Debt Market Observer - Aug 2020

Posted On Tuesday, Aug 11, 2020

Done with the bond rally probably?

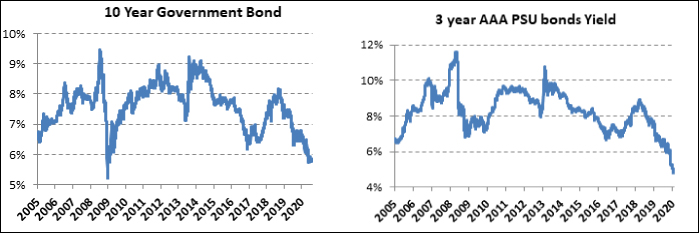

The Bond Market roller-coaster has been on a one way trend. Since March, bond yields have fallen sharply. The momentum continued in July with Bond yields (price moved up) falling across the maturity curve by 5-15 basis points (1% = 100 basis points). The 10 year benchmark government bond yield fell by about 5 basis points in the month to 5.84%. The rally was even more pronounced in the longer maturity segment where yields declined by more than 10 basis points.

Corporate bonds also followed the positive momentum. Yields on AAA rated bonds came down by 15-20 basis points. The yield on 3 year AAA PSU bond fell to a decade low ~5.0% and that on 10 year bond fell to 6.4%.

Chart – I & II: Bond yields at decade low

Past performance may or may not sustained in future.

Source – Bloomberg, Quantum Research

Primary market activity also increased substantially in the month. Attracted by the historic decline in bond yields, many corporates rushed to raise funds from the bond markets. Investor demand remains strong, seemingly unaffected by the large amount of new issuances.

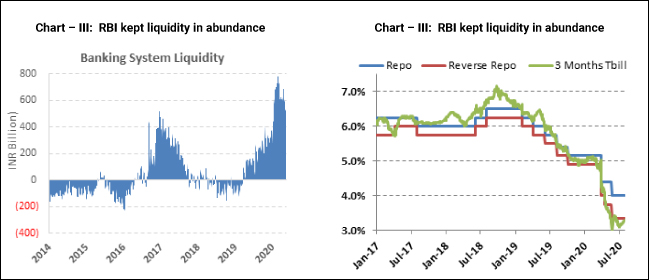

Contrary to the long term bonds, money markets witnessed hardening in yields in July. Yield on 3 months treasury bills rose to 3.29% in July as against 3.15% in the previous month.

The short maturity bonds and money market papers are more closely aligned to the expectation on RBI’s rate decision and liquidity conditions. After the CPI inflation data for June which surprised on the upside, investors dialed back their rate cut expectation from the August MPC meeting which led to this rise in yields on the shorter maturity segment.

Liquidity condition remained in surplus mode. On average, banks were parking around INR 7 lakh crore (7 trillion) of surplus liquidity under the RBI’s Reverse Repo window on daily basis. Given the persistent surplus liquidity, overnight rate and yield on short term treasury bills, CP, CDs etc. remained anchored to the reverse repo rate which is currently at 3.35%.

Past performance may or may not sustained in future.

Source – RBI, Bloomberg, Quantum Research

Long term bonds outperformed shorter tenures

Fall in long term bond yields and compression in credit spreads for good quality corporate bonds helped longer term bonds to outperformed shorter maturities in the month.

Past performance may or may not sustained in future. Source – Bloomberg, Quantum Research;

*Bond prices rise when bond yields fall; Prices of longer maturity bonds rise more than shorter maturity on a similar fall in yields

The inflation hurdle

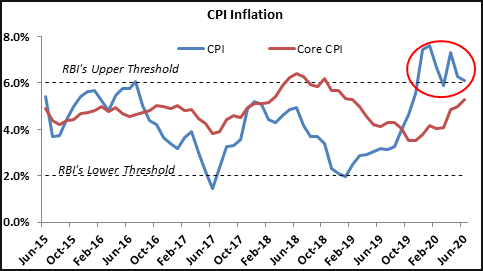

After a two month gap, the National Statistical Office (NSO) released detailed consumer price inflation data for the month of June. It shows that the CPI inflation has moderated to 6.1% in June from the imputed inflation levels of 6.3% in May and 7.3% in April. The fall in the inflation reading was mainly on account of favorable base effect and moderation in food prices.

The Core inflation measure, which excludes the volatile food and fuel prices, reported a sharp jump in the past three months. The average core inflation in March to June 2020 quarter was at 5.0%. This was significantly higher than average core inflation of 4% in the preceding four quarters.

Despite steep slowdown in economic growth, the CPI inflation has been above the RBI’s upper threshold of 6% in the last three quarters. Remember, the RBI’s mandate is to keep the headline CPI inflation at 4% (+/-) 2%.

Chart – V: Inflation holding above the RBI’s upper tolerance band

Source – Ministry of Statistic GOI, Quantum Research

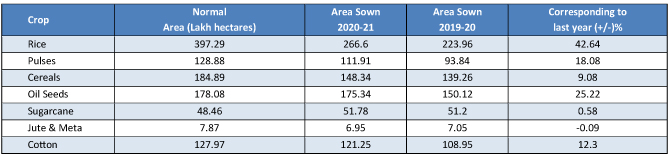

The main reason for higher inflation in the recent past was food prices which are now showing signs of moderation. Normal rainfall (rainfall at long term average level) and healthy kharif sowing trends will also be supportive in keeping food prices under control in near future.

Chart – VI: Good rainfall distribution supported early Karif sowing

Source: Dept of Agri,Cooperation & Farmer Welfare; data as of 31st July 2020

The worrying part is the non-food inflation especially from - (1) fuel prices which are impacted by increase in taxes and (2) imported goods due to rising duties. Nevertheless the headline CPI inflation is likely to trend down towards 4% by December 2020 as the base effect turns favorable and supply chains regain normalcy.

Dovish RBI favored a prudent pause

The monetary policy committee of the RBI met in August on a challenging backdrop of high inflation and contracting economy. Acknowledging the uncertainty around both inflation and growth, it voted unanimously to keep the policy repo rate unchanged at 4% and reverse repo rate at 3.35%.

This move was broadly in line with the market expectations. However, a section of market which was expecting some announcement on OMOs (open market operations to buy government bonds) and increase in HTM (Held till Maturity) limits for banks to absorb the increased supply of government bonds, were left disappointed. Yet the bond market remained relatively calm after the policy. Yields moved up marginally by 3-5 basis points on the day.

Though The RBI raised concerns on elevated inflation trajectory in the recent past however it doesn’t seem too worried about inflation at this juncture. In the policy statement, the governor did point to inflationary risks from supply side disruptions and hike in taxes on fuel items. But it still expects headline CPI inflation to come down in the second half supported by healthy outlook on the food production given a bumper rabi harvest and a good kharif sowing.

The RBI reiterated its accommodative stance and mentioned that in the current environment of an unprecedented shock, “supporting the recovery of the economy assumes primacy in the conduct of monetary policy”.

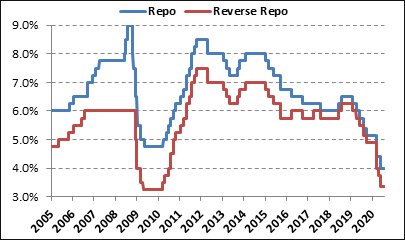

The RBI has been in an accommodative mode since early 2019. It has lowered the policy repo rate by 250 basis points since February 2019. Out of this 115 basis points of rate cut has happened post Covid-19 impact during March to June 2020. This aggressive rate cut has brought the policy rates to a decade low.

Chart – VII: RBI frontloaded rate cuts; policy rates near historic lows

Source – RBI, Bloomberg, Quantum Research

Given the fact that the RBI has frontloaded the rate cuts and inflation remains elevated, the space for further rate cuts is limited. There is now uncertainty on when and whether there would be another rate cut and hence we may see bond yields drift higher.

Outlook – Supply pressure to weigh on long bonds

The immediate risk for bonds is the excessive supply pressure emanating from increased government borrowings. There is an expectation that the RBI will buy a large part of government bond supply this year.

Till now, the RBI has been silent on monetization of government debt (RBI directly buying large amounts of government bonds) and preferred a more tactical approach in intervening in the bond markets. In the recent past they conducted OMOs only when bond yields had moved above a certain threshold providing a “Put option” to the market. (In Put option the losses are limited while the buyer can enjoy all the gains).

In our opinion the RBI may refrain from announcing any preplanned OMO calendar to absorb the supply of government debt. Instead they will continue with tactical intervention in the bond market to prevent government bond yields from moving higher.

At current juncture it seems the RBI is fairly comfortable with the level of bond yields. Nevertheless we do see high possibility of OMOs in the second half of this fiscal if demand supply imbalance starts to weigh on the market rates.

At current level of bond yields, we believe the market is already factoring in large bond purchases by the RBI. Thus we do not expect bond yields to decline materially when it happens. The trajectory of the bond yields will be dependent on the quantum and timing of the RBI actions of monetization or OMOs.

On the other hand there is risk of more negative surprises on the supply side as we expect the government to raise their market borrowings even further. If the economy remains weak then the government may provide another round of stimulus. State governments have witnessed an even dramatic fall in tax revenues and are expected to increase their market borrowing in the second half.

We see higher probability of bond yields (market interest rates) going up than down from here. Additionally, there is also a risk of India’s rating downgrade below the investment grade which might keep foreign investors away from Indian bonds in near term.

We find the risk reward unfavorable in the longer maturity bonds though the shorter maturity bonds (upto 3 years) might remain supported by the easy liquidity condition. The RBI is also likely to keep rates lower for a longer period of time.

Portfolio Recommendations and Strategy

Based on our cautious view on the bond market, we maintain a lower maturity profile (lowered the interest rate risk) in the Quantum Dynamic Bond Fund. Currently, the portfolio is concentrated in upto 3 year maturity government bonds and is holding higher than usual cash/treasury bills which can be deployed if interest rates move up.

We understand the economy and markets are currently adjusting to an unprecedented shock. There are too many moving parts and things are still evolving. Thus any forecast about future is susceptible to change based on policy responses from the government and the RBI and the changes in global markets. We stand vigilant to review our outlook as and when new information comes. Nevertheless, it would be prudent for investors to be conservative at times of heightened uncertainty.

We recommend investors to stick to debt funds with lower maturity and good credit quality. While investing in debt funds, investors should keep the market risks in mind. Investors with low risk appetite should stick to Liquid Funds to avoid any sharp volatility in their portfolio value.

Given the excess liquidity situation, which we expect to continue, returns from overnight and liquid funds will remain muted. However in the current uncertain times, investors should live with lower returns and should prioritize safety and liquidity over returns.

Data Source: Bloomberg, RBI

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – https://www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More