Why Has Gold Been Valuable Since 2009?

Posted On Thursday, Apr 25, 2019

Are you a hands-on investor who is always striving to optimize his portfolio returns? If yes, then it’ll serve you well to gain insight on what the big and informed money of the world is up to. Read on.

First of all, what is informed money? It is the cash invested by those who have a better understanding of the market or with access to information channels that a regular investor doesn’t. As such, this money is considered to be invested more accurately or profitably, and tends to make broad allocation changes much before the herd tends to follow.

Central bank money, for example, is big, informed money, given their scale, influence on global economics and access to non-public information.

Other examples are institutional investors like hedge funds or commercial banks and market mavens like Warren Buffet.

Think about it. Knowing where this money is flowing can be of great benefit to retail investors. This is not to blindly follow it, but definitely to gauge the direction in which world markets and economics are headed, thus helping you take “smarter” investment decisions.

Now let’s get to the money we are interested in. Central bank money.

Central banks around the world have been doing a lot of gold shopping, with Russia, China, Turkey, Kazakhstan, and India taking the lead.

| Country | Tonnes |

| Russian Federation | 311.7 |

| Turkey | 60.1 |

| Kazakhstan | 56.5 |

| India | 50.6 |

| China | 31.7 |

| Hungary | 28.4 |

| Poland | 25.7 |

| Qatar | 10.9 |

| Mongolia | 10.5 |

| Colombia | 8.6 |

| Argentina | 7 |

| Iraq | 6.5 |

| Uzbekistan | 6.2 |

Data to end- February 2019

Source: World Gold Council

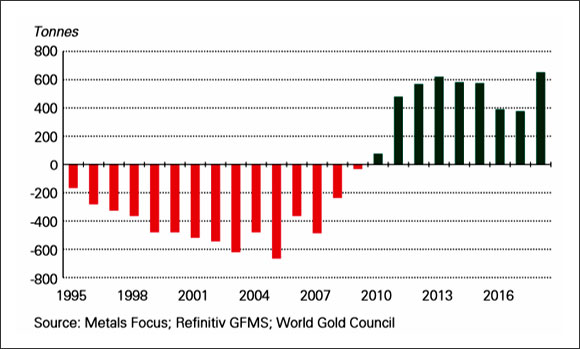

And this is old news! Because they’ve been quietly, gradually and consistently stocking up on the metal since 2009!

And why is this important? Because for decades prior to that global central banks were consistently gold sellers!

Past Performance may or may not be sustained in the future.

This data gives rise to a number of pertinent questions for investors. What prompted this major structural change in central bank attitude towards gold? Why 2009? What could central banks be preparing for that we don’t know about? And what should we as prudent investors learn from this central bank gold acquisition?

Well, obviously the Global Financial crisis of 2007-2008 preceded this central bank policy shift. With its profound effect on markets, industries and economies worldwide, the GFC resulted in a changed attitude and renewed focus on risk and risk management for investors all around the world, central banks included. The GFC prompted the reappraisal of gold’s role and relevance in todays’ times, not necessarily as a source of returns, but definitely as a portfolio diversifier and liquidity tool.

As part of this risk management, central banks have been strategically bolstering their gold reserves since 2009 and reducing their reliance on the US dollar as a reserve asset. Let’s understand why.

Preference for gold after decades of selling is indicative of central bank concerns about financial markets and geopolitics. Higher global risks due to radical monetary policies, decade long quantitative easing, exploding world debt, deteriorating quality of reserve assets like dollars and euros, and geopolitical tensions have fueled the need for central bank reserves diversification.

Clearly, central bank confidence in paper currencies/the dollar is dwindling and they see a role for gold in a future international monetary system. After all for how long can the world trust a reserve currency which is based on unlimited debt creation and money printing?

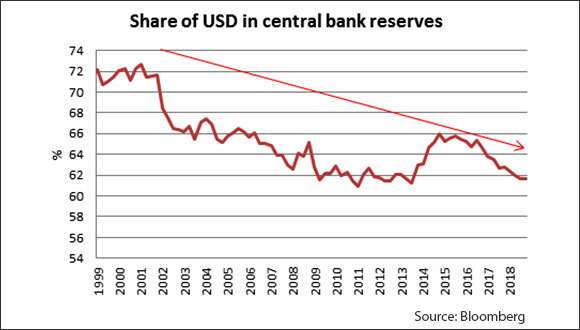

Despite it getting stronger, the share of the dollar in total central bank reserves has reduced from 72% in 2001 to 61% in 2018.

Also, the Dollar dominance via threat of sanctions is definitely a looming threat to many economies and they are preferring to invalidate this threat by moving out of dollar, and into gold.

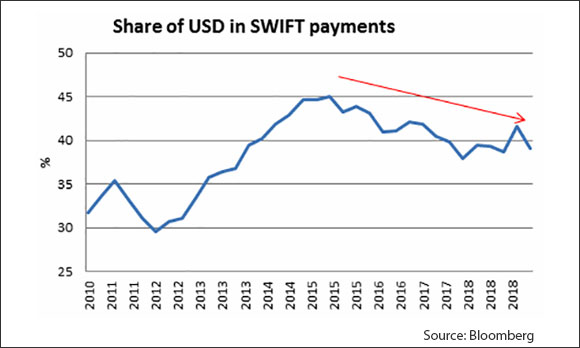

In fact, usage of dollar in international payments has been declining since the last three years. From 45% share of global SWIFT payments in April 2015, the dollar’s share has declined to 38% as of April 2018.This means trade has started shifting away from the dollar and countries are using other currencies / bilateral trades for payments. These could be the first signs of the end of dollar dominance.

In this scenario where other major currencies like the Euro and Yen are plagued with problems of their own, no currency is in a state to dethrone the dollar on immediate basis. Gold is thus becoming an asset of choice for central banks who are recognizing that the rules of the international monetary system are changing.

Preserving its status as a payment instrument in world trade, gold reduces dependence on any currency. Take the case of Venezuela. With its currency worth less every hour someone holds it, the government has been using its gold to keep the country afloat since 2015, using the metal for all kinds of international trade.

Gold retains its intrinsic value because its value is not dependent on the ability of others to honor their liabilities, thus protecting against an active risk in today’s overly indebted world economy.

It has traditionally been a major beneficiary of crumbling faith in the monetary authority due to its inverse relationship with paper assets like stocks and currencies, something which will not change.

Gold is thus a source of return, liquidity, diversification and credit risk reduction.

As per a recent survey commissioned by the World Gold Council: 76% of central banks view gold’s role as a safe haven asset as highly relevant, while 59% cited its effectiveness as a portfolio diversifier. And almost one fifth of central banks signaled their intention to increase gold purchases over the next 12 months.

Just like the global central banks, we need to relook at our risk management practices. Gold is a valuable strategic asset for our investments as it plays a stabilizing and defending role, minimizing downside risk in times of crisis. We can use gold to counterbalance our currency risk by investing 5-10% of our money in it.

The shiny metal definitely has a clear role to play in a world dominated by radical uncertainty. The big, informed money thinks so and is lapping it up while it remains relatively cheap. Are you?

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More