Debt monthly view for August 2021

Posted On Monday, Sep 06, 2021

Fixed Income Monthly Commentary – August 2021

August was a positive month for the bond market. Bonds yields came down across the maturity curve. The only exception was the 10-year bond, on which yield moved up marginally from 6.20% on July 30, 2021, to 6.22% on August 31, 2021.

On the yield curve, the 2-4 year maturity bonds rallied the most as yields in this segment fell by about 20 basis points in the month. The longer maturity bonds (above 10-year maturity) also participated in the rally with a 7-15 basis points drop in their yields; in the month.

The rally was first triggered by a substantial increase in liquidity in the banking system which supported a significant decline in the short-term bond yields. Subsequently, a sharp fall in crude oil prices, dovish MPC minutes, and a non-event ‘taper’ talk in the US revived the market sentiment.

The RBI continued its support to the market. It conducted two OMO purchase auctions of Rs. 250 billion each under the GSAP 2.0 and tactically intervened in primary auctions to keep yields under check.

CPI inflation softened to 5.6% in July 2021 as against 6.3% in the previous month. Although a big part of the decline is due to the base effect, underlying inflationary momentum has tapered down. Nevertheless, the headline CPI inflation is expected to average between 5.5%-6.0% in FY22 as against the RBI’s target of 4%.

It could prompt the RBI to start policy normalisation as uncertainty around growth subsides. The RBI is already in the process of normalising its liquidity operations by increasing the size of variable-rate term reverse repos (VRRR). Moving forward, it may introduce longer tenor VRRRs to absorb part of the liquidity surplus for a longer period and push up the overnight rates closer to the reverse repo.

We would also expect a staggering increase in the reverse repo rate from 3.35% to 3.75% possibly starting from the December policy meeting. Change in policy stance from “Accommodative” to “Neutral” and hike in repo rates may start in the first half of next fiscal year.

In the near term, market will take cues from the developments in the money markets and RBI’s response to it. The core liquidity surplus has increased to over Rs. 11 trillion now as against ~Rs. 7 trillion at start of the current fiscal. The 3-month Treasury bill rate which was at ~3.45% a month back is currently around 3.28%.

This amount of excess liquidity could limit RBI’s capacity to buy bonds and foreign exchange. If forex inflows continue, the RBI will have to deploy other tools like MSS bonds (Market Stabilisation Scheme), SDF (standing deposit facility), etc., to absorb part of excess liquidity on a durable basis.

This is a significant risk for short-end bonds which are richly priced at current levels. On the other hand, the long end of the yield curve still offers a reasonable valuation considering the terminal repo rate may remain below its pre-pandemic normal.

Another positive for long-end bonds is the government’s fiscal position. The central government tax collections have been significantly higher than budget estimates during April-July 2021. If the trend sustains, there is a possibility of a significant reduction in the government’s borrowing program. Long-term bonds would gain more in case of borrowing cut.

There is still very high uncertainty around the future trajectory of interest rates. The biggest risk for bonds would be a change in the RBI’s view on inflation being ‘transitory’. There is also a threat of faster normalisation of monetary policy in developed economies which could cause turbulence in emerging countries like India.

Thus, for long-term asset allocation in fixed income space, investors should go with dynamic bond funds over longer duration funds. The dynamic bond fund gives flexibility to the fund manager to change the portfolio positioning depending on the evolving market condition.

However, for any such allocation, investors should be prepared to hold for a longer time horizon while also tolerate some volatility in the intermittent period. Conservative investors should stick to categories like liquid funds that invest in very short maturity debt instruments and tends to benefit from rising interest rates.

We also suggest investors lower their return expectation from debt funds as the potential for capital gains will be limited going forward.

Source: Worldometer.info

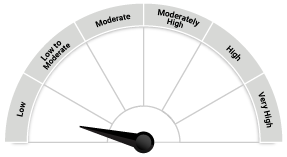

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on July 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More