Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges. While we may be facing unfavourable macroeconomic conditions, the long term growth story is still intact and looks promising. Now may be a good time to relook at your investments and plan for your financial freedom too!

For attaining financial freedom, really understanding what is meant by RISK is the first important step.

RISK is perhaps one of most misunderstood and misinterpreted term in the financial realm. According to the Oxford Dictionary, when used as a noun (a noun is a word that refers to something) risk is a situation involving exposure to danger. For example, 'There is a risk in investing in stock markets.

When used as a verb (a verb is a word that describes an action) risk means to expose (someone or something valued) to danger, harm or loss.

Mutual fund investments are indeed subject to market risks. Since the very nature of the Equity market is that of facing highs and lows – equating market volatility i.e. the up and down movement of a share price of a stock or commodity or the NAV of a mutual fund, to risk does not necessarily hold true.

A measure of the behaviour of change in the price of a share or the NAV of a mutual fund, tells you very little about the possible underlying risk inherent in that share or mutual fund. It may, however, give you an indication about the bumpiness of the ride if you remain invested in that share or mutual fund. Risk like beauty cannot be articulated into a mathematical grid or equation and tucked away into a corner box. It is something more qualitative – not quantitative.

A volatility measure does not predict the true risks of facing a company its ability to retain and retrain talent, its ability to win mandates, the impact of a slowing global economy, technological shifts that may impact its ability to stay relevant to clients, or the US Dollar to INR foreign exchange rate - to name a few. These are the real questions investors need to ask and be aware of.

Plan and Think Long Term

A sensible and thoughtful investor should not be an investor in one style, one asset class or one approach. It’s important to remember that asset classes are cyclical. They do not move in a linear direction. Instead of trying to predict how the markets will behave in the short term or predicting next week's outcome based on past patterns, it’s better to plan your portfolio through diversification and prudent asset allocation.

If you are embarking on a true, long term-path to making deliberate, calibrated investments for specific long-term wealth creation - or keeping aside money for a specific goal, here are Quantum’s suggested - 2 ways to help you diversify your investments and build a secure future:

Option #1: Pick a Ready-Made Portfolio – With the Quantum Multi Asset Fund of Funds

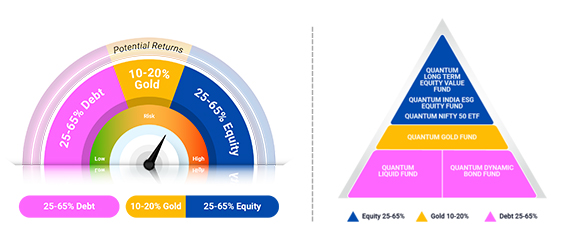

Fig 1: Ready-made Asset Allocation

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

The first way to achieve diversification is to choose a readymade portfolio with the Quantum Multi Asset Fund of Funds (QMAFOF). As the name suggests, QMAFOF is a dynamic portfolio that invests in not one, but THREE asset classes. Quantum Multi Asset Fund of Funds uses a strategic approach to balance your investment across three asset classes of Equity, Debt and Gold.

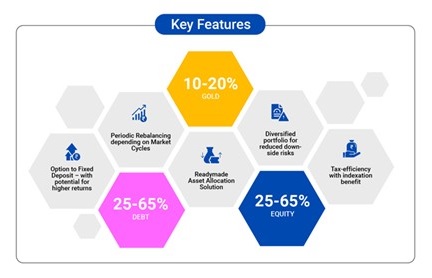

![]() Option to Fixed Deposit with the potential for higher returns:

Option to Fixed Deposit with the potential for higher returns:

Choose to invest in QMAFOF as an option to a fixed deposit as you cannot count on low FD interest rates to cope with the rising inflation. Although returns in Quantum Multi Asset Fund of Funds are not guaranteed like a fixed deposit, it has the potential to give returns at par or better than Bank savings accounts or Fixed Deposits over the long term.

![]() Readymade Asset Allocation Solution:

Readymade Asset Allocation Solution:

QMAFOF is a good option for you if you do not have the time or bandwidth to track multiple funds and want to balance risk-reward sensibly.

.

![]() Periodic Rebalancing depending on market cycles:

Periodic Rebalancing depending on market cycles:

Here the fund manager regularly rebalances within each asset class as per the valuation of equity, debt and gold.

![]() Diversified portfolio for reduced downside risks:

Diversified portfolio for reduced downside risks:

Through the balanced allocation that QMAFOF offers, you have the potential to be generally rewarded with a higher return for the risk you take.

![]() Better Post-Tax Return/Tax Efficiency with Indexation Benefit:

Better Post-Tax Return/Tax Efficiency with Indexation Benefit:

Unlike fixed deposit returns which are taxed as per the income tax slab of the investor, Quantum Multi Asset Fund of Funds ’ long term capital gains are taxed at 20% with the benefits of indexation and offering better post-tax return.

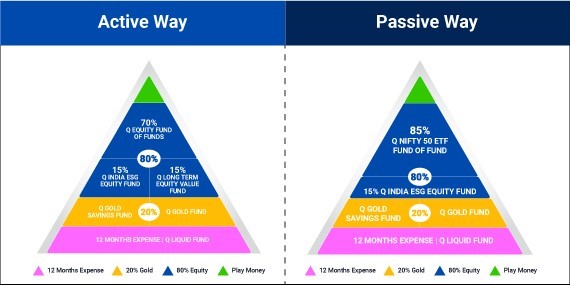

Option #2: Build an Active or Passive DIY Portfolio

If you prefer a Do It Yourself approach, Quantum Mutual Fund has devised an Asset Allocation strategy of 12-20-80 (baaraa, bees, aur assi) that has the potential to help you reach your financial goals and reduce the risk of downside. We have seen this strategy work across time horizons, across cycles, across crises - be it the global financial crisis or the Covid crisis. And therefore, it gives us the conviction to advocate that this could be the formula that can help you meet your financial goals.

You can strengthen your portfolio with Quantum’s DIY 12-20-80 Asset Allocation Strategy with an active or passive approach.

Fig 2: DIY with 12:20:80# Asset Allocation with Actively or Passively Managed Funds

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

So, to build a portfolio that gives you financial freedom, you need to PLAN investments better, diversify and beware of the RISKS involved and keep a long-term approach. Stay 'Thoughtful and Deliberate' and make balanced investment decisions for your family and you as you embark on your journey of protecting your capital and enhancing your wealth. Visit our Asset Allocator Tool online to plan your investment portfolio and diversify to reduce Risks.

|

|

Note: The comparison with Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / mutual funds investment. Investment in Mutual Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low to Moderate Risk |

Quantum Nifty 50 ETF Fund of Fund** An Open-ended fund of fund scheme investing in Quantum Nifty ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on July 31, 2022.

**The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 05, 2022.

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More