Beat Inflation: Time to Move Beyond Bank Deposits

Posted On Thursday, Jun 16, 2022

Inflation is when your hard-earned money loses value. It’s when you pay a higher price for daily food items such as cereals, milk, fruits, vegetables, spices, etc. It can also mean that the money that you have set aside for your goals is falling short of meeting your expectations.

This presents a good opportunity to relook at your financial goals and plan your investments to earn a real return on your investments. Real returns is nothing but net return after deducting the impact of inflation.

| Decoding Inflation Inflation essentially means your money tends to lose value with time while the cost of goods & services increases. It devalues your currency and impacts your return on investments. Inflation impact can be assessed by a simple formula: Real Return = Nominal returns – inflation. |

Beating Inflation - Think Beyond Bank Deposits

The impact of inflation tends to be more pronounced on traditional investments such as fixed deposits. In the current times, though Bank FD interest rates are inching higher, it is not commensurate with the rate of inflation, thereby offering you a negative real return. With negative real rates, Bank deposits may not be the preferable investment option.

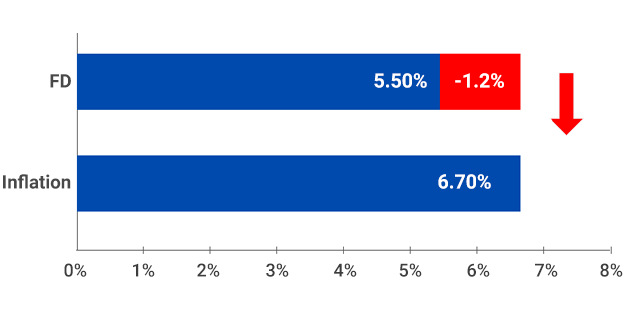

For example, assuming you plan to invest in a Bank FD that increases in value by 5.5% each year, but inflation is projected to be 6.7%, the real return from that investment will be a negative 1.2%. Along with this, taxation on Bank FDs is based on the investor’s income tax slab, further reducing returns. For instance, if you are in the highest tax bracket, a 30% tax will be levied reducing your net return from 5.5% to 3.85%.

A Widening gap between FD rates & inflation

Source: Inflation Data as of RBI Estimates as of Jun 08, 2022. Past performance may or may not be sustained in the future.

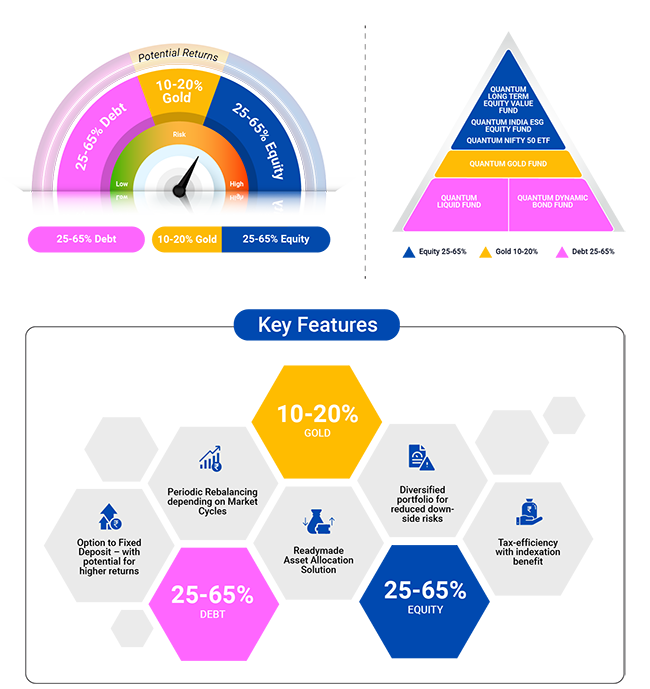

Different asset classes perform differently during periods of inflationary pressures. Thus, a diversified portfolio comprising equity, debt and gold asset classes could be geared for better downside protection to fend off high commodity prices.

Here’s an easy way to diversify your portfolio which has potential to beat the inflation:

Readymade Allocation - Quantum Multi Asset Fund of Funds

If you wish to simplify your investments and potentially earn higher than a Bank FD over the long term, you can consider balanced allocation with Quantum Multi Asset Fund of Funds (QMAFOF).

Quantum Multi Asset Fund of Funds Portfolio

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

The Quantum Multi Asset Fund of Funds offers a balanced allocation with Equity, Debt and Gold asset classes in a single investment. Here the fund manager has the flexibility to rebalance depending on the market scenario.

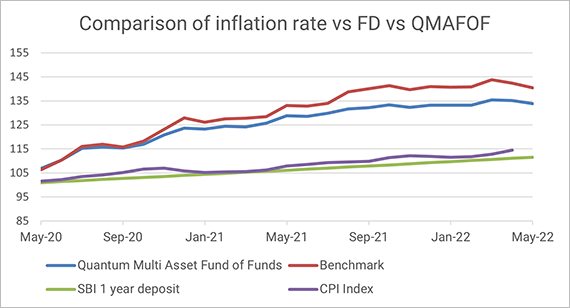

As you can see below, over the last 2 years, QMAFOF has historically given better inflation adjusted returns than Bank FDs. The period since the onset of Covid-19 in 2020 has been considered for the illustration as inflation has been firming since then on account of the pandemic-induced supply chain disruptions. It showcases the gap in Bank Fixed Deposits vs QMAFOF to catch up with inflation and showcases the importance of balanced allocation in an investment portfolio.

Quantum Multi Asset Fund of Funds Portfolio

Sources: Quantum, SBI, RBI. Data as of May 2022. (CPI data for May 2022 is not available yet).

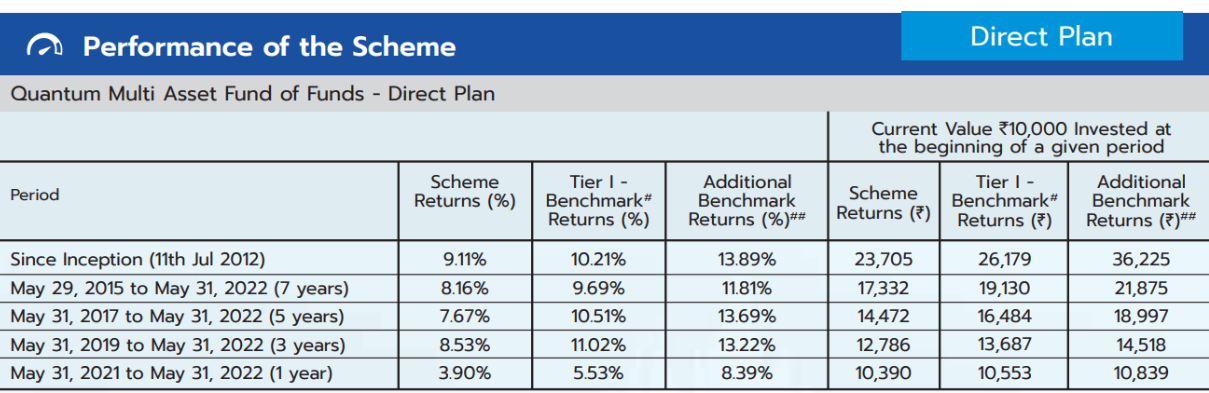

Benchmark Index: #CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index (25%) + Domestic Price of Gold (15%).

It is a customized index and it is rebalanced daily.

The above data is to be read in conjunction with the complete performance given below.

Values are respective indices and fund nav rebased to 100. Past Performance may or may not be sustained in the future.

Since conventional investments are trailing behind inflation, consider this readymade option to an FD. Give your investments an option which has the better potential to beat the inflation using Quantum Multi Asset Fund of Funds (QMAFOF) and be on your way to achieving your much awaited goals.

|  |

#CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index (25%) + Domestic Price of Gold (15%). It is a customized index and it is rebalanced daily.

##S&P BSE Sensex TRI

Data as of April 29, 2022. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Fund is managed by Mr. Chirag Mehta. Mr. Chirag Mehta is managing the scheme since July 11, 2012. For other schemes managed by Mr. Chirag Mehta, please Click here.

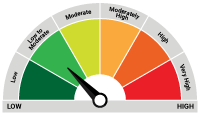

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor. |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk. |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark: CRISIL Composite Bond Fund Index (20%) + S&P BSE Total Return Index (40%) + CRISIL Liquid Index(25%) + Domestic Price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis its portfolio as on May 31, 2022.

The Risk Level of the Tier I Benchmark Index in the Risk O Meter is basis it's constituents as on May 31, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Geopolitics, Oil and the Bond Market

Posted On Wednesday, Mar 16, 2022

The ongoing military conflict between Russia and Ukraine has become the centerpiece of all the economic and market discussions around the world.

Read More -

Reluctant Normalisation

Posted On Thursday, Sep 23, 2021

Liquidity surplus in the Indian banking system surged to a new historic peak at over Rs. 11 trillion in September 2021.

Read More