Equity monthly view for November 2020

Posted On Monday, Dec 07, 2020

December 07, 2020

Quantum Equity Team

S&P BSE Sensex increased by 11.5% on a total return basis in the month of November. On the back of this strong rally, it has fully recovered from the March 2020 lows & has turned positive for the year returning 8.3% YTD. S&P BSE Sensex performance was better than developed market indices such as S&P 500, which gave 10.1% returns during the month. It was also better than the MSCI Emerging Market Index which rose by 8.4% (like-to-like currency).

Mid-cap and Small-cap indices outperformed the Sensex in November; with the BSE Midcap Index rising by 13.7% and the BSE Small-cap Index rising by 13.4%. On an YTD basis, their performance is much better compared to the Sensex with the BSE Midcap index rising by 14.3% and the BSE Small Cap Index rising by 24.5%.

Metals, Banking, and Capital Goods were among the winning sectors for the month. Metal stocks have rallied on the back of improved global commodity prices. Banking sector stocks have positively surprised in the Q2FY21 results with much better collection efficiency and Asset Quality relative to expectations. Healthcare & Technology stocks underperformed during the month.

| Market Performance at a Glance | |

| Market Returns %* | |

| S&P BSE SENSEX YTD** | 8.35% |

| S&P BSE SENSEX MTD** | 11.45% |

| S&P BSE MID CAP MTD** | 13.68% |

| S&P BSE SMALL CAP MTD** | 13.43% |

| BEST PERFORMER SECTORS | Metals, Banking & Capital Goods |

| LAGGARD SECTORS | Technology & Healthcare |

| * On Total Return Basis | |

| ** Source-Bloomberg | |

Past Performance may or may not be sustained in future.

YTD - Year To Date | MTD - Month To Date

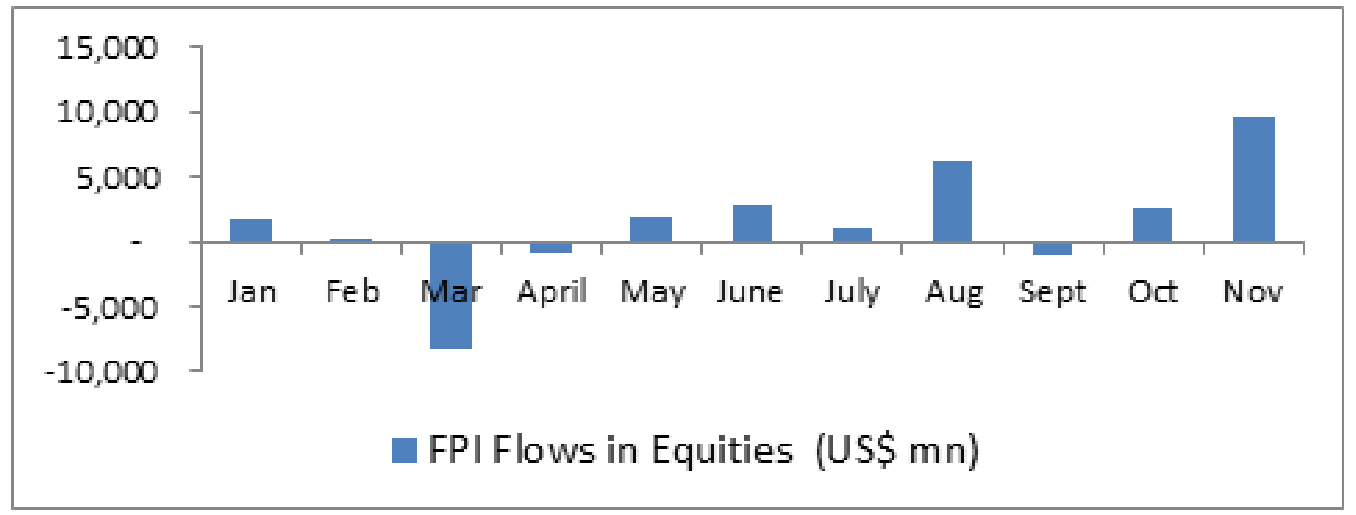

FII Flows: When it Rains it Pours

Indian Equities have seen $9.6 bn of net buying by foreign investors in the month of November 2020 this includes large passive buying on back of MSCI. To put things in perspective, this month has seen the highest net FII buying figure ever in India. It is higher than annual inflows of last four out of five preceding years. In first eleven months of 2020, FIIs have been net buyers of USD 16.1 bn. DIIs were large net sellers in the month, selling USD 6.5 bn worth of stock. Indian rupee was flat during the year.

Source: NSDL. Past Performance may or may not sustained in future.

US Elections Results & Vaccine Approval: A Perfect Catalyst

Equity markets cheered clarity on US Elections (though it emerged rather slowly than initially thought). Going by pre-election speeches & debates of Mr Biden (President Elect) the US external policy towards trade and immigration are expected to be more pacifying than those under Mr. Trump. The equity markets are factoring significantly lower global tensions both on economic and political level, thus paving the way for more predictable global recovery. The other news of significance in November was the successful completion of clinical trials of Covid-19 vaccine announced by Pfizer-BioNTech, AstraZenca-Oxford & Moderna besides the Russian & the Chinese ones. Amongst all the three Astra Zeneca-Oxford is the most relevant in the Indian context due its lower cost & less challenging logistics need for distribution. The vaccine is expected to be available as early as December 2020, thus bringing possible solution to ‘once in 100 years ‘event. These developments have improved the global sentiments & world markets have started a fresh risk on rally.

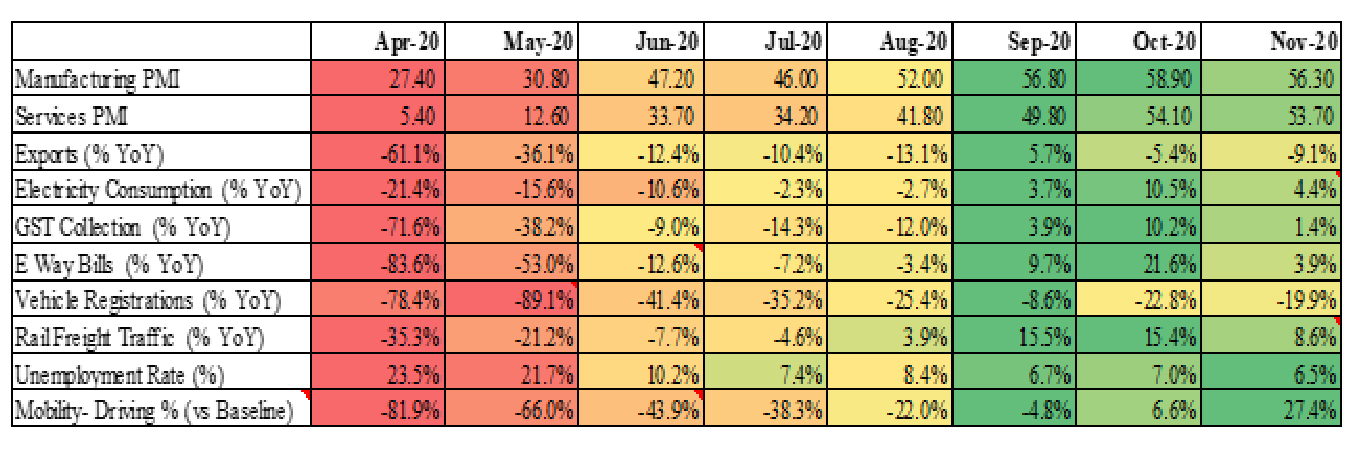

Domestic Economy Continues to Improve: Sticky unemployment is worrying

Source GSTN, CEIC, Haver Analytics, CRISIL, Tom Tom, PPAC, Vaahan Vehicle Registration, Morgan Stanley Research

The monthly economic indicators have continued their path of improvement in November 2020. The manufacturing & services PMI are in expansion mode for the past three month now. The E-way bills & rail freight plus traffic data also suggest goods movement across country moving towards normalisation. India’s active Covid-19 case load has halved from 1 million to closer 0.5 million. Though, some regions like Delhi & Punjab are seeing a third wave, overall the active case load appears to have stabilised for now. As the winter sets in, a Covid-19 third wave & ensuing lockdown (before most of us get access to the vaccine) remains a credible risk which the equity markets have chosen to ignore till now.

QLTEVF NAV was increased by 13.0% in the month of November. This appreciation in its NAV in the month of November compares to an 11.69% increase in its benchmark S&P BSE 200. Outperformance for the month was driven by holdings in Financials, Auto & select PSUs. Cash in the scheme stood at approximately 11% in November. The scheme added to an existing capital good name as it offered good upside.

The benchmark indices look richly valued, after the sharp November rally, but the broader market still offers significant opportunities. We remain optimistic about Indian equities with a slightly longer-term view. As investors in the developed world seek alternatives to low yielding fixed income assets, India with a recovering economy and attractive nominal fixed income yields may look as a credible destination (We have seen a glimpse in this month). This could trigger substantial increase in FII flows into India, relative to what it has been receiving historically every year. An incremental US$ 100 bn of capital inflows every year for next few years can potentially compress domestic interest rates further, stirring economic activity and give a fillip to the rate sensitive sectors like real estate & construction. Both these sector have a high GDP multiplier potential and push growth higher over the next couple of years compared to our current estimates. However, this scenario is not a given, there are additional caveats about, who is the beneficiary of these flows. If the government is the primary recipient via bonds it might end up spending more on social cause and the rub off on GDP growth will be minimal in the near term. On the other hand if the capital flows into banks & corporate balance-sheets the impact on GDP growth will be more profound. We will be looking for signs which suggest the above scenario is playing out and are evaluating the impact on companies in our stock universe

Data Source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More