#ValueWaliDiwali: Here's a Low-Cost Way to Invest in Gold

Posted On Tuesday, Nov 02, 2021

Though Gold prices may have corrected from their historic highs, we believe that its long-term potential still holds good. Gold has played a strategic role in an investor’s portfolio especially during times of macro-economic uncertainty such as the current pandemic.

Fundamentally Strong Gold

During the Covid-19 triggered equity markets crash in March 2020, many investors sold equity mutual funds due to the market fall and rushed to invest in gold. This is because Gold generally has a negative correlation with equity and played the important role of being a source of liquidity and potential to limit the downside risk for all who those who had diversified their investments to a combination of assets

With equity markets witnessing a steep run-up currently, investors have increasingly realised that allocation to gold is essential for diversification, and which may help to minimize downside risks.

The fundamentals that propelled gold prices last year still hold valid that include:

• Rising deficits and debt

• Low interest rates

• Currency debasement due to excess liquidity

In addition, rising inflation is now another reason to invest in gold.

The fundamentals along with its long-standing cultural significance warrants an allocation to the yellow metal this Diwali. Investing through Gold ETFs translates to better price efficiency as illustrated below.

Table 1: Gold Pricing Markups

| Components | Gold Rate (24K) Rs. |

| 24 K Plain Gold | 45,000 |

| Making Charges @ 10% | 4500 |

| Sub Total | 49,500 |

| GST @ 3% | 1485 |

| Grand Total | 50,985 |

For illustrative purposes only.

As you see in the table above, there are making charges including GST. On the other hand, if you were to invest in a Gold ETF, you would have to pay the scheme’s annual expense ratio that is annually upto 1%. Moreover, Gold ETFs can be liquidated anytime during market hours and does not have any lock-in period.

5 Reasons to Invest in Quantum Gold Fund ETF

|

Use the Opportunity to Grow Your Allocation

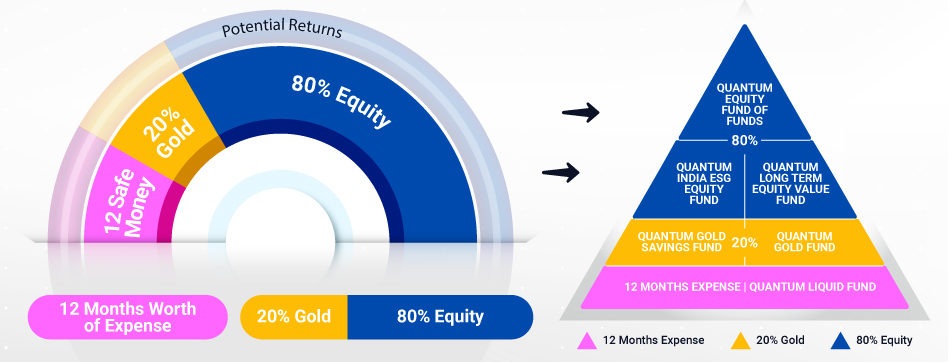

Take the opportunity of the correction to invest in Quantum gold ETF and gradually grow your gold allocation to form up to 20% of your investment portfolio. Investors can use our simple 12-20-80 Asset Allocation Strategy that offers the benefits of diversification and reduced downside risks.

After setting aside money equivalent to 12 months of expenses’ in an emergency corpus with the Quantum Liquid Fund, you can then consider investing 20% of your portfolio to the risk reducing and portfolio diversifying asset of Gold with Quantum Gold ETF.

You can also invest using a monthly SIP (Systematic Investment Plan) of Rs.500 without having the need to open a DEMAT account with the Quantum Gold Savings Fund.

Thereafter, you can invest the balance 80% in a diversified equity bucket comprising of Quantum Long Term Equity Value Fund, Quantum Equity Fund of Funds and Quantum India ESG Equity Fund.

Please note that the above suggested fund allocation only and is not to be considered as investment advice / recommendation, please seek independent professional advice and arrive at an informed investment decision before making any investments.

This Diwali, usher in the innovative and price-efficient way to invest in gold with the Quantum Gold ETF or Quantum Gold Savings Fund.

Watch our latest Mega webinar video on Asset Outlook & the Economic View in the Current Market Scenario where Chirag Mehta, Senior Fund Manager, Alternative Investments, give you further insights into how to invest in Gold.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Sep 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Gold Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

After a strong September, gold extended its bullish momentum into October, marked by heightened volatility and significant price swings.

Read More