This Festive Season Invest In Gold ETFs

Posted On Wednesday, Sep 08, 2021

With the news of mutant Coronavirus variants and social distancing protocols still in place, the festive season might be muted for the second year in a row. However, Indians have preserved the tradition of buying Gold during the festive & wedding season as a symbol of auspiciousness ushering in prosperity for the future. This is because we have understood the intrinsic value of the yellow metal and gold’s capacity for long-term store of value.

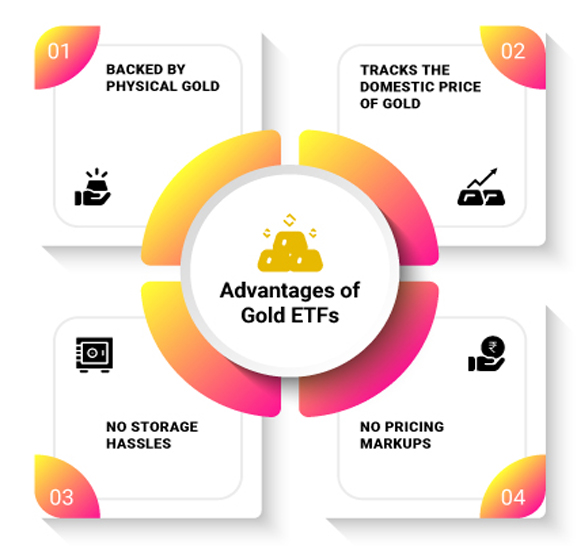

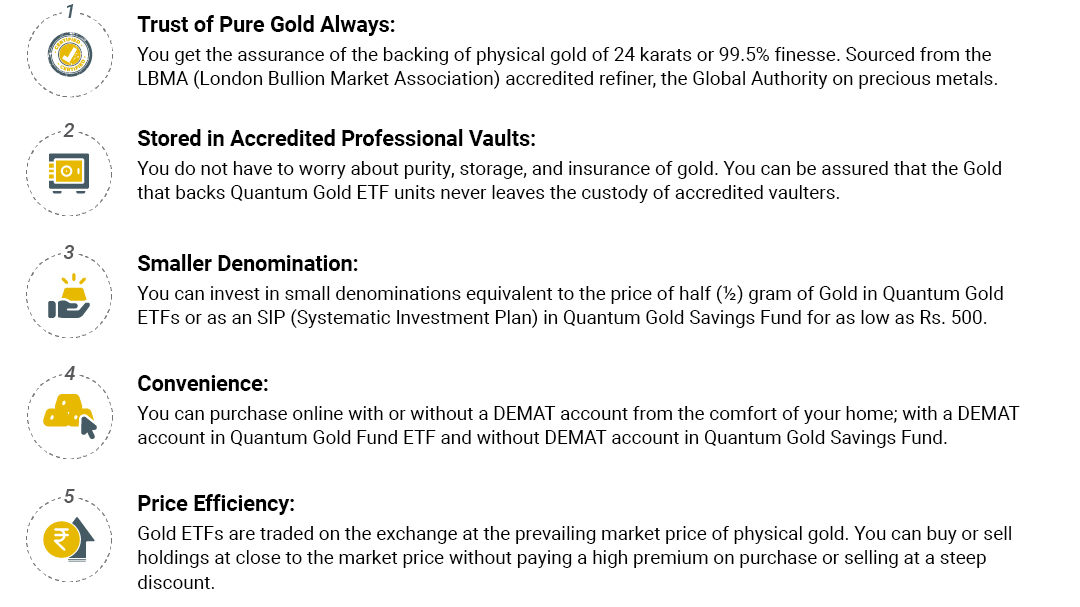

A safer way to invest in gold in the new normal might be to invest digitally. One of the innovative ways to invest in gold digitally is a Gold ETF (Exchange Traded Fund). As seen in the infographic below, a Gold ETF has several advantages over physical gold. Firstly, it does away with pricing markups due to making charges associated with physical gold. You do not have to go through the hassle of finding adequate storage and pay hefty locker charges. The fund takes care of all these things. Gold ETFs track the domestic price of Gold and is backed by physical gold.

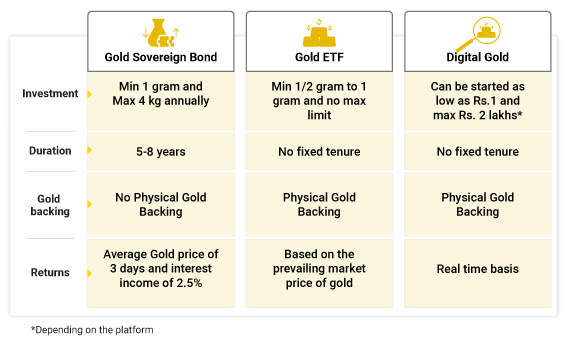

Let’s understand how this compares to other forms of investing in Gold.

Since Gold prices have corrected from the highs touched in 2020, you can use the correction to build your allocation to gold. We believe that the fundamentals that uphold long-term value continue to remain strong which include:

As you see in the illustrations above, Gold ETF has several advantages that surpasses physical gold and other forms of Gold investments. To elucidate, here’s how Gold ETF compares to two popular digital assets in Gold; Sovereign Gold Bond and Digital Gold.

Sovereign Gold Bond

While Sovereign Gold Bonds are securities issued by the RBI on behalf of the Government, it helps you build wealth and receive interest income. However, it comes with a lock-in of 8 years, making it a relatively illiquid option when you need money.

Digital Gold

Recently, NSE has restricted the sale of digital gold by stockbrokers, stating that it does not come under the definition of securities. Though there are many similarities to Gold ETFs, the primary difference is that digital gold is unregulated.

So it goes without saying that that glitters are not gold. Two of the most innovative ways of investing in Gold this festive season are the Gold ETF and Gold Mutual Fund or Fund of Funds which invest in Gold.

Here are the advantages of investing in the Quantum Gold ETF and the Quantum Gold Savings Fund that invests in the Quantum Gold ETF.

Use the Correction to Build Your Allocation

Since Gold prices have corrected from the highs touched in 2020, you can use the correction to build your allocation to gold.

Use the NSE code QGOLDHALF to buy Gold ETF units. Add the glitter of a Gold ETF this festival season!

Watch our latest Mega webinar video on Asset Outlook & the Economic View in the Current Market Scenario where Chirag Mehta, Sr. Fund Manager, Alternative Investment, give you further insights into the future prospects of Gold.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on August 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for September 2025

Posted On Tuesday, Sep 02, 2025

August 2025 saw renewed strength in gold, with international prices rising 4.79% for the month and posting a robust 37.75% year-on-year gain.

Read More