The Great Normalization

Posted On Wednesday, Jan 13, 2021

Despite the subdued celebration in welcoming the New Year, we have now passed the tumultuous 2020 and entered in 2021 with lots of hope and excitement. Scientists have made a landmark achievement in developing vaccines for the coronavirus in record time. Hopes are high that the virus will be contained and the global economy will gather momentum in 2021.

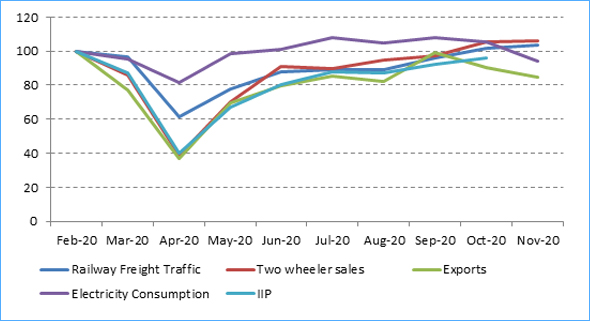

Indian economy has turned out to be more resilient than many of us thought. Most of the high frequency indicators are pointing towards better than expected recovery. Market experts and economists are now forecasting GDP to contract by 7%-8% in FY 2020-21. This is much better than the earlier forecasts of more than 10% contraction. In the FY 2021-22, GDP growth is expected to rebound to 9%-11%.

Chart – I: Economic Activity Rebound to Pre-Covid Levels

Source – CMIE, Quantum Research

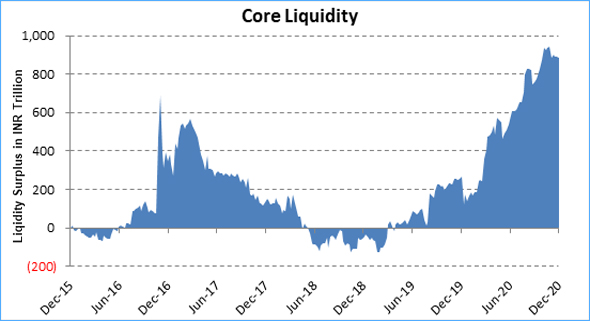

One of the factors which drove this recovery is the easy monetary policy. The RBI reduced the policy repo rate by cumulative 115 basis points and the reverse repo rate by 155 basis points in 2020. This was after a 135 basis points reduction in the policy rates in 2019. Currently the repo rate stands at 4.0% and the reverse repo rate at 3.35% which is lowest in the last decade. RBI’s action on liquidity was even more aggressive. Liquidity surplus in the banking system has been kept over Rs. 6 trillion for most of the time after the pandemic outbreak.

Chart – II: RBI flooded banks with liquidity post covid

Source – RBI, Quantum Research

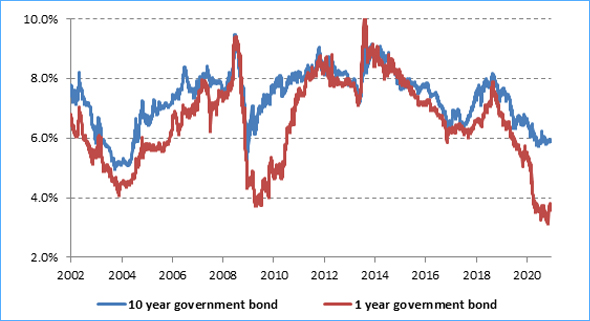

RBI’s easy monetary policy has been the biggest driver of the fixed income markets. Bond yields came down to lowest levels since the aftermath of global financial crisis. The 10 year government bond is currently quoting below 6% and short term upto 1 year maturity bonds are below 3.5%.

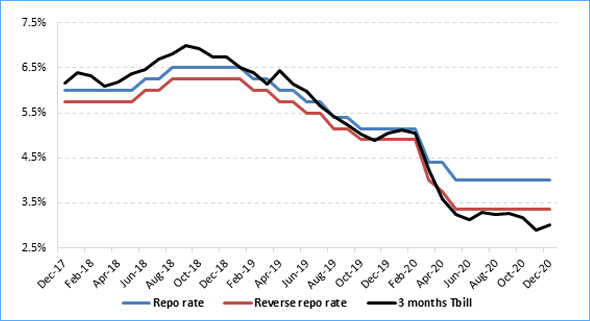

Chart – III: Interest rates are at decade low

Source – RBI, Quantum Research

Past performance may or may not sustain in future

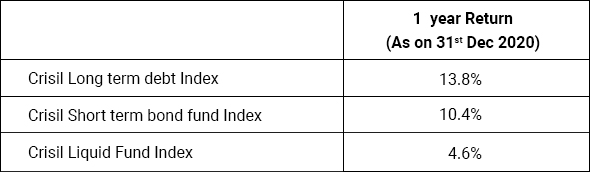

With the fall in interest rates, prices of long term bonds appreciated and consequently long term bond funds gained. While returns from shorter maturity funds like liquid funds suffered due to falling yield on short term debt securities.

Table – I: Long term debt index gained on falling interest rate

Source – AMFI, Quantum Research

Past performance may or may not sustain in future

Going into 2021, the drivers of fixed income performance are likely to change. In the last two years performance of the fixed income asset class was predominantly driven by the RBI’s monetary accommodation. But now with inflation hovering above the policy repo rate, room for further rate cuts may not be available. On the contrary, the RBI may look to roll back some of the easing measures undertaken during the last year.

Monetary Policy Normalization

In 2020 central banks across the globe have gone ‘all in’ to neutralize the economic pain caused by the covid-19 pandemic. Most of them have committed to keep interest rate lower for longer to allow economy to gain sustainable momentum. The RBI too, in its monetary policy in October 2020, has committed to maintain an accommodative monetary policy stance over the next fiscal year.

Going into 2021 impact of the crisis is subsiding and the economy is getting back on track faster than anticipated. There are also some early signs of inflation picking up. Being an inflation targeting central bank, it would be difficult for the RBI to maintain this ultra-easy monetary policy for long. Nevertheless, the economic recovery is still at a nascent stage and will require continued policy support to gain strength.

Given the macro backdrop of fragile growth recovery and sticky inflation trend, the RBI may maintain a status quo on policy rates in the next year. But, if growth sustains, its focus could shift towards policy normalization and a gradual withdrawal of excess monetary accommodation.

In past, liquidity excesses have caused macro instability and resulted in crisis. Uncontrollable inflationary pressures post 2008 global financial crisis and the recent credit crisis in the bond and money markets after the IL&FS collapse all have their roots linked to liquidity excesses.

The RBI may begin normalization of monetary policy by the middle of 2021. It could start by reducing the amount of excess liquidity. The effective policy rate could shift up from the reverse repo to repo rate. This could reset all the short term money market rates upward. Currently, overnight call, TREPS and most segments of the money markets are trading below reverse repo rate.

Chart – IV: Money Markets suppressed below the Reverse Repo

Source – RBI, Bloomberg, Quantum Research

Past performance may or may not sustain in future

We expect money market interest rates to rise which will have implications for the entire bond curve. Though the longer term yields may not rise as much as the RBI is expected to continue its OMO/twists to support the government bond borrowing programme.

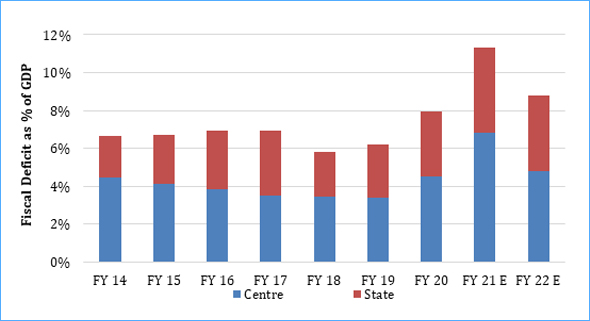

Fiscal consolidation roadmap

Just like monetary policy, the government also stretched its fiscal position to deal with the crisis. Even before this pandemic, consolidated fiscal deficit of center and state government was at elevated levels. In the crisis it faced a double whammy of lower tax collections and an increased spending on health care and welfare.

Chart – V: Fiscal deficit to remain elevated

Source – CMIE, Quantum Research

Data for FY21 and FY22 are Quantum Estimates

In the current fiscal year 2020-21, center’s fiscal deficit could rise to 8% of GDP while states could add about 5% of GDP. India’s public debt could jump to about 90% of GDP this year. This is one of the highest among similar rated emerging economies.

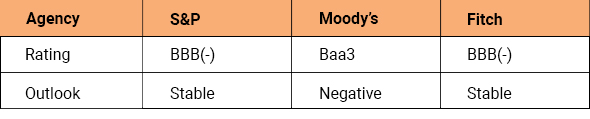

India is rated “BBB-” and equivalent by all the big three rating agencies. Ratings of BBB (minus) and above are considered “Investment grade”. Ratings below this threshold are termed as ‘speculative grade’ or more commonly in bond market parlance as ‘Junk’ category.

Table – II: India is rated just a notch above ‘junk’ category

Source: Rating agency websites, As at January 2021

*Baa3 is Moody’s equivalent of BBB (minus)

Being investment grade, makes it easier for the Indian government and companies to raise capital from the global markets. In other words if India gets downgraded to ‘Junk’ which is just a notch down, it could seriously constrain our ability to raise foreign capital especially through debt.

Thus a medium term fiscal plan will be needed to bring down the fiscal deficit and debt levels to more sustainable levels. Government’s roadmap for fiscal consolidation will have bearing on the bond markets as well. Market will closely watch for cues in the budget for FY 2021-22 which would be presented early next month. Anything higher than 5% FD/GDP would require a lot of support from the RBI, else long term interest rates will move higher.

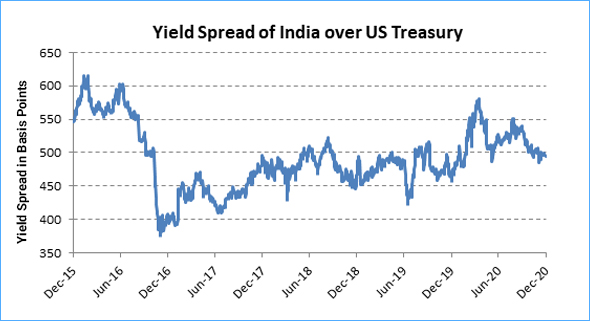

Global Bond Index and Foreign flows

Globally bond yields have come down. In most of the developed economies yields are close to zero or even negative. Negative yielding debt has surpassed USD 18 trillion in December 2020. Compared to this, the yield on Indian bonds looks attractive even after adjusting for potential INR depreciation.

Chart – VI: India offers attractive yield spread over developed markets

Source – Bloomberg, Quantum Research

Past performance may or may not sustain in future

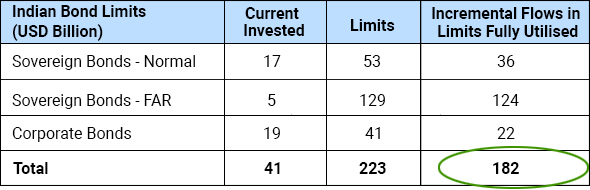

Government is also keen on attracting foreign capital into Indian debt market. They have made necessary changes in the rules for foreign investments to get into global bond indices. A new fully accessible route (FAR) has been created for foreign investors to buy specified Indian government bonds with restriction. This is a major step in direction of listing Indian bonds into global bond indices.

There is a hope that India will become part of some global bond index as soon as middle of this year. If it happens, this would create a new sustainable demand source for the Indian bonds. There is an expectation that index inclusion could attract foreign inflows of USD 20-30 billion.

Foreigners have been selling Indian bonds for the last 3 years. Foreign investments in India bonds are now below USD 40 bn. The potential limits available for investment is now upwards of USD 200 billion.

Table – III: Foreign holding of Indian debt

Source – Bloomberg, Data till November 2020,

FAR = Fully Accessible Route

Given the high global liquidity and low yields in developed economies, India could attract sizeable foreign inflows in the domestic bond markets. If happens this would be a major positive for the bond markets.

Portfolio Outlook

In 2021 bond yields could reverse their downward trend and grind up towards the year end. Short end rates (upto 3 years maturity) are currently priced aggressively due to excess liquidity and thus carry maximum risk of reversal. While the longer segment may continue to get the RBI’s support from OMO purchases and twists. Thus the yield curve will likely to flatten (short term rates move up more than longer ends).

In the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on tactical trading opportunities within a narrow range. QDBF does not take any credit risks and invests only in sovereigns and top-rated PSU bonds, but it does take high-interest rate risk from time to time.

Given the yield curve is already very steep and the RBI is actively intervening in the market to protect long bond yields from rising, we are positioned at the longer end of the maturity curve which is offering better accrual yield.

This is a tactical position that can change based on market developments and new information flows. Given the objective of the fund stated in the name itself – we retain our right to remain dynamic in our portfolio construction as we remain cognizant of the risks on the horizon.

We understand the economy and markets are currently adjusting to an unprecedented shock. There are too many moving parts and things are still evolving. Thus any forecast about the future is susceptible to change based on policy responses from the government and the RBI and the changes in global markets. We stand vigilant to review our outlook as and when new information comes. Nevertheless, it would be prudent for investors to be conservative at times of heightened uncertainty.

Investors should acknowledge that the best of bond market rally is now behind us. At this time it would be prudent to lower the return expectations from fixed income – as money market yields, fixed deposits will remain low and potential capital gains from long bond funds will be muted.

Conservative investors should remain invested in categories like liquid fund where impact of interest rate rise would be favorable. However, while selecting a liquid fund be cautious of the credit quality and liquidity of the underlying portfolio.

At this point where fixed deposit rates have come down to historical lows, liquid funds could be better alternative in comparison to locking in long term fixed deposits. Liquid Funds invest in upto 91 day maturity debt securities which get reprised higher when interest rates rise. Fixed deposits interest rates remain fixed for the entire tenor thus lose out during rising interest rate cycle.

Investors with higher risk appetite and longer holding period can look for dynamic bond funds where the fund manager has flexibility to change the portfolio when market views change. These funds are best suited for long term fixed income allocation goals. However, do remember that bond funds are not fixed deposits and their returns could be highly volatile and even negative in short period of time.

For any further queries you can write to us at

[email protected] / [email protected] or call us on Tel: 9870458160 / 8689961495

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open Ended Dynamic Debt Scheme Investing Across Duration | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More