Achieve Your Short-Term Goals With Mutual Funds

Posted On Tuesday, Nov 23, 2021

We have all seen a bad time in the past year due to the dreaded pandemic. Life has changed drastically and as we leave the worse behind us…we now see hope!

The world is opening up; people are getting vaccinated, the movie theatres are welcoming us again, and the malls are buzzing!

We have now adopted the changed lifestyle, what people call the “New Normal”.

This also means it’s time to get back to acting towards our goals…the goals that took a back seat due to the pandemic.

And we are talking about your short-term goals here. By short-term, we mean something you want to achieve soon, say in the next 1-3 years.

Some Examples of your Short-Term Goals

• Buying that bike / car that you have been eyeing for some time now.

• Take the much-awaited luxury vacation with family to get away and enjoy life.

• That jewellery piece you always wanted to gift your loved one.

And it is not limited to these happy goals.

What about medical emergencies? Are you prepared for the ones that could pop up (God Forbid)?

Well, we know many investors prefer the traditional way of thinking about this i.e. through Fixed Deposits. After all, Fixed Deposits have been around for decades and many people head straight to them when it comes to saving up for their goals.

But what if we told you that mutual funds could help you in a quicker as well as in a tax-efficient way.

Mutual Funds v/s The Traditional Way

We all grew up watching our parents and their parents put in all extra money into FDs. Honestly, FDs are not as shining as they used to be in the past.

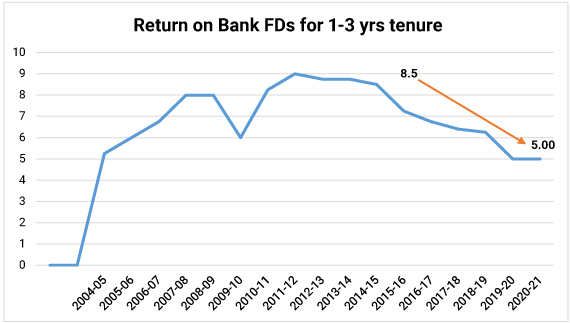

Source: TABLE 67: STRUCTURE OF INTEREST RATES - RBI as on Sept 05, 2020

In the recent years, mutual funds have emerged as a frontrunner among strong investment options. And over a duration of three years and above, Debt mutual funds are more tax efficient due to indexation benefit. Indexation helps an investor to adjust inflation while gauging the long-term capital gains, which lowers the taxable income.

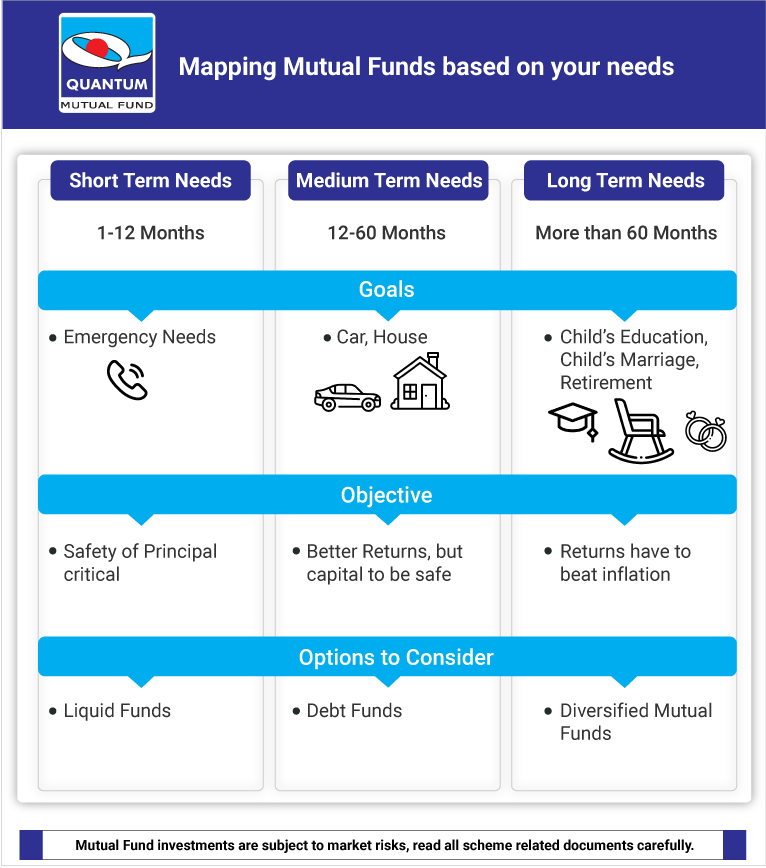

Let’s not forget that when it comes to mutual funds, you also get flexible options when it comes to meeting your goals, be it long-term or short-term.

However, it’s essential to tag your investments to a short or long-term goal. You don’t want to invest the money you need for your short-term needs in a long-term mutual fund that you're using to build wealth. Tagging your goals will also prevent you from tapping into your mutual funds meant for long-term goals and using it to achieve short-term expenses.

One option that an investor could consider to meet his/her short term goals is Debt Mutual Funds.

The below table highlights comparison of FD vs debt mutual fund:

| Area | Fixed Deposits | Debt Funds |

| Risk | Low | Low to High |

| Liquidity | High | High |

| Investment Style | Can choose recurring deposit or automatic deposit | Can choose either Lumpsum or SIP |

| Lock In | Early withdrawals attract a penalty | Depending on the mutual fund type, one is allowed to exit with or without exit load |

| Expenses | Zero Management Costs | An expense ratio is charged |

Within Debt funds too, there is a category that could be considered to help achieve your short-term goals – Liquid Funds.

Liquid funds are a class of debt funds that majorly invest in short-term fixed interest generating money market instruments like commercial papers, treasury bills, etc., with a maturity not exceeding 91 days

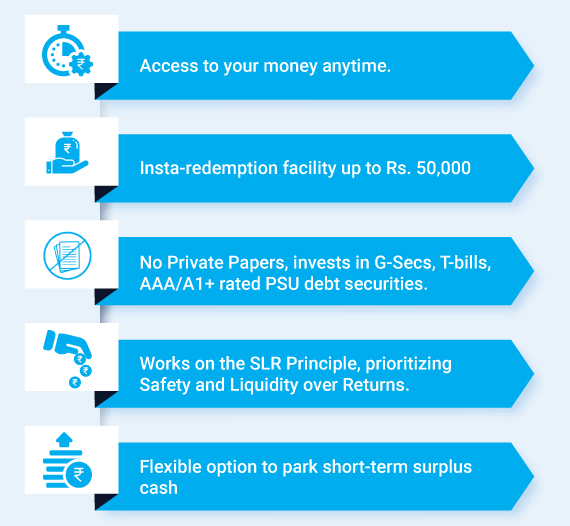

A good example of a liquid fund is the “Quantum Liquid Fund”, which is similar to a saving Bank account while offering additional benefits as outlined below. Liquid Funds can be used to park your emergency money that can be redeemed anytime.

Quantum Liquid Fund – Salient Features

Now, having said all that, you should also know the risks associated with these types of investments.

Types of Risks in Debt Mutual Funds

Market Risk

Well, “Mutual funds are subject to market risk”… We have all heard that. It simply means the risk which may cause losses for an investor due to the poor performance of the market.

Concentration Risk

This means the underlying portfolio has too much exposure to a particular instrument or securities and fails to diversify.

Interest Rate Risk

The returns earned from debt fund are inversely proportional to the interest rates prevailing in the economy. You see, an increase in the interest rates during the investment period may result in a reduction of the price of securities. So, it is a risk to be considered before you start investing in mutual funds.

Credit Risk

Credit risk is the risk that the issuer of the scheme may be unable to pay the promised interest. So, before investing in a debt fund, always have a look at the credit ratings. An AAA rating is the ‘highest’ rating and C is a low credit rating, resulting in credit rating downgrades and fall in NAV. A fall in rating might be due to the deteriorating financial/governance profile of the company in which the fund is invested, resulting in credit rating downgrades. To minimize credit risk, Quantum Liquid Fund does not invest in private papers and invests only in G-secs, T-Bills, AAA/A1+ rated PSU debt securities.

Liquidity Risk

Liquidity risk refers to the inability to liquidate an asset at the desired price. Liquidity risk could occur due to various reasons, including demand and supply conditions, an increase in interest rates, change in the credit rating of the underlying instrument, and so on. The best way to avoid this, is to have a very diverse portfolio and to select the fund carefully. You can invest in a diversified portfolio that comprises of equity, debt and gold asset classes.

A very simple way of diversification would be to invest by adopting an Asset Allocation Strategy. You can follow our easy and diversified 12-20-80 Asset Allocation Strategy to help you achieve risk-adjusted returns over the long term.

Quantum 12-20-80 Asset Allocation Strategy

Please note that the above suggested fund allocation only and is not to be considered as investment advice / recommendation, please seek independent professional advice, and arrive at an informed investment decision before making any investments.

You can have 12-24 months of expenses set aside as emergency money in Quantum Liquid Fund. Liquid Mutual Funds help create liquidity and offer an ideal investment avenue for maintaining your emergency funds. This could prepare you for unforeseen events such as natural calamities, sudden loss of income, job loss, medical expenses, or unplanned expenses.

After setting aside an emergency corpus, you can consider investing 20% of your portfolio to Quantum Gold Fund ETF and Quantum Gold Savings Fund. This would help further diversify your portfolio and act as a long-term store of wealth during geopolitical and macroeconomic uncertainty.

The balance of 80% can be invested in a diversified equity portfolio comprising of Quantum Long Term Equity Value Fund, Quantum Equity Fund of Funds and Quantum India ESG Equity Fund. Investing in a diversified portfolio that is sector, market cap, or style agnostic has the potential to help you reach your financial goals over the long term.

Readymade Asset Allocation

If you wish to have a diversified portfolio and do not have the time to track multiple funds in DIY asset allocation, you can consider investing in a Readymade Allocation.

At Quantum, we have the “Quantum Multi Asset Fund of Funds” that invests in other schemes within the Quantum Family with underlying investment in Equity, Debt and Gold, and could help you with the diversification needed to achieve your short-term goals.

Quantum Multi Asset Fund of Funds – Salient Features

| One fund, three Asset Classes of Equity, Debt & Gold | ||

| Better post-tax returns for long-term investments due to indexation | ||

| Potential to earn real returns to help you cope better with inflation | ||

| Regular rebalancing within assets to offer risk-adjusted returns |

Start investing in the Quantum Liquid Fund or Quantum Multi Asset Fund of Funds to meet your short term needs now.

Watch our recent webinar where QMAFOF Fund Manager Chirag Mehta takes you through what are your options in the scenario of low interest rates from your Bank FD.

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on October 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More