Fiscal Escalation: Spend, Borrow and Print

Posted On Thursday, Feb 11, 2021

An American Investment Manager Warren Mosler, in 1970s, proposed an idea that governments which issue their own currency can spend as much as they want without any restriction and can fund that spending by printing new money. This is now known as Modern Monetary Theory (MMT). Although the concept of MMT has been around for very long, it gained popular support only recently.

In the Indian context, this concept is still foreign. Nevertheless, the recent fiscal-monetary coordination exhibited in the Union Budget and the RBI’s monetary policy statement seems to have a tilt towards some form of MMT.

Fiscal U-Turn

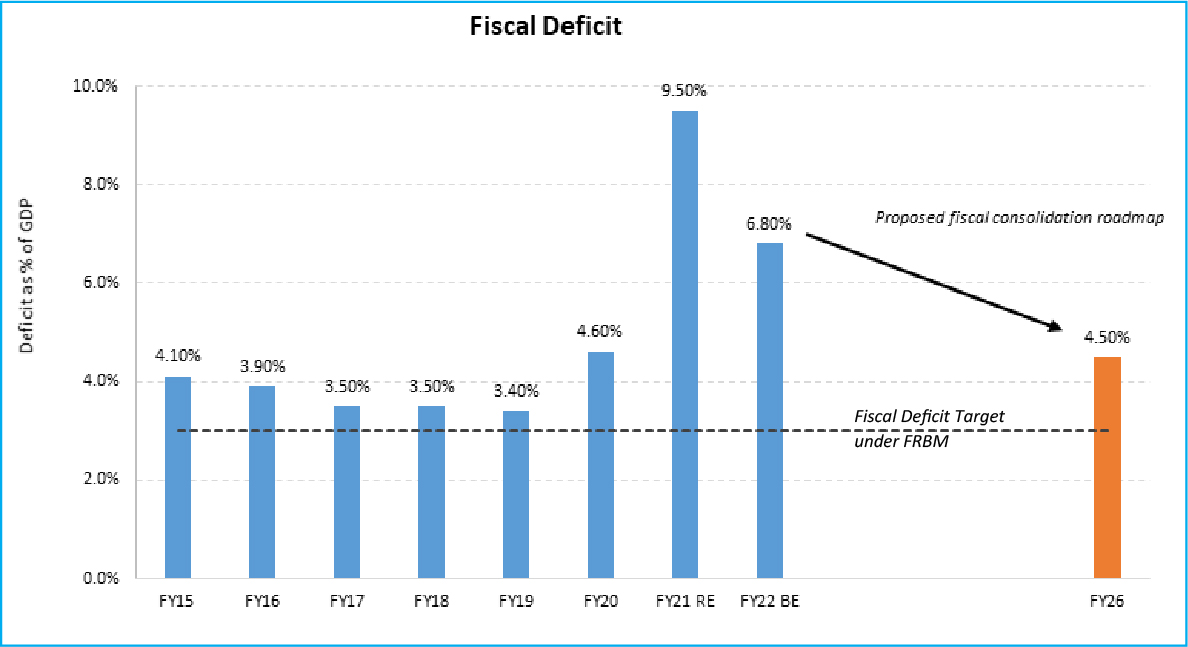

After following a conservative fiscal stance for 7 years, the union government under Mr. Modi took a different turn this time. The fiscal deficit (government spending over and above revenues) in the current financial year 2020-21 raised to 9.5% of GDP against the budget aim of 3.5%. Given the pandemic shock and the economic damage caused by the lockdown, there was an expectation that the fiscal deficit would be higher than the 3.5% target which was set before the Covid crisis. However, deficit number of 9.5% is significantly higher than even the highest market forecasts. The broader expectation of FY21 fiscal deficit was around 7.0-7.5% of GDP.

What is more significant is that the government has now decided to run higher fiscal deficit for extended period rather than rolling back crisis time measures quickly. The fiscal deficit for FY 2021-22 is slated at 6.8% of GDP higher than market estimates of between 4.8%-5.5%.

The timeline to bring down the fiscal deficit and the medium term target level has also been raised when compared to earlier FRBM targets. The central government has now set a target to bring down the fiscal deficit to below 4.5% of GDP by FY 2025-26. The fiscal deficit aim under the FRBM framework was to achieve 3.0% of GDP. This budget does not provide any guidance to move towards 3% fiscal deficit aim. This will be a major deviation from the FRBM roadmap.

Chart – I: Fiscal Deficit to remain elevated for long; No guidance to get to 3%

Source: CMIE, Indiabudget.gov.in, Quantum Research

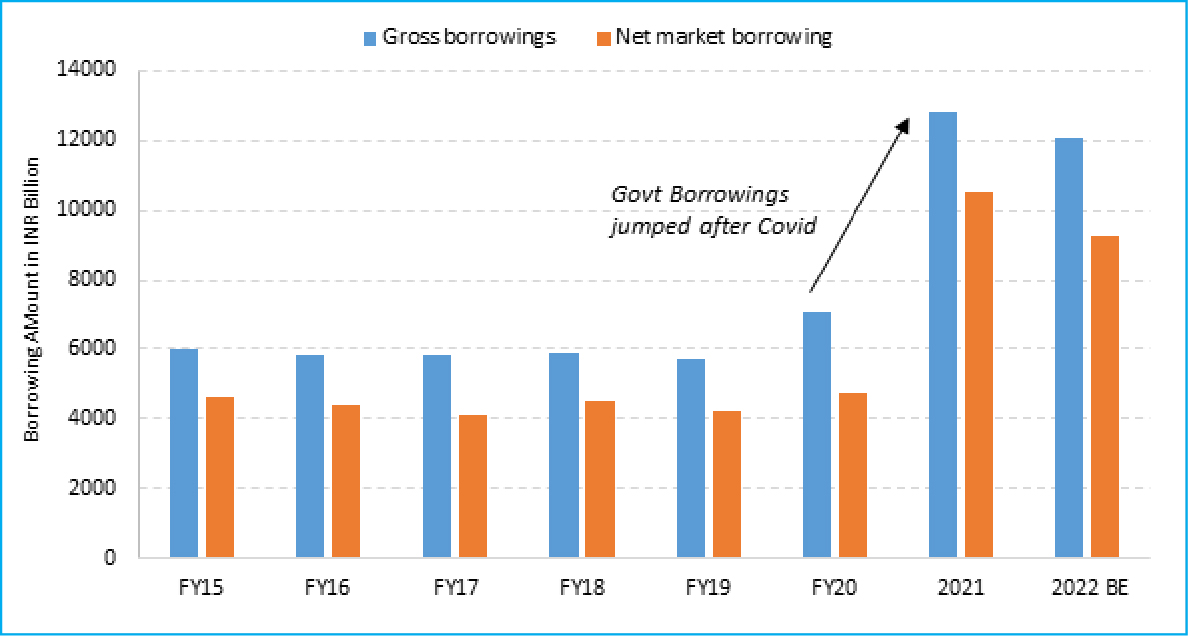

In order to fund this increase in fiscal deficit, the government has already announced to once again increase the market borrowings in the current financial year by Rs. 800 billion and set the gross market borrowings for FY 2021-22 at Rs. 12 trillion. To put these numbers in prospective, FY21 gross market borrowing estimate of the centre government before the pandemic was Rs. 7.8 trillion. So there has been a substantial increase in the government’s market borrowings in FY21 and FY22 relative to its past trend.

Given the extended fiscal glide path government’s market borrowing is likely to remain elevated for longer period. Borrowing limit for state governments has also been relaxed. States are now allowed to borrow net amount upto 4% of State GDP in FY 2021-22, increased from 3% of GDP. Most of the states are likely to follow an expansionary fiscal policy like the center. Thus the bond market will have to face a larger than usual supply of government bonds in coming few years.

Chart – II: Government’s borrowing requirement to remain high in foreseeable future

Source: CMIE, Indiabudget.gov.in, Quantum Research

The goal is to boost economic growth through increased government spending at a time when private sector in not in best of shape. This is based on an assumption that with increase in government spending private sector will crowed in and have a multiplier impact on growth.

Although increased government spending would be favorable for economic growth but the resultant increase in government borrowings could lead to sharp rise in interest rates and take away some of the gains. Thus it would be critical to keep interest rates under check until material recovery in economic growth is achieved.

The RBI will have to play a significant role in keeping interest rates low and facilitating smooth functioning of financial markets.

Deficit Monetization

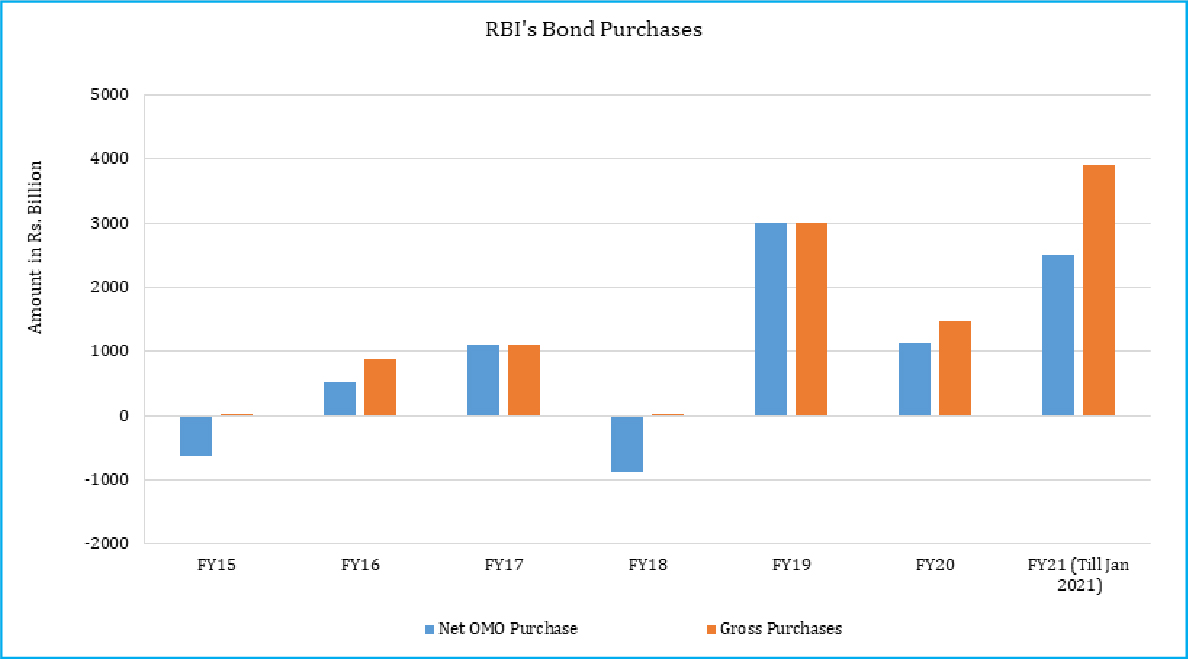

The RBI governor Shaktikanta Das has, at many occasions, presented a case for coordination between monetary and fiscal policy to bring the economy back on growth track. RBI’s support for this idea is evident from its actions. They bought a significant part of the government debt in the last 2 years.

In the monetary policy statement on Feb 05, the RBI reiterated its commitment to support bond market and ensured an ‘orderly completion of the government’s market borrowing programme in a non-disruptive manner’.

There is an expectation that the RBI will continue to use open market operations (OMO) and twists to defend long term yields from rising sharply. Phased roll back of CRR cuts (Cash reserve ratio) and cyclical increase in currency in circulation will create room for OMOs by lowering the prevailing excess liquidity.

Chart – III: RBI buying large portion of government debt to keep bond yields low

Source: RBI, Quantum Research

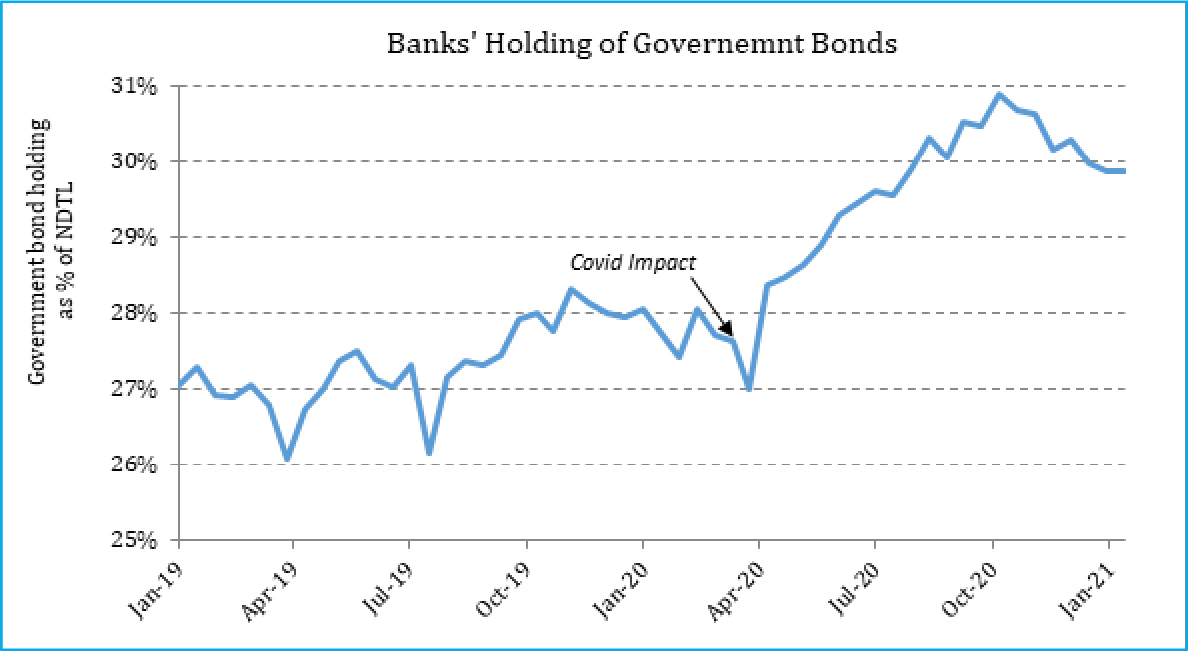

Apart from direct bond purchases, the RBI has also extended the enhanced HTM (Held to Maturity) limit of 22% of NDTL (Net Demand and Time Liabilities) for banks by one more year till March 31, 2023. This will include securities acquired between April 01, 2021 and March 31, 2022. In our opinion this move will allow banks to hold a larger than usual share of government bonds and thus create an additional demand source.

Chart – IV: Increased HTM limit will encourage banks to buy more bonds

Source: RBI, Quantum Research

Trend Reversal

Although the RBI has been supportive for the bond markets in the last two years, we should remain cognizant of the risks on the horizon. Macro backdrop will be significantly different this year given the economy is showing signs of recovery and inflation momentum is picking up. There is also abundance of liquidity in the banking system. This means the RBI will have to walk on a very tight rope to support the government’s borrowing program.

We maintain our long held view that the bond yields have already seen the bottom and it seems that reversal is coming sooner than anticipated. We expect bond yields to move higher in next 3-4 quarters due to – (1) normalization of liquidity by the RBI, (2) increased supply of government bonds and (3) fears of inflation and policy rate normalization towards the year end.

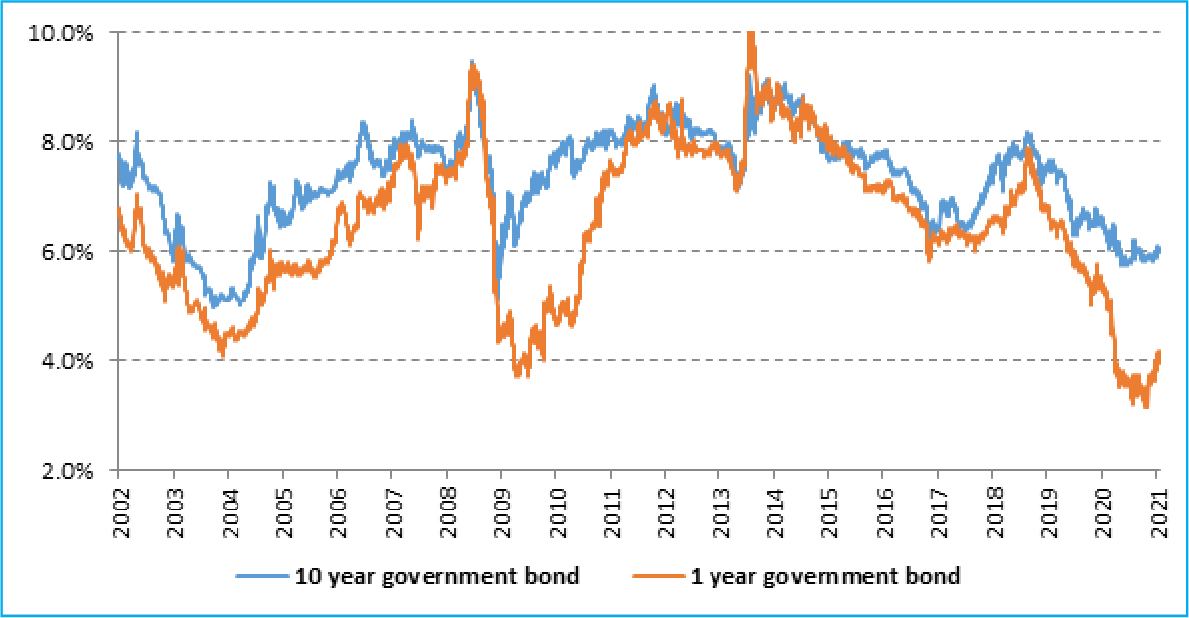

Chart – V: Bond yields are near decadal lows

Source: RBI, Quantum Research

Past performance may or may not sustain in future

We expect the RBI will continue to conduct OMOs and twists at least in this calendar year which will ensure yields do not move up very sharply and will also put a cap on extent of rise in long term yields.

Apart from the domestic fiscal and monetary policy, we are carefully watching following to get cues about future direction of bond yields:

• Development around India’s inclusion into the global bond indices,

• Movement in commodity prices particularly the crude oil,

• Actions of developed market central banks and

• Actions of rating agencies about India’s sovereign rating.

Portfolio Outlook and Recommendation

In the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on tactical trading opportunities within a narrow range. QDBF does not take any credit risks and invests only in sovereigns and top-rated PSU bonds, but it does take high-interest rate risk from time to time.

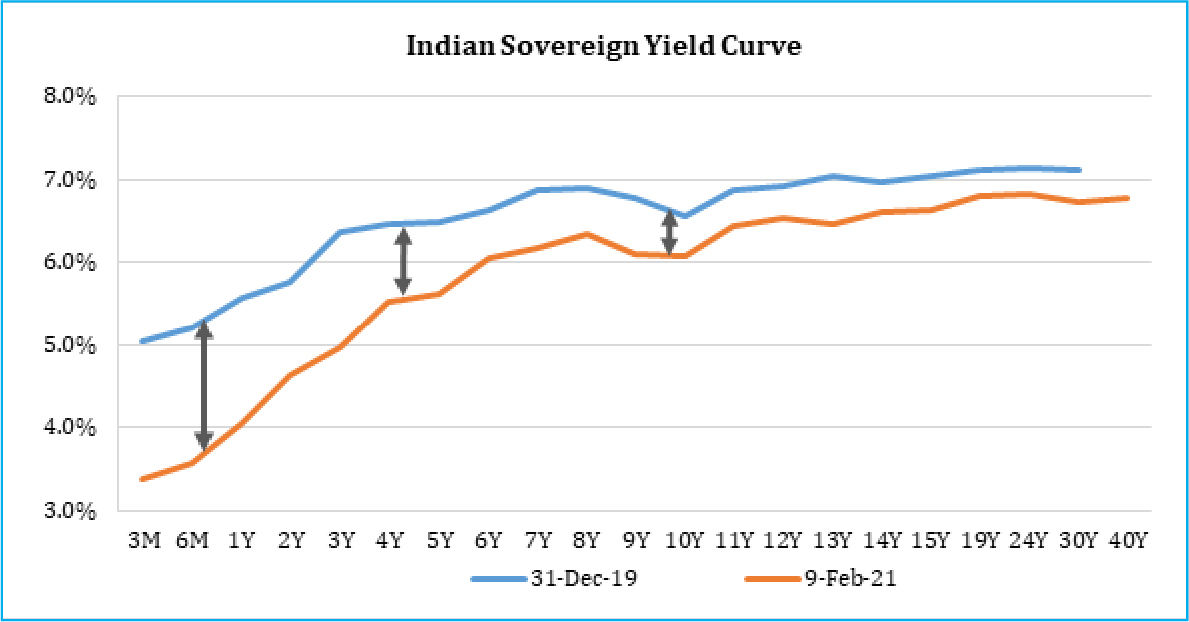

Given the yield curve is already very steep and the RBI is actively intervening in the market to protect long bond yields from rising, we are positioned at the longer end of the maturity curve and at the same time holding higher than usual cash.

This is a tactical position that can change based on market developments and new information flows. Given the objective of the fund stated in the name itself – we retain our right to remain dynamic in our portfolio construction as we remain cognizant of the risks on the horizon.

Chart – VI: Yield Curve is still very steep

Source: RBI, Quantum Research

Past performance may or may not sustain in future

We understand the economy and markets are currently adjusting to an unprecedented shock. There are too many moving parts and things are still evolving. Thus any forecast about the future is susceptible to change based on policy responses from the government and the RBI and the changes in global markets. We stand vigilant to review our outlook as and when new information comes. Nevertheless, it would be prudent for investors to be conservative at times of heightened uncertainty.

Investors should acknowledge that the best of bond market rally is now behind us. At this time it would be prudent to lower the return expectations from fixed income products – as money market yields, fixed deposits rates will remain low and potential capital gains from long bond funds will be muted.

Conservative investors should remain invested in categories like liquid fund where impact of interest rate rise would be favorable. However, while selecting a liquid fund be cautious of the credit quality and liquidity of the underlying portfolio.

At this point where fixed deposit rates have come down to historical lows, liquid funds could be better alternative in comparison to locking in long term fixed deposits. Liquid Funds invest in up to 91 day maturity debt securities which get re-priced higher when interest rates rise. Fixed deposits interest rates remain fixed for the entire tenor thus lose out during rising interest rate cycle.

Investors with higher risk appetite and longer holding period can look for dynamic bond funds where the fund manager has flexibility to change the portfolio when market views change. These funds are best suited for long term fixed income allocation goals. However, do remember that bond funds are not fixed deposits and their returns could be highly volatile and even negative in short period of time.

For any further queries you can write to us at

[email protected] / [email protected] or call us on Tel: 9870458160 / 8689961495

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on January 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More -

Inevitable Pivot: Resetting Market Expectations

Posted On Tuesday, Apr 26, 2022

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation.

Read More