Debt monthly view for November 2020

Posted On Monday, Dec 07, 2020

Fixed Income Monthly Commentary – November 2020

Bond market carried its positive momentum in November. Bond yields came down across the maturity curve though with varying degrees for different maturities. Yield on the longer maturity bonds fell marginally by 3-7 basis points, while the shorter maturity bond yields declined by 20-30 basis points in the month.

At the November end, the 10 year benchmark government bond was trading at yield of 5.83% (yield on new paper issued in the month) vs 5.88% in October. During the same period, the 3 year government bond yield fell from 4.40% to 4.2%.

Rally in the short term bonds was primarily driven by large increase in the liquidity surplus. Net surplus liquidity in the banking system increased from around Rs.4 trillion in September to about Rs. 6.5 trillion by November end.

Foreign capital inflows into Indian equity markets have increased substantially in the last few months. To neutralize its impact on the INR, the RBI has been buying into much of these inflows which led to flood of liquidity into the banking system.

In the last monetary policy meeting, held in October, the MPC committed to a forward guidance that they will maintain an accommodative stance in the current financial year and the next financial year. This set an expectation in the markets that interest rates will remain lower for longer.

Since then, inflation has moved up even higher and the economic recovery also gathered some pace. Hence going into this MPC meeting there were speculations that the RBI will change its tone and turn more inflation focused. Additionally it was also expected to announce measures to suck out excess liquidity from the banking system to normalize the money markets which have been trading much below the reverse repo rate.

Given these expectations, the RBI surprised the markets positively by looking through the recent inflation numbers and not showing any unease over the excess liquidity conditions.

The monetary policy committee (MPC) of the RBI unanimously decided to keep the policy repo rate unchanged at 4.0%. Accordingly the reverse repo to remain at 3.35% and the MSF (Marginal Standing Facility) rate at 4.25%.

The MPC also decided to continue with its forward guidance of an “accommodative stance” at least during the current financial year and into the next financial year – to revive growth on a durable basis.

Nevertheless, it did acknowledge the emerging inflationary pressures and revised its inflation forecast upward. The RBI now projects the CPI inflation to average at 6.8% in Q3 FY21 and 5.8% in Q4 FY21. In the first half of FY22 CPI inflation is expected to cool down to 5.2%-4.6%.

It also raised the GDP growth forecast upward from (-)9.5% to (-) 7.5% in FY21. But also highlighted fragility of the economic recovery – “...the signs of recovery are far from being broad-based and are dependent on sustained policy support.”

The RBI has been cutting rates and pumping liquidity into the banking system to support growth for the last 2 years. Their actions got even more intense after Covid-19. We believe that the RBI has already frontloaded the monetary support and possibility of further rate cuts look meagerly low.

However, given the recovery is still at a nascent stage, it will possibly maintain the current low rates and excess liquidity for extended period of time despite inflationary risks.

For the bond markets, the RBI once again assured market participants of its support - “the Reserve Bank, on its part, stands ready to undertake further measures as necessary to assure market participants of access to liquidity and easy financing conditions”.

We believe that the RBI will continue to conduct OMOs/ twists to protect bond yields from rising. This will put a cap on long term bond yields and thus offer an equivalent of a PUT option to investors.

The shorter maturity bonds are more influenced by liquidity conditions. Given that the RBI is not in hurry to absorb the excess liquidity, short term bond yields are likely to drift lower.

The gap between the short and long maturity bonds have widened in the last few months. Currently the 2 year government bond yield is around 3.9% while the yield on 10 year bond is at 5.9%. Given this high term premium and stable interest rate outlook, longer maturity bonds look attractive from accrual stand point.

However investors in longer maturity bonds/funds should remain cautious of fiscal and inflation risks over medium term. In this scenario dynamic bond funds can be good option for investors with longer time frame and moderately high risk appetite.

Investors with low risk appetite should stick to liquid funds or ultra- short term funds with good credit quality portfolios.

We also suggest Investors to lower their return expectations from debt funds as the rate cutting cycle is nearing its end and potential for capital gains are limited.

Given our above view on interest rates, in the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on longer maturity bonds and explore tactical trading opportunities within a narrow range. Quantum Dynamic Bond Fund (QDBF) takes high interest risk from time to time, but does not take any credit risks and invests only in Government Securities, treasury bills and top rated PSU bonds.

We always advise investors to have a longer time frame if they invest in bond funds and should also note that the bond fund returns are not like fixed deposit and can be highly volatile or even negative in a shorter time frame.

Quantum Liquid Fund (QLF) prioritizes safety and liquidity over returns and invests only in less than 91 day maturity instruments issued by Government Securities, treasury bills and top rated PSUs.

We advise debt fund Investors to choose Safety (over Credit) and Liquidity over Returns while investing in debt funds.

Data Source: Bloomberg, RBI

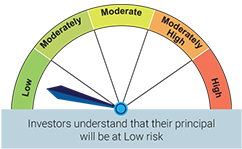

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More -

Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

September was a pivotal month for fixed income markets, both globally and domestically.

Read More