Retirement Planning Made Easy with Diversified Mutual Funds

Posted On Wednesday, Mar 27, 2019

The best time to start thinking about your retirement is when you are young. Whatever be your retirement age you should ideally plan for your retirement when you get your first paycheck. Don’t think about retirement planning after your office Farewell Party, but start planning for way before that.

Retirement Planning is a long term process whereby you should have a roadmap which will help you to meet all your life’s expenses post retirement. Investment in mutual funds is a preferred investment option for long term investing. Why? Because mutual funds invest your money in stock markets which has the potential to give you good returns in long term. In short term, markets have always been volatile which you may have observed many times. There are many ways you can invest in stock markets however investing in stock markets through mutual funds is one of the most preferred options. Why?

1. Mutual funds are managed by professional fund managers who track markets on a daily basis.

2. Mutual fund business is regulated by SEBI.

3. There are more than 1000 mutual funds available in the markets which are capable of meeting all your short and long term financial needs. You can take the help of your financial advisor and invest in the best suitable fund.

Plan your retirement with diversified Mutual Funds

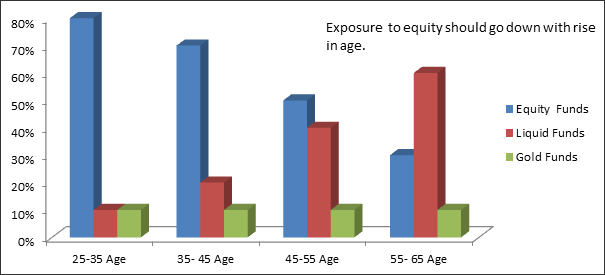

Equity, debt and gold mutual funds are 3 major asset classes where you should invest for your retirement. You can invest in all 3 funds and keep changing your portfolio as per age, income and risk taking capacity. You can take high risk at a young age and investment in equity is the best option, however don’t invest only in equity funds and lock your money in one asset class.

| Types of Mutual Funds | Advantage | Disadvantage |

| Equity Funds | Potential to gain high returns | Risk is higher for losing capital |

| Debt/Liquid Funds | Low risk of losing capital | Low /average return |

| Gold Funds | Diversification , balanced portfolio | Highest volatility to global risk |

You should remain invested in debt and gold mutual funds as well which offer you diversification and make your portfolio balanced. You can refer to the graph below which explain the relation between age and your portfolio. The exposure to equity funds should go down as one gets older the risk taking capacity goes down with age.

The above investment allocation is not be considered as an Investment advised / recommendation. Please seek independent professional advice based on your financial needs and your financial situation and arrive at an informed investment decision before making any investments in any mutual fund or when making a decision on investment diversification or asset allocation.

It's not mandatory but advisable that you should remain invested in gold at all stages of life. Keep 10 % investment in gold during all stages of life as its offer diversification. To conclude, plan your retirement as early as possible and let your money grow over a span of 15-20 years. Don’t invest only in one type of mutual funds like equity. You should plan your retirement planning with all 3 asset classes which offer different set of advantages; diversification which is a must needed factor in long term investment like retirement planning.

To conclude, you should keep 3 major points in consideration while doing retirement planning

1. Start at young age

2. Invest in all 3 types of mutual funds, equity, gold and debt

3. Keep changing investment proration in these 3 funds with the help of financial advisor

Happy Investment 2019!

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More