Equity Monthly View for March 2024

Posted On Friday, Apr 05, 2024

S&P BSE Sensex grew by 1.59% in the month of March 2024. S&P BSE Midcap Index increased by 0.01% & S&P BSE Small cap Index declined by -4.8% respectively. Equities across the globe (except China) did well in March. S&P 500 was up 3.2%, tech heavy Nasdaq 100 Composite Index was up 1.85%; MSCI Emerging Markets Index was up by 1.77% in March.

Near term economic indicators continue to trend well; December quarter GDP print was strong at 8.4% yoy (partly supported by base revision) and as result India is slated to finish FY24 on a strong note. Some of the external rating agencies such as Moody's have upgraded FY24 growth to 8% from 6.6% during the month gone by. Reflecting the economic momentum; tax collection has also continued to trend positively with 11.5% yoy growth in March 24. Latest CAD numbers at 1.2% of GDP for 3qFY24, also point to improving external balances supported by services export. On the inflation front, while trajectory is declining, latest reported CPI inflation number came at 5.1%, mainly due to volatile food inflation. This remains higher than RBI's target range of 4%. Corporate India commentary largely reflects the buoyancy in the economy; the only sore point being lack of consumption pick up especially in rural belt.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 0.28% in its NAV in the month of March 2024; Tier-I benchmark S&P BSE 500 TRI and Tier-II Benchmark S&P BSE 200 TRI increased by 0.86% and 1.47% respectively. Technology and Financials driven by banks were a key drag in our portfolio mainly due to NIM pressures.

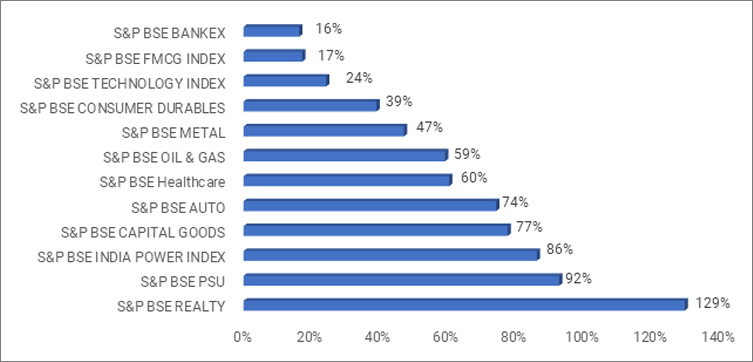

How have the major sectors fared in FY24?

Sector Returns in FY24

From portfolio actions during FY24, we added to stocks where upside potential remains high and trimmed/exited out of position where upside was low or negative. Some of the key sectors which we added during FY24 are Banking, Cement, Life Insurance, and consumer durable. We exited out completely from an Industrial name, which we had accumulated during covid period and trimmed out of sectors such as Utilities, Auto, Healthcare and select NBFC.

Where do we find value now?

We continue to remain positive on financial especially private banks. Some of the private banks are trading at decadal low valuation, in a benign credit cycle and should witness reasonable credit growth. Consumer discretionary (Auto-2W) also remain reasonable allocation, although we are trimming in some of these names due to sharp uptick in valuations.

To conclude, our portfolio is well positioned to benefit from cyclical economic upcycle over the medium term with major overweight being Financials and Autos. While there could be uncertainty emerging globally or in India; investors should not be unnerved by the near-term volatility and focus on allocating prudently to equities based on their financial goals. Any sharp correction due to near-term headwinds can offer additional valuation comfort and should be used to allocate more to equities with a long-term perspective.

Data source: Bloomberg

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I & Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark: S&P BSE 500 TRI Tier II Benchmark: S&P BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More