Equity monthly view for September 2020

Posted On Friday, Oct 09, 2020

October 09, 2020

Quantum Equity Team

S&P BSE Sensex fell 1.4% in the month of September. It is down 6.8% year to date recovering most of losses since March month. It had plunged 36.7% between 19 February and 23 March. S&P BSE Sensex performance was better than developed market indices such as Dow Jones, S&P 500 during the month. It was slightly lower than MSCI emerging market index which fell 1.35% (like-to-like currency)

Mid cap and small cap indices had a good run for second consecutive month. BSE Midcap index rose 0.4% in September while BSE Smallcap index appreciated 3.8%. On YTD basis, their performance is -0.8% and +9.6% respectively.

IT and healthcare were among the winning sectors for the month. One of bigger IT companies increased its growth guidance leading to multiple re-rating for leading players. Telecom, banking and PSU stocks were losers during sector rotation. They all had double digit declines. One of conglomerates in telecom slashed post-paid tariffs leading to sell off.

| Market Performance at a Glance | |

| Market Returns %* | |

| S&P BSE SENSEX YTD** | -6.8% |

| S&P BSE SENSEX MTD** | -1.4% |

| S&P BSE MID CAP MTD** | +0.4% |

| S&P BSE SMALL CAP MTD** | +3.8% |

| BEST PERFORMER SECTORS | IT, healthcare |

| LAGGARD SECTORS | Telecom, banking, PSU |

| * On Total Return Basis | |

| ** Source-Bloomberg | |

YTD - Year To Date | MTD - Month To Date

FIIs were net sellers in the month of September. They sold stocks worth USD 767 Mn. In 9 months of 2020, FIIs have been net buyers of USD 4.0 Bn. DIIs were marginal buyers in the month of USD 12 Mn. Cumulatively they have bought USD 9 Bn worth of stocks. Indian rupee depreciated 0.2% during the month.

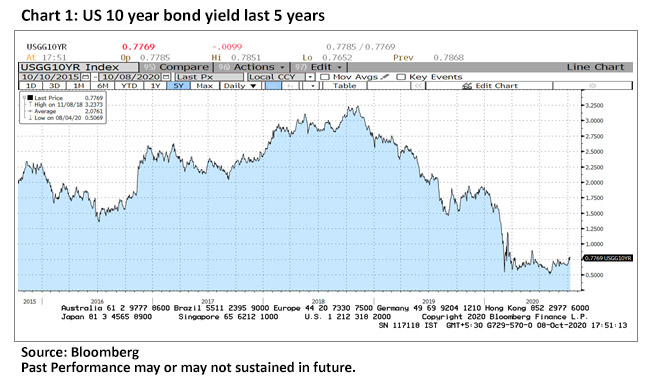

Among international monetary events, US Fed decided to keep interest rates low. Interest rates in world’s biggest economy are likely to remain closer to zero till 2023, it forecasts. Yields are in negative territory in large parts of Europe and close to zero in most developed markets. Yield on 10 year US government bonds hover in 0.6%-0.8% range currently. They used to be above 3% few months ago. Stimulus money is likely to boost risky assets like equity.

Economic recovery and investment cycle

Data releases point to normalisation of economic activity after lockdown related to Covid. Many parts of economy are gradually coming to pre-Covid impact levels after unlock measures initiated in May. September saw improvement momentum continuing. GST collection turned positive growth for the first time since March. Sales of most industries improved including core sectors such as auto, cement and steel.

Such recovery is surprising to most economists as India didn’t take stimulus measures like western world. There, 10%-15% of GDP as fiscal boost is norm which would be less than 2% for India. Decision of government to keep opening parts of economy has played a part in resilience. Opening of cinema halls, parts of school and few states allowing restaurant dine in are to start in October.

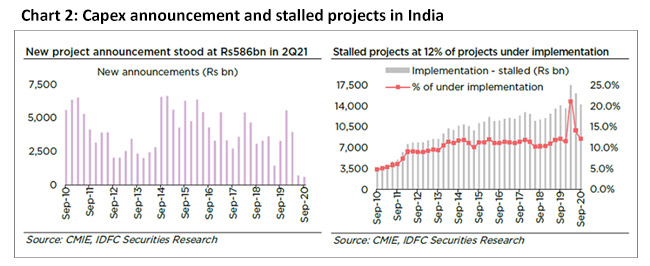

Weak investment cycle remains a long term problem for India. It was drag on the economy even earlier. The same has become acute after pandemic outset. Companies are unlikely to invest in new capacities as FY21 GDP decline would affect demand and their capacity utilisation. And slower investment cycle leads to very less job creation. If unaddressed, this leads to a vicious cycle of less employment and low demand. India’s current account has turned from deficit to surplus because of lower imports, isn’t a good sign for developing economy of our size.

As per CMIE, new capex announcement are down 82% from last year. Moreover, there isn’t broad participation as only 5 projects make up for 50% of planned investments. There is need for government to fill in the shoes till there is confidence and private sector starts participating.

Reforms and bills

Parliament passed 2 landmark bills during the recently concluded session. One was related to farm bills and has generated controversy among states. Farmers can now sell their produce outside mandis and APMC which wasn’t allowed earlier. This leads to states foregoing tax that they collected from transactions. Also there is a fear that MSP or minimum prices that farmers were assured on crops will be done away with.

Secondly the government has brought 4 labour laws. They replace many old laws which were archaic, time consuming and gave power to officers which led to harassment. It also becomes easier to hire and fire, as well as gives social security to workers. Whether they serve the intended purpose of making it easy to do business in country will be clear only in time.

Secondly the government has brought 4 labour laws. They replace many old laws which were archaic, time consuming and gave power to officers which led to harassment. It also becomes easier to hire and fire, as well as gives social security to workers. Whether they serve the intended purpose of making it easy to do business in country will be clear only in time.

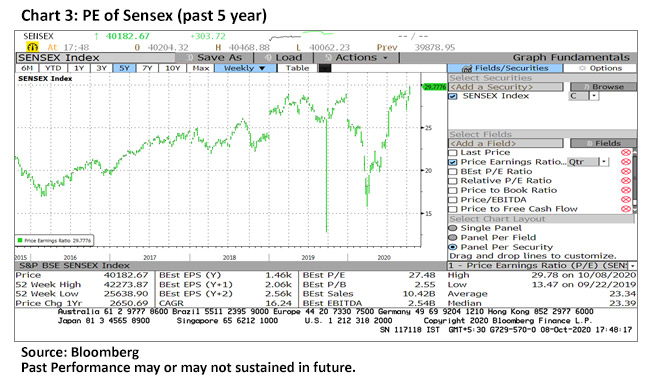

Market valuation, earnings

BSE Sensex has risen from PE of 16 times in March month to almost 30 times currently. While economic recovery is underway, market valuations have come back to pre Covid-19 impact levels (chart below). In fact the valuation looks close to 5 year high. However, it is only a handful of stocks which have contributed to the overall rally.

Q2 earning of listed companies is likely to be released over next few weeks. Expectations are that profits will decline at 10% approx. compared to last year for Nifty companies. There will be a sharp rebound compared to earning 3 months back. On an aggregate, operating margin is likely to improve.

QLTEVF NAV was declined 0.2% in the month of September. This compares to 0.5% decline in its benchmark S&P BSE 200. Holding of stocks in IT and healthcare boosted the performance of scheme. This was dragged by positions in financials and PSU stocks. Status quo on moratorium by judiciary impacted financials.

Cash in the scheme stood at approx. 9% in September. Scheme added to its existing weight in 2 stocks in financial sector. Some rebalancing of weights was also done in the month.

India is likely to grow faster than many nations. Economy is dependent on domestic consumption and thus insulated from any global problems over the long term. While economic growth faces pressure in near term, better rural economy and measures to ease liquidity are likely to stimulate growth. Opening up of most parts of economy is likely to lead to demand revival and employment creation. The risk being corona virus doesn’t see a resurgence.

Data Source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More