Equity monthly view for June 2022

Posted On Wednesday, Jul 13, 2022

S&P BSE SENSEX declined by -4.47 % on a total return basis in the month of 2022. It has outperformed developed market indices like S&P 500 (-8.2%) and Dow Jones Industrial Average Index (-6.56%). S&P BSE SENSEX has also outperformed MSCI Emerging Market Index (-6.62%). The broader market has been weaker, S&P BSE Midcap Index has declined by -6.00% for the month & S&P BSE Small cap Index declined by 5.90%. Metal Sector has been the biggest loser falling by -12.9%. The BSE Auto Index was the only sectoral index in the green moving up by 1.5%.

The month of June-22 has seen FPI outflows of US$ 6.43 bn. This has been the second worst month of FPI flows since FPI investments were allowed to invest in India in 1991. Interestingly, of the five ‘worst ever’ months of FPI flows, 4 have come in this calendar year. Domestic institutional investors (Mutual Funds & Insurance put together) have been net buyers for the month of June 2022 to the tune of US$ 5.97 bn.

Quantum Long Term Equity Value Fund (QLTEVF) saw a decline of -4.49% in its NAV in the month of June 2022. This compares to a -5.07% decline in its Tier I benchmark S&P BSE 500 & -4.94% decline in its Tier II Benchmark S&P BSE 200. Some of our stocks in the Auto & Financial sector showed resilience in an otherwise weak market & contributed to the outperformance. Cash in the scheme stood at approximately 2.9% at the end of the month. The portfolio is valued at 12.9x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 17.2x FY24E consensus earnings.

The fund owns three of the top four listed 2-wheeler auto OEMs with an aggregate weight of approximately 12%. Our outsized positioning in the sector reflects our belief, that India’s auto sector (specifically two wheelers) remains one of the few examples of country’s manufacturing prowess notwithstanding past few years of slowdown.

Home-grown two-wheeler makers have not only kept the best of the MNC competition at bay but also captured market share in the export market especially in emerging markets in the last two decades. Overall, the following medium-term to long-term investment thesis for the sector remains intact.

• Large domestic two-wheeler opportunity driven by increasing income levels, poor public transportation infrastructure and cheaper cost of ownership.

• Expanding export opportunity in markets having similar market dynamics & demographics as India.

• Excellent brand equity developed over time by delivering high quality reliable products & after-sales support.

• Well entrenched distribution network of both of sales & service support.

Past performance may or may not be sustained in the future

Adhering to Churchill’s adage ‘Never let a crisis go waste’, the managements of top OEMs in the Indian 2-wheeler have used this slowdown to work on their product mix, optimize cost, churn efficiencies, and take judicious price hikes. This is getting reflected in the recent reported all time high EBITDA per vehicle despite working with 21% lower volumes lower volumes.

| EBIDTA per Vehicle (Rs) | FY19 | Q4FY22 | % Change |

| Company 1 | 9,844 | 13,982 | 42% |

| Company 2 | 6,304 | 6,961 | 10% |

| Company 3 | 3,600 | 6,501 | 81% |

| Company 4 | 35,621 | 40,661 | 14% |

| FY19 | FY22 | ||

| Industry Volumes mn (including Exports) | 16.4 | 13.0 | -21% |

The domestic 2-W volumes in FY22 were the lowest since FY11. This shows a probable postponement of replacement decision due to higher prices & lower disposable income. This also substantiates that the industry is catering to just the replacement demand. The cyclical recovery in the economy & the related boost in individual disposable income should unlock this bunched-up demand in the next couple of years resulting in strong financial performance by these companies.

| Mn units | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 |

| Domestic 2-W volume | 9 | 10.1 | 10.1 | 10.5 | 10.7 | 10.7 | 11.1 | 12.6 | 13.6 | 11.2 | 10 | 9 |

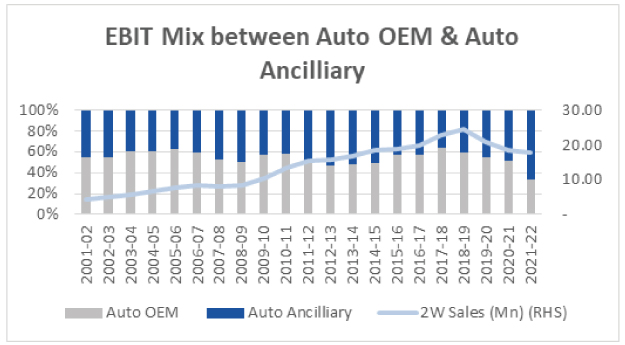

A pertinent question here is, why not look beyond OEMs? Except for few auto-ancillary companies with niche products and strong brand recall, the superior pricing power of OEMs has enabled them to record higher return ratios during good times. In a demand upcycle, OEMs have historically been able to capture a higher share of the profit pool. A strong balance sheet places them in a good position to tide over down cycles and transitionary phases. A typical auto ancillary company operates on a cost-plus model offering little upside during an upcycle.

On EV (electric vehicles) too all the leading OEMs seem to well prepared for to participate in the expanding market. They have invested in EV technology and have announced their EV product pipelines. A strong track record of delivering quality products & efficient after-sales services will act as an edge for the traditional players over startups (who appear to make enough mistakes in haste to gain market share).

Chart Source

1) BSE Sensex vs BSE Auto: Source Bloomberg

2) EBIDTA vs volume: Company, SIAM, Q Research

3) Industry Volume: SIAM , Q Research

4) EBIT Mix: Q research, CMIE

Sectors referred above are for illustrative and not recommendation of Quantum Mutual Fund/AMC. The Fund may or may not have any present or future positions in these sectors. The above information of sectors which is already available in publicly access media for information and illustrative purpose only and not an endorsement / views / opinion of Quantum Mutual Fund /AMC. The above information should not be constructed as research report or recommendation to buy or sell of any stocks from any sector.

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on June 30, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on June 30, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More