Small-Caps Still Hold Potential but be Cognizant of Risks for a Rewarding Experience

Posted On Thursday, Oct 12, 2023

The Indian equity market has had a remarkable run in the last couple of years, driven by a broad-based market rally. In the last one year, the S&P BSE Sensex generated an annualized return of 16.15% (as of Sept 30, 2023). Not surprisingly, the mid and small-cap stocks have outperformed by a wide margin where the S&P BSE Smallcap Index and S&P BSE Midcap index have generated 31.63% and 33.17% annualized returns, respectively, during this period.

While many in the market seem worried that Indian equities are near the peak, we believe there is still more steam left. India is a “bright spot” in the global economy with several reforms being implemented in the last decade and many more to roll in the future. Corporate earnings too have been encouraging and appear to justify valuations.

You see, the recent correction in the Indian equity market has reduced the valuation premium.

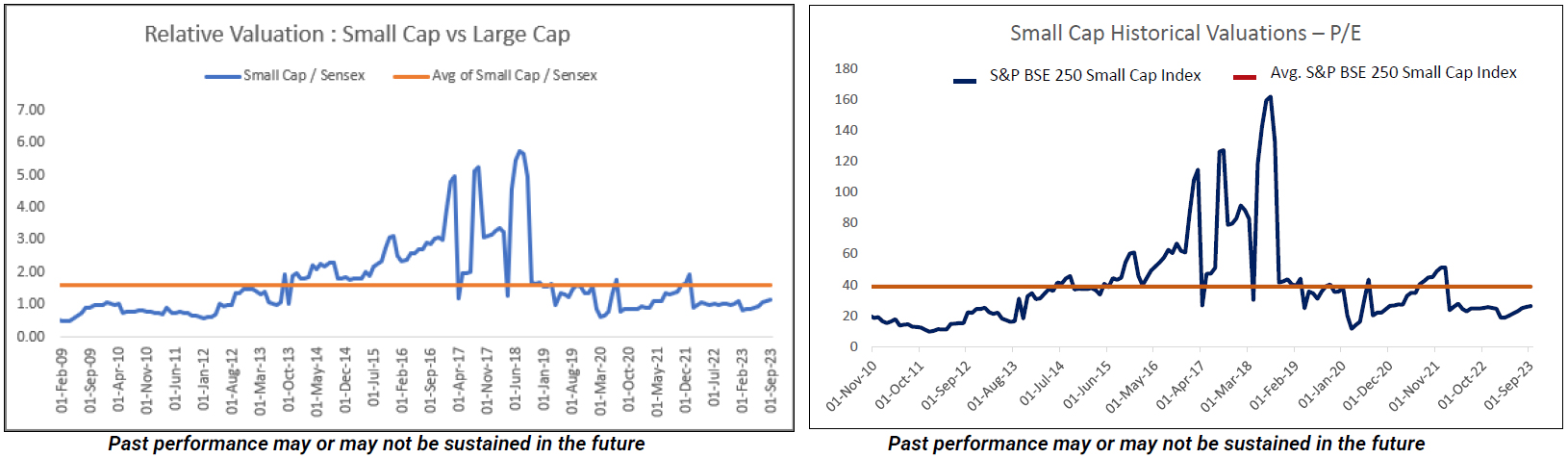

Speaking of small-caps, the S&P BSE 250 Small-cap P/E is trading below the long-term average.

Graphs: S&P BSE Smallcap Index-to-Sensex Ratio

Data as of Sep 30, 2023

If we consider the S&P BSE Smallcap Index-to-Sensex ratio, it is trading close to long-term averages with pockets of value. In other words, the scenario seems favourable to invest in Small Caps by taking calculated risks. Certain small-cap companies are trading still lower than their valuation. Such stocks may still have room for further growth and the potential to scale fresh peaks.

So, if you are looking to generate wealth over the long term, Small-Caps hold potential.

Having said that, it is important to be careful and aware of the risks before investing in a Small Cap Fund.

Risks to watch out for when investing in Small-Caps mutual funds:

1) Whether the Small Cap Fund is True to Label

While there are many small-cap mutual fund schemes managing a large AUM, fund managers can find a problem to deploy the money due to high inflows.

At Quantum Mutual Fund, we believe, a fund’s capacity is the most defining trait in the small-cap world. A mutual fund should be a prudent asset manager.

Unlike large-caps, investing in small-caps can get tricky if the fund house (and the fund manager) may not rightly recognise the capacity of the fund. It is this capacity that helps manage the liquidity risk and returns.

2) Funds with large AUM become Index – like?

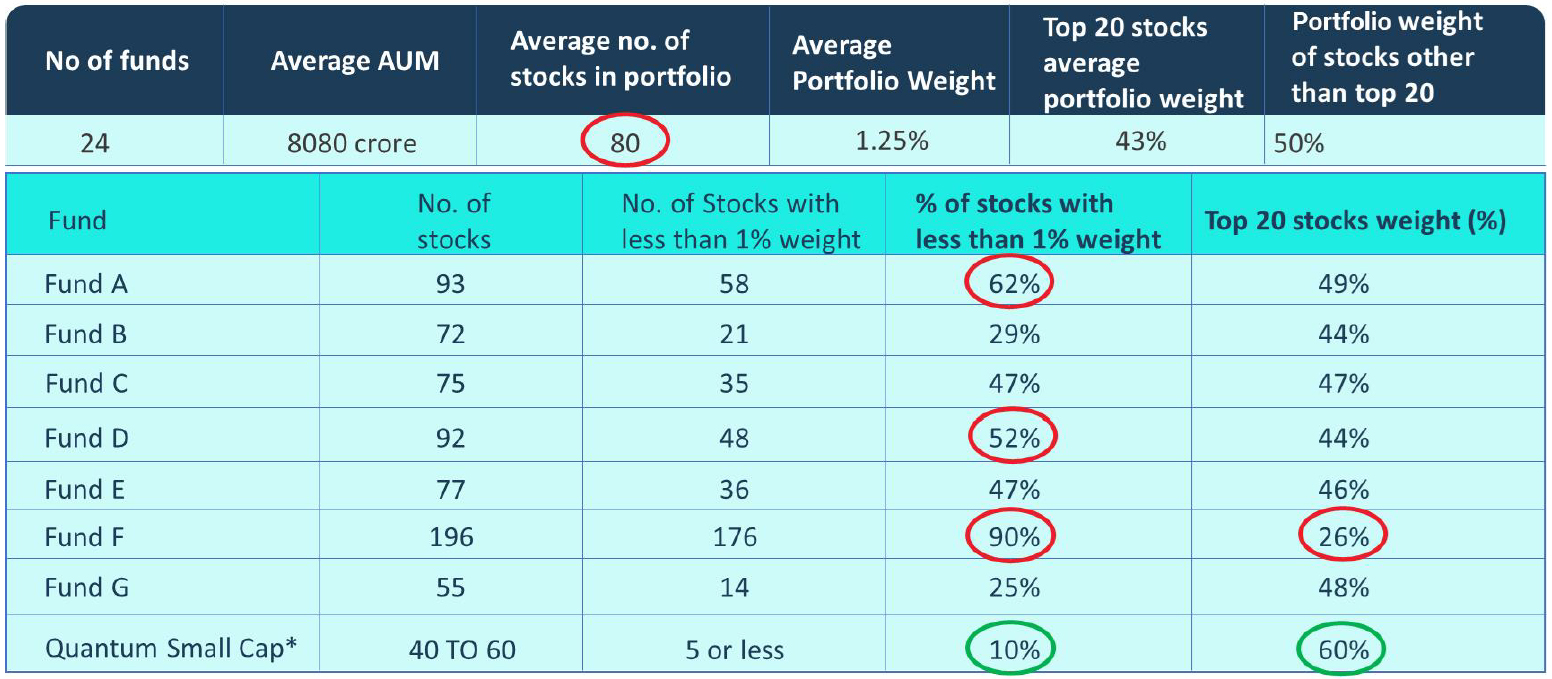

The underlying portfolio of many small-cap funds is over-diversified (in some cases over 100 stocks) and with a weight of less than 1%, which may not contribute to the fund performance. Besides, some small-cap funds find some liquidity comfort in large and mid-caps. While exposure to large and mid-caps is fine. However, it should not be substantial.

Source : ACE MF | Data Compiled by: Quantum AMC. The above information is to explain the concept of over diversification on account of average AUM size of the small cap funds and is for illustrative purpose only. The above information should not be constructed as views/ opinions of Quantum Mutual Fund / Quantum AMC in any manner. *Please refer Scheme Information Document of the Scheme for complete Investment Strategy.

At Quantum Mutual Fund, we believe that investments in Small-Caps should be made with high conviction assessing the fundamentals. Why should you, the investor, pay for active fund management fee for ‘closet’ indexes – in other words an actively managed small-cap fund that performs like an index fund?

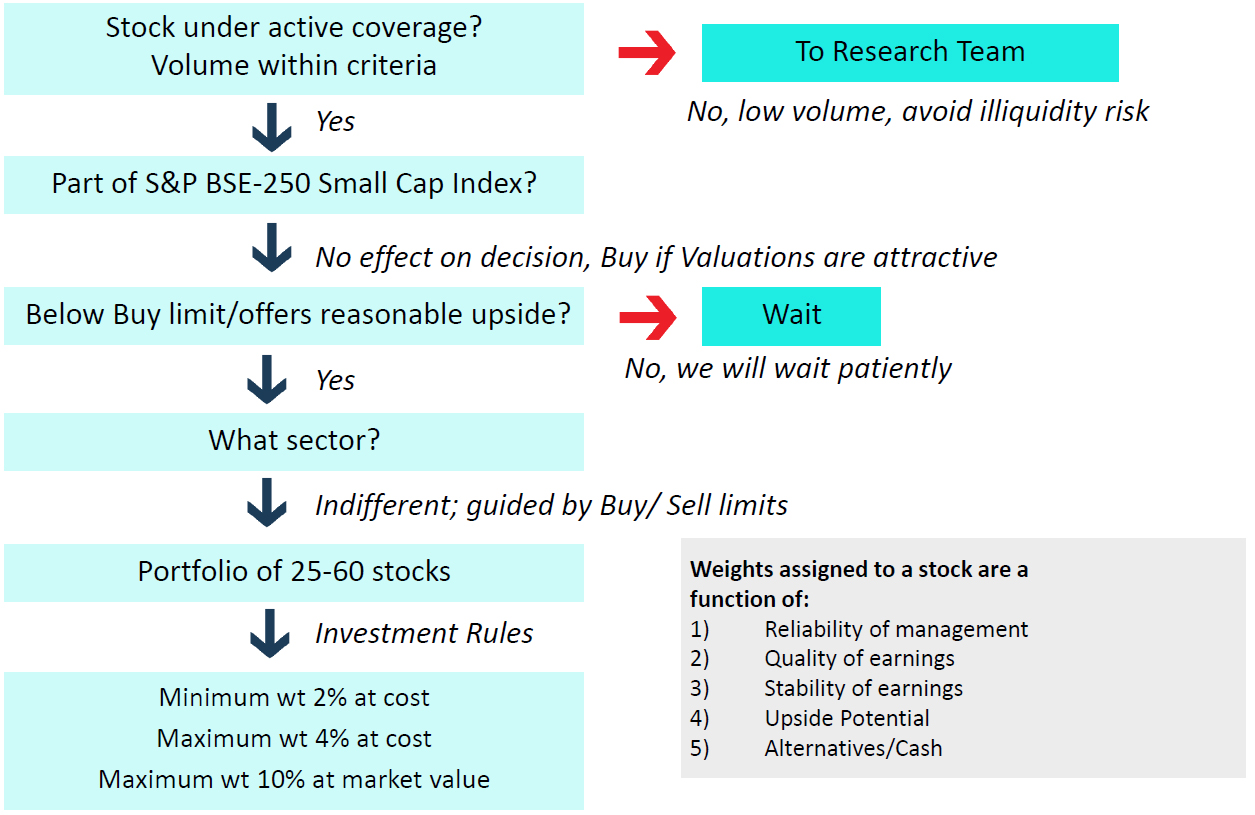

The Quantum Small Cap Fund seeks to hold an optimally diversified portfolio (ranging from 25 to 60 stocks) with high conviction.

We aspire to have a sizeable stock exposure to small-caps – a minimum weight of 2% (at cost) in each stock, and a maximum 4% at cost. A very high exposure, in our view, is not suitable from a risk management standpoint.

3) Low Liquidity:

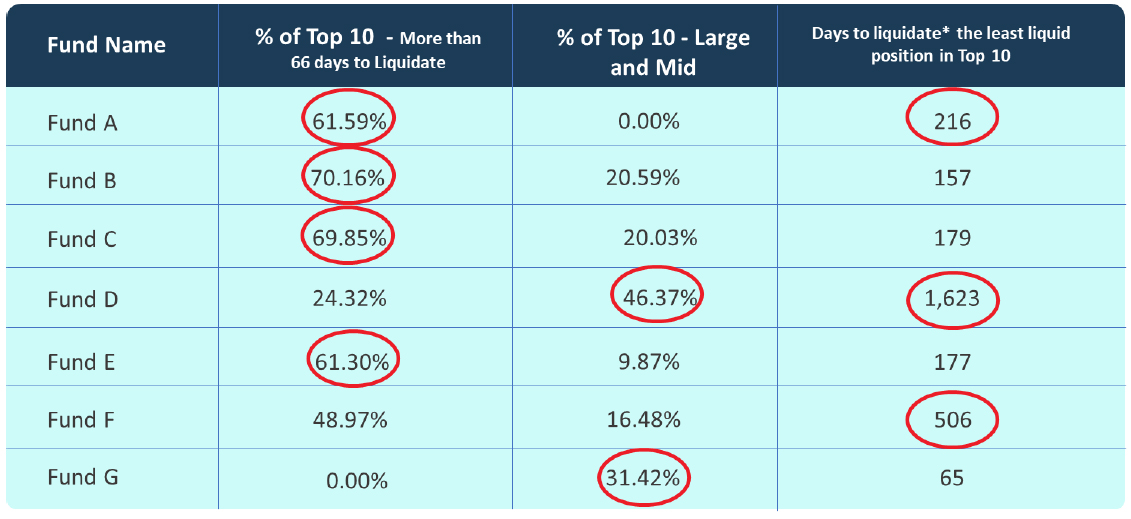

The small-cap space is generally less liquid than large and mid-caps owing to limited volumes.

Low liquidity in small-caps leads to the risk of exit and is one of the big challenges of investing in small-caps. If fundamentals do not support, and market sentiments turn sour, small-caps could take a knock.

Hence when investing in a Small-Cap Fund, assess and ask the question of how many days would it take for a fund to liquidate its holdings, particularly the top 10 holdings.

Source : ACE MF | Data Compiled by: Quantum AMC. The above information is to explain the concept of illiquidity on account of average AUM size of the small cap funds and is for illustrative purpose only. The above information should not be constructed as views / opinions of Quantum Mutual Fund / Quantum AMC in any manner. *Liquidity is defined as daily average traded value over last one year and the fund being not more than a 1/3rd of the total value traded.

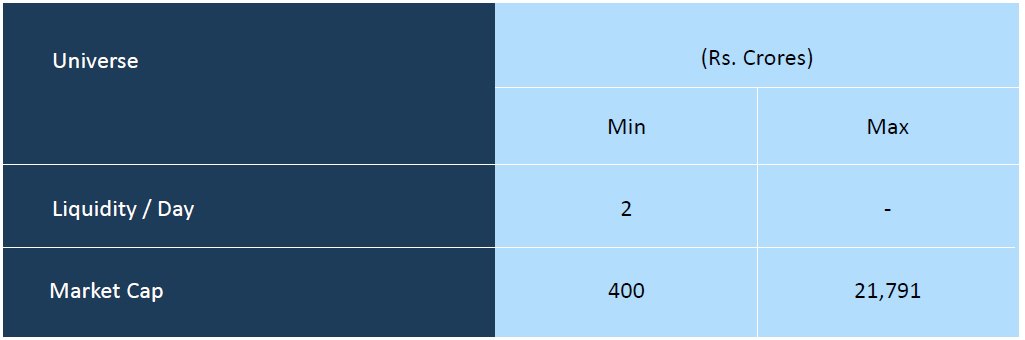

At Quantum Mutual Fund when we approach Small Caps, we ensure that the average liquidity per day should be at least Rs 2 crore. In other words, Quantum Mutual Fund prioritises liquidity when investing in Small-Caps.

The above Liquidity & Market Cap Universe Based on current market thresholds and are subject to change as per changing market conditions. Please refer Scheme Information Document of the Scheme for complete Investment Strategy

Quantum Small Cap Stock Selection Process covers around 945 stocks from addressable universe of market cap of Rs.400 Crores to Rs. 21791 Crores with average volume of Rs. 2 Crores as on September 30,2023.

Portfolio Construction

At Quantum Mutual Fund we have set up an investment process and follow very agile portfolio construction backed by strong research capabilities to navigate the small-cap universe. We lay emphasis on good governance and management quality, look for businesses that have sustainable business models (across sectors) and prudently allocating capital, and follow a GARP (Growth At Reasonable Price) approach to pick small-cap stocks.

Please refer Scheme Information Document of the Scheme for complete Investment Strategy.

This process, we believe, serves to be in the interest of you, the investors at large to manage the risk and return.

To sum-up…

For those looking to diversify their portfolio with a Small Cap Fund, consider investing in a True-To-Label Small-Cap Fund with a long term time horizon.

Whether to invest a lump sum or take the SIP route, the choice is ultimately yours. However, the latter may help handle volatility better with the inherent rupee-cost averaging and potentially compound wealth in the long run. Stay tuned for our upcoming NFO on Quantum Small Cap Fund launching soon. The NFO Period begins on Oct 16 and closes on Oct 27, 2023.

For more information, visit our fund page.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stockx |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

#The product labeling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More