operates under a flexible inflation target of 4+/- 2. India now operates under a flexible inflation target of 4+/- 2. RBI has, however, been tolerating higher inflation to secure growth. The likelihood of a Covid-19 third wave & another economic lockdown is the most critical variable right now for market direction. However, if the inflation levels are not addressed, and RBI hikes interest rates, it will impact the assumption of lower interest rates supporting the economic recovery.

You can cope with inflation by investing in Equity mutual funds which has the potential to generate long term risk adjusted returns which may be higher than the prevailing inflation rate. However, you should always consider a portion of investment in Gold for diversification since Gold has negative correlation with respect to equity.

6. Interest rates

Traditionally, an economy with a higher growth potential can also tolerate a higher relative interest rate. However, as the Indian economy is still recovering the pandemic shocks, it requires the support of low interest rates to achieve higher growth; boost credit, investments, and eventually increase consumption. So the RBI continues to keep the interest rate unchanged at 4%.

When interest rates are too low, it leads to an increased demand for money and raise the likelihood of inflation as we have witnessed in the economy currently. Low interest also means that investors are increasingly seeking option to Fixed Income in search of higher returns. We would caution against this approach. Fixed income investment is for your safety, liquidity and diversification.

While there are many other decisive factors and statistical indicators that shape the economy, above are few key factors that we believe, drive the change. Considering these economic indicators can help you make informed investment decisions.

As Arvind Chari, CIO, Quantum Advisors says, "Given, how weak growth was prior to Covid-19, it requires time for this nascent recovery underway to get established. Low and negative real interest rates for a period of time is supportive of investment and physical asset creation creation (think house building) which in turn will create jobs and boost incomes. However, the RBI has a balancing act now in managing growth and inflation".

It is for you to acknowledge the importance of evaluating economic parameters to keep learning more & be able to take prudent investment decisions.

Related Articles

Investment Outlook 2021: Q&A with Arvind Chari, CIO

FPI inflows and Equity Markets - here's all you need to know to stay invested

Watch our recent webinar video on Pandemic Impact. Economic Recovery. Investment Strategy - Insights Revealed where Sorbh Gupta, Fund Manager Equity and Chirag Mehta, Sr. Fund Manager, Alternative investments give you further insights about the impact of the pandemic and other macro economic indicators on your investments.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More