Debt monthly view for April 2021

Posted On Tuesday, May 04, 2021

Bond yields came down in April. The 10-year Gsec yield fell by 15 basis points (100 basis points = 1%) in the month from 6.18% on March 31, 2021, to 6.03% on April 30, 2021. The Yield on state development loans (SDLs) and PSU bonds came down in the shorter maturities while remained unchanged at the longer end. The 10 year SDL and PSU bond yields remain almost flat around 6.75% and 6.83% respectively.

Positive movement in bonds in the last month could be attributed to a confluence of factors. It could be a sharp decline in the US treasury yields or the economic uncertainty caused by the second wave of covid-19 infections. But the most important driver of the bond market was RBI interventions.

The announcement of a bond-buying program – GSAP (Gsec Secondary Market Acquisition Program) at the start of the month, played a crucial role in turning the market sentiment. Under the GSAP 1.0, the RBI committed to purchase Rs. 1 trillion worth of government bonds during April – June 2021. Out of this, the RBI purchased Rs. 250 billion of government bonds in April 2021.

The RBI didn’t restrict itself to the scheduled GSAP. It continued to send strong yield signals by cancelling and devolving government debt auctions. Auction cancellation has become a regular tool of market signaling under the current RBI regime. In the last month alone, the RBI cancelled more than Rs. 300bn worth of debt auctions. Although part of this amount was offset by availing the greenshoe option (option to accept bids for more than the notified amount of debt auction) in other securities.

Since these interventions have been concentrated in on-the-run benchmark securities, the spread between the benchmark and non-benchmark securities has widened over the period. To put things in perspective, the spread of illiquid non-benchmark government bonds maturing in 2026 over the similar maturity benchmark paper was between 30-40 basis points at April end.

This could be one of the reasons which led to a surprise announcement of an operation twist worth Rs 100 billion on April 29, 2021. Under this, the RBI will purchase long-term government bonds maturing in 2026, 2028 and 2030 and simultaneously sell treasury bills maturing in 6 months.

If the RBI continues with adhoc OMOs/Operation Twists over and above the committed GSAP amount, bond yields will likely fall further. However, this is the only force that is keeping the markets calm despite an ultra-loose fiscal deficit and record supply of government bonds.

The resurgence of Covid-19 has brought back uncertainty around the course of fiscal and monetary policy going forward. These would now depend on the duration and severity of this health crisis.

As of April 30, 2021, the number of new cases of covid-19 in a day hit a new global high of 4.01 lakh . Health infrastructure across many states is already overwhelmed. Thus more states could impose stricter lockdowns to control the virus. In that situation, there will be a demand for increased government spending for livelihood support to weaker section and in general on healthcare.

Increased uncertainty on economic recovery will also push the potential monetary policy normalization further into the future. Earlier there was an expectation that the RBI will start withdrawing surplus liquidity and hiking the reverse repo rate by the last quarter of 2021. This could get postponed to the next year.

A delayed policy normalization path will be favorable for bonds in the near future. However, global cues are turning incrementally unfavorable for the Indian bond markets. Given strong economic data and a vast vaccination drive, economic sentiment is upbeat in the US and many other parts of the world. Inflation is also picking up at a faster pace than anticipated.

The US Federal reserve till now has characterized this pickup in inflation as transitory and guided to maintain the monetary accommodation for a longer period. However, if the inflation trend sustains, there is a risk of change in FED’s tone.

Dallas Federal Reserve Bank President Robert Kaplan on April 30, 2021, called for beginning the conversation about “tapering” central bank support for the economy, warning of imbalances in financial markets and arguing the economy is healing faster than expected.

India was one of the worst hit economies during the “taper tantrum” episode of 2013 when then US Fed chairman Ben Bernanke hinted to reduce the amount of bond purchases. Indian bond yields spiked and the value of the Rupee collapsed within few months.

India’s macro position and external accounts are in much better shape than in 2013. Nevertheless, Indian markets will not be immune to any such shock in the global sphere. Potential change in the monetary policy direction in the US is the biggest risk factor for the Indian bond market in 2021.

Notwithstanding this risk, bond yields may remain in a tight range in near future supported by RBI’s bond purchases. Over the medium term, inflation and potential monetary policy normalization will play a more important role in shaping the interest rate trajectory. We expect market interest rates to move higher gradually over the next 1-2 years.

Given the high uncertainty over the interest rate trajectory, it would be prudent for investors to be conservative in their fixed income allocation. Conservative investors should stick to very short maturity debt categories like a liquid fund.

Investors with a longer holding period and an appetite to tolerate volatility could consider dynamic bond funds which can change the portfolio’s risk profile depending on the market situation.

Investors should also lower their return expectations from debt funds as the potential for capital gains will be limited. We advise investors to have a longer holding period to ride through any intermittent turbulence in the market.

Source: Worldometer.info

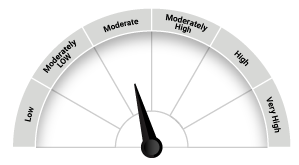

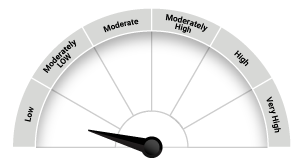

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More