Gold or international equities - Which is a better portfolio diversifier?

Posted On Friday, Oct 11, 2019

“Diversify your equity portfolio by investing in US-focused mutual funds” is something you must have read or heard time and again, especially when Indian equity markets are more volatile than usual.

This well-meaning piece of advice is based on the conventional wisdom that diversifying an investment portfolio across different markets can reduce the overall risk and volatility, as these geographically and economically diverse markets are not expected to move in tandem. Sounds good, right?

But there’s a small problem. I’m not sure how effective geographical diversification is anymore! Courtesy financial globalization!

Countries, their economies and their now liberalized stock markets are highly interconnected due to international financial flows moving in and out swiftly, and freely.

With access to such liberalized markets, investors, mostly institutional and from developed economies try to enhance their returns by diversifying their portfolios internationally, especially in high growth, emerging markets like India.

No wonder then that Foreign Portfolio/Institutional Investors (FPI/FII) have been one of the biggest drivers of India’s financial markets and have invested around Rs 12.51 lakh crores (US$ 171.81 billion) in India between FY02-18. (Source: https://www.ibef.org/economy/foreign-institutional-investors.aspx)

Yes, financial globalization has had significant economic benefits for India, but at the same time it has made local Indian markets dependent on these foreign flows, which are highly sensitive to source country and global sentiments and economics, and even on India’s fundamentals.

Now if a country becomes heavily dependent on foreign money, sudden large movements in foreign capital flows can affect its entire financial system, leading to financing difficulties and economic downturns.

For example, when Lehman Brothers collapsed in the US in 2008, Indian markets witnessed a major pullback of FII flows as investors moved to safe havens.

Also since domestic investors tend to follow “smart” foreign investors, this flight to quality phenomenon tends to have a domino effect, with the market disturbances or crises spreading from one regional market to another, in this case from United States to rest of the world, including India.

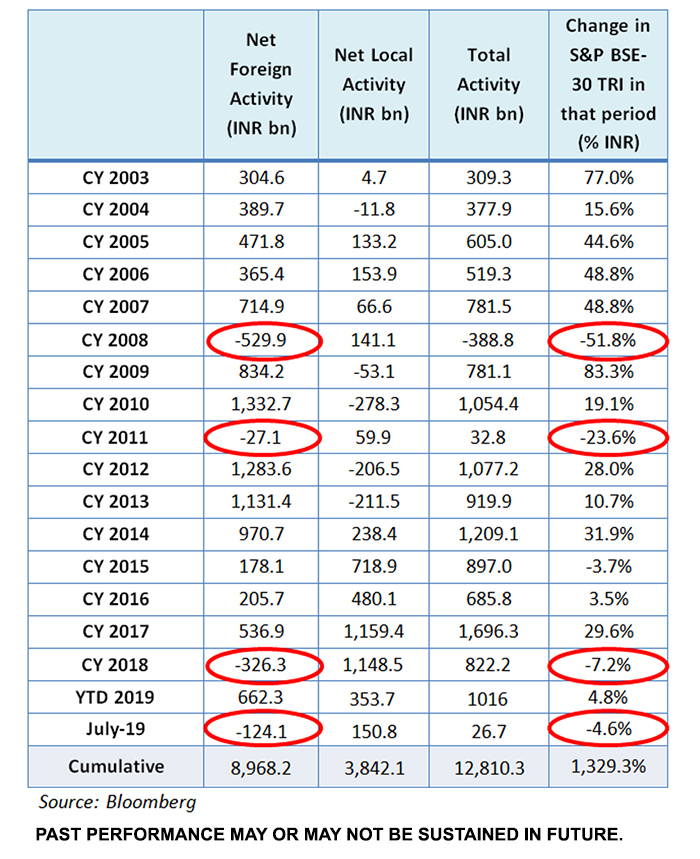

Foreign and Domestic flows in Indian markets and stock market performance for calendar years

FII’s have pulled out from Indian markets, it has had significant impact on stock prices

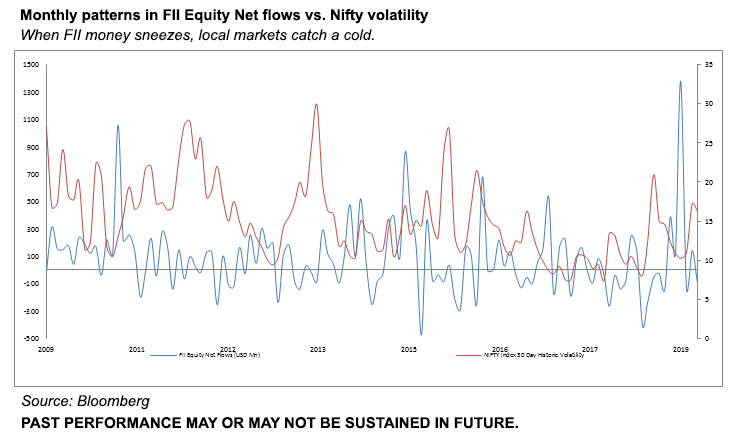

It can thus be said that in these times of high financial integration and inter-linkages among stock markets, FII trading activity has become a channel for the transmission of global volatility to domestic markets and could be responsible for substantial volatility in markets, especially during times of stress. This transmission may be due to fundamental linkages among economies or by factors unrelated to fundamentals, such as herd behavior and influenced by liquidity flows from central bank actions.

So if not geographical diversification to counter stock market volatility, then what?

We did some number crunching for you.

| Correlation# | MSCI US Index | GOLD INR/10 gms |

| MSCI India Index | 0.40 | -0.25 |

| MSCI US Index | 1 | -0.46 |

Data based on one year rolling returns from February 2007 to July 2019

#The correlation coefficient is a statistical measure that calculates the strength of the relationship between the relative movements of two variables. The values range between -1.0 and 1.0. A correlation of -1.0 shows a perfect negative correlation, while a correlation of 1.0 shows a perfect positive correlation. A correlation of 0.0 shows no relationship between the movements of the two variables.

So gold has a lot of unique qualities, but the first and foremost one is that it is good portfolio diversifier. As seen above, gold is generally negatively correlated with equities, Indian or international, giving it true diversification value and thus improving risk adjusted returns. This is mainly because it tends to have a confidence building, stabilizing effect in times of economic stress when equities suffer.

We thus suggest you take a note from what the CIO of the world’s largest pension fund based in Japan had to say recently. He thinks global markets have become so synchronized that money managers risk losing on every front. Hence his fund is now seeking uncorrelated returns by pushing into private investments and alternatives like gold.

To sum up, gold is a better portfolio diversifier option than international equities for an Indian investor in these times of volatility and uncertainty. It may reduce the risk in the portfolio without compromising the long term returns. It’s important to reiterate that “it is important to have an allocation to gold”.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More