Your Anchor in a Storm - Grow your Wealth with a Value + Tax Advantage

Posted On Friday, Dec 23, 2022

The financial markets have been through a bumpy ride the past year – the Russia-Ukraine war has led to a global energy crisis and led to rising inflation and subsequent interest rate hikes. Just like an anchor helps you remain steadfast during a storm, choosing to be in a diversified portfolio can safeguard your portfolio from downside risk

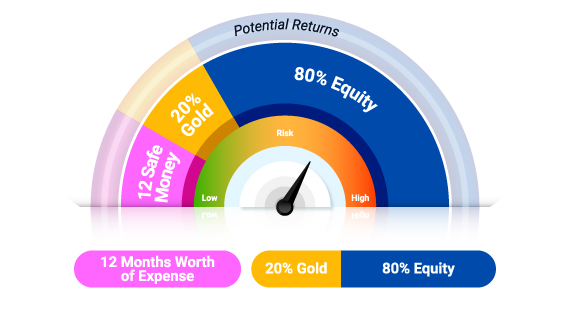

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation. .

By investing in three asset classes using Quantum’s tried and tested 12:20:80 (Barah, Bees aur Assi) Asset Allocation Strategy, you get the right mix of security, stability and growth in your portfolio.

Equity – Your growth block, forms the largest part of the allocation. However, it is important that within this block, you invest in a diversified equity portfolio as different styles do well during different market cycles. Post-2020, due to cyclical recovery, value investing has made a comeback. Thoughtful investors can stay the course by adding value funds as part of their well-crafted diversified bouquet of funds.

Adding VALUE to the Mix

Given the rising interest rates, the cost of borrowing would also increase, impacting profitability and thereby equity returns. However, interest rate hikes do not negatively impact all equity investments uniformly. Each style of investing has its pros and cons. Finding the correct mix of value and growth funds may lead to enhanced diversification and better potential to beat downside risks arising out of interest rate hikes.

Fund | 12:20:80 Allocation with Value | 12:20:80 Allocation without Value | Sensex |

Investment Value | 100,000 | 100,000 | 100,000 |

56,000 | 64,000 |

| |

12,000 | - |

| |

12,000 | 16,000 |

| |

20,000 | 20,000 |

| |

Market Value | 1,05,676.50 | 1,05,366.8 | 1,06,449 |

Absolute Return | 5.68% | 5.37% | 6.45% |

Data for the period from April 01, 2022 to Nov 30, 2022. The above table to be read in conjunction with the complete fund performance below. Past performance may or may not be sustained in the future.

The table above indicates how the equity-gold portion of the 12:20:80 Portfolio would have performed with or without value against the benchmark. This substantiates how the presence of a value fund helps lower portfolio downturns. The potential for risk-adjusted returns increases over the long term.

Why does it make sense to add a Value-oriented ELSS fund to your portfolio?

Considering it’s time when companies ask for investment proof from employees, it’s a good opportunity to grow your wealth with a value-based ELSS fund.

Add Quantum Tax Saving – a-true-to-label value-based ELSS fund as a part of your diversified equity allocation using our tried and tested 12:20:80 Asset Allocation Strategy (Barah, Bees Aur Assi).

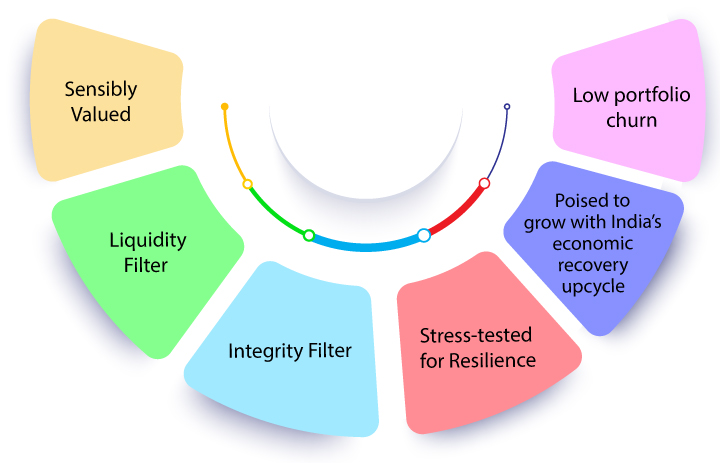

Quantum Tax Saving Fund is managed in the identical style as our Quantum Long Term Equity Value Fund. It consists of a well-balanced and diversified portfolio - typically 25 to 40 stocks, selected after a thorough bottom-up stock selection.

• Sensibly Valued - When you consider Quantum Tax Saving Fund in your portfolio, you get a comparable earning potential as the benchmark at relatively lower valuations. (Ref Fig 2 below)

• Liquidity Filter - You are invested in a scheme portfolio screened with a liquidity filter of companies trading over $1 Million per day, so you never have to worry about the flexibility to redeem on reaching your goals

• Integrity Filter – The portfolio invests in companies that are selected based on their governance standards. Companies with poor governance will not be included in the portfolio no matter their weight in the benchmark.

• Stress-tested for Resilience – The underlying stocks go through a stress test for balance sheet strength thereby reducing risks in case of downturns.

• Poised to grow with India’s economic recovery upcycle - The scheme portfolio is diversified and poised to grow with India's economic recovery. (Ref Fig 3)

• Low portfolio churn – The Fund Managers of QTSF invest with a long-term perspective and don’t deviate from the stated style. It has a portfolio turnover ratio of 18.48% as of September 30, 2022, translating to an average holding period of 5.4 years.

| QTSF | % of BSE-30 Index | BSE-30 Index | |

WEIGHTED DIVIDEND YIELD (Mar'23/Dec'22) | % | 2.0% | 154% | 1.3% |

WEIGHTED PER FY2E | X | 12.2 | 72% | 17.1 |

EPS Growth - FY2E (Mar'25/Dec'23) | % | 10.4% | 74% | 14.1% |

WEIGHTED EPS GROWTH - FY2E | % | 10.8% | 76% | 14.1% |

EPS Growth - 2 Year Forward (FY'25/FY'23) | % | 13.7% | 85% | 16.2% |

WEIGHTED EPS GROWTH - (FY'25/FY'23) | % | 14.5% | 86% | 16.8% |

T 12 M PE |

| 16.2 |

| 24.0 |

%Wt of stocks with PER > 20 T12M PE |

| 58% |

| 87% |

%Wt of stocks with PER < 20 T12M PE |

| 42% |

| 13% |

%Wt of stocks with PER > 30 T12M PE |

| 18% |

| 27% |

Investment Value |

| 100% |

| 100% |

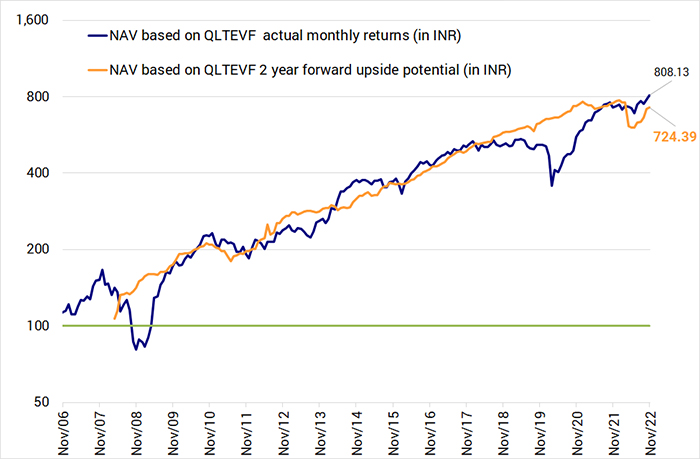

Data as of Nov 30, 2022. The above graph shows the estimate of rebased NAV on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2.

• Saffron line is the predicted NAV based on the forecasted upside (Two years prior)

• The Blue line is the actual Fund NAV

• Barring black swan events, forecasted upside potential over the next two years has closely tracked the actual fund performance over the long term. The trend is indicative of a robust investment process that has worked over the long term.

Investing in an ELSS has its share of advantages: -

• Tax benefit u/s 80C allows you to save up to Rs.46,800 per year, considering you are in the highest tax bracket.

• It has the lowest lock-in among other tax saving options.

• You can invest using an SIP or lumpsum mode,

Undoubtedly, adding a Value-based ELSS Fund to your diversified equity portfolio is the way forward to help you create wealth, reduce risk of downside and save tax in the process. Try using our Asset Allocation Calculator to rebalance your equity allocation.

Irrespective of the macroeconomic challenges, add value investments as part of your diversified equity portfolio to sail through every market environment. Get started on your tax + wealth building goals with Quantum Tax Saving Fund.

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Tax Saving Fund - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (23rd Dec 2008) | 16.43% | 16.66% | 16.61% | 15.94% | 83,430 | 85,738 | 85,302 | 78,722 |

| Nov 30, 2012 to Nov 30, 2022 (10 years) | 13.08% | 14.51% | 14.53% | 14.04% | 34,200 | 38,801 | 38,875 | 37,224 |

| Nov 30, 2015 to Nov 30, 2022 (7 years) | 11.93% | 14.76% | 14.88% | 14.81% | 22,031 | 26,241 | 26,420 | 26,309 |

| Nov 30, 2017 to Nov 30, 2022 (5 years) | 9.84% | 13.30% | 13.84% | 15.07% | 15,992 | 18,677 | 19,127 | 20,184 |

| Nov 29, 2019 to Nov 30, 2022 (3 years) | 16.28% | 19.24% | 18.70% | 16.98% | 15,736 | 16,970 | 16,738 | 16,020 |

| Nov 30, 2021 to Nov 30, 2022 (1 year) | 12.17% | 10.73% | 11.55% | 12.04% | 11,217 | 11,073 | 11,155 | 11,204 |

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of November 30, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006

The Fund is managed by George Thomas & Christy Mathai. George Thomas has been managing the fund since April 1, 2022. Christy Mathai has been managing the fund since November 30, 2022.

Click here to view other funds managed by them.

| Performance of the Scheme | Direct Plan | |||||

| Quantum Equity Fund Of Funds - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (20th Jul 2009) | 13.76% | 13.23% | 12.76% | 56,072 | 52,709 | 49,818 |

| November 30, 2012 to November 30, 2022 (10 years) | 14.15% | 14.53% | 14.04% | 37,579 | 38,875 | 37,224 |

| November 30, 2015 to November 30, 2022 (7 years) | 12.25% | 14.88% | 14.81% | 22,472 | 26,420 | 26,309 |

| November 30, 2017 to November 30, 2022 (5 years) | 10.02% | 13.84% | 15.07% | 16,125 | 19,127 | 20,184 |

| November 29, 2019 to November 30, 2022 (3 years) | 15.08% | 18.70% | 16.98% | 15,254 | 16,738 | 16,020 |

| November 30, 2021 to November 30, 2022 (1 year) | 4.89% | 11.55% | 12.04% | 10,489 | 11,155 | 11,204 |

#S&P BSE 200 TRI, ##S&P BSE Sensex TRI.

Data as of November 30, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated based on Compounded Annualized Growth Rate (CAGR). The fund is managed by

Chirag Mehta since Nov 1, 2013. Chirag Mehta manages 5 Schemes of Quantum Mutual Fund.

For other schemes managed by him, please Click here.

| Performance of the Scheme | Direct Plan | |||||

| Quantum India ESG Equity Fund - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (12th Jul 2019) | 18.10% | 17.85% | 16.84% | 17,580 | 17,453 | 16,952 |

| November 29, 2019 to November 30, 2022 (3 years) | 18.41% | 18.33% | 16.98% | 16,616 | 16,586 | 16,020 |

| November 30, 2021 to November 30, 2022 (1 year) | 3.35% | 4.17% | 12.04% | 10,335 | 10,417 | 11,204 |

#NIFTY100 ESG TRI, ##S&P BSE Sensex TRI.

Data as of November 30, 2022.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Chirag Mehta manages 5 Schemes and Sneha Joshi manages 1 scheme of the Quantum Mutual Fund. For performance of other funds managed by Chirag Mehta, please Click here.

| Performance of the Scheme | Direct Plan | |||||

| Quantum Gold Savings Fund - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (19th May 2011) | 6.55% | 7.92% | 6.47% | 20,793 | 24,104 | 20,618 |

| November 30, 2012 to November 30, 2022 (10 years) | 3.98% | 5.24% | 6.31% | 14,772 | 16,670 | 18,448 |

| November 30, 2015 to November 30, 2022 (7 years) | 9.81% | 11.15% | 6.01% | 19,268 | 20,968 | 15,050 |

| November 30, 2017 to November 30, 2022 (5 years) | 11.21% | 12.60% | 5.10% | 17,015 | 18,109 | 12,828 |

| November 29, 2019 to November 30, 2022 (3 years) | 10.26% | 11.88% | 3.47% | 13,412 | 14,014 | 11,079 |

| November 30, 2021 to November 30, 2022 (1 year) | 8.49% | 10.32% | -0.21% | 10,849 | 11,032 | 9,979 |

#Domestic Price of Physical Gold.

Data as of November 30, 2022.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

The fund is managed by Mr. Chirag Mehta. Chirag Mehta is handing the fund since May 19, 2011. For other funds managed by Chirag Mehta, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Tier-1 Benchmark | Tier-2 Benchmark |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years |  Investors understand that their principal will be at Very High Risk |  |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Benchmark |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |  |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |  |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |  |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The investors of Quantum Equity Fund of Funds, Quantum Gold Savings Fund, Quantum Nifty 50 ETF Fund of Fund will bear the Scheme expenses in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Kickstart the New Year with a 12:20:80 Mutual Fund Portfolio Review

Posted On Tuesday, Dec 27, 2022

As the year draws to a close, it is a good time take a closer look at your investment portfolio.

Read More -

Your Anchor in a Storm - Grow your Wealth with a Value + Tax Advantage

Posted On Friday, Dec 23, 2022

The financial markets have been through a bumpy ride the past year – the Russia-Ukraine war has led to a global energy crisis and led to rising inflation and subsequent interest rate hikes.

Read More