Geopolitics and Shifting Demand-Supply Balance

Posted On Thursday, Oct 26, 2023

Elevated crude oil prices and the ‘higher for longer’ narrative for US interest rates continue to dominate the investor sentiment in the bond market. Escalating tensions in the Middle East have added to the prevailing nervousness. It is keeping market participants on their toes. So much so that it took away focus from some remarkable improvements in the domestic macros and market dynamics.

Before going into the discussion of domestic trends that we are seeing, let’s first explore the issue related to the recent flareup of geo-political conflict between Israel and Palestine and its impact on the bond markets.

West Asian Conflict-Lessons from history

Our understanding of geopolitics is no better than anybody else following news regularly. However, based on the lessons from past conflicts in the region and borrowed wisdom of geo-political experts, we note following:

• Conflict in Middle East can have a significant impact on the global and Indian economy through two major channels – (1) crude oil supply/prices, and (2) disruption of global trade route.

• Neither Israel nor Palestine are significant producers of crude oil. Thus, a localized war between the two might not have any material impact on the global oil supply – keeping prices under check.

• Direct involvement of major oil producing nations particularly Iran can push oil prices higher, though experts assign a low probability to this outcome.

• Middle East has three key chokepoints in the global trade route - the Suez Canal, and the straits of Hormuz and Bab-el-Mandeb. Wider spread of war could pose a threat to global trade routes which in turn would be inflationary.

Table – I: Conflict Scenarios and Potential Market Impact

Scenarios | Market Impact | Probability |

1. War limited between Iseral and Palestine | Market neutral, crude oil prices to retrace back over period | Most likely |

2. Major regional Conflict; but no direct involvement of Iran or Saudi | Increased Geopolitical risk premium Crude to remain elevated for extended period Risk of trade route blockage to put pressure on global community particularly the US Upside risk to inflation and bond yields | Low |

3. Major regional Conflict with direct involvement of Iran in war | Global risk off Significant upside risk to crude oil prices. High risk of disruption in trade routes Significant upside risk of inflation and bond yields | Very Low |

In conclusion, potential market impact of the current middle eastern conflict can be categorized as – ‘high impact - low probability’ outcome.

Till now, Indian bond yields have shown resilience with the 10-year IGB (Indian government bond) trading almost at the same level as prevailed before the war broke out. While crude oil prices jumped about 10% in anticipation of broader conflict hurting the global oil supply.

Table – II: Indian Bond yields sowing resilience to geopolitical tensions and rising crude oil

Before the war... (October 6, 2023) | Current (October 18, 2023) | |

Brent Crude Oil price (USD per Barrel) | 84.5 | 92.4 |

10-year US Treasury Yield | 4.81% | 4.99% |

10-year Indian Government Bond Yield | 7.34% | 7.37% |

INR/USD | 83.24 | 83.1 |

Source – Bloomberg, Quantum Research; data as of October 19, 2023

We expect the resiliency of the Indian bonds and the rupee to continue supported by domestic fundamentals unless crude oil moves up substantially from current levels.

Fiscal Flexibility

Government’s tax collections have shown a healthy growth in the first half of the fiscal year 2023-24. As per the government’s press release, direct tax collections for FY24 up to October 9, 2023 have grown by 21.8% compared to same period last year. This is significantly higher than the government’s budgeted direct tax growth target of 10.5% YoY.

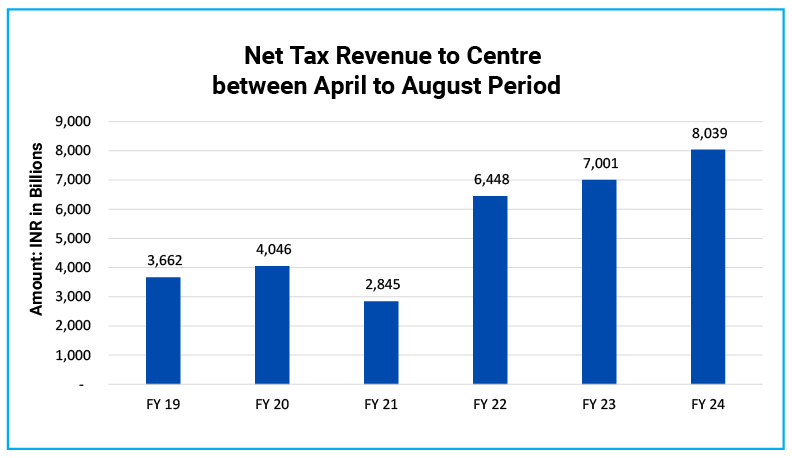

Chart – I: Tax Revenues continue to grow at a faster pace than budget estimates

Source – cga.nic.in, Quantum Research, Data upto August 31, 2023

Non-tax revenues have also shown a remarkable jump over the last year owing to the large dividend of Rs. 874 billion from the RBI. We expect other public sector companies particularly public sector banks to deliver significant growth in dividend payouts to the government.

In our estimate, combination of tax and non-tax collections could provide government around Rs. 1.5 trillion extra revenues than their budget estimates. Even after adjusting for some shortfall in the disinvestment target, the government will likely have more than Rs. 1.2 trillion of extra cash this year. This can be used to reduce taxes on fuel or increasing welfare spending without stretching the government’s fiscal position. This also opens a possibility of reduction in government borrowing later in the year.

Collections under various small saving schemes of the government have also shown a robust 50% increase during April-August 2023 compared to the same period last year. This further boosts the chances for reduction in government borrowing.

Even without a borrowing cut, demand supply mix in government bonds looks favorable in the remainder of FY24. The gross and net borrowing in the H2 FY24 is pegged at Rs. 6.6 trillion and Rs. 3.8 trillion respectively. The net bond supply in H2 FY24 is significantly lower than last year’s net issuance of Rs. 5.5 trillion in the same period.

Going by the past trend, combined demand of top buyers such as banks, insurance, pensions, provident funds will likely be higher than total supply in the reminder of FY24. These institutions had bought government bonds worth Rs. 4.2 trillion on net basis between October 2022 to March 2023.

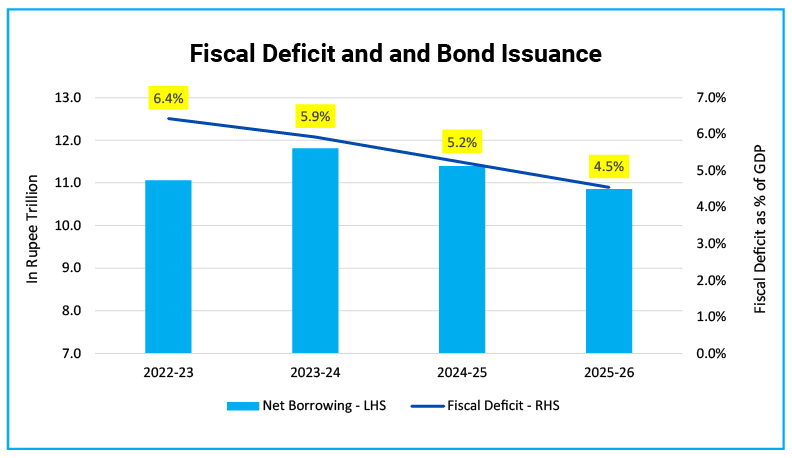

From more medium-term perspective, assuming government follows its fiscal glide path to reduce fiscal deficit to 4.5% of GDP by FY 2025-26, net supply of government bonds will likely fall by around Rs. 1.6 trillion over the next 2 years bringing it down to around Rs. 10.2 trillion by FY26 from current Rs. 11.8 trillion.

Chart – II: Fiscal consolidation will lead to significant reduction in bond supply over coming years

Source – IndianBudget.gov.in, Quantum Research, Data for FY25 and FY26 is based on Quantum Research team’s estimates

On the demand side, we expect a healthy demand growth from long term investors like insurance, pensions, provident funds etc. to continue in line with the growth in the nominal GDP. India’s inclusion in the global bond indices will also be supportive for demand in the bond market.

India will be included in the JP Morgan GBI EM Index starting June 2024 with an eventual 10% index weight to be reached in March 2025. This is expected to attract USD 25-40 billion of foreign inflows into Indian bonds over the next 12-15 months.

Read more about the potential impact of bond index inclusion - {Why Soaring Oil Prices Couldn't Dampen Market Mood}

What about the RBI’s OMO Sales?

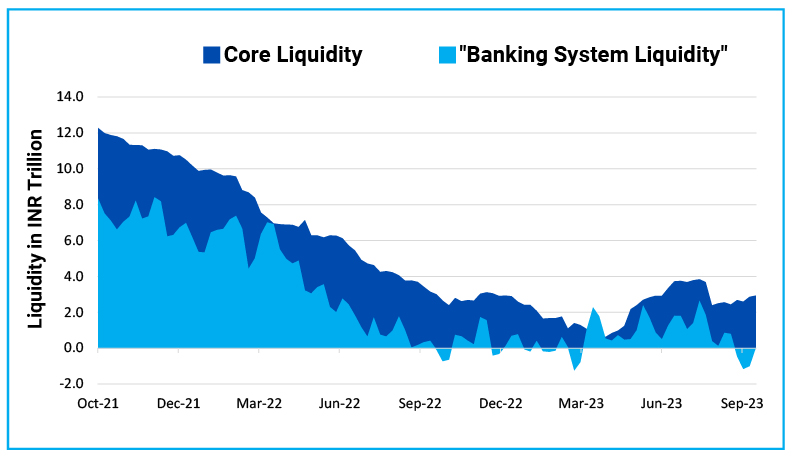

Since the RBI governor’s statement that the RBI may conduct OMO sales (operation market operation to sell government bonds) to manage excess liquidity, bond yields have moved up more than 15 basis points. Given the RBI’s objective of liquidity management, we expect the timing and quantum of the OMO sale auctions would be dependent on the prevailing liquidity condition in the banking system.

The banking system liquidity (as measured by banks’ net lending/borrowing in the RBI’s liquidity adjustment facility) is currently in a slight deficit of Rs. 29 billion. While government has a surplus cash balance of Rs. 2.86 trillion which will eventually add to banking system liquidity upon government spending.

Chart – III: Banking System Liquidity is near neutral as the government continue to maintain high surplus balances

Source – RBI, Quantum Research, Data as of October 6, 2023 #Core Liquidity = Banking system Liquidity + Government cash balance+ excess bank reserves

We expect OMO sale auctions will be conducted only when the banking system liquidity is in surplus. For total quantum of the OMO sale, we expect the RBI will also consider other natural drainers of liquidity like currency in circulation.

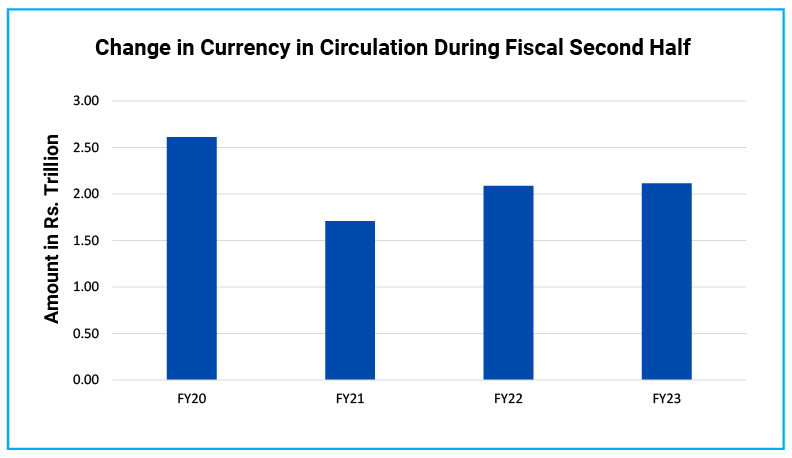

Currency in circulation tends to increase during the second half of the financial year between October to March due to high cash withdrawals from banks during festive and wedding season. Upcoming state and union election might also lead to an increased cash withdrawals this year. Based on the historical trend, we expect a durable liquidity outflow of around Rs. 2.0-2.5 trillion till March 2024. This can take out almost entire durable liquidity surplus (Banking system liquidity + Government cash balance) over the next five months. Thus, we expect the total quantum of OMO sale to be limited to Rs. 400-500 billion only.

Chart – IV: Increased Cash withdrawals to tighten liquidity condition between October-March

Source – RBI, Quantum Research, Data as of September 29, 2023

Banking system liquidity will likely ease in November due month end spending and large government bond maturities to the tune of Rs. 1.43 trillion. The RBI may conduct OMO sale auctions during November to absorb the access liquidity.

Based on the RBI’s bond holdings, we expect OMO sales to be concentrated in the shorter maturity bonds particularly those maturing between years 2025 to 2029. Thus, we might see yield curve moving higher in the intermediate maturities while long term bond yields may remain anchored drawing comfort from low overall quantum of OMO sales.

Market Outlook

Given the sharp jump in bond yields since start of the month, much of the near-term negatives are already priced for. The risk of geopolitical conflict intensifying – pushing commodity prices higher, will continue to keep investors on sidelines in near term.

While from a medium-term perspective, outlook for bonds looks favourable supported by peaked policy rates, strong external position, and favourable demand supply mix. Falling core inflation should also be supportive for bonds as near-term risks subside.

At current yield levels, valuation also look reasonable for medium to long duration bonds. The 10-year government bond is currently trading at 85 basis points above the policy repo rate. Given the policy repo rate is near cycle peak, this spread looks significantly higher than its historical average during peak rate environment.

In line with this view, we would use every rise in yield to extend the portfolio duration by accumulating long term bonds in a staggered manner.

What should Investors do?

With most of the government bond yield curve above 7.30%, there is decent accrual available at current levels. There is also a strong case for yields to decline over the next 1-2 years based on the reasons described above.

Investors with 2-3 years holding period can consider Dynamic bond funds which have flexibility to change the portfolio positioning as per the evolving market conditions.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Portfolio Positioning

Scheme Name | Strategy |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given sharp jump in yields, we have increased the portfolio duration of the fund in line with our positive medium-term outlook. We intend to keep portfolio duration high to benefit from potential fall in yields as per our view. |

Source – RBI, Quantum Mutual Fund

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Why Soaring Oil Prices Couldn't Dampen Market Mood

Portfolio Information Scheme Name: Quantum Liquid Fund | |

| Description (if any) | |

Annualised Portfolio YTM*: | 6.86% |

Macaulay Duration | 53 Days |

Residual Maturity | 53 Days |

As on (Date) | 30-09-2023 |

*in case of semi annual YTM, it will be annualised

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More -

Inevitable Pivot: Resetting Market Expectations

Posted On Tuesday, Apr 26, 2022

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation.

Read More