Dynamic Bond Fund stands to benefit from Fiscal Consolidation: Fixed Income Perspective from Pankaj Pathak

Posted On Tuesday, Jan 23, 2024

The interim union budget for 2024-25 will be presented on February 1, 2024 As has been the custom, the government may not announce any major policy changes in the interim budget ahead of Union elections. So, the key focus area, from the market’s perspective, would be the government’s medium term fiscal plan and its fiscal deficit target.

What is Fiscal Deficit and why is it important?

Fiscal deficit is the gap between government’s income and expenditures. It signifies the amount the government might need to borrow to fill the revenue shortfall.

A higher fiscal deficit indicates increased government borrowing and vice versa. Ceteris paribus, higher government borrowing pushes yield on government bonds higher and bond prices lower and vice versa.

Where do we stand and where are we heading in deficit management?

For the current financial year 2023-24, the fiscal deficit target is set at Rs. 17.87 trillion or 5.9% of GDP. So far in the last nine months of FY2024, government’s revenues have been trending higher than budget estimates, while their expenditure is lagging the past year’s trend. Based on the prevailing trend, the government is most likely to meet its fiscal goals for the current financial year.

In the budget 2021, the government set a target to bring down the fiscal deficit to 4.5% of GDP by FY2025-26. To meet this target, the fiscal deficit must be lowered by around Rs. 1.5 trillion over the next two years. Consequently, government market borrowing (new supply of government bonds) shall also fall by around Rs. 1.5 trillion.

But, what about demand for government bonds?

That is the interesting part. The fall in supply will be happening at a time when demand for government bonds is picking up. Assets of long-term domestic investors like insurance companies, pension and provident funds etc. have been growing at a strong pace over the last few years and this trend is expected to continue in the near future. These investors invest a large part of their assets in government bonds and their demand is likely to grow in double digits over the next few years.

The demand for bonds will also be boosted by India’s inclusion in the global bond index. In September 2023, JP Morgan announced to include India into its suites of emerging market debt indices including GBI-EM Index which is benchmarked by over USD 275 billion of fixed income AUM.

The inclusion in the GBI-EM Index will start from June 2024 with 1% index weight which will be increased by 1% every month to reach an eventual 10% index weight by March 2025.

Recently, the Bloomberg Index Services has also proposed to include Indian bonds into its Bloomberg Emerging Market Local Currency Index. If approved by the index participants, Indian bonds will be included in the Bloomberg index start September 2024.

India’s inclusion in the global bond indices will open a source of consistent demand for Indian bonds from investors who track the index, particularly from the exchange-traded funds or ETFs. Even active investors will be more comfortable investing in India when it becomes part of the index. These are expected to attract around USD 25-30 billion of foreign inflows into Indian bonds over the next few months.

This presents a very favorable demand supply dynamics for the Indian bond market wherein demand might outpace the supply. Given this expectation, bond yields should fall, and bond prices should move higher.

Demand supply mix for bonds look favourable. But, how to position for it?

Since long term bonds are more sensitive to interest rate changes, in falling rate environment long term government bonds are expected to benefit the most.

From investors standpoint, dynamic bond funds are probably best placed to capture this opportunity.

In the Quantum Dynamic Bond Fund, a large portion of assets is invested in long term bonds to benefit from falling bond yields over medium term. At the same time, the fund management team is ready to change the portfolio positioning quickly if the interest rate outlook changes.

In an environment of heightened global uncertainty, the flexibility to change the portfolio positioning adds value to overall investment process.

Read more about Quantum Dynamic Bond Fund

Features of the fund:

- Offers a solution for all your long-term debt investment needs

- It acts as a versatile investment that can accomodate various market conditions

- Active “Duration” management based on interest rate view - investors need not worry about interest rate cycle. Fund Managers manage this on their behalf. Investors can remain invested for the long term (irrespective of the interest rate cycle)

- Minimizes credit risk and liquidity risk by investing primarily in G-Secs or PSU bonds

Source: pib.gov.in

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

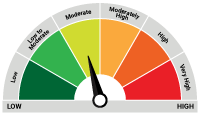

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More