Equity monthly view for April 2021

Posted On Friday, May 07, 2021

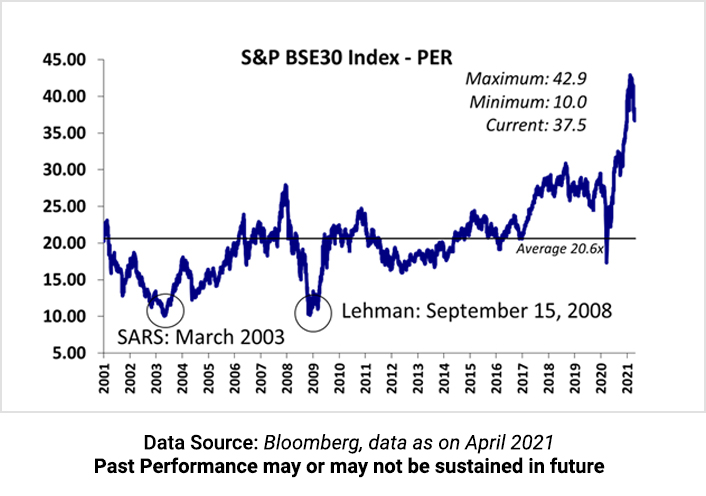

S&P BSE Sensex declined by -1.45% on a total return basis in the month of April 2021. The kind of humanitarian crisis & economic cost of lockdowns we are facing, the equity markets have shown remarkable resilience. On a trailing twelve-month (TTM) basis, the index has returned 46.26%. A favourable base of April-May 2020 is getting reflected in the TTM return. S&P BSE Sensex performance was worse than developed market indices such as S&P 500 & Dow Jones Industrial Average which appreciated by 5.2% & 2.7% respectively, during the month. A better vaccine proliferation in the US is resulting in more confidence in their economic recovery which is getting reflected in US equity markets.

Last month the broader market has done better than the Sensex. The S&P BSE Midcap Index appreciated by 0.69% and the S&P BSE Small-cap Index rose by 4.97%. Healthcare & metals were the winning sectors for the month. The resurgence of Covid-19 has brought the focus back on healthcare whereas, metals have reacted positively to the up move in global commodity prices. Capital goods & real estate stocks underperformed during the month, as state-level lockdowns made investors nervous about its impact on near-term business prospects.

Quantum Long Term Equity Value Fund saw a 0.33% appreciation in its NAV in April. This compares to a 0.17% appreciation in its benchmark S&P BSE 200TRI. Outperformance for the month was driven by holdings in materials & metals. Cash in the scheme stood at approximately 6% at the end of April. Our approach remains to position the portfolio towards economic recovery without undermining the risk associated with pandemic-related economic upheavals.

| Market Performance at a Glance | |

| Index | YTD Returns (%) |

| S&P BSE SENSEX | 2.35 |

| S&P BSE 200 | 6.95 |

| S&P BSE MID CAP | 13.67 |

| S&P BSE SMALL CAP | 19.99 |

| S&P 500 | 12.98 |

* On Total Return Basis

Source: Bloomberg

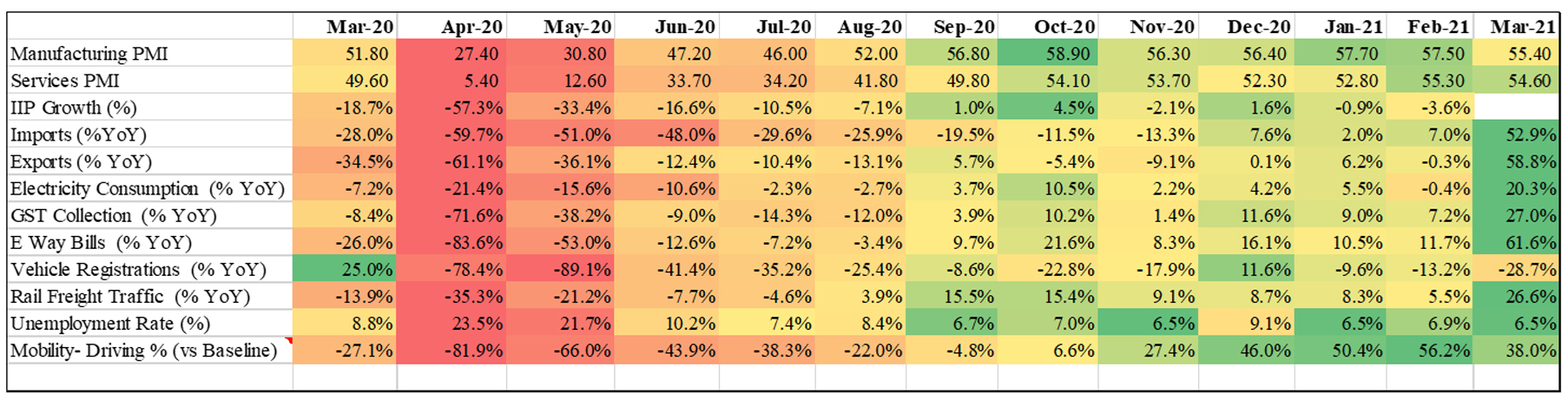

Multiple state-level restrictions on mobility are impacting economic activity: The economic indicators have broadly in growth mode in March 2021. Both the services & manufacturing PMI show expansion. However, the data points will get increasingly mixed from April 2021 onwards as more and more states have placed strict restrictions on movement to arrest the rapidly rising covid-19 cases. The data points should be better than March-April 2020 as the lockdowns are not as severe. The manufacturing activities & transportation of goods have been allowed. The essentials activity has also not been disturbed.

Data Source: CMIE, RBI, ewaybill.nic.in Data as on March 2021

Inflation emerging as key risk:

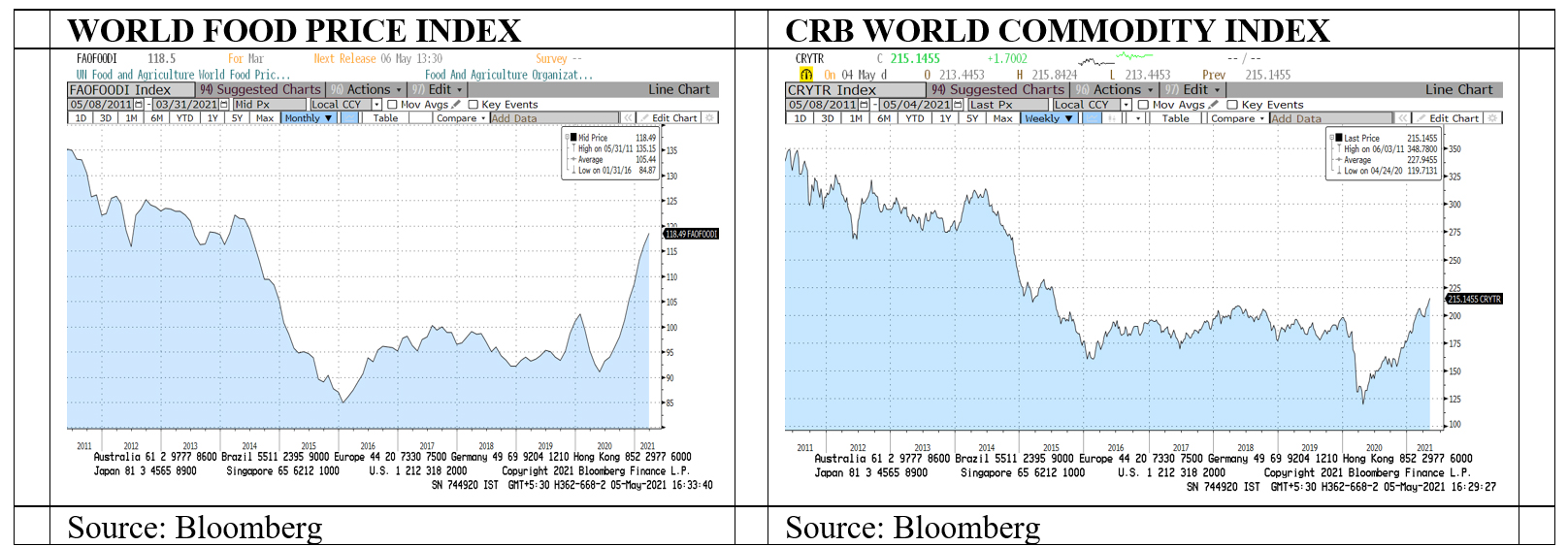

All the commodities have seen a sharp run-up post the pandemic-related fall in March-April 2020. The metal & energy price inflation will eventually find a way into manufactured product inflation as companies turn to increase prices to protect margin. A bigger risk in India is the rise in global food prices. In the last 8 years, food prices have been benign. However, in the last 8 months, the world food price index has moved up rapidly. Though India is self-sufficient in food grains, it imports large quantities of edible oil & pulses and this will result in domestic food inflation higher. This will push RBI to increase the interest rate sooner than later.

Foreign flows have come to a pause:

Indian Equities have seen $1.6 bn of net selling by foreign investors in April. This is the first time after September 2020 that FPIs have turned negative every month. On a YTD basis, FPI inflows stand at US$ 5.5 bn. DIIs have been buyers in the month of April. They have bought stocks worth US$ 1.5 bn this month. India’s economic recovery can face near-term headwinds due to the Covid-19 second wave and ensuing lockdowns, this might result in short-term FII hedge funds pulling out capital from Indian markets. However, in the medium & long term, India’s nominal GDP growth will look better than the western world. This makes it a sought-after destination for yield & growth-seeking long-term global investors. The conclusion being, strong FII inflows can continue after a brief pause.

Covid 19 Second Wave or Tsunami:

| 30th April 2020 | 30th June 2020 | 30th Sept 2020 | 31th Dec 2020 | 28th Feb 2020 | 5th May 2020 | |

| Daily Tests | 72,453 | 217,931 | 1,426,052 | 1,127,244 | 7,95,723 | 1,923,121 |

| Daily new infections | 1,901 | 18,522 | 80,472 | 21,822 | 16,752 | 412,262 |

| Cumulative Cases | 33,610 | 566,840 | 6,225,763 | 10,266,674 | 1,10,96,731 | 21,077,410 |

| Of which -Recovered | 24,162 | 334,822 | 5,187,825 | 9,860,280 | 1,07,75,169 | 17,280,844 |

| Deaths - Cumulative | 1,075 | 16,893 | 97,497 | 148,738 | 1,57,051 | 230,168 |

| Vaccine Shots – Cumulative | 1,43,01,497 | 163,015,441 |

In a matter of two months, India’s Covid-19 response has moved from being worthy of bouquets to brickbats. Reasons range from complacency to historic underinvestment in medical infrastructure. The infection this time is moving to the hinterland, where medical infrastructure is virtually non-existent and reporting is sketchy.

As of 5th May 2021, 163 mn vaccine dosages have been administrated. And the daily vaccination rate is hovering around 3-4 mn. While this is quick (India is inoculating equivalent to the Canadian population every 10 days) the large populace means at this rate it will take a little over a year for everyone to get a single jab and two years to completely vaccinate all inhabitants.

Equity markets are resilient:

The Resurgence of Covid-19 & ensuing lockdown on economic activity gives a sense of Déjà vu. The difference this time being equity markets have shown remarkable resilience. We enumerate the following reasons for the same:

• The lockdowns are lesser stringent and more localized this time

• Corporate Balance-Sheets are better. The focus has been on debt reduction and liquidity

• The last one year has been all about cost control and business continuity for corporate India

• Pvt. Banks & NBFC’s have raised capital and are best capitalized in the last 10 years

• As global recovery is intact, export companies and commodity producers are comfortably placed

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More