All You Need to Know About Exchange-traded Funds

Posted On Monday, May 15, 2023

Exchange-traded Funds (ETFs) are popular investment options in developed countries and are now slowly and steadily making inroads in India. As per AMFI, the average asset under management (AAUM) of ETFs has more than doubled from Rs 1.7 trillion as of May 2020 to Rs 5.01 trillion as of Mar 31, 2023.

What are ETFs?

ETFs are passively managed mutual fund schemes that invest in a basket of securities such as stocks or bonds. These funds aim to track and replicate the performance of a particular index such as Nifty 50, S&P BSE Sensex, etc. by mirroring their composition. This makes ETFs suitable if you, the investor, are looking to earn returns in line with the market.

Unlike other passively managed schemes like Index Funds, ETFs are traded on stock exchanges. Being passively managed, ETFs entail much lower cost compared to actively managed mutual fund schemes. The ETF segment has broadened over the past couple of years with mutual fund houses offering new and innovative products to help investors create a diversified portfolio.

These factors have enabled ETFs to gain traction in India. Here are the different types of ETFs available for investment in India:

1) Equity ETFs

It is now possible to create a diversified portfolio of equity mutual funds through ETFs. Equity ETFs offer the growth potential of equities but at a lower cost compared to actively managed equity mutual funds.

Notably, ETFs that track equity indices such as Nifty 50, Nifty Next 50, and S&P BSE Sensex are among the most popular options available at present. Investors also have the option to get exposure in the mid-cap segments through ETFs that track indices such as Nifty Midcap 150.

Mutual fund houses have also launched Factor-based ETFs that target specific drivers of returns such as momentum, low volatility, value, quality, etc.

Equity ETFs also include schemes designed to replicate a particular sector such as Banking, Infotech, Pharma or a theme such as ESG, Consumption, Infrastructure, etc. International ETFs that replicate indices such as Nasdaq or S&P 500 have also gained popularity as they offer diversification across geographies.

2) Debt ETFs

Debt ETFs are passively managed mutual funds that invest predominantly in fixed-income instruments such as corporate bonds and government bonds. These schemes invest in the same proportion as the underlying index such as Nifty Bharat Bond Index, Nifty 5-year G-sec Index, Nifty CPSE Bond Plus SDL Index, etc. While Debt ETFs have been around for a very long time, it has gained momentum only in the last couple of years.

Investors have the option to choose Debt ETFs across various maturities and categories such as G-sec, Corporate Bond, etc. to suit their risk profile, financial goals, and investment horizon. Since Debt ETFs are traded on stock exchanges, they offer the stability of debt instruments and the flexibility of stock investments. It is a cost-effective way to build a debt portfolio.

3) Commodity ETFs

In India, the commodity ETF market is dominated by gold. Recently, SEBI also allowed mutual fund houses to launch ETFs that track prices of silver. Gold ETFs and Silver ETFs track the respective domestic bullion prices on a real-time basis and can be bought and sold just like stocks. Each unit of the fund is is backed by physical gold/silver of purity. The benefit of investing in a commodity in ETF form over physical form is that you are assured of purity. Furthermore, since the units are held in demat form, you need not have to worry about theft and storage hassles.

How to invest in ETFs?

Since ETFs are traded on stock exchanges (just as stocks), you need a trading and demat account to transact. The prices of all types of ETFs fluctuate throughout the trading session as per the demand. The units can be purchased and sold (intra-day trading is possible) at the prevailing real-time NAV. The closing NAV of ETF is disclosed at the end of the day.

Prefer ETFs that have low tracking error compared to similar schemes in the category which will ensure that the performance of the fund does not deviate much from the index. A Tracking error is the deviation of an ETF's returns from its underlying index. Factors such as, cash balance held by the fund, the time lag in rebalancing/reshuffling of the portfolio in accordance with the index, dividend payouts, etc., can cause tracking error to rise.

When you invest in ETFs, it is important to determine the liquidity for the ease of buying and selling units. Liquidity is usually higher for ETFs that track popular indices such as the Nifty 50 and S&P BSE Sensex, but lower in the case of other indices. Therefore, buying and selling units at a preferred price may not be as convenient for ETFs with lower liquidity.

Should you opt for ETFs?

ETFs can help you earn good returns in the long run; but don’t expect market-beating returns. Ensure that you choose schemes carefully, taking note of its suitability to your investment objectives. You should avoid sector/theme-oriented ETFs if you don’t have high risk appetite.

Assess your risk appetite, investment objective, the financial goal/s you are addressing and time horizon before the goal/s befall to determine whether to invest in an actively managed fund or passive fund such as ETFs, or a combination of both.

Investors can consider investing in Quantum Nifty 50 ETF that invests in stocks that form part of the Nifty 50 index in the same proportion and weightage as that of the benchmark index. It will allow you to diversify across the top companies in different sectors through a single investment.

In addition, you can consider adding Quantum Gold Fund – a Gold ETF, that provides investors with an opportunity to diversify their portfolio and adopt prudent asset allocation.

Happy Investing!

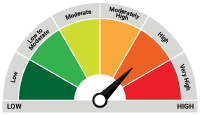

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Riskometer of scheme | Tier I Benchmark |

Quantum Gold Fund (An Open Ended Scheme Replicating / Tracking Gold) Tier I Benchmark: S&P BSE 500 TRI | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |  |

Quantum Nifty 50 ETF (An Open Ended Scheme Replicating / Tracking Nifty 50 Index) Tier I Benchmark: Nifty 50 TRI | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More