Strategic Reasons For Iinvesting In Gold

Posted On Saturday, Aug 22, 2020

If you've been following our newsletters, you know the strategic reasons for investing in Gold.

Here they are again:

#1 Gold acts as a store of value and helps to protect against inflation.

#2 Gold is generally a relatively safer asset in times of economic uncertainty (like now).

#3 Gold is an effective portfolio diversifier

But gold, just like any other asset class, cannot move in a linear direction.

On August 11 2020, Gold dipped after a sharp rally that lasted weeks.

Gold prices headed south on news of a Covid-19 vaccine and an uptick in US interest rates.

The question that arises is this - Is there still a strong investment case to own Gold?

Yes, of course Gold is still a good investment.

This was a temporary market correction because the fundamentals underlying gold are still strong. But it is natural for investors to get nervous when such sharp movements occur.

Perhaps some investors are jittery by nature. But it is more likely that they invested incorrectly in Gold.

You see, there are some common pitfalls to be avoided when owning Gold.

Chirag Mehta, our Senior Fund Manager who manages our Gold funds spoke about this in his webinar.

He highlighted two main reasons why investors can go wrong when investing in Gold.

The first mistake people make is "Going overboard with Gold".

Over the years, various asset classes have done well and poorly. There have been years when equity markets had a dream run. Bonds have seen times when they were touted as the most dependable of assets. At times it's Gold that has shined the brightest.

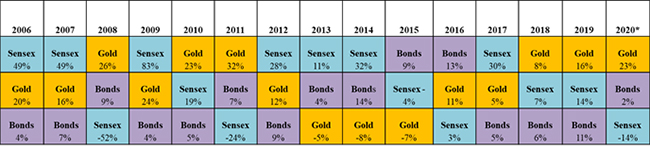

Take a look at this chart.

It ranks the best to worst performing indexes each calendar year from top to bottom.

PAST PERFORMANCE MAY OR MAY NOT BE SUSTAINED IN FUTURE.

*YTD - Jan to June 2020. Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

As you can see, predicting and chasing the next best performing asset class is a futile exercise. And a well-diversified portfolio is the best way to weather the ups and downs of the various asset classes.

Gold has historically been generally negatively correlated to major asset classes. Thus, when the stock markets suffered, gold could have limited your overall portfolio losses. Just like it has this year.

Any positive price movement if any is just the icing on the cake.

This is why the best way to look at Gold is as a portfolio diversifier.

Treat Gold as a strategic member of your portfolio that charges up its performance and lowers its risk during the uncertain economic times.

We recommend not going overboard with gold while chasing higher returns in the current environment.

Similarly, temporary price corrections shouldn't be triggers to sell.

An ideal weightage is allocating 10-15% of your portfolio to Gold.

Now, coming to the second mistake people make with gold.

As per the Bureau of Indian Standards, 18-20% of items picked from the market for random sampling have lower gold content than what is marked.

To eliminate impurity risk, Quantum follows a unique process to ensure the Gold that is purchased for its funds is always 100% PURE.

Chirag is very careful about the quality of gold, and takes extra care to ensure that gold held in the funds is indeed pure (See this video for details).

Having said that, many retail investors just don't have the resources to check the quality of gold so thoroughly. And this leads to the issue of owning impure gold.

Finally, gold is recommended for every portfolio.

We stand by our recommendation to invest in Gold.

Just be sure to allocate well, and buy pure gold.

Editor's Note: Want to know more about the right ways to invest in Gold. Write to us at [email protected] Or give us a missed call at +91-22-68293807 and we will call you back.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More