Subbu Answers Your Investment Queries

Posted On Monday, Apr 01, 2019

Mr. I.V. Subramaniam (Subbu), Director, Quantum Asset Management Co. Pvt. Ltd. is pleased to answer investment related queries. Once again, read on to know his views on some interesting queries posted recently...

Q. The S&P BSE Sensex has breached an all-time high of 39,000 today. I am really excited and want to invest. Please share some stock tips Subbu! - DeepaliWhile it's great that you've decided to actually start investing, but sorry to dampen your enthusiasm! Though markets have breached an all-time high today, our answer, however, stays the same. Ignore the market levels and remain invested till the time your financial goals are achieved. Whatever the market levels are, stick with your long-term plan. Markets, as is their nature will attain new highs or may enter into correction mode (may fall). Don't get too excited about the gains you've already experienced, and you won't be too disappointed when that point in the future is a reality where gains are a little harder to come by. So if you have a financial plan, stick to it irrespective of market levels.

To know what your asset allocation is based on your risk profile, click here.

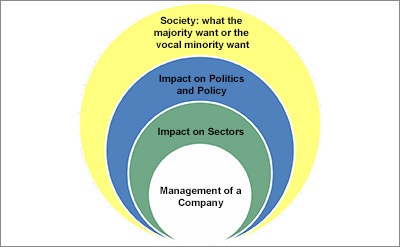

Q. Why does Quantum look at social and economic parameters and not stick only to company information? - RahulGood question Rahul. There is always something happening in society, issues that affect society in some way or the other which are dear to some and not so dear to others. Based on those issues, leaders are elected. Those leaders in turn will create policies which will either help society or help them resolve those issues. Once leaders create those policies, it will have an impact on sectors which will then have an impact on management of a company e.g. If government bans smoking in public, tobacco companies may get affected. This can be best explained by way of an illustration below.

Investments are a part of many things in the world and investors need to be aware of the various events happening that can influence the environment in which companies will operate. There are many ways to figure out the outermost circle of what Society wants and how that could impact Politics and the eventual Policy that influences what is likely to happen in any economy. A company in a great business sector but with poor management may not be good for your portfolio returns! A good management can work hard and build a great business even when it is surrounded by bad policy and unethical competitors. While the 'Management of a Company' is the smallest circle in terms of size in the chart above, it deserves the most attention. But never ignore the larger circles which can have a significant impact on the fortunes of a company and, therefore, the potential long term value of the underlying business and its long term share price.

So, yes. Quantum Mutual Fund looks at the social and economic factors apart from the fundamentals.

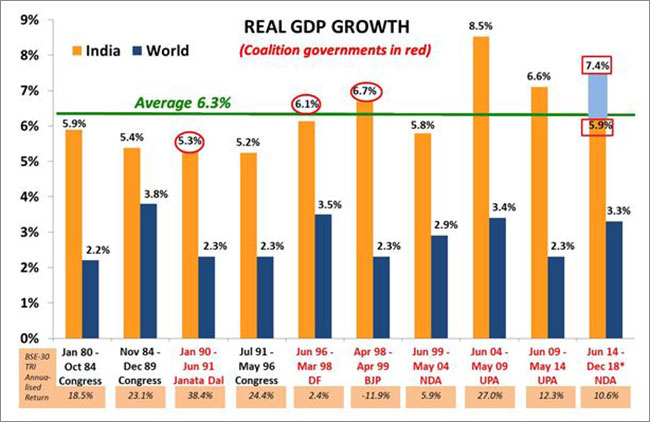

Q. Elections are around the corner and I am wondering where to put in my money... any advice for me? - PriyankaA. Elections don't matter for your investments in the long run. The results do matter - but only in the near term. Analysis by Quantum Mutual Fund shows that talking about election results is a great conversation starter but elections have no impact on your long term investments! The heat and dust which encompasses the campaigning season and then dies down is a reason for our conviction that elections do not matter to your investments. That is summarized by this powerful chart:

Data Source: RBI.org

Data Compilation: Quantum

Past Performance may or may not be sustained in future

This chart shows that across 39 years, 10 governments and 6 coalitions, the Indian stock markets (BSE-30 Index) have grown by a whopping 305 times. India's GDP has grown by 6.3% irrespective of whoever has been in power. Therefore, Quantum believes that there is no impact of elections on your investments whatsoever.

But, in case you are still worried, while nothing changes for us at Quantum, we do realize that these elections could be one of the most closely fought in recent times - and the election results may have an immediate impact on the stock markets.

| Date When Election Results Were Declared | Outcome of National Polls | S&P BSE Sensex (in INR) | |

| Market Reaction | 2 Years (Annualized Return) | ||

Data Compilation: Quantum

Past Performance may or may not be sustained in future

As you can see in the table above, markets react in the short term, however in the long term, returns are greater.

So, for those who wish to worry about something, Quantum is offering you a simple solution to rejig your portfolio based on who you think will win the next elections:

• Scenario 1 - If you believe that a BJP-led coalition will come to power;• Scenario 2 - If you believe that a Congress-led coalition will come to power;

• Scenario 3 - If you believe that a Mahaghatbandhan-led coalition will come to power;

| Your Expected Outcome | Equities | Gold | Liquid | Grand Total | ||

| Quantum Long Term Equity Value Fund | Quantum Equity Fund of Funds | Total (Equities) | Quantum Gold Savings Fund | Quantum Liquid Fund | ||

| Option B: Congress Led Coalition | 10% | 60% | 70% | 20% | 10% | 100% |

| Option B: 3rd Front or Mahaghatbandhan | 10% | 40% | 50% | 30% | 20% | 100% |

The above investment allocation is not to be considered as an Investment advised / recommendation. Please seek independent professional advice based on your financial needs and your financial situation and arrive at an informed investment decision before making any investments in any mutual fund or when making a decision on investment diversification or asset allocation.

Given the past data and our analysis of the impact of elections and governments on the growth rate of the Indian economy, Quantum firmly believes that elections do not matter when it comes to investing in stock markets. However if election results do worry you and you are wondering how to allocate your investments then Quantum has a one click solution for that too. So go ahead and make your allocations based on your expected outcome, you can curl up in front of your favourite noisy TV channel and watch the election tamasha!

Yes, Subbu, I believe that the BJP-led coalition will win so let me buy your suggested basket of mutual funds in one easy click.

Yes, Subbu, I believe that the Congress-led coalition will win so let me buy your suggested basket of mutual funds in one easy click.

Yes, Subbu, I believe that the Mahaghatbandhan-led coalition will win so let me buy your suggested basket of mutual funds in one easy click.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds (An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds) | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies | |

| Quantum Gold Savings Fund (An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund) | • Long term returns • IInvestments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold | |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Related Posts

-

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More -

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More