Equity monthly view for March 2021

Posted On Thursday, Apr 08, 2021

S&P BSE Sensex appreciated by 0.85% on a total return basis in the month of March 2021. On trailing twelve month (TTM) basis the index has returned 69.82%. A favourable base of March 2020 is getting reflected in the TTM return. S&P BSE Sensex performance was worse than developed market indices such as S&P 500 & Dow Jones Industrial Average which appreciated by 3.34% & 5.71% respectively, during the month. However, the Sensex has outperformed the MSCI Emerging Market Index which fell by -2.48%.

The broader market has done better than the Sensex in the month of March 2021. The S&P BSE Midcap Index appreciated by 1.20% and the S&P BSE Small-cap Index rose by 2.48%. Technology, Consumer Staples & Metals were the winning sectors for the month. The technology stocks have rallied taking cues from good results of some global technology stocks. Metal have reacted positively to the up move in global commodity prices. Banking & Real Estate stocks underperformed during the month, as resurgence of Covid-19 made investors nervous about its impact on near term business prospects.

| Market Performance at a Glance | |

| Index | YTD Returns (%) |

| S&P BSE SENSEX | 3.85% |

| S&P BSE 200 | 6.76% |

| S&P BSE MID CAP | 12.88% |

| S&P BSE SMALL CAP | 14.31% |

| MSCI Emerging Market Index | 2.36% |

| S&P 500 | 6.32% |

* On Total Return Basis

Source: Bloomberg

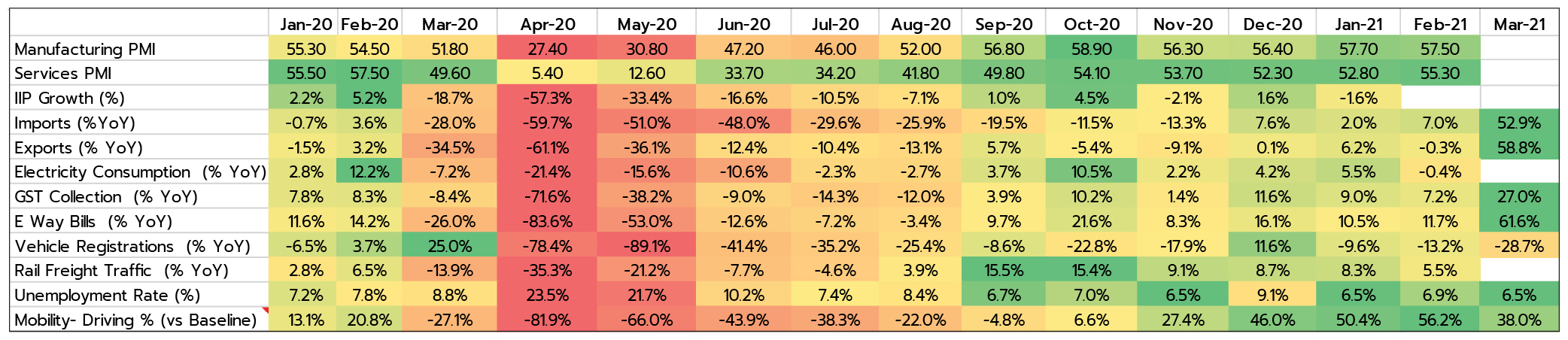

Economic Recovery is flattening: The economic indicators continue to reflect improving economic recovery. However, some of the data indicates flattening of m-o-m recovery momentum of late. The index of industrial production (IIP) has averaged just ~0.6% YoY in past five months. Most of the macro data points & corporate earnings will look attractive from a y-o-y basis for the next few months (starting from March 2021) as the base gets favourable (last March-April was a period of strict nation-wide lockdown).

Data Source: CMIE, RBI, ewaybill.nic.in

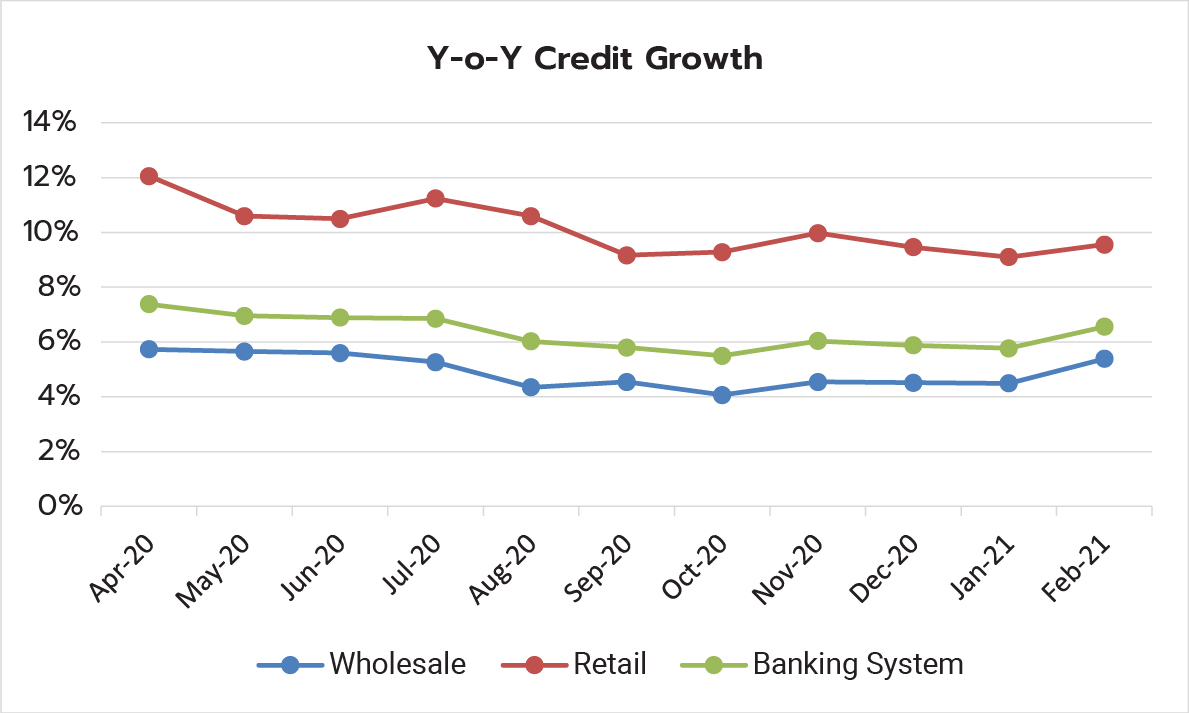

Credit growth pick up is gradual: The mid-march banking data indicates credit growth is recovering but the pick-up is gradual (6.5% YoY growth). The sectoral data indicates, credit growth is being driven by retail while the corporate loan books are flat on y-o-y basis. This clearly means the private corporate capex cycle is yet to pick up (it remains the key for a sustainable economic recovery).

Data Source: RBI

Flows: Inflows have continued in the New Year.

Indian Equities have seen $ 2.3 bn of net buying by foreign investors in the month of March 2021. One an YTD basis FPI inflows stand at US$ 7.4 bn. This is on the back of US$ 23 bn of FII flows in CY2020. DIIs have turned buyers in the month of March 2021, after four months of being sellers. They have bought stocks worth US$ 205 mn this month. Indian rupee appreciated by 0.49% during the month. India’s nominal GDP growth trajectory is improving and will look better than the western world in the medium term. This makes it a sought after destination for yield & growth seeking developed world investors. This means strong FII inflows can continue.

Covid 19: Resurgence risk more apparent now. Universal immunization still some time away

The resurgence in Covid-19 cases in March poses a challenge. The state of Maharashtra is worst effected and there has been instances of weekly lockdowns & night curfews in some towns. But till now local governments have not imposed a strict lockdown akin to March-April 2020. As of Mar 27, 0.65% of population has been fully vaccinated and 3.13% of population has taken the first dose. At the current daily run rate of 2.2 mn, India would take close to three years in achieving universal immunisation. The government has set a stiff target of vaccinating 300 mn (22% of population) by August.

| Apr-30 2020 | Jun-30 2020 | Sep-30 2020 | Dec-31 2020 | Feb-28 2021 | Mar-31 2021 | |

| Daily Tests | 72,453 | 217,931 | 1,426,052 | 1,127,244 | 7,95,723 | 1,046,605 |

| Daily new infections | 1,901 | 18,522 | 80,472 | 21,822 | 16,752 | 89,129 |

| Cumulative Cases | 33,610 | 566,840 | 6,225,763 | 10,266,674 | 1,10,96,731 | 12,392,260 |

| Of which -Recovered | 24,162 | 334,822 | 5,187,825 | 9,860,280 | 1,07,75,169 | 11,569,241 |

| Deaths - Cumulative | 1,075 | 16,893 | 97,497 | 148,738 | 1,57,051 | 1,64,110 |

| Vaccine Shots – Cumulative | 1,43,01,497 | 73,041,092 |

Quantum Long Term Equity Value Fund saw a 1.67% appreciation in its NAV in the month of March 2021. This compares to a 1.29% appreciation in its benchmark S&P BSE 200. Outperformance for the month was driven by holdings in IT, Materials & Metals. Cash in the scheme stood at approximately 6% at the end of March.

The two near term macro risks we have been highlighting in our previous newsletters; Covid-19 resurgence & inflation, have come to the fore. Equity markets are clearly not factoring the further worsening of both these factors. The government’s fiscal expansion driven spending is focussed on capital expenditure rather than consumption boost and will not lend a helping hand to soften the near term macro headwinds. We remain constructive on Indian equities with longer-term view & recommend investors to use the near term corrections as buying opportunity to create a long term equity exposure.

Source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More