The Debt Funds India

Posted On Thursday, Dec 30, 2021

| Table of Contents | |

| Sr no | Header |

1 | Debt Funds India |

2 | Debt Funds Returns |

3 | Debt Funds Taxation |

4 | Investing in Debt Funds for NRI’s |

Try and google “debt funds India” and see for yourself what is in store.

But what are debt funds?

There is a very simple way to understand the debt funds meaning.

You see, a debt fund basically invests in securities like corporate bonds, government securities, treasury bills, commercial paper, and other money market instruments.

So, the main objective for investing in debt funds is generally to diversify portfolio to avoid it from stock market volatility, and potential capital appreciation.

The company/entity that issues the debt instruments generally have pre determined maturity dates and fixed interest rates that the buyer can earn if held till maturity.

Therefore, debt funds are also sometimes being referred to as ‘fixed-income’ product.

With that, you now have a better understanding of the debt funds meaning.

Debt funds India has on its palette for investors do this job pretty well.

Now that you know the debt funds meaning better, it is also important that you understand what an investor can expect when it comes to debt funds returns.

Debt Funds Returns:

It is almost a known fact that debt funds usually give relatively lower returns when compared to their contemporary Equity funds. In the case of equity funds, the returns are dependent on the stock market volatility.

But when it comes to debt funds returns, its NAV is dependent on the interest rate. If the interest rates go up, the NAV of the fund falls & vice-a-versa.

Hence, there is no guarantee of the returns.

Now, you know about what an investor can expect when it comes to debt fund returns while having debt funds meaning clear in your mind.

But there is one thing that affects debt funds returns like any other type of investment – Taxation!

You must know about debt funds taxation.

Debt Funds Taxation:

However, it must be noted that when it comes to debt funds in India, the tax on the capital gains coming from debt funds depends completely on the holding period.

For a holding period shorter than three years (Short Term Capital Gains), the taxation is based on the income tax slab an investor falls under.

On the other hand, capital gains that an investor gets with a holding period of over 3 years (Long Term Capital Gains) are taxed at 20% after indexation.

In both cases, the cess and other charges are applicable as per norms.

That gives you a much clear picture about debt funds taxation.

We understand all this sounds very lucrative.

But what if you are someone who has settled abroad in search of better opportunities.

Many people who are settled abroad have a goal of coming back to India. Because for most of them, their loved ones are here in India. In such a scenario, it would make sense for them to invest in debt funds India has in its kitty.

Let us know more about this.

Debt Funds India for NRI:

As an NRI, one must know that they are allowed to invest in debt mutual funds in India.

All they have to do is follow and strictly adhere to the rules of the Foreign Exchange Management Act (FEMA). Those are the guidelines for debt funds India for NRI’s

Once an NRI has those checks in place, he/she can start investing in debt funds India for NRI, based on investment objectives and risk acceptance.

So, you see, there are many options when it comes to debt funds in India.

One such debt fund we want to tell you about is the Quantum Dynamic Bond Fund.

Quantum Dynamic Bond Fund – QDBF is an open-ended debt scheme with defined credit exposure and a dynamic maturity profile. The fund tends to invest in high-quality debt and money market instruments. The fund manager has the flexibility to actively manage the portfolio based on interest rate views. If interest rates are expected to rise, it may invest in short term securities that mature early and reinvest the proceeds at a higher rate. Conversely, if interest rates are expected to fall, the scheme may invest in long-term bonds to lock in high interest rates.

And if interest rates fall subsequently, the value of bonds will increase providing capital growth.

Here are 5 reasons why any investor should consider investing in Quantum Dynamic Bond Fund:

1. Manage portfolio duration based on market assessments

2. Portfolio is built to minimize credit risk (Credit risk is the risk of loss due to default by a borrower.) by investing majority of its assets primarily in Government securities or in PSU bonds which are rated as AAA /AA and so forth by a SEBI registered credit rating agency.

3. Controls interest rate risk by active interest rate management. The macro economy research team actively tracks and forecasts interest rate outlook and the portfolio maturity profile is altered at an appropriate time based on interest rate views.

4. Offers a solution for all your long-term debt investment needs.

Here is a look at the performance of the scheme:

| Performance of the Scheme | Direct Plan | |||||

| Quantum Dynamic Bond Fund - Direct Plan - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (19th May 2015) | 8.37% | 8.43% | 7.03% | 16,916 | 16,986 | 15,602 |

| Nov 30, 2016 to Nov 30, 2021 (5 years) | 6.43% | 7.13% | 5.12% | 13,661 | 14,111 | 12,838 |

| Nov 30, 2018 to Nov 30, 2021 (3 years) | 8.38% | 9.39% | 7.83% | 12,732 | 13,094 | 12,539 |

| Nov 27, 2020 to Nov 30, 2021 (1 year) | 4.00% | 4.03% | 2.38% | 10,404 | 10,407 | 10,239 |

Data as of Nov 30, 2021. #CRISIL Composite Bond Fund Index, ##CRISIL 10 Year Gilt Index. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The scheme is managed by Mr. Pankaj Pathak. For other Schemes Managed by Mr. Pankaj Pathak, please click here.

| Performance of the Scheme | Regular Plan | |||||

| Quantum Dynamic Bond Fund - Regular Plan - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (01st Apr 2017) | 7.01% | 7.76% | 5.69% | 13,721 | 14,178 | 12,950 |

| Nov 30, 2018 to Nov 30, 2021 (3 years) | 8.24% | 9.39% | 7.83% | 12,685 | 13,094 | 12,539 |

| Nov 27, 2020 to Nov 30, 2021 (1 year) | 3.88% | 4.03% | 2.38% | 10,391 | 10,407 | 10,239 |

Data as of Nov 30, 2021. #CRISIL Composite Bond Fund Index, ##CRISIL 10 Year Gilt Index. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The scheme is managed by Mr. Pankaj Pathak. For other Schemes Managed by Mr. Pankaj Pathak, please click here.

To sum up, today we spoke about debt funds returns one can expect, what is debt funds meaning, all about debt funds taxation, the options for debt funds India for NRI’s etc

So, if you want to start investing in the Quantum Dynamic Bond Fund, you can start right here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

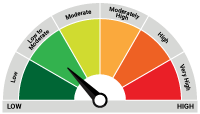

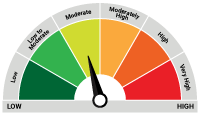

| Quantum Dynamic Bond Fund (An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk.) Primary Benchmark: Crisil Composite Bond Fund Index | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities. |  Investors understand that their principal will be at Low to Moderate Risk |  |

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on November 30, 2021.

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for March 2026

Posted On Sunday, Mar 01, 2026

As FY26 draws to a close, India’s bond markets sit at the crossroads of macro stability

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More