How to Define Your Asset Allocation as Per Your Age

Posted On Wednesday, May 17, 2023

Long-term wealth creation demands an optimally diversified investment portfolio and long trem risk-adjusted returns on your investments, which is what every investor strives for. In order to attain this, you need to allocate the right amount of funds to equities, fixed-income securities, and other asset classes in your investment portfolio.

Asset allocation is an investment strategy that balances the risk-reward trade-off by diversifying investment across different asset classes such as equity, debt, and gold. The asset allocation approach you choose while constructing your investment portfolio is one of the most crucial factors that will impact your portfolio returns and hence your asset allocation strategy should ideally focus on minimising risks and maximising returns.

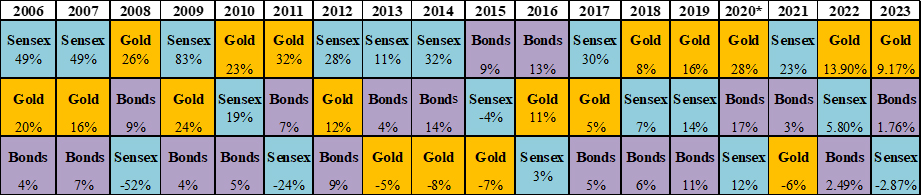

Different asset classes perform differently depending on the varying macroeconomic situation. Thus, when you diversify your investments across asset classes that have a negative correlation with one another, the impact of any dramatic decline in one asset class is typically offset by the likelihood of an increase in other asset classes.

Illustration: Performance across asset classes differs every year

Data as of Mar 31, 2023. Past performance may or may not be sustained in the future (Source: ACE MF)

Asset allocation is the key to successful investment, but since every investor has distinct financial needs, there is no standard formula for constructing the ideal mix of assets. However, you can build your asset allocation in mutual funds depending on a few parameters, including age, income, investment horizon, existing investments, debt obligations, etc.

Now does it make sense to plan your asset allocation as per your age? Let’s find out. This article elucidates how you can define your optimal asset allocation in mutual funds based on your age.

How your age plays a key role in planning your asset allocation in mutual funds?

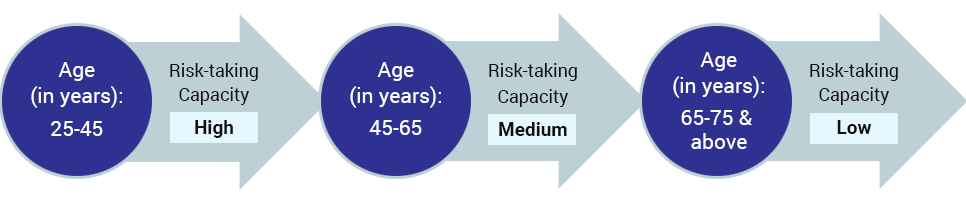

Your asset allocation plan will be significantly influenced by your age and capacity for risk. When you make an investment, you’re looking to buy something that will appreciate in value with time. Every asset class shows different behaviour over time and carries a different level of risk.

Your age and investment horizon determine how much time you have on your side to achieve your targeted corpus for a certain goal while riding through market fluctuations, which is a key factor in determining your risk tolerance. It dictates how much risk you're willing to take on your investments. The rationale behind this is that usually, risk tolerance is high when you are young. The older you get; you must reduce the amount of risk in your portfolio. One’s risk appetite decreases over time since expenses, responsibilities, and financial obligations increase, whereas the number of earning years left decreases.

The fundamental idea behind asset allocation by age is that as you get older, your exposure to high-risk asset classes should decrease. Due to the high risk associated with equities, it is generally understood that the percentage of equity in your portfolio should decline as you age. As you near your retirement age, your risk tolerance would decrease even further because of the absence of a steady source of income, and you can't afford any wild swings in your portfolio value. As a result, it only makes sense to strategize your asset allocation by age.

However, the ‘Rule of 100’ is one thumb rule that you may consider for defining your asset allocation by age.

How does the ‘Rule of 100’ work?

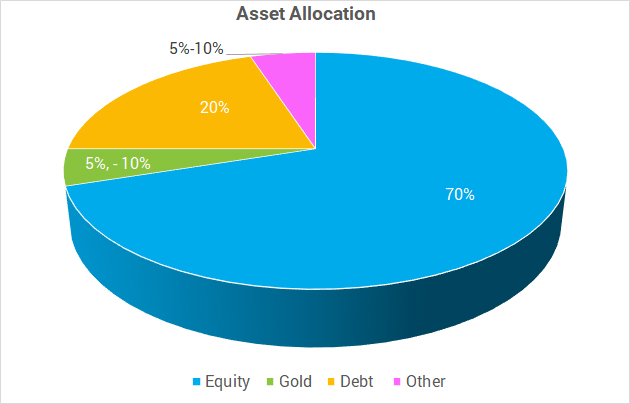

The Rule of 100 – merely states that the age of the investor should be deducted from 100, and the resultant number should be the proportion of equity in one’s investment portfolio. So if you are 30 years old, you should hold 70% (100-30) of your portfolio in equity and the balance in debt and gold. This formula assists you to decide an allocation to high-risk investment avenues such as equities based on your age and risk tolerance.

(For illustration purpose only)

To help you better understand asset allocation by age, let’s analyse two different scenarios:

Case – I

Rohit is currently 25 years of age; he has started earning and is now willing to make investments in mutual funds to begin his wealth creation journey. Now, if Rohit decides to plan his asset allocation based on his age, going by the formula (100-25), 75% of his total investments should be in equities, whereas the remaining 25% can be in a mix of relatively safer asset classes like debt and gold. To put it differently, the proportion of debt or fixed-income and gold investments should be equal to your age. Thus, a young investor at the start of his career may have a higher risk tolerance and invest a significant portion of the portfolio in equity investments as compared to an older investor.

Case – II

On the other hand, Ashish (Rohit’s father) is nearing his retirement age; he should prioritise capital preservation, with a higher allocation to debt or fixed-income instruments and a lower exposure to equities. His father is currently 55 years old, as per the ‘Rule of 100’ formula, Ashish should allocate 45% (100-55) of his assets to equities and maintain a majority of his investments in a mix of relatively safer asset classes like debt and gold, which offer a fair level of stability due to lower risk as compared to equity.

(For illustration purposes only)

However, as your age advances or you cross a certain age bracket, your circumstances change, responsibilities increase, and/or you are nearing your financial goals; these elements lead to a change in your risk tolerance level, which necessitates a review of your existing asset allocation and rebalancing if required. Periodic reviews of your asset allocation strategy could enhance your portfolio performance by booking profits in asset classes that have rallied and reinvesting in other asset classes with better opportunities ahead.

Therefore, defining an optimal asset allocation is not as easy as it might seem because you need to take into account a host of factors to reap the benefits of prudent asset allocation. However, once you have a sensible asset allocation strategy in place, you can relax knowing that you will generate a better return, reduce risk and taxes, have enough liquidity, and even achieve your financial goals. Do note that merely choosing an investment option based on hearsay tips from friends and relatives and investing a chunk of your money is not going to serve any purpose.

Ensure you make investments in worthy mutual funds based on your suitability. Several fund houses have introduced Multi-Asset Funds, which invest in multiple assets – equity, debt, and gold – with a predetermined asset allocation strategy.

Similarly, asset allocation in mutual funds can be achieved if you tactically allocate exposure across various Equity Funds, Debt Funds, and Gold (via Gold ETFs or Gold Funds). All you need to do is select the best and most appropriate schemes investing in each of these asset classes and invest as per your personalised asset allocation plan.

Additionally, you may consider building your portfolio with Quantum Mutual Fund’s DIY 12-20-80 Asset Allocation Strategy, a time-tested approach that has the potential to minimise downside risk and achieve your long-term goals. This asset allocation strategy could potentially offer your portfolio an optimal mix of stability, growth, and safety of capital.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Happy Investing!

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More