Debt monthly view for June 2022

Posted On Thursday, Jul 07, 2022

June 2022 was a month of two halves. The first half of the month was dominated by an ‘inflation’ narrative. Bond yields in India and globally moved up - pricing for higher inflation for a longer period and more aggressive central bank action.

But we reached the peak of inflation scare by the middle of the month. In the second half, the pendulum swung towards the ‘recession’ narrative. Markets started pricing for a contraction in the economic activity across many advanced economies.

The US 10 treasury started acting like a haven asset as investors rushed to seek protection. Bond yields dropped; prices jumped.

The US 10-year treasury yield peaked at 3.47% on June 14, 2022, a day before the US Federal Reserve hiked the Fed Funds rate by 75 basis points. It fell to 3.01% by June 30, 2022. At the time of writing this report on July 6, 2022, the 10-year US treasury note is trading at a yield of 2.81%.

Indian bond yields followed a similar path as the US treasury yields, though at a slower pace. The 10-year Indian government bond yield peaked at 7.60% on June 13, 2022, and fell back to 7.45% by the month-end. Currently, on July 6, 2022, the 10-year Indian government bond is trading at a yield of 7.30%.

Commodity prices also came off from its April-May 2022 peak in fear of economic contraction and demand destruction. As of July 5, 2022, most of the metal commodities are down by 10%-20% since the end of May 2022. Many of the Agricultural commodities have also come off by 5%-20% during this period.

From India’s perspective, the most notable is the decline in crude oil, palm oil, and wheat prices which fell by 14%, 37%, and 23% respectively in one month period ending July 5, 2022. These were major contributors to domestic inflation on the way up. So, this drop in prices should ease some of the inflationary concerns.

From the bond market’s perspective, the tussle between the two narratives of Inflation and Recession in the US will continue to shape market expectations. If indeed the economic activity decline at an accelerated pace and the US economy gets into serious contraction - the US Fed may slow down the pace of rate hikes, global commodity prices will soften and bond yields will come down further.

However, if this economic slowdown is not that serious, central banks will continue to focus on the inflation problem and rate hikes may continue.

Although we expect the global economy to slow down due to high inflation and synchronized global monetary policy tightening, it may not fall into recession as quickly as expected.

Employment numbers in the US are fairly strong, incomes are still growing at a healthy pace and there is a saving buffer available to spend. Corporate sector balance sheets carry lesser debt and are stronger than before.

We may possibly see a slowdown in the demand for goods and consequently in the manufacturing activity; while demand for services like travel, recreation, etc. picks up due to the removal of pandemic-related restrictions.

We do not see any material change in the FED’s policy direction and its commentary in the upcoming monetary policy on July 27, 2022. It will likely hike the Fed Funds rate by another 50 or 75 basis points as was guided earlier.

Thus, we see the recent move down in the US treasury yields as a temporary retracement and expect it to rebound over the coming months.

For the Indian bond market, local inflation and demand-supply dynamics will likely have a greater influence. A drop in commodity prices should help in easing some of the inflationary concerns. But it may not be enough to have any material impact on the RBI’s policy direction and its pace, as yet.

We expect another 35-50 basis points of a rate hike in the August meeting of the RBI’s monetary policy committee. The RBI may continue with the rate hikes in the remaining MPC meetings in 2022. However, the pace of rate hikes (quantum of hike in each policy) may slow down after the pandemic time ultra-accommodative monetary policy is reversed. Overall, we expect the repo rate to peak around 6% by early 2023.

Since bond yields have come down sharply over the past two weeks, there is a possibility of a reversal in the near term.

From a medium-term perspective, mostof the potential rate hikes are already priced in the current bond valuations. Thus, the bond market may not be too sensitive to RBI’s rate hikes going forward.

However, the adverse demand-supply gap will continue to put upward pressure on the longer maturity bonds. We continue to like the 3-5 years segment of the bond market, which in our opinion, offers the critical balance between the accrual (interest income) and duration (price changes). At this stage, our priority is to have higher accrual with a lower duration.

From an investor's perspective, the return potential of liquid and debt funds has improved significantly after the sharp jump in bond yields over the last 12 months. The gap between the bank savings rates and liquid fund returns will widen further and remain attractive for your surplus funds. Investors with a short holding period and low-risk appetite should stick to categories like liquid funds of good credit quality portfolios.

Medium to Long term interest rates in the bond markets are already at long-term averages as compared to fixed deposits which remain low. Investors with more than 2-3 years holding period can consider dynamic bond funds which have the flexibility to change the portfolio positioning as per the evolving market conditions. However, such investors should be ready to tolerate some intermittent volatility.

Source: Worldometer.info

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

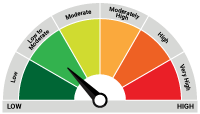

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on June 30, 2022.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More