From Fiscal Math to Market Outcomes: What Changes for Bonds as FY26 Ends

Posted On Tuesday, Jan 27, 2026

FY26 is increasingly looking like a year where the headline numbers understate the underlying resilience of India’s fiscal framework. Tax collections have fallen short of Budget assumptions on the back of Income tax and GST cuts. But the shortfall was largely foreseeable and, more importantly, has been absorbed through a combination of stronger non-tax revenues (led by RBI and PSU dividends) and tight expenditure control. The end result is a fiscal outcome that remains aligned with the government’s consolidation path, even as the burden of adjustment has been carried by composition rather than the headline deficit.

As the year draws to a close, there is little ambiguity around the FY26 outcome. The fiscal deficit is on track to meet the 4.4% of GDP target, revenue slippage has been managed without disruption, and capital spending has been ring-fenced.

For bond markets, however, the focus is already shifting away from how FY26 ends to how FY27 begins specifically, to what the evolving supply–demand balance will look like in the coming year.

And it is here that the narrative becomes more complex.

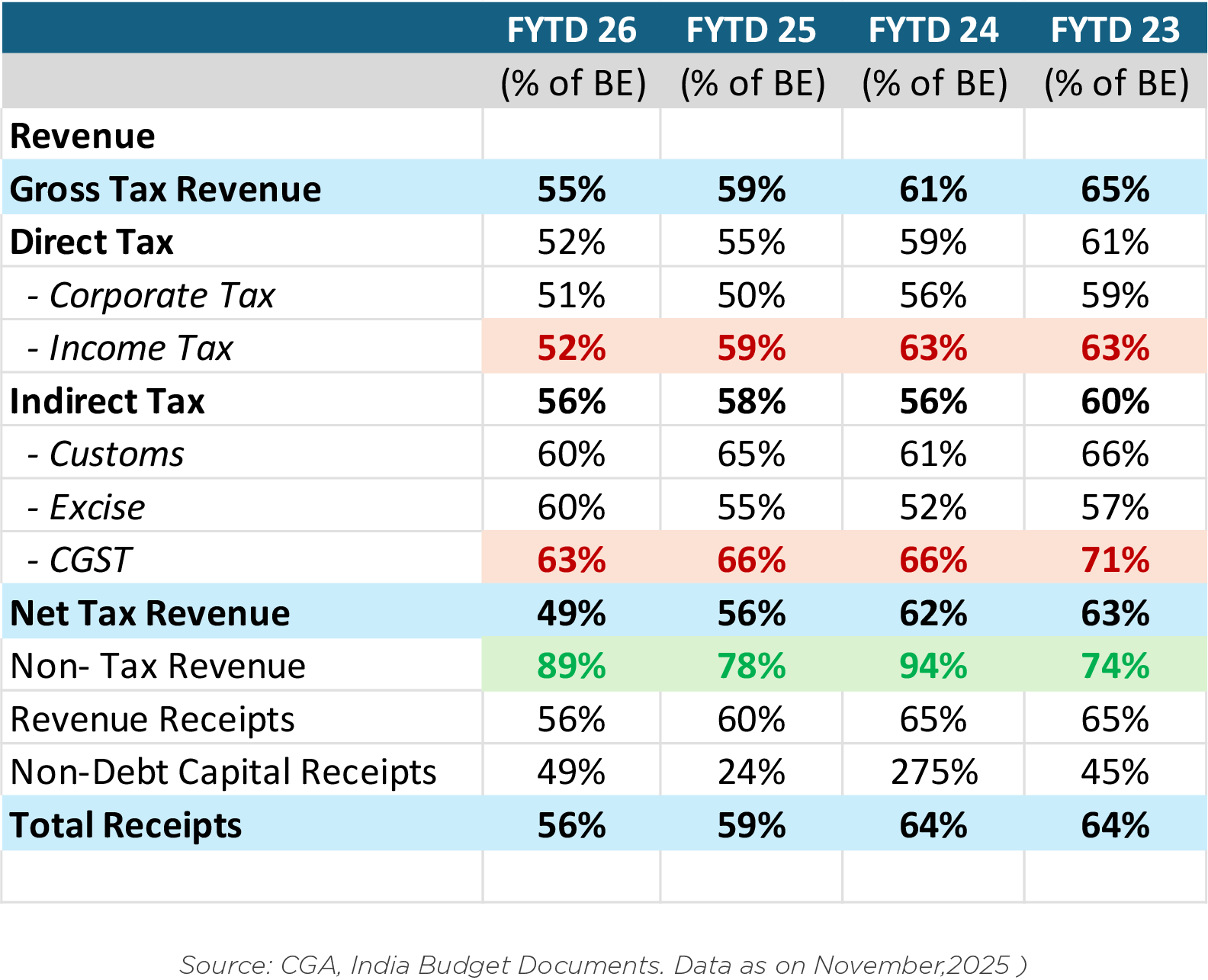

Table 1: Tax collections slow in FY26 as income tax relief shows up in FY26 collections

Source: CGA, India Budget Documents. Data as on November,2025

FY26 revenues: weaker headline, steadier undercurrents

The shortfall in tax collections this year needs to be seen in the context of how FY26 was framed. The FY26 Budget projected gross tax revenues of Rs 42.7tn, implying 11% YoY growth, while offering close to Rs 1tn in income tax relief, effectively signaling a moderation in personal income tax growth.

That moderation has played out: income tax collections grew just 7% YoY during April–November 2025, lagging corporate tax growth and slowing from last year. By November, income tax had reached only 52% of the Budget Estimate versus 59% last year, while corporate taxes broadly held pace, highlighting a divergence within direct taxes.

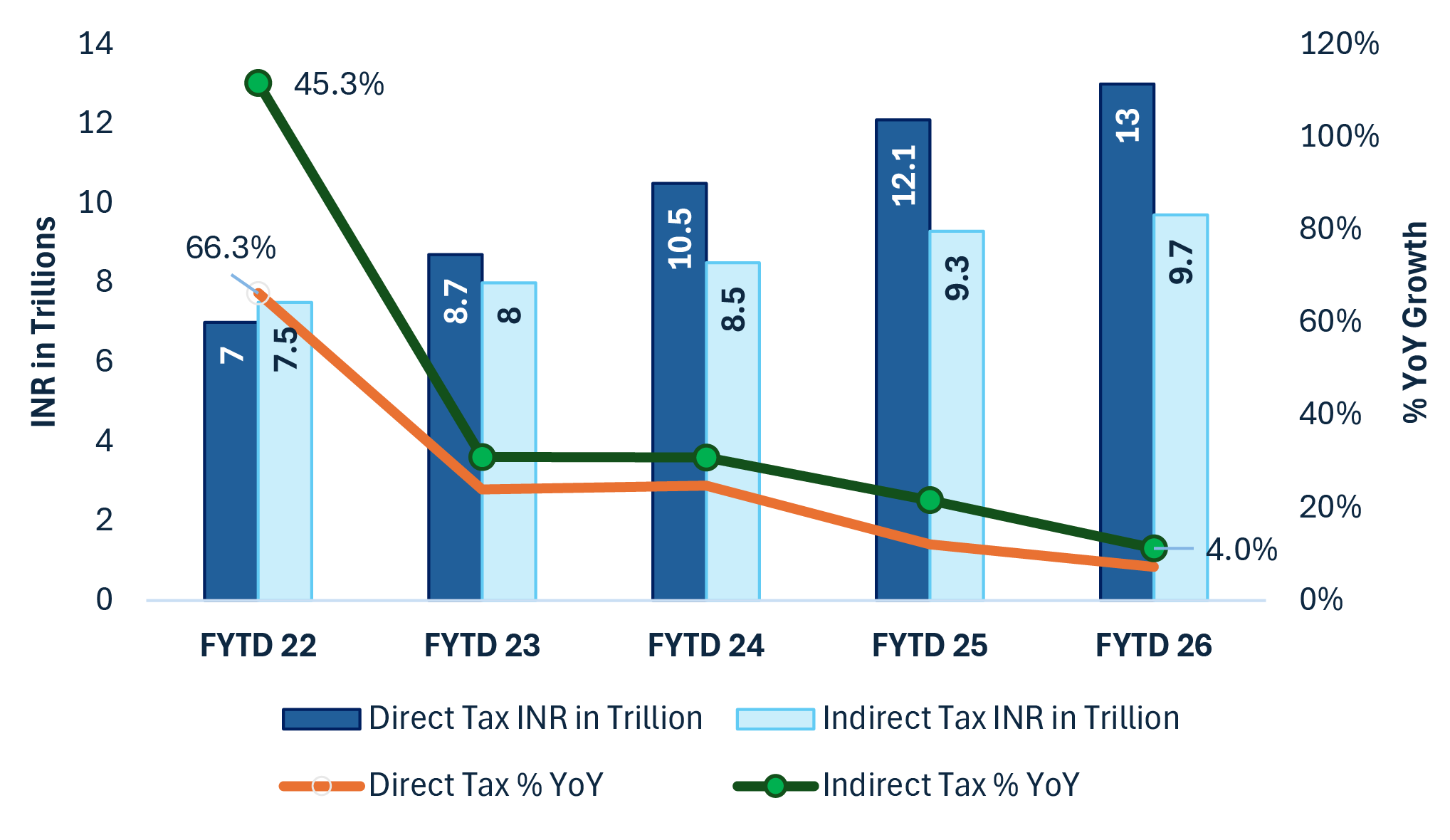

Chart I: FY26 Tax Collections Reflect Policy-Led Moderation

Source: CGA, India Budget Documents. Data up to the month ended November 2025 (latest available). *FYTD: April to November for the corresponding year

Collections have improved in recent months, aided by December advance tax payments and lower refunds (Rs 1.3tn versus Rs 1.7tn last year) lifting net inflows. Even so, the income tax shortfall was largely anticipated, given FY25 ended below revised estimates.

Indirect taxes too show a mixed picture. Excise has outperformed, boosted by a Rs 2/litre hike on petrol and diesel, while GST growth slowed after mid-year rate cuts and customs duties contracted amid softer imports, leaving these components below Budget Estimates.

On current trends, corporate tax may exceed its BE, while income tax could fall short by around Rs 1.4tn, leaving overall direct taxes up roughly 11% YoY, broadly higher than the nominal GDP growth.

FY26 revenues: weaker headline, steadier undercurrents

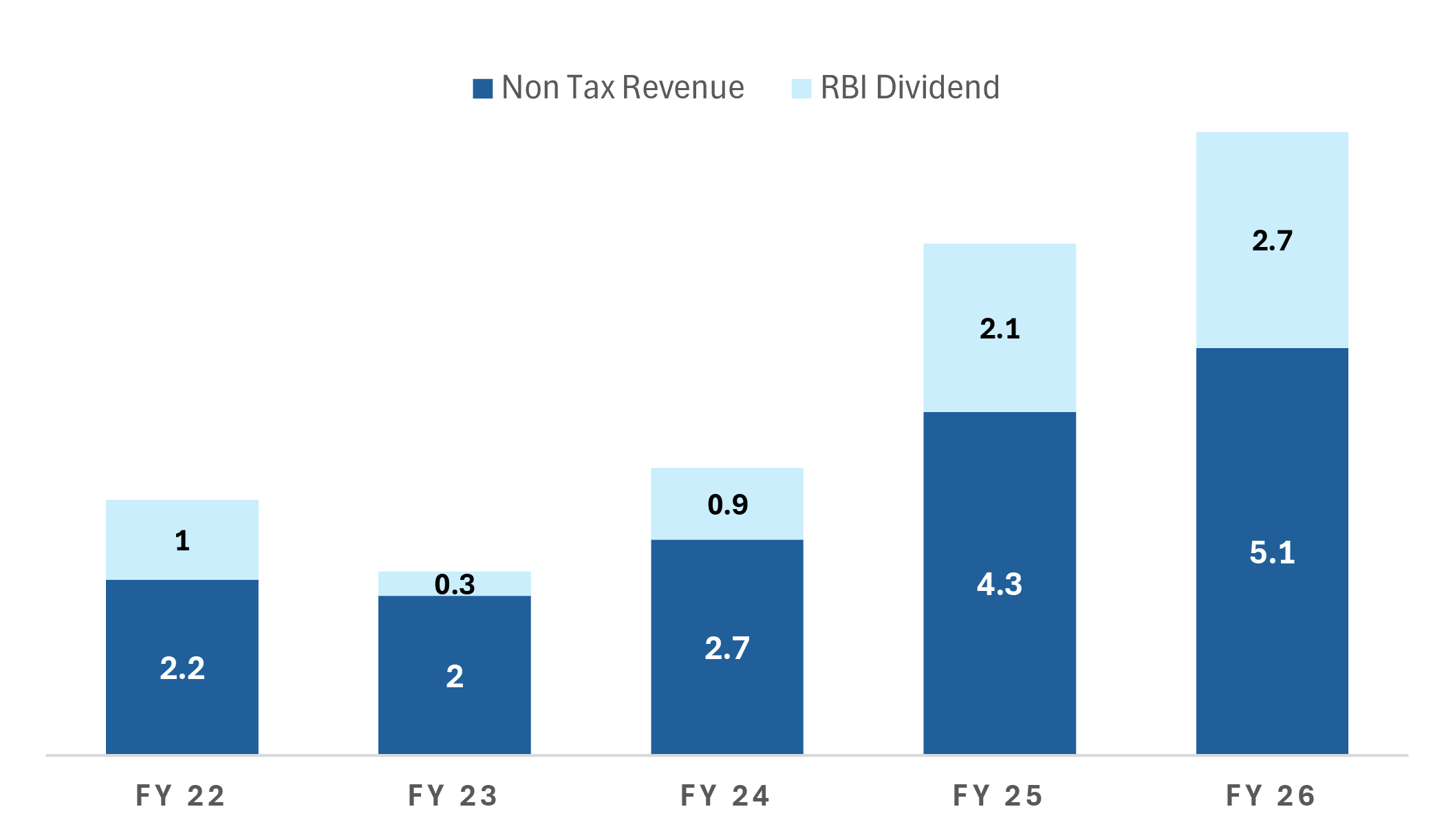

While tax revenues have underwhelmed, non-tax receipts have more than made up ground, reaching around 89% of FY26 Budget Estimates. This has been largely driven by the RBI dividend, which came in at Rs 2.7tn, along with stronger-than-expected payouts from other CPSEs, now at about Rs 0.5tn for FYTD26.

On current trends, non-tax revenues are set to exceed the FY26 BE by roughly Rs 380bn, offering a much-needed fiscal buffer.

Chart II: Non-Tax Revenues Provide a Strong Fiscal Cushion in FY26

Source: CGA, RBI.

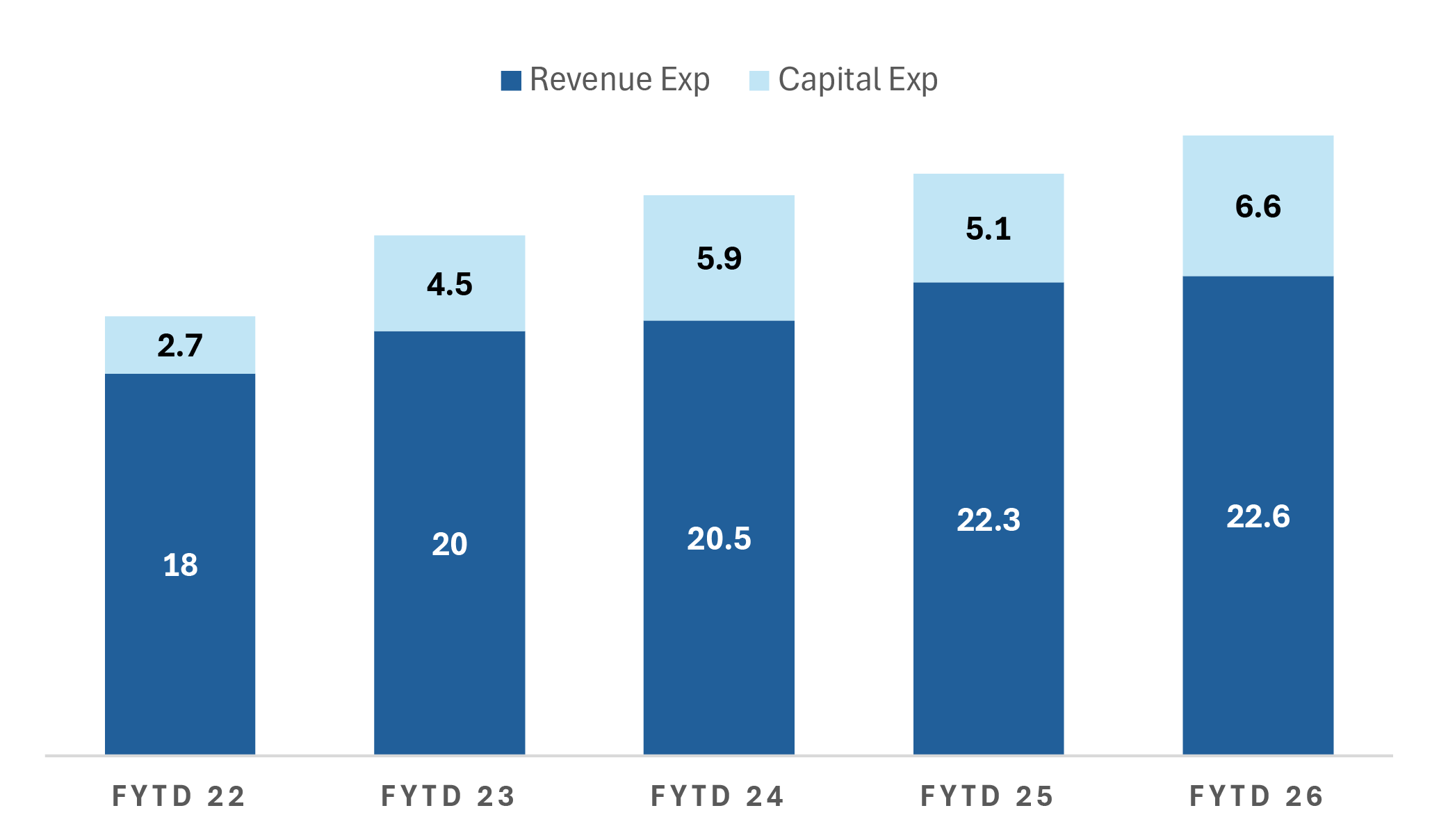

On the expenditure side, the adjustment has fallen mainly on revenue spending. The FY26 Budget had envisaged an 8.3% YoY rise in total expenditure, driven by a 10.1% increase in capital spending and a moderate 6.7% growth in revenue expenditure. Through November, total spending has grown 6.7% YoY, with revenue expenditure notably restrained at just 2% YoY.

Several ministries including Rural Development, Jal Shakti, Commerce & Industry, Corporate Affairs, Heavy Industries, Housing & Urban Affairs, and Tourism, have under-utilized their allocations, pointing to potential savings of around Rs 1.5tn. This ensures the Centre stays on track to meet its fiscal deficit target, even after ~ Rs 415bn in supplementary grants for fertilizer and petroleum subsidies.

Chart III: Non-Tax Revenues Provide a Strong Fiscal Cushion in FY26

Source: CGA, India Budget Documents. Data up to the month ended November 2025 ). * FYTD: April to November for the corresponding year

Capital expenditure, by contrast, has surged 28% YoY in FYTD26, front-loaded in the first half and concentrated in railways, roads, highways, and defence. While growth is likely to moderate in the coming months to align with the Budgeted ₹11.2tn target, the government’s focus on infrastructure-led growth and crowding-in private investment remains evident. Some areas, such as transfers to states, could see lower spending if revenue collections soften.

Combined with non-tax revenue gains, this has kept the fiscal deficit firmly on track despite the tax shortfall.

FY27 Fiscal Outlook: Maintaining Deficit Discipline, Guiding Debt-to-GDP, and Supporting Growth

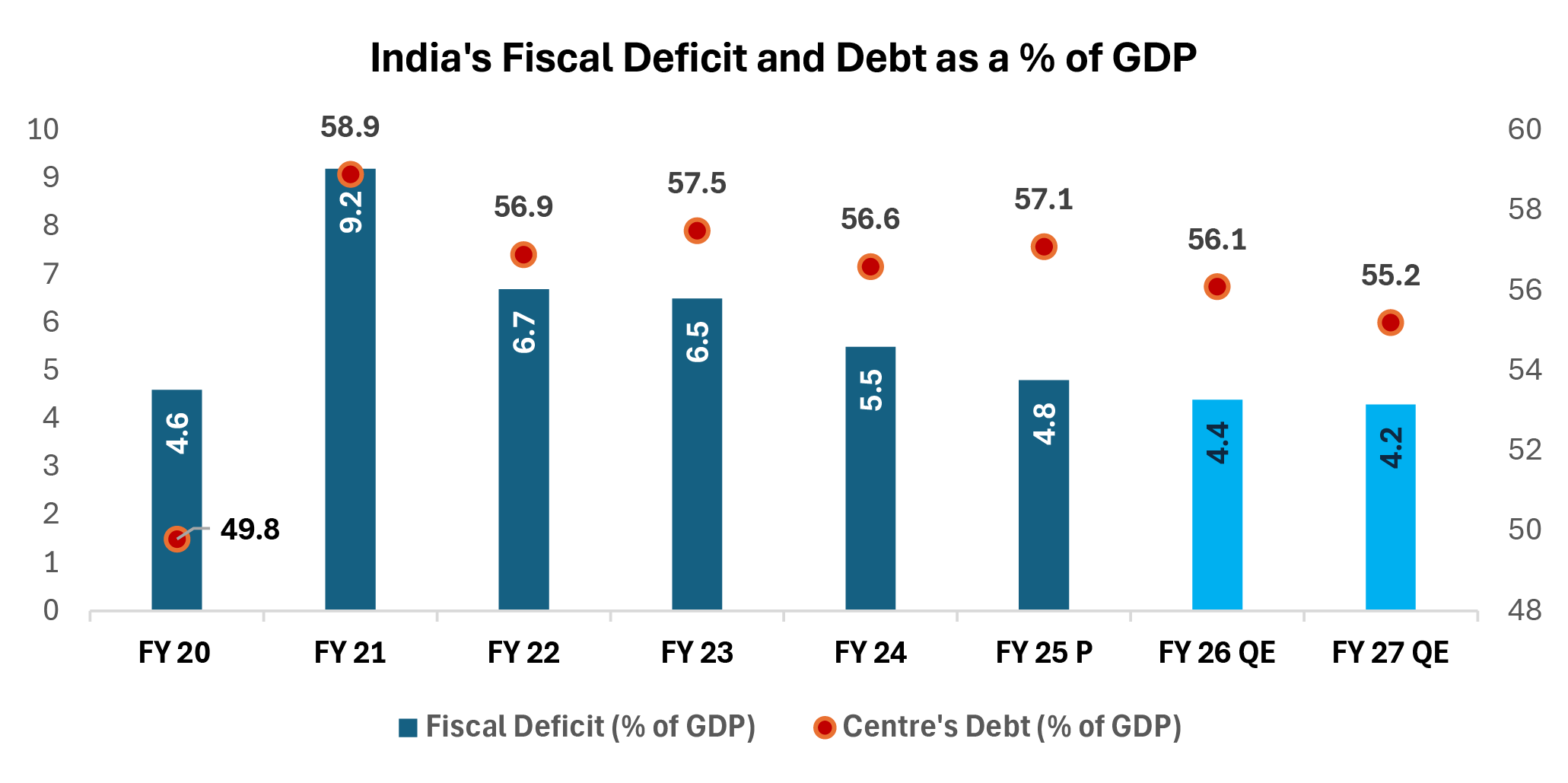

India’s fiscal consolidation over the past few years has been credible. From a high of 9.2% of GDP, the fiscal deficit narrowed to 5.6% in FY24 and further to 4.8% in FY25, beating Budget Estimates. FY26 is on track to meet the 4.4% target.

Chart IV: Debt-to-GDP Becomes the New Fiscal Anchor as India Charts a Consolidation Path to 2031

Source: RBI, India Budget Documents, Quantum Internal Estimates(QE).

Looking ahead, the fiscal anchor is shifting from deficit targets to debt-to-GDP, with a glide path aiming for around 50% by March 2031. This implies modest, steady consolidation (roughly 1% of GDP per year) without constraining growth, assuming 10% nominal GDP growth.

The improved fiscal space also allows the government to accommodate 16th Finance Commission recommendations and the 7th Pay Commission payouts, which could support higher growth through increased government compensation from January 2026 onwards.

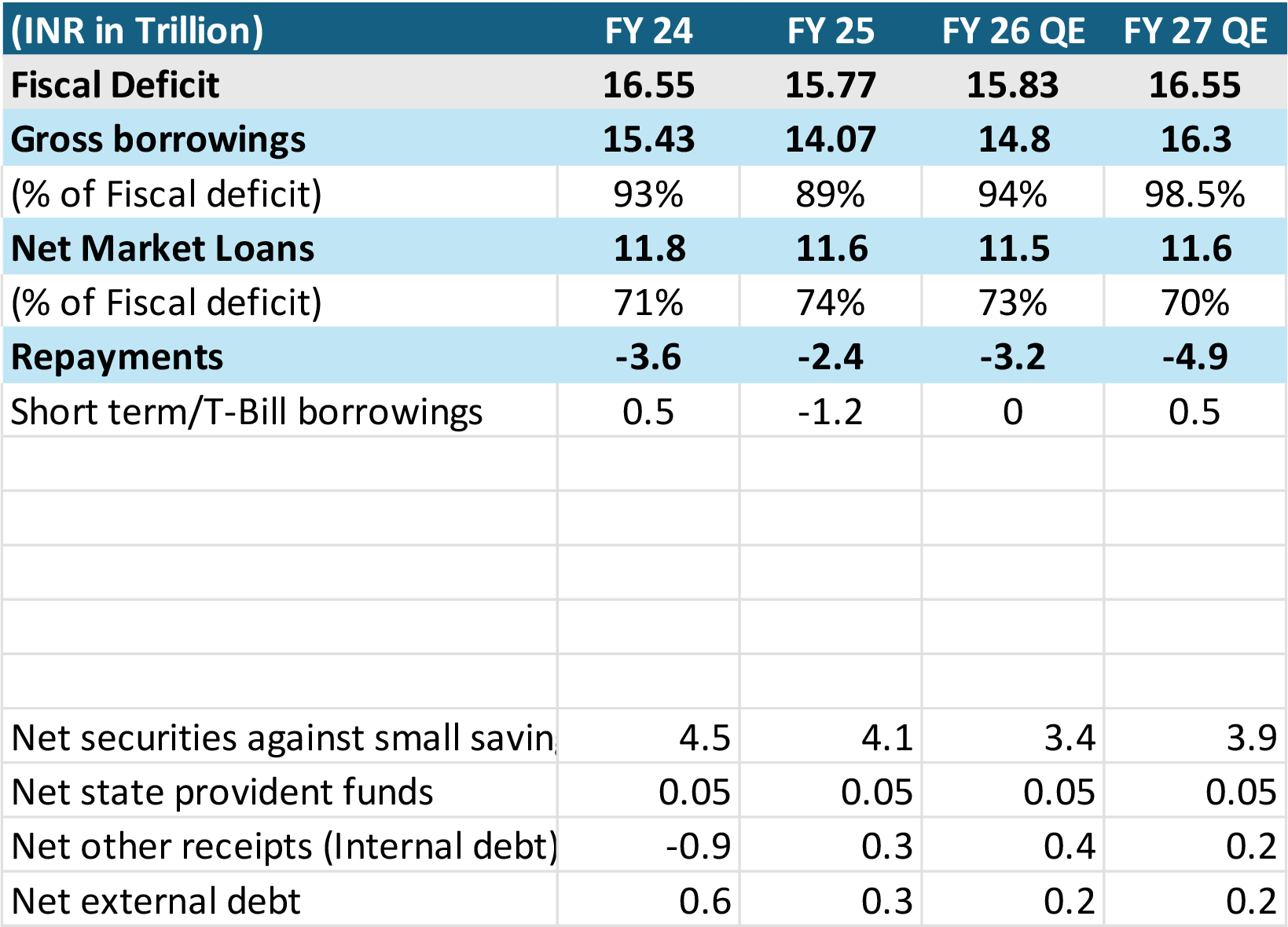

Gross supply, not the deficit, is the binding constraint

Even as India’s fiscal deficit gradually narrows, gross borrowing is set to rise in FY27 and beyond, not because of higher fresh borrowing needs, but due to a steepening redemption cycle. Both central and state government securities face a heavy maturity schedule over the next few years, pushing gross supply higher.

In FY27, central government redemptions are expected to increase significantly, while state governments also confront a busy maturity calendar. Taken together, gross issuance of G-secs could exceed Rs 16 tn, and with state development loans included, total gross supply may stay well above Rs30 tn.

Table 2: Gross Borrowing to Rise in FY27; Net G-Sec Borrowing Steady at Rs 11.5 tn

Source: India Budget Documents. Data for FY 26 and FY 27 are Quantum Estimates(QE)

Net G-sec borrowing, by contrast, is expected to remain largely unchanged at around ₹11.5 tn, similar to FY25.

This distinction is crucial. In the bond market, yields also respond to gross supply rather than just headline deficit numbers. Even in a year where fiscal consolidation is successful, heavy redemption schedules could keep term premia under pressure, creating upward stress on yields despite stable net borrowing.

Demand remains fragmented, not absent

On the demand side, the investor base is behaving very differently from previous cycles. Insurance, Provident and Pension funds which have emerged as the most consistent source of absorption of long bonds, have been missing in the market for most part of the second half of the financial year.

Banks too, remained constrained. Credit growth has outpaced deposit growth, pushing the system-wide credit–deposit ratio to historically high levels. As long as this persists, banks’ appetite for duration is likely to remain limited, even in a stable rate environment. This is a key difference from earlier easing cycles, where banks were the marginal buyers of government bonds.

Insurance companies and pension funds have also turned more cautious. For insurers, the removal of tax benefits on guaranteed return products has dampened inflows. For pension funds, higher equity allocation limits have structurally reduced demand for government securities. These are not cyclical issues and are unlikely to reverse quickly.

Foreign participation has also plateaued following India’s inclusion in the JP Morgan EM bond index. While this has improved market depth and reduced volatility, incremental inflows have slowed materially in FY26. Without a new trigger, foreign demand is unlikely to meaningfully alter the demand–supply balance.

Provident funds, however, have emerged as the most consistent source of absorption, increasing their share of net supply in FY26.

RBI remains the swing factor

In this environment, the RBI has effectively become the swing player.

OMO purchases in FY26 have been unusually large and have played a critical role in absorbing excess supply, particularly when bank demand has been weak. Going into FY27, RBI liquidity operations are likely to remain an important stabilizer, especially if gross issuance remains elevated and private demand does not fully step up.

That said, reliance on RBI support also places an implicit ceiling on how aggressively yields can rally. In the absence of strong organic demand, rallies tend to fade once OMO expectations are priced in.

CY 2025 was a strong year for the bond market, but the landscape is shifting. With spreads between state and central government bonds widening, the market may look less compelling in CY 2026. While demand for bond issuances particularly from non-bank financial companies (traditionally the largest borrowers), remains, issuers are increasingly turning to bank loans, which have become more attractive following the 125 bps rate cuts.

Wholesale lending activity has also picked up, while corporate bond issuances, both domestically and overseas, have remained subdued over the past two quarters. Overall, CY 2026 is likely to see steady activity, but it may not match the robustness of the previous year.

What could change sentiment?

The most obvious upside catalyst for bonds remains India’s inclusion in the Bloomberg Global Aggregate Index. Inclusion would materially broaden the foreign investor base and create a more durable source of demand across the curve.

Until there is clarity on this front, however, bond markets are likely to remain largely range-bound, with yields responding more to supply dynamics and liquidity conditions than to fiscal optics.

Other potential triggers - such as a sharper-than-expected slowdown in growth or a renewed rate-cut cycle, appear less likely in the near term and are not part of our base case scenario. We believe the rate cutting cycle is at its end and the rates are likely to remain at a pause for long. However, possibility of one final 25 bps cut in the February 2026 policy cannot be completely ruled, but we believe the terminal rate is likely to be 5.25%. Inflation has moderated, but the policy rate cycle looks largely behind us, limiting the scope for duration-led rallies.

What could bond investors expect and/or do?

For bond investors, the implication is not one of alarm, but of realism.

The fiscal backdrop is no longer a source of tail risk. Deficit slippage risks are contained, debt dynamics are improving gradually, and capex-led growth supports medium-term macro stability. This reduces the probability of a disorderly sell-off in yields.

At the same time, elevated gross supply, uneven demand, and limited foreign inflows argue against a sustained bull flattening of the curve. Long-end yields are therefore likely to trade with a mild upward bias, punctuated by periods of support from RBI operations. Thus:

• Looking ahead, the 10-year G-sec yield is expected to hover around 6.5–6.7% through 2026 with some intermittent periods of spikes, implying that returns will be driven more by accrual and credit quality than sharp price moves.

• Intermediate maturities may offer better risk-adjusted outcomes than the very long end.

• Volatility around issuance calendars and OMOs should be expected, rather than interpreted as regime shifts.

Conservative investors should focus on laddering maturities, reviewing credit quality, and reinvesting gradually rather than chasing yield moves. Short- and low-duration funds offer stability, while high-quality corporate bond or dynamic bond funds with a blend of high quality SDLs, G-secs and AAA-rated PSUs can provide better carry without adding credit risk.

Long-duration or gilt funds may benefit from easing yields, but come with higher volatility. Until a durable demand source, such as global index inclusion, emerges, bond yields are likely to remain range-bound, supported by policy but constrained by supply.

Data Source: RBI, CGA, India Budget Documents, MOSPI, Bloomberg

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Sneha Pandey, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Mohit Bhatnagar - Head - Sales, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9987524548

Read our last few Debt Market Observer write-ups -

- Why Are Bond Yields Still High Despite Rate Cuts?

- The Macro Three Body Problem: Currency, Liquidity & Bond Yields

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More