Did Your New Car Come Without a Steering Wheel?

Posted On Monday, Mar 11, 2024

Everything that is produced, as you know, follows a particular process and has certain constraints. A very simple definition of manufacturing process is the ability to create anything of value while maintaining consistent quality standards.

Do you ever ask whether the car you purchased is the 1st or 100th car produced by a particular company? Every Car company follows a standard production process & passes every car through certain quality checks. This ensures the buyer that every car produced carries a assurance of uniform quality, functionality and performance. There is no difference in the first, second, and nth car the company produces ensuring that all cars exhibit identical characteristics.

Now, let's draw a parallel to Mutual Fund schemes. Does each scheme have a well-defined investment process akin to a car factory? Does a fund house have a clearly stated rationale behind stock picking of each scheme they offer? These questions are crucial to assess whether all schemes managed by mutual funds uphold their defined 'product characteristics' or if there are disparities in their processes. Yes, every fund has got to follow a certain investment process for the assets it can manage while it endeavours to accomplish the stated investment objectives. Investors often anticipate that the chosen fund will deliver on its investment objectives irrespective of the market conditions.

As asset managers and custodians of people’s wealth, it is the responsibility of mutual fund houses to handle their hard-earned money thoughtfully. A fund house ought to be a prudent asset manager with effective investment processes and systems in place and not just function as an asset gatherer. This is because every investment needs to be as exceptional as the first to meaningfully generate risk adjusted returns for investors.

At Quantum Mutual Fund, we believe that, like doctors who need to handle each patient independently with care and integrity, asset management is primarily a professional service that must follow an investor-first approach.

At Quantum, we are building an institution, not just launching funds and gathering AUM. For instance, amid the rising flows in small-cap and midcap space, there have been concerns about whether schemes with large AUM become more complex to manage. The capital market regulator SEBI has recently issued a directive requesting fund houses to disclose monthly disclosure of risk parameters including result of stress test & liquidity, volatility, valuation & portfolio turnover in the Small & Mid Cap Schemes.

At Quantum Mutual Fund, we have a well-defined process with emphasis on liquidity. A robust investment framework with guardrails around liquidity that defines the capacity to which the fund can scale without compromising the portfolio characteristics and liquidity traits. Read more

This reveals that we have been at the fore-front in following the good investment practices that are in the interest of the investors (much like automakers consciously do to provide the safety standards for their customers).

At Quantum, our approach is guided by the 4Ps: People, Philosophy, Process, and Predictability of Performance.

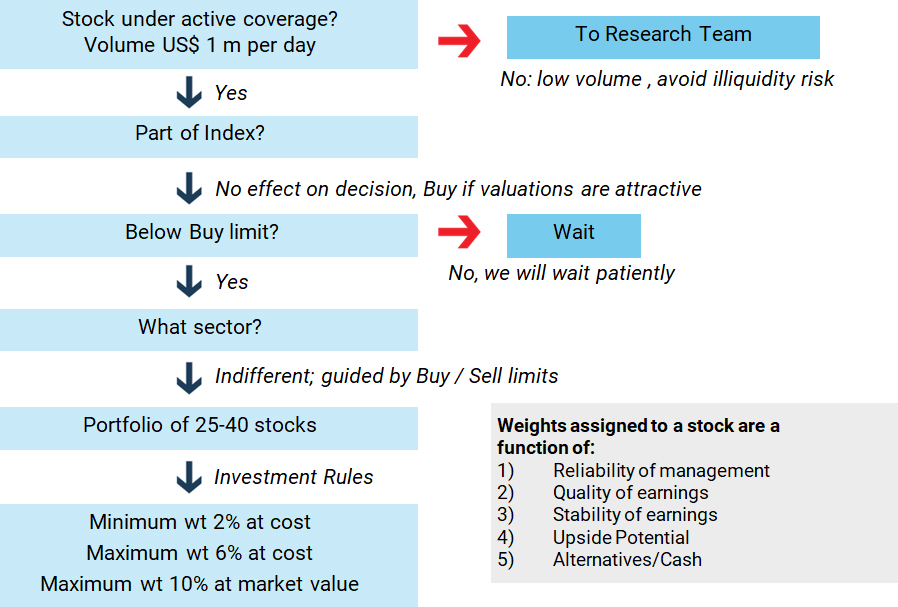

We follow a well-defined robust investment & research process to make conscious ‘Buy’ & ‘Sell’ decisions.

Please refer Scheme Information Document for the complete Investment Strategy.

Quantum Long Term Equity Value Fund - Conscious of liquidity

The investment process followed by the fund restricts exposure to stocks that lack liquidity. We employ a liquidity filter during stock selection, identifying companies with a trading volume of US $1Million per day. As per the investment process, either the entire portfolio or the majority of the portfolio i.e. 90% can be liquidated within 66 trading days at any given time.

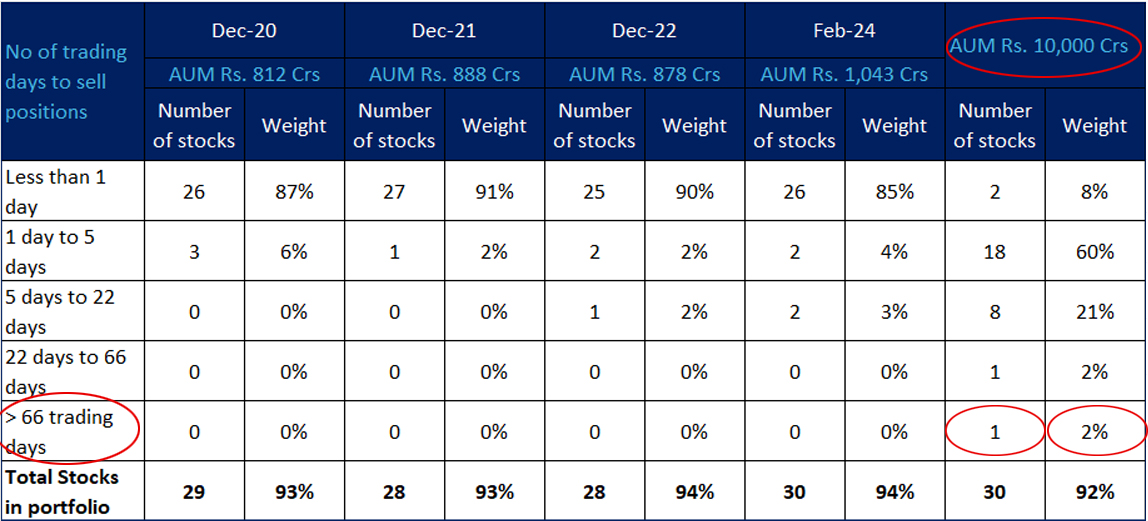

With Quantum Long Term Equity Value Fund, we follow a scalable portfolio strategy that does not dilute the portfolio characteristics while aiming to achieve the investment objective. Scalability means the ability to expand and adapt to accommodate growth without compromising on core principles. As you can see below, even if the AUM (Assets Under Management) were to scale 10 times, the fund would still be able to adhere to the portfolio characteristics.

Scalable Portfolio Strategy without diluting Portfolio Characteristics

Source: Bloomberg. Data as on Feb 29 ,2024 Based on average daily volume of portfolio stocks for the last one year and Quantum’s trading share of -33%.

The number of stocks in portfolio will be changed from time to time based on Investment Strategy of the Scheme.

With a well-defined bottom-up approach to stock picking, Quantum Long Term Equity Value Fund also considers the ‘values’ aspect of investing with the proprietary ‘Integrity Screen’ initiated by our Sponsor in 1996.

To achieve the stated investment, Quantum Long Term Equity Value Fund has not exposed its investors to undue very high valuations. At times when valuations seemed overvalued or expensive, it has taken cash calls, and been conscious of liquidity.

Choose to follow a thoughtful approach to steer the ups and downs of the equity markets well. Much like a well-equipped car ensures a smooth and safe journey, a reliable investment provides peace of mind and potential to provide consistent risk adjusted returns. Stay invested with Quantum Mutual Fund which ensures that every investment you make is as exceptional as the first. And for this, be in control of your investments, just as the way you would take control of the steering wheel (and brakes) while driving your car on terrain with twists and turns.

Happy Investing!

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (13th Mar 2006) | 14.26% | 13.19% | 13.20% | 12.68% | 109,880 | 92,720 | 92,931 | 85,572 |

| February 28, 2014 to February 29, 2024 (10 years) | 14.90% | 16.70% | 16.36% | 14.59% | 40,161 | 46,890 | 45,554 | 39,067 |

| February 28, 2017 to February 29, 2024 (7 years) | 12.77% | 16.14% | 15.99% | 15.52% | 23,211 | 28,528 | 28,269 | 27,472 |

| February 28, 2019 to February 29, 2024 (5 years) | 15.61% | 18.98% | 18.40% | 16.48% | 20,666 | 23,865 | 23,294 | 21,463 |

| February 26, 2021 to February 29, 2024 (3 years) | 18.64% | 19.41% | 18.51% | 15.21% | 16,722 | 17,050 | 16,669 | 15,312 |

| February 28, 2023 to February 29, 2024 (1 year) | 39.32% | 39.34% | 37.17% | 24.51% | 13,944 | 13,947 | 13,729 | 12,458 |

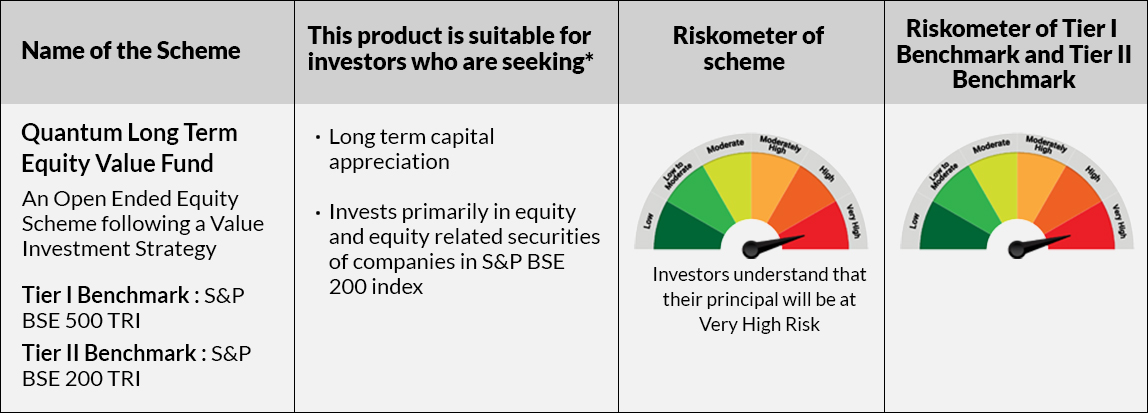

Data as of Feb 29, 2024. #S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai, please Click here.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More