Equity monthly view for March 2022

Posted On Wednesday, Apr 13, 2022

The S&P BSE SENSEX moved up by 4.12% on a total return basis in the month of March 2022. It has outperformed developed market indices like S&P 500 (3.71%) and Dow Jones Industrial Average Index (2.45%). S&P BSE SENSEX has also sharply outperformed MSCI Emerging Market Index (-2.25%). S&P BSE Midcap Index has increased by 3.29% for the month thereby underperforming the SENSEX. However, S&P BSE Smallcap Index performance was much better with a monthly return of 5.85%. Technology, Telecom & Energy were the outperforming sectors for the month while Auto & Banks were the laggards.

Quantum Long Term Equity Value Fund (QLTEVF) saw an improvement of 3.22% in its NAV in the month of March 2022. This compares to a 4.22% increase in its Tier I benchmark S&P BSE 500 & 4.07% improvement in its Tier II Benchmark S&P BSE 200. Cash in the scheme stood at approximately 7.1% at the end of the month. The portfolio is attractively valued at 14.4x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 19.9x FY24E consensus earnings.

FPI outflow intensity has increased due to geopolitical risks

March-22 has seen FPI outflows of US$ 5.3 bn, though the second fortnight of the month saw some respite from the FPI selling. With this month’s outflows, FIIs have sold close to US$ 14.5 bn till date in CY22. DIIs have been net buyers for the month of March 2022 to the tune of US$ 3.1 bn and have absorbed a lot of selling pressure from the FIIs

Global food inflation challenges are emerging. India is better placed

The Russia-Ukraine conflict has extended to more than 40 days now & is showing no signs of letting up. The conflict has the potential to impact global food supplies in the medium term as fertilisers costs are expected to go up reflecting higher energy prices (a key input in making urea). Also, Ukraine is one of the largest exporters of wheat & edible oil in the world. Disruption and higher prices of food & energy have already started to impact smaller nations as being seen in Sri Lanka and will start to spread to other marginal nations. India is relatively immune to higher food prices & shortages. Since the green revolution in the 1970s, it has produced more food grains in most of the years than the annual domestic consumption. The central government (through the Food Corporation of India) currently holds the inventory of food grains sufficient to take care of 3-4 months of national consumption (assuming zero production & zero inventory in the private sector). Pulses are the primary source of protein in India & import dependency was high a few years ago. Here too the situation is comfortably balanced now & the import dependency has been arrested in the last few years The only mass food item where import dependency is currently high for India is edible oil. India currently imports 66% of edible oil requirements.

| Wheat - FY22 ('000 tons) | |

| Consumption FY22 | 1,043 |

| FCI stock March 22 | 234 |

| No. of months of stock | 2.7 |

| Rice - FY22 ('000 tons) | |

| Demand | 1,035 |

| FCI stock | 296 |

| No. of months of stock | 3.4 |

There could be a second-order impact on India’s food production due to the unavailability of imported fertilisers in the near term. Also, the high cost of key inputs like natural gas required for the manufacturing of fertilizers might force the government to increase fertiliser subsidy to cushion the impact on the farmers or increase the MSP (minimum support prices) to cover the increased cost of production.

India has a high dependence on imported energy resources

In terms of energy dependency, India has a high import dependency for oil and much lower for coal. India’s primary energy consumption mix is coal (44%), crude oil (25%), gas (6%), and renewables (4%), and others like biomass, hydro, non-conventional (21%).

The current oil consumption in India is 4.58mnbbl/day of which 87% is imported. While fuel price increases are generally passed on to consumers, in the past govt. had absorbed high oil prices in its own finances to shield the economy from shock.

For natural gas annual consumption for India is at 60.8bcm. of which 45% is imported. Unlike in the west where the major use of gas is for heating purposes, electricity generation, and industries, in India, ~30% of gas consumption is for manufacturing fertilizer, 18% for power generation, 15% for Citi gas distribution, 13% refineries and 24% used by other industries. Since gas is just 6% of the energy basket for India, the ruckus is much lower.

While the dependency on imports is high in energy a foreign reserve of US$ 606 bn provides a lot of comfort as it covers more than 10 months of merchandise imports.

Geopolitical challenges, inflation. rising interest rates, recurrence of covid in some parts of the world (yes, u read it right, cases are increasing in some parts of the world) & premium valuations have made equity look a bit directionless in the near term. However, these are times for investors to stay the course in their investment journey to achieve their financial goals. Equity investors should stagger their allocation to equity over a period & move the asset allocation to the optimum level as defined by their asset allocation plan.

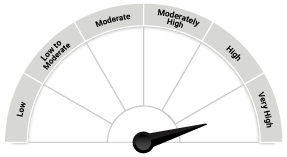

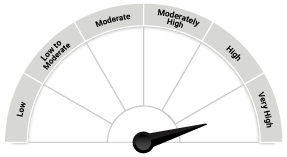

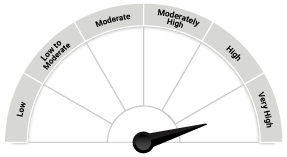

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on March 31, 2022.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on March 31, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More