The Macro Three Body Problem: Currency, Liquidity & Bond Yields

Posted On Friday, Nov 21, 2025

If you’ve been tracking India’s bond markets over the past few months, you’ll know that nothing moves in isolation anymore. The rupee, liquidity, and bond yields together have created what can only be described as the Macro three-body problem. Just like in physics, where three celestial bodies influence each other in unpredictable ways, these economic forces - the pressure on the rupee, liquidity stress in the banking system, and high bond yields despite a 100 bps rate cut by the central bank - are creating a scenario that no single policy tool can easily control. The interaction between these forces is shaping the path of interest rates, influencing the RBI’s policy decisions, and ultimately determining the return outlook for both debt and equity investors.

Let’s break it down.

The First Body: The Rupee

First up, we have the rupee - The Currency. The Indian rupee has been under pressure lately, mainly due to a series of global and domestic factors. Capital outflows, global risk sentiment, and trade imbalances have been pushing the rupee weaker. The INR (Indian Rupee) has depreciated to new all-time lows against the US dollar, briefly touching ₹89/$.

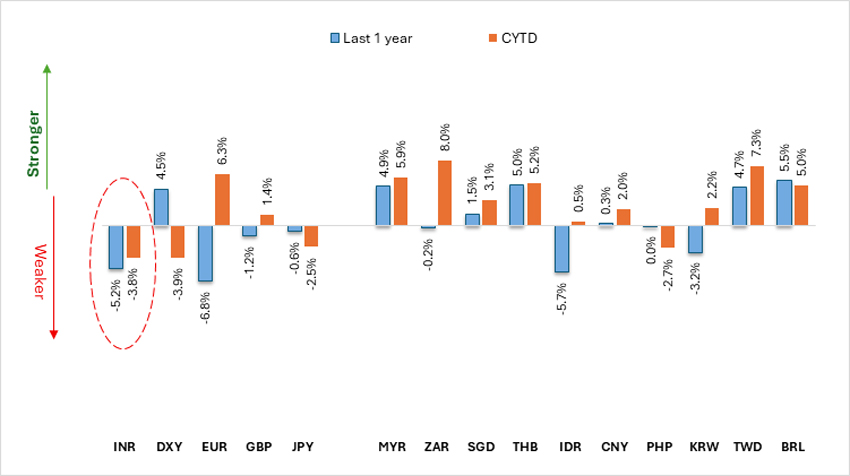

Chart I: Movement in major currencies against USD

Source: Bloomberg. Quantum AMC Graphics. Data up to October 31, 2025

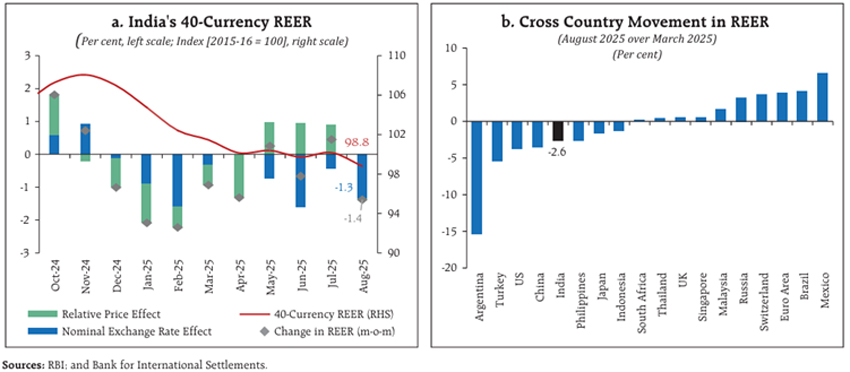

The pressure is not just a short-term problem. The real effective exchange rate (REER) - a measure of currency strength against a basket of trading partners - is at its lowest levels in over a year, signaling that the rupee’s underperformance is starting to have broader implications on India’s competitiveness and economic stability. Between March and August 2025, the INR’s 40-currency REER depreciated 2.6%, broadly tracking nominal movements and remaining modest compared to major economies.

Chart II: INR REER Trends

Source: RBI Bulletin – October 2025. Data up to August 2025

So, what’s the impact of this on the financial markets?

A weaker rupee may add to inflationary pressures in the long run. Higher import costs - especially for oil, raw materials, and machinery - push prices up. This could lead to tightening of policy, but higher rates could slow economic growth, leaving the RBI in a tough spot.

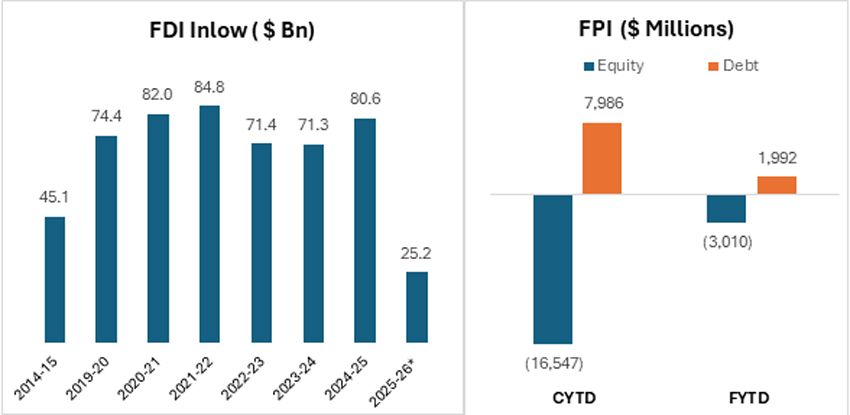

A depreciating rupee makes India less attractive to foreign investors, as it erodes their returns and creates uncertainty. However, a strong uptick in foreign direct investment (FDI) could help offset some of this negativity, providing a silver lining in an otherwise challenging currency environment.

FDI inflows have been rising, hitting a 3-year high of $25.2 bn in the first quarter of FY26. This has largely been driven by sectors like tech and manufacturing, where investors remain optimistic about India’s long-term growth potential.

Chart III: Strong FDI Inflows Offset Weak FPI

Source: Bloomberg, NSE Cogencis, Quantum AMC Graphics. Data up to November 11, 2025

*Data for FDI is for the Financial Year. Except for FY26 Data is for the period April-June 25.

But here’s the catch: Foreign Portfolio Investment (FPI) remain weak, especially in equities, due to factors like uncertainty over tariffs, changing visa policies, and other external factors. This has made the rupee more susceptible to downward pressure and it makes the country more vulnerable to shifts in capital flows, especially in a high interest rate environment globally, where capital tends to flow towards higher-yielding assets.

Now as the rupee weakened, the RBI has been forced into intervention mode.

Its strategy? A mix of spot interventions (selling dollars to support the rupee) and forward market interventions (entering into forward contracts to manage expectations around future rupee weakness). But here’s where the problem deepens. These interventions are draining liquidity from the banking system. And that brings us to the next body in this complex equation - banking system liquidity.

The Second Body: Liquidity and its invisible tightening

It all starts with liquidity. In simple terms, it's about how much cash is floating around in the system and how easily banks can get their hands on it. Think of liquidity as the fuel that powers the economy - without it, the engine can’t run.

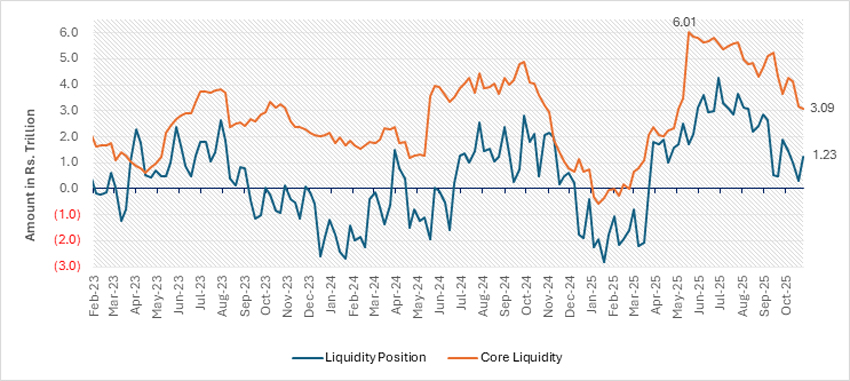

At the start of FY26, liquidity was in a relatively comfortable place with core liquidity hovering near INR 2.4 trillion. In October 2025, core liquidity stood ~ INR 3.2 trillion. In our estimates, without any intervention, this number could plummet to lower than ~ INR 1 trillion by March 2026 – which is a massive drop. There’s a combination of factors at play here that are putting a squeeze on liquidity.

Chart IV: Core Liquidity Keeps Falling Despite CRR Cut Support

Source: RBI. Quantum AMC Graphics. Data up to the week ended October 31, 2025.

Why is this happening? The currency in circulation (CIC) - the actual money we use in daily transactions - is climbing too and has surpassed the seasonal trend in uptick. This means there’s more cash floating around in people’s pockets and less in the banks for lending or investing.

Now the RBI has been working overtime to ensure liquidity doesn’t dry up as much and one of its key tools that it deployed for this purpose is the Cash Reserve Ratio (CRR) cut. The CRR is the percentage of a bank’s total deposits that it must keep in reserve with the RBI. When the RBI cuts the CRR, it’s essentially releasing more cash into the banking system, making it available for lending and investment.

In FY26 so far, the RBI implemented a 100-basis-point (bps) CRR cut, releasing about ~ INR 2.5 trillion into the system. Nearly INR 1 trillion of this is to flow in by November 2025. But here's the thing: even after this injection, the liquidity situation still doesn’t look as comfortable. Between September and October 2025, durable liquidity had dropped sharply from ~ INR 5 trillion to ~INR 3 trillion - a nearly INR 2 trillion slide in just five weeks.

Now, the increase in CIC over that period was just INR 135 billion. So, this drop in liquidity can't be fully explained by the money we’re all spending. We believe it’s the RBI’s FX intervention, which has absorbed massive amounts of liquidity. The central bank has been actively managing the value of the rupee, intervening in the foreign exchange markets to stop the rupee from weakening too quickly. However, these actions come at a cost - they’re draining liquidity from the system.

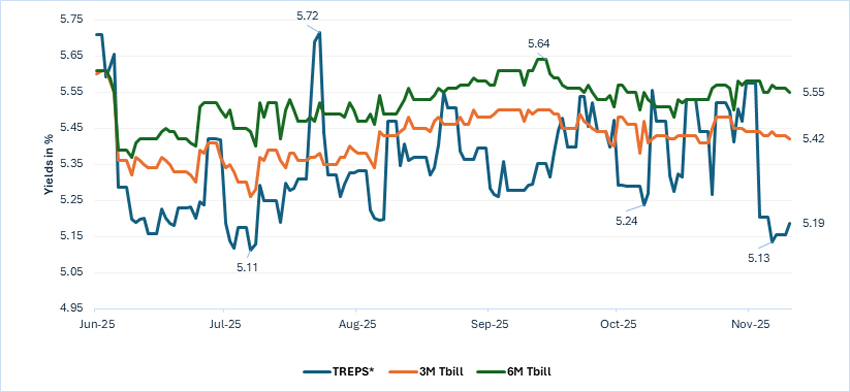

Chart V: Overnight and Short-Term Rates Stay Volatile Amid Liquidity Swings

Source: CCIL, RBI, Quantum AMC Graphics. Data for the last six months up to November 10, 2025.

* TREPS: Treasury Bills Repurchase - It’s a short-term money market instrument that lets investors earn returns on idle cash, commonly used by banks, financial institutions, and mutual funds for quick investments.

As a result, even short-term (frictional) liquidity has started tightening. We can see this pressure in the money markets: the weighted average call rate (WACR) edged above the repo rate - a key signal that money markets are feeling the strain. When this happens, it becomes harder for banks to borrow money in the short-term, pushing up borrowing costs across the economy.

So, what happens next? This brings us to the third body of the problem: Open Market Operations (OMOs).

Third Body: OMOs

The RBI has some tools left to manage the situation. Historically, when liquidity tightens and credit growth picks up, the RBI has turned to Open Market Operations (OMOs) to inject durable liquidity. OMOs are essentially the RBI buying government bonds from the market, which puts cash back into the system.

Markets and analysts now estimate that the RBI to have the space for ~ INR 1-2 trillion worth of OMO purchases over the next few months which in our opinion is not that Given the RBI’s ₹79 trillion balance sheet growing at ~11%, this aligns with its usual practice of holding 20% to 23% in G-sec.

The tricky part, however, is the timing. We believe the RBI is holding its cards close to its chest, waiting for the right trigger to act. We believe the RBI may announce OMOs based on either:

- A quantity signal — If durable liquidity falls below INR 3 – 4 trillion, or

- A price signal — If the yield on 10-year government bonds rises above 6.6%, making borrowing more expensive and potentially impacting market stability.

For now, the RBI appears to be managing liquidity tightly, leaving itself room to act if conditions worsen. It’s a careful balancing act, but one that could prove crucial in maintaining market stability and supporting growth in the coming months.

Chart VI: How OMO Operations Over the Past Year Helped Ease Bond Yields

Source: CCIL, Quantum AMC Graphics. Data for the bond yields through OMO’s conducted by RBI since the last one year.

And right now, we believe the RBI needs to step up its OMO game. Why? Because we’re we have found ourselves in a situation where despite a 100 bps rate cut by the RBI, bond yields have remained elevated – due to the fiscal concerns post GST 2.0 cuts, heavier borrowings by the state governments in the first half and investor demand for bonds weakening in the longer maturities. We believe the bond market needs some serious intervention, or yields may continue to remain elevated, especially if the Government Securities (G-sec) issuance, and State Development Loans (SDLs) supply picks up. We may then potentially see an excessive supply and low demand sentiment, hurting the bond prices.

If at this point, the RBI buy bonds (OMO Purchase), to the tune of ~INR 1–2 trillion, it would help stabilize bond yields and ensure that the market doesn't get too stretched. But here’s the tricky part—OMOs aren’t just about putting money in the system; they’re about timing and finding the right balance. If the RBI waits too long and yields start to rise too quickly, it could make it more expensive for the government to borrow and hurt the broader economy.

We believe, the space for OMOs is narrowing and there’s only so much room left to keep buying bonds. The key question now is how much room the RBI will leave for these interventions - and how they’ll balance that with the need to manage inflation, growth, and the rupee.

Bringing It All Together: What’s Next for Bond Markets and Investors?

To recap, India's financial markets are facing a complex set of challenges, with the rupee, liquidity, and bond yields all pulling in different directions. The rupee's volatility has forced the RBI into a delicate balancing act, intervening in the foreign exchange markets to prevent further depreciation. Meanwhile, liquidity in the banking system is under pressure, with core liquidity expected to plunge over the coming months, despite RBI's attempts to stabilize the situation through CRR cuts and potential OMOs.

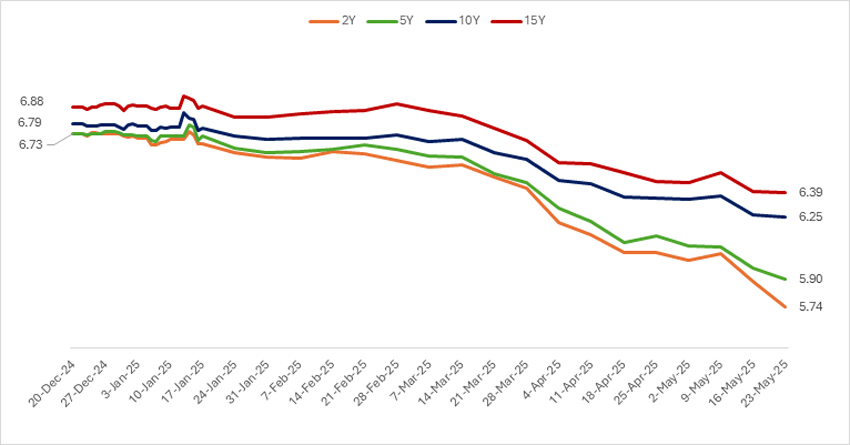

Now, let’s talk bond markets, which are feeling the squeeze from all sides. The 10-year benchmark yield has remained in a tight 6.50–6.60% range for the past two months — steady on the surface, but showing signs of tension beneath.

In October, bond yields swung sharply amid shifting domestic and global cues. Early rate-cut hopes eased yields, but they rose after the RBI held rates, then fell on dovish comments. Hawkish Fed signals and rupee weakness pushed yields higher, while RBI intervention talk and softer global sentiment pulled them lower. By month-end, mixed global signals and oil prices kept yields volatile. The 10-year closed at 6.53%, reflecting uncertainty, while the OIS curve suggests the RBI will likely keep rates steady for now.

For the bond market, the next few months could be tricky. 10-year government bond yields have been stuck in a tight range of 6.35%–6.60% for a while now. That’s relatively stable, but if liquidity keeps tightening and the bond issuances continue, there’s a risk that yields could rise. This is where the RBI’s OMOs will come into play. If the RBI steps in and buys bonds aggressively, it could cap the upside on yields and help keep borrowing costs manageable.

But it is important to remember, OMOs come with a cost. So, the RBI’s next steps are crucial. If they time their OMOs well and manage the FX interventions carefully, they could keep the bond market stable without letting the rupee fall off a cliff.

The Big Takeaway

At the end of the day, India’s economy is facing a three-body problem. Liquidity, the rupee, and OMOs are all pulling in different directions, and the RBI is stuck in the middle, trying to balance them. It’s going to be a tricky few months, especially for bond markets and currency traders.

The key will be how the RBI manages these three forces: how much liquidity it can infuse without worsening inflation, how it controls the rupee without triggering too much FX drain, and how it manages the bond market without letting yields rise too much.

For investors, it’s a game of timing and patience. Markets shall keep an eye on RBI moves and how they impact liquidity and the currency. The upcoming December monetary policy shall be crucial. If OMOs are ramped up, there might be an opportunity in bonds. But if the rupee gets too volatile, or if liquidity keeps tightening, we might see more bumps ahead.

At the end of the day, it’s all about balancing these three forces—and right now, the RBI has its work cut out for it.

We anticipate that the RBI may conduct Open Market Operations (OMO) purchases in the range of INR 1-1.5 trillion, potentially as soon as December 2024 or January 2025, depending on its intervention in FX markets to support the rupee. The cooling inflation, particularly with October 2025 inflation falling to a low of just 0.25% YoY, provides the RBI with sufficient room for a potential rate cut. However, despite a more cautious tone in the policy and minutes regarding trade tariff risks, the RBI seems more optimistic on growth following the implementation of GST 2.0. High-frequency data points to stronger growth, and with global agencies revising FY26 forecasts above 6.5%, markets are speculating about another 50 bps rate cut this year. We expect the RBI to remain cautious, likely delivering a final 25 bps cut—unless trade talks with the US make significant headway.

Post the potential rate cut, we expect bond yields to remain range-bound, with some steepening of the yield curve, which may then flatten slightly. In line with this, we have reduced portfolio duration and shifted towards spread assets at the near end of the curve. We have moved away from our barbell strategy, despite the attractive valuations in long bonds, due to weak demand for long-duration paper in the current market environment. We continue to focus on spread assets, cutting duration, and maintaining low credit risk while ensuring sufficient liquidity in the portfolio.

Dynamic Bond Funds

For investors with a slightly longer investment horizon, we suggest evaluating Dynamic Bond Funds as an investment option. These funds offer flexibility to adjust duration based on interest rate movements and market conditions, making them well-suited for navigating periods of uncertainty like the one we expect. Given the potential for rate cuts and a shifting yield curve, Dynamic Bond Funds can tactically allocate across varying maturities, helping investors capture higher yields during periods of falling interest rates. This category is ideal for those seeking a balance between risk and return, with the added benefit of professional fund managers actively managing interest rate risk.

Liquid Funds

For investors with a lower risk appetite or a shorter investment horizon, we suggest considering Liquid Funds. These funds invest primarily in short-term money market instruments, providing high liquidity and low risk. They are particularly suitable for parking funds in the near term while maintaining minimal interest rate risk and credit risk.

Data Source: Reserve Bank of India (RBI)

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Sneha Pandey, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Mohit Bhatnagar - Head - Sales, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9987524548

Read our last few Debt Market Observer write-ups -

- Tariffs Pressures, GST Reforms, Rising Yields: India’s August Bond Story

- Quantum Dynamic Bond Fund Turns 10: Reflecting with Pride, Advancing with Purpose

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More