Coronavirus & Your Equity Mutual Fund Portfolio

Posted On Friday, Mar 13, 2020

This article is authored by Mr. Chirag Mehta, Senior Fund Manager - Alternative Investments

On Thursday, March 12th, Indian markets woke up to the WHO declaring Covid-19 a pandemic, and said bye to the bulls with the Sensex shedding a massive 2,900 points. What a day! Today too Indian markets fell over 10% and hit the lower circuit for the first time since 2008 triggering a trading halt. Though the news of a vaccine developed to counter the virus led markets to end the day in the green, its efficacy still remains unknown and laden with uncertainties. Probably, volatility is here to stay!

Similar market reactions are being seen world over. Growing investor fears over the coronavirus epidemic and its long-term economic implications are translating into a massive selling in equities. Uncertainty has gripped the entire world. Hope seems to have been replaced with fear. But before you succumb to the doom and gloom commentary and exit equities, stop! Because you're going to get through this!

Yes, it's normal to panic as you see the market crashing, but hear us out.

Firstly, stocks have been trading at expensive levels from a valuation perspective for a while now. Nifty P/E was at a high of ~26.5 through December last year. Now it stands corrected at around 18.5. So wouldn't you agree that the market was in need for a reality check given that over the past couple of months it was disconnected from the pains of the economic slowdown and continued to rally? And even though this dose of rationality is coronavirus induced, it was due.

Secondly, you're correct in thinking that the negative demand and supply shocks will hurt output and company earnings, which is indeed difficult to estimate. But you need to understand that this impact will only be temporary. In time, life will return to pre-covid-19 levels and business will run as usual - people will shop, flights will fly, trucks will move and factories will run. To believe otherwise is to disregard history and good sense.

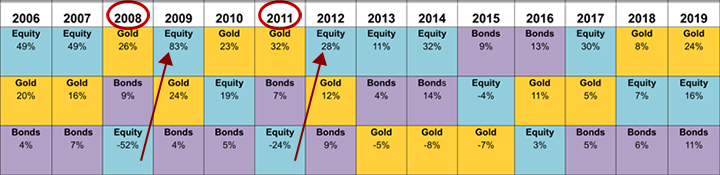

To make it easier for you, let's quickly recap black swan events in recent history - the Global Financial Crisis in 2008-09 and Sovereign Debt Crisis in 2011. Yes, equity markets were battered both times, but eventually bounced back to reflect long term business fundamentals. This proves that buying into the asset class when it is down in the dumps, can turn out to be rewarding for an investor as and when the dust settles.

The chart ranks the best to worst performing indexes per calendar year from top to bottom

Past performance may or may not be sustained in future.

Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Finally, an analysis of market reactions to such epidemics in the past suggests that the pain has usually been short lived. For instance, while the SARS epidemic did cause considerable damage to global markets in 2002, by the second half of 2003 the market had again begun to rally with the S&P 500 posting gains of 20% merely 12 months post the first occurrence. Similarly within a year of Ebola and Zika virus outbreaks, the S&P 500 was up 10% and 17% respectively.

Now, we don't know where the markets are headed from here, no one does. But prudent investing tells us that given the extent of correction and rationality to an extent now reflected in the markets, it's a good time to start allocating money to the stock markets with a long-term view.

At Quantum, the Quantum Multi Asset Fund of Funds (QMAFOF) cautiously reduced allocation to equities over last few years as they got more expensive, thereby booking gains and reducing risk. And now, as prudent investing principles suggest, we are capitalizing on this fall by gradually reshuffling our portfolio and increasing our exposure to equities, counting on the economy gradually returning to normalcy and the market getting back on its feet.

We believe all long term investors must take advantage of this correction. If as per your asset allocation strategy, you are considering a measured, opportune increase in equity allocation, you can opt for the QMAFOF which follows principles based on buy-low sell-high approach and aims at reducing volatility of returns.

And if you're significantly underweight equities and looking for an all-out equity allocation to take advantage of the recent correction, the Quantum Equity Fund of Funds (QEFOF) would be a good choice. The fund enables you to outsource fund picking to experts by investing in a basket of diversified equity schemes.

The QEFOF gives you exposure to funds that are actively managed and rely on the hand-picked fund manager's capability to take advantage of the correction and build a robust portfolio that can weather any prolonged crisis and perform on the rebound.

So pick your style, but fundamental investing suggests that it's only wise to build your equity exposure now!

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk< |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More -

The Third Investment Anchor Most Investors Ignore

Posted On Tuesday, Sep 30, 2025

Now shift the lens to investing.

Read More -

Are You Navigating Small Caps or Just Following the Herd?

Posted On Monday, Sep 15, 2025

Imagine a small castle surrounded by a deep, wide moat filled with water.

Read More