Why Are Bond Yields Still High Despite Rate Cuts?

Posted On Wednesday, Dec 24, 2025

As we approach the end of calendar year 2025, India appears to be in a relatively favourable economic position often described as a “Goldilocks” scenario. This assessment has also been echoed by RBI Governor Sanjay Malhotra in his remarks during the December monetary policy announcement.

The Goldilocks Situation Explained

Simply put, it's an ideal economic scenario where inflation is under control, growth is steady, and interest rates are at levels that support economic activity. In theory, when the central bank (the RBI, in this case) cuts rates, it should lower the cost of borrowing, push up bond prices, and lead to lower long-term bond yields.

Chart I: Bond Yields Edge Higher Despite Easing Headline Inflation and Repo Rates

Source: Bloomberg, RBI, MOSPI. Data up to the month ended November 2025.

IGB 10 year: Indian Government Bond yields for the 10-year maturity (benchmark)

Typically, when a central bank embarks on a sustained easing cycle, the yield curve responds with a bullish steepening meaning long-term bond yields fall more sharply than short-term rates as markets price in lower inflation, easier financial conditions.

In India, however, the response has been counterintuitive. Despite consecutive rate cuts, bond yields have remained uncomfortably elevated, and the curve has steepened but with long-end yields moving higher rather than lower. This inversion of the textbook response is what markets refer to as bear steepening.

The irony is that India's macroeconomic backdrop doesn’t really justify such persistent bearishness in bonds.

The Indian Bond Market’s Paradox

With inflation running at just 0.7% YoY in November 2025, full-year FY26 inflation expected to average below 2%, and real GDP growth clocking a robust 8% in H1FY26, the macro backdrop could hardly look more benign. In such a textbook Goldilocks environment, bond markets should ideally be rallying and not resisting.

The country’s fiscal health has improved over time. India has been consistently following the fiscal glide path and has been able to reach the fiscal deficit target of 4.8% of GDP by FY 25 against 9.2% in FY21.

So why, despite these near-ideal conditions, do bond yields continue to behave as if they are trapped in a bear market?

Despite RBI’s aggressive rate cuts (125 basis points this CY 2025), long-term yields have been rising, particularly after June 2025. The 10- year bond yields have moved up ~ 30 bps post the front loaded 50 bps rate cut in June 2025. It’s almost as if bond markets are ignoring the rate cuts and becoming more bearish. A big part of the issue is that in the CY 2025 easing cycle, only a small portion of the rate cuts have been reflected in the bond yields. In comparison, previous easing cycles saw a much quicker and more pronounced transmission of rate cuts into the bond market.

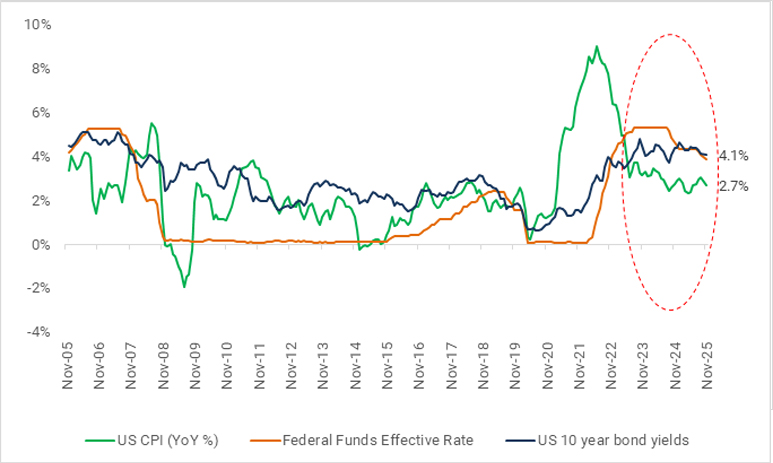

We went a step further and tried to figure if this was an Indian debt market paradox alone or was it a global phenomenon as well. And we realized that even in the U.S. we saw similar behavior.

Chart II: Despite Cooling of Fed Funds Rates, US Treasury Yields Inched Higher

Source: Bloomberg, Federal Reserve Bank of St. Louis, US Bureau of Labor Statistics.

Data for the last 20 years up to the month ended November 2025

Why Are Yields So Sticky?

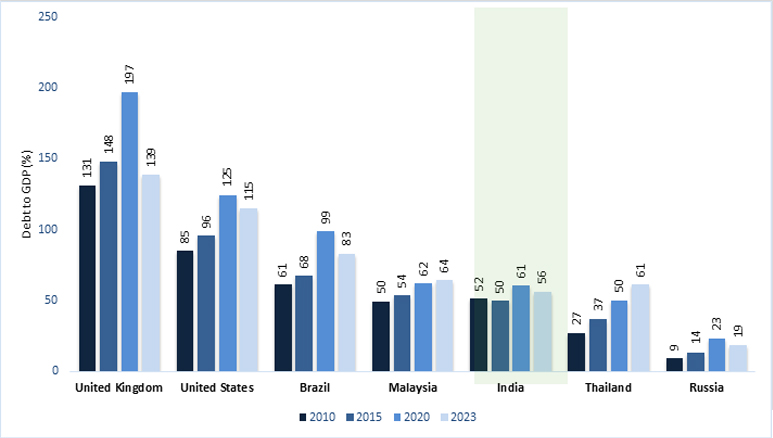

1. Fiscal worries and Rising Debt levels

While India’s fiscal health has improved in a broad, structural sense, concerns have now begun to resurface around the debt trajectory - particularly at the state level. Until recently, fiscal policy was anchored by a clear glide path focused on reducing the fiscal deficit as a percentage of GDP, and by most measures India has delivered commendably on that front.

From FY26 onwards however, policy priorities appear to have shifted toward reducing the debt-to-GDP ratio, though without a clearly defined glide path for fiscal consolidation. While the government has reiterated its commitment to lowering debt levels, the absence of a transparent roadmap makes this objective harder to assess and, consequently, challenging to factor into our projections.

Chart III: India Demonstrates Relative Fiscal Discipline Among Major Economies

Source: IMF: International Monetary Fund.

Data up to year ended 2023 (last available on IMF)

Complicating matters further, the Centre is likely to face growing challenges in managing its fiscal deficit going forward as recent income-tax and GST cuts are likely to moderate revenue growth. At the same time, rising incremental borrowing by states is adding to the overall supply burden on the bond market.

If these dynamics persist, long-term yields are likely to remain elevated, as investors increasingly price in concerns around debt sustainability rather than taking comfort from near-term macro strength.

2. Supply of Long-Dated Bonds

Another issue is the supply of long-dated government securities (G-Secs) and state development loans (SDLs). The government has issued a significant amount of long-term bonds in recent years to cater to long-term investors like insurance companies and pension funds. But now, that supply is starting to feel a bit heavy, especially when demand isn’t keeping up. With these long-term investors now facing regulatory changes and slower growth in their assets, demand for these bonds is weakening. This mismatch between supply and demand is one reason why yields are staying high.

3. Fatigue from Captive Investors

Banks and other long-term investors, traditionally the primary buyers of bonds, are beginning to show signs of fatigue. One contributing factor may be their efforts to limit unrealized losses on existing bond portfolios, making them more cautious about adding further exposure.

In addition, regulatory changes affecting insurance and pension funds have reduced their appetite for long-duration debt. The resulting decline in demand from these traditionally captive investors is adding to the current bearish tone in the bond market.

4. The Rupee depreciation

As the INR weakens, concerns around capital outflows and a probable increase in import-led inflation may have added to bond market volatility. Policymakers now face a delicate trade-off: managing interest rates and stabilizing the currency, without further unsettling the bond market.

What Needs to Change?

1. Reduction in Long-Term Debt Issuances and Increase in T-bill Issuances

The government could consider reducing long-duration bond issuance. Given the already large stock of long-term bonds outstanding, limiting additional supply may help ease supply-side pressure and could contribute to lower long-term yields.

Another option is to tilt borrowing towards short-term Treasury bills rather than long-duration bonds. T-bills are less sensitive to interest rate movements and tend to be more attractive in a low-rate environment, while also helping the government manage its borrowing costs more effectively. Coordinating the issuance of government securities (both central and state) based on actual market demand is crucial.

2. Liquidity Support

The RBI could inject more liquidity into the system through Open Market Operations (OMOs) and/or FX swaps, particularly in liquid securities. This could improve bond market sentiment and help with smoother transmission of rate cuts due to liquidity support.

The Near-Term Outlook:

Even with these adjustments, the outlook for India’s bond market remains uncertain. While there is a possibility of some relief in FY27 due to potential passive inflows from global investors upon India’s inclusion in the Bloomberg Index - the overall trend is not leaning towards a bullish market or an extended rally in the bond markets.

In the near term, we believe the bond yields may stay sticky in the range of 6.40%-6.70% with some term spread contractions.

What Can investors Do?

The longer end of the yield curve typically reflects longer-term risks around inflation, growth, and broader macro dynamics, and therefore tends to command a term premium. While the near-term inflation outlook remains benign, inflation in FY27 is expected to hover around 3.8% YoY. Similarly, while growth momentum in H1 FY26 remains strong at about 8%, it is likely to normalize closer to 7% in FY27. Against this evolving growth-inflation backdrop, term spreads appear relatively attractive.

That said, persistent demand–supply imbalances continue to weigh on the longer end of the curve. As a result, positioning in this segment may warrant a more calibrated and cautious approach, despite attractive valuations. Investors may therefore want to carefully assess the risk-return trade-off before increasing exposure to longer-duration assets.

In this context, Dynamic Bond Funds could be a reasonable option, given their ability to actively adjust portfolio duration in response to changing interest-rate conditions. At the same time, it may be prudent to avoid layering multiple risks, such as liquidity or lower credit quality while seeking duration exposure.

Accordingly, investors could evaluate strategies with a balanced dynamic allocation to government securities alongside high-quality AAA-rated instruments, helping to manage credit risk while navigating the current rate environment.

Data Source: Reserve Bank Of India, Bloomberg

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Sneha Pandey, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Mohit Bhatnagar - Head - Sales, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9987524548

Read our last few Debt Market Observer write-ups -

- The Macro Three Body Problem: Currency, Liquidity & Bond Yields

- Tariffs Pressures, GST Reforms, Rising Yields: India’s August Bond Story

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More