Debt monthly view for February 2021

Posted On Tuesday, Mar 02, 2021

March 02, 2021

Fixed Income Monthly Commentary – February 2021

Bond markets had a shaky start of year 2021. Renewed optimism on economic recovery & fears of pick-up in inflation put the bond yields on upward path globally. Last 2 weeks had been particularly turbulent when the pace of rise in bond yields caught investors by surprise and caused panic in all the financial markets across oceans.

The US 10-Year treasury yield jumped to a year high at 1.60% before cooling off to close the month at 1.41%. This was still significantly higher than its previous month’s level of 1.07% and low of around 0.70% just five months back.

Indian bond yields also witnessed similar trend as the 10-Year Government Bond yield surged by about 32 basis points to end the month at 6.23%. Selling was more pronounced in all other maturity segments both at long and the short end where yields rose by 40-60 basis points in the same period. Spreads on Corporate Bonds and State Development Loans also witnessed pressure as their yields rose by somewhat higher proportion.

In the Indian context the biggest development in the month was the Union Budget in the first week of February. The government pegged the fiscal deficit for the financial year 2020-21 at 9.5% of GDP and set the target for financial year 2021-22 at 6.8% of GDP. These were much higher than the market expectations. The fiscal consolidation roadmap also got extended to lower the fiscal deficit to 4.5% only by fiscal year 2025-26. This was a big sentiment dampener for the Bond Market which has to absorb a much higher quantum of Government Bonds over many years.

The RBI though extended its support through words, failed to give any outright commitment in the form of OMO schedule or quantum of its purchases. Nevertheless, they bought more than Rs. 500 billion worth of long Government Bonds in the month of February 2021. But these had been of little help in absence of any clear roadmap.

Going ahead, RBI’s interventions will be key determinant for the trajectory of bond yields. Governor Das, at many occasions, have indicated that the RBI will continue to conduct more OMOs/twists to contain long term bond yields from rising sharply. This would put a lid on the long term yields or at least moderate the momentum.

In near term global bond yields, crude oil prices and RBI’s market intervention will continue to drive the bond markets. However, given the sharp rise in yields, there is a possibility of some retracement lower or consolidation around current levels.

Shorter Maturity Bonds seems good from valuation point of view. For reference Government Bond of 3-Years maturity (~5.0%) is trading at yield of more than 100 basis points of over the policy repo rate (4.0%) and more than 180 basis points over the effective overnight rate (Treps rate ~3.2%) as on February 2021.

For medium term, we maintain our earlier view that bond yields have already seen their bottom in this cycle and are likely to move higher over next 1-2 Year period.

In Quantum Dynamic Bond Fund portfolio, we were holding higher cash at the start of the month which we deployed later as valuations improved after selloff. Currently the portfolio is focused on the 5-15 Year segment of the Government Bond curve. This is a tactical position and we will continue to follow a dynamic approach to exploit any market opportunity.

In the Quantum Liquid Fund, we continue to focus on short term Treasury Bills and good quality PSU Debt Securities.

Investors should acknowledge that the best of the bond market rally is now behind us and should lower their return expectation from fixed income products. It would be prudent for investors to be conservative in their fixed income allocation despite have lower return compared to past.

Investors who have higher risk tolerance and longer holding period can take advantage of the market opportunities through dynamic bond funds while conservative investors with very low risk appetite should stick to very low duration funds like liquid funds.

Source: RBI

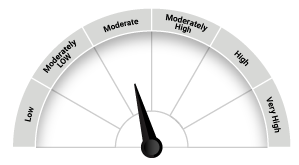

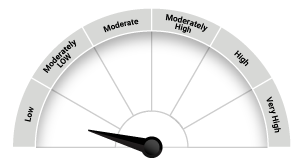

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on February 28, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More -

Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

September was a pivotal month for fixed income markets, both globally and domestically.

Read More