ELSS Funds Simplified with Sorbh Gupta, Fund Manager

Posted On Tuesday, Mar 02, 2021

As the tax season is about to end, investors want to park their money to save tax under section 80/C. In this exclusive interview, Sorbh shares his insights on how Equity Linked Savings Scheme (ELSS mutual fund) offers twin benefits of tax savings and opportunity to build wealth by investing in equities for the long term vis a vis other tax saving instruments. Read his views to help you make a prudent investment decision.

1. How to select ELSS mutual funds?

An Equity linked saving scheme (ELSS) is the perfect avenue of investment to save tax and create wealth. As the product has a lock-in period of 3 years (once invested it cannot be redeemed for three years), one should be careful when selecting an ELSS. A good ELSS should have the following characteristics:

• Stability of the investment team & consistency in style.

• Long term track record across market cycle.

• Ideally, the fund should have a lower turnover ratio (lower churn) so as to reflect alignment of Fund Manager’s approach and your investment horizon.

• Portfolio with good quality companies across large caps & mid-caps depending upon where opportunity lies.

2. How to save tax in ELSS mutual funds?

Investments in Equity Linked Savings Scheme or an ELSS mutual funds help you save tax as it qualifies for deduction from your taxable income under Section 80C of the Income Tax Act 1961.

Watch our webinar on how ELSS could be your chance to save tax & create wealth

The maximum investment amount eligible for tax deduction under Section 80C, is Rs 1.5 lakhs. Investors in the highest tax bracket (30%) can therefore save up to Rs 46,350 in taxes (Rs 1.5 lakhs X 30.9% tax + cess) by investing in ELSS mutual funds.

Since it is subject to the growth of the equity markets, ELSS returns are taxable at 10% if the gain exceeds Rs. 1 lakh in the year.

Earlier ELSS was also tax-exempt after 1 year, but as announced in the 2017-2018 budget, now any gains in equity mutual funds or stocks are taxable @10% when you sell them, but you get an exemption of Rs 1 lakh per year. This means that if your profit after selling ELSS is Rs. 4 lakhs, then you have to pay a 10% tax on Rs. 3 lakhs.

3. Is ELSS good for long term investing?

Investors are tempted to redeem the ELSS as soon as the lock-in of three years is over. However, since it is an equity product, the best outcome in terms of benefit of compounding is achieved, when the investment horizon is long term. It is a perfect product for achieving your long term financial goals like Child’s education & retirement.

4. How does ELSS compare with PPF, NPS & ULIPs?

ELSS being a tax saving product, is often compared with other products like PPF, NPS & ULIPs. However there are two clear advantages of ELSS. Firstly, it has the lowest lock-in period (three years) when compared to all other instruments like PPF (five years) & ULIP (five years). Secondly, it gives an exposure to equity investing, a very important aspect of financial planning for achieving long term financial goals.

| Name of instrument | Lock-in period | Tax on returns |

| ELSS | 3 yrs | Long term capital gains tax of 10% above Rs, 1 lakh LTCG Tax |

| ULIP | 5 years | Capital gains tax of 10% for annual premium above Rs.2.5 lakhs* |

| Tax saving FD | 5 yrs | Taxable as per Investors Income Tax Slab |

| National savings certificate (NSC) | 5 yrs | Taxable as per Investors Income Tax Slab |

| Public Provident Fund | 15 yrs | No |

| National Pension System (NPS) | Upto 60 years | Partially Taxable |

*The cap of Rs. 2.5 lakh on the annual premium of ULIP shall be applicable only for the policies taken on or after 01.02.2021.

The long-term capital gains, in excess of Rs. 1,00,000, shall be taxable at the rate of 10% without indexation under Section 112A. Whereas the entire amount of short-term capital gains shall be taxable at the rate of 15% under Section 111A.

5. Why to invest in Quantum Tax Saving Fund?

Quantum Tax Saving Fund is the ELSS scheme which follows the value style of investment. Being value oriented, the fund gives relatively higher importance to capital preservation. A steady well-researched portfolio and consistent investment style gives additional comfort, as the investors do not have the option to redeem (within three years) even if the fund manager or investment style of the fund changes midway. Through a much disciplined research and investment process, QTSF invests in quality midcap & large cap companies with a minimum stock liquidity filter & creates a portfolio for long term capital appreciation.

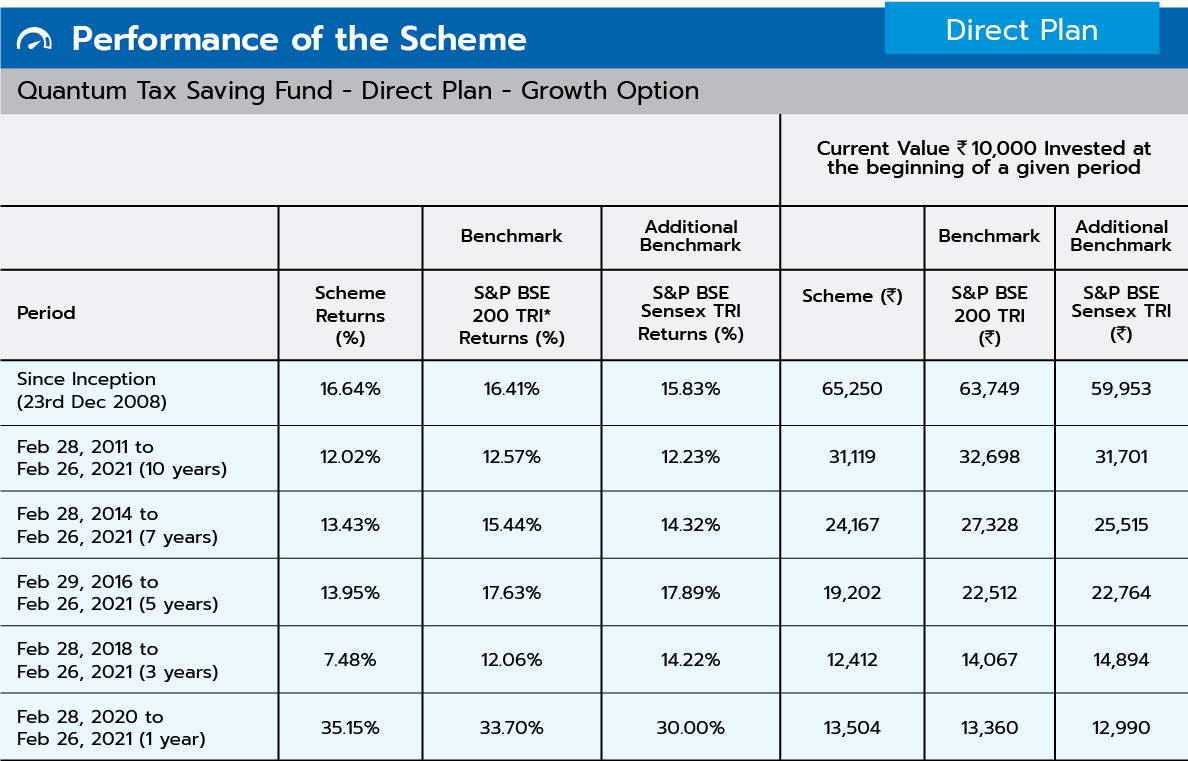

Data as on February 26, 2021

Past Performance may or may not sustained in future

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Sorbh Gupta, since Oct 2016. For performance of other schemes managed by Mr. Sorbh Gupta please click here.

6. Is SIP investment or lumpsum better in ELSS?

It is always better for retail investors to stagger the investments through SIPs and not wait for till the end of the financial year for tax planning investments. The current financial year sets a good example; anyone who would have started an SIP at the start of the year would have been much better off vs. one who is making a lump-sum investment now when the markets are at an all-time high. Overall, it is not a great idea to try to time the market and it is always better to stagger your investments via SIPs.

Make the most of the opportunity to save tax & start your journey towards achieving your goals.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on January 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More