Union Budget 2023-24: A Quantum Perspective

Posted On Wednesday, Feb 01, 2023

Increased capex spending, agri push and much needed tax rebates were the underlying themes of the Union Budget 2023-24. Explore perspectives on the budget from the CIO and our fund managers, who analyze how the different asset classes are set to fare.

Boosting growth through Capex spending:

As expected, the budget is heavy on Capex (at 10 lakh crore, increase of 37% from FY23 revised estimates) which is needed to ensure the cyclical recovery continues.

• Infra (railways 2.4 lakh crore, 50 new airports and clean energy 35,000 crores) along with the Agri push will help the rural economy improve by boosting employment and incomes.

• Allocation to affordable housing of 79,000 crores, increase of 66%, will also help the housing market retain momentum.

• Incentives for local production in form of lower duties will also be helpful.

Overall, this budget push on capex will ensure that the private capex green shoots really sustain, help inclusive growth and make the economy become more resilient in light of the global slowdown.

Both Equity and Bond markets have reacted positively to the budget, as the thrust to maintain the cyclical recovery and largely maintain fiscal prudence has helped lift sentiments.

• Government has chosen higher capital expenditure as the main catalyst to stimulate the economy, than any major consumption boost.

• Budgeted Capex has a robust growth of ~37% over the revised estimates of current year. Despite being the last full year budget prior to election, absence of major populist measures is positive.

• Budget lacked any major direct measures to stimulate consumption and rural economy.

• Absence of any changes in capital gains tax rate is a relief.

Overall, the fiscal consolidation pathway and robust infra spends would support the broader economic growth in the medium term.

What investors should do:

Keep invested and use a long-term horizon

Equities remain as an attractive asset class to generate returns that exceed inflation over the long term.

Investors can build a diversified equity portfolio where Quantum Equity Fund of Funds of Funds can be the core holding (70%) and a periphery of Quantum Long Term Equity Value Fund (15%) and Quantum India ESG Equity Fund (15%) to generate balanced returns across market cycles.

The quality of government expenditure has improved consistently in the last three years with capex to total expenditure rising from 12% in FY21 to 22% in FY24. This should enhance future growth potential of the economy and should lead to higher revenues for the government over medium to long term.

• Reduction of fiscal deficit to 5.9% of GDP and lower than expected market borrowing of Rs. 15.4 trillion were somewhat positive.

• Government reiterated its commitment to further consolidate its fiscal deficit to below 4.5% of GDP by FY 2025-26. This should help investor sentiment in the bond market.

What investors should do:

We expect the government bond yields to remain around current levels or decline marginally over the coming months.

Investors with 2-3 years holding period should consider adding their allocation to dynamic bond funds. Dynamic bond funds have the flexibility to change the portfolio positioning as per the evolving market conditions. This makes dynamic bond funds better suited for long-term investors in this volatile macro environment than other long-term bond fund categories.

Investors with a short-term investment horizon and with little desire to take risks should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

No reduction in gold duty

Domestic gold prices were trading at a discount of close to 2% for most of January. This was partly due to market anticipation of a reduction in custom duty on gold in Budget 2023-24. But Finance Minister Nirmala Sitharaman maintained the status quo with duty standing at 15% + GST. As a relief reaction, prices moved up by about 1% as the discount evaporated. But while the short-term price distortions prevailing in the market may have been taken care of, the longer-term structural issue remains unaddressed. This has to do with the higher government intervention through higher custom duty which results in large price differentials between international and domestic gold prices. This hinders efficient functioning of the gold markets in India by encouraging illicit gold imports which in turn lead to price distortions. Price distortions ensure India remains a price taker on the international front and make it difficult to channelize the hoard of India’s gold savings into circulation and thereby integrate the gold market with other financial markets. While rationalization of custom duty did not make it to the Government’s agenda this year amid concerns around the current account deficit and weaker rupee, we hope it does the needful sooner rather than later.

In the precious metals space, custom duty on silver was increased from about 10.75% to 15% to bring it at par with duty on gold. Despite that domestic silver prices saw an up move of only 1.5-2% reflecting lower domestic demand for the metal.

The government also gave a thrust to the lab-grown diamonds industry by reducing the basic customs duty on seeds used in their manufacturing. If lab-grown diamonds become more mainstream in the time to come, it could be positive for gold demand as demand for natural diamonds and thus their prices and appeal as an investment asset declines.

What investors should do

Gold to continue as a risk-diversifying portfolio diversifier

Given the macroeconomic uncertainties and equity market volatility, gold can be an effective portfolio diversifier. It is a prudent choice to have a 15-20% allocation to gold in the portfolio.

|

|

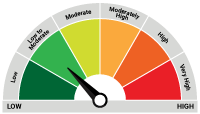

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The investors of Quantum Equity Fund of Funds will bear the Scheme expenses in addition to the expenses of other schemes in which Fund of Funds scheme makes investment (subject to regulatory limits).

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

No ‘Rate Hike’ as a Positive Surprise – What lies ahead

Posted On Monday, Apr 10, 2023

At the first RBI’s bi-monthly monetary policy committee (MPC)

Read More -

The Last Hike - View on the RBI Policy by Pankaj Pathak

Posted On Wednesday, Feb 08, 2023

The policy was broadly in line with the market expectations though we were expecting a pause in the rate hiking cycle this time.

Read More -

Union Budget 2023-24: A Quantum Perspective

Posted On Wednesday, Feb 01, 2023

Increased capex spending, agri push and much needed tax rebates were the underlying themes of the Union Budget 2023-24.

Read More