Equity Investment Strategy to Overcome Challenges in Uncertain Markets

Posted On Wednesday, Mar 23, 2022

The last couple of months for the equity markets have been very uncertain. Investors have been on a rollercoaster ride full of ups and downs. Other than the COVID-19 pandemic, a variety of factors have caused these fluctuations. Currently, the markets seem worried about the escalating geopolitical tensions in many parts of the world (Ukraine-Russia, Indo-China, among the Middle-east countries) and with it the political and macroeconomic risk involved.

Russia’s invasion of Ukraine, and sanctions imposed by countries such as the U.S., U.K., Canada, Germany, France, among others to deter Russia, the aggressor, has already led to widespread repercussions including:

• Increase in Brent crude oil prices , though it has seen some cooling to $100 per barrel,

• Increase in prices of food have due to supply chain disruptions,

• Input cost for industries has gone up,

• Import deficit from Russia, as India mainly imports oil, fertilizers, minerals, and certain agriculture commodities, among others.

• Currencies have depreciated, and

• Business alongside consumer confidence has taken a beating.

All these factors could weigh down on the economy, including India's, as indicated by many credible agencies or institutions.

Finance Minister, Ms Nirmala Sitharaman, against the backdrop of the geopolitical tensions in the recent past, issued a statement saying, “India’s development is going to be challenged by newer challenges emanating in the world Peace is being threatened, and after the Second World War, (a) War of this significance, this impact, on the globe probably is not felt.”

Along with the geopolitical tensions, tightening financial conditions with the U.S. Federal Reserve’s interest rate hikes going forward could make matters worse.

For now, US Fed Reserve has increased interest rates by 25 basis points (bps) in the mid-March 2022 meeting given that inflation in the U.S. has accelerated to nearly 8.0% - the highest ever since January 1982 - and hasn’t proved to be transitory as expected by the U.S. Federal Reserve. Hence, the U.S. Federal Reserve chairperson, Mr Jerome Powell, recently said, “It is time to retire the term transitory inflation.”

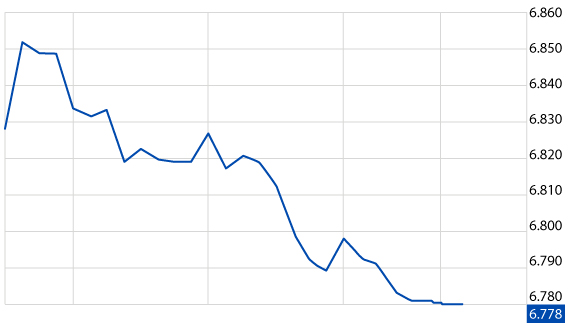

Graph 1: The U.S. 10-Year Treasury yields have lowered

(Source: Bloomberg Finance L.P) Past performance may or may not be sustained in the future.

Indian 10Y Bond yield eased around 6.8%, not far from its 2-½-year high of 6.89% hit on February 3rd after the budget announcement of India’s borrowing program.

Here’s sensible investment strategy to follow

1) Keep the powder dry, stagger your equity investments: Amid these challenging times, you will get many opportunities to buy at dips in the Indian equity markets. Hence when investing in the equity market through mutual funds, instead of deploying all the investment surplus at one go (in one shot), consider investing lump sums in a piecemeal manner. This would help you take a calculated risk and manage the risk better.

Alternatively, you may take the Systematic Investment Plan (SIP) route, which through the inherent rupee-cost averaging feature, would help you mitigate the volatility of the equity markets and compound wealth in the long run.

If you are already SIP-ping in some of the best mutual fund schemes, do not commit the mistake of discontinuing or stopping your SIPs in the current volatile conditions. It would prove counterproductive and put brakes on the process of compounding.

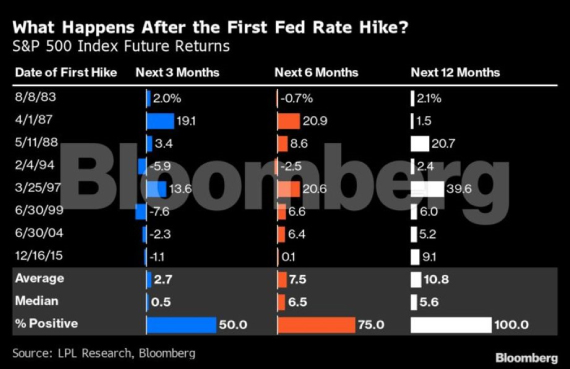

Graph 2: The Indian equity market has risen during previous rate hikes

(Source: Bloomberg Finance L.P) Past performance may or may not be sustained in the future.

The history of the Indian equity market stands testimony to the fact that after negative events such as the downturn of 2002, the U.S. subprime mortgage crisis of 2008-09, the Dubai debt debacle of 2009-10, later the debt crisis in Greece, the slowdown in China in 2016, and the crash at the onset of the COVID-19 pandemic in 2020, the Indian equity markets have well trounced supported by buying activity from investors.

So, take the golden opportunity to invest in long-term opportunities in a diversified equity basket comprising of Quantum Equity Fund of Funds, (70%) Quantum India ESG Equity Fund (15%) and the Quantum Long Term Equity Value Fund (15%).

2) 70% - Maintain a diversified equity basket with Quantum Equity Fund of Funds: Understanding your need for diversification and simplifying the fund selection process, the Quantum Equity Fund of Funds was launched.

|

|

|

|

|---|

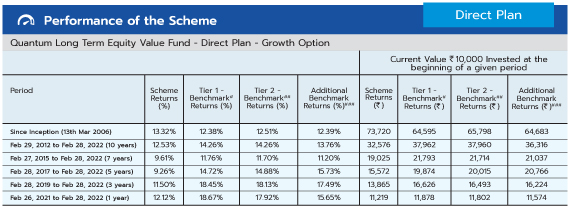

3) 15% - Go for a sensibly valued fund with Quantum Long Term Equity Value Fund: Quantum Long Term Equity Value Fund (QLTEVF) is dedicated to picking the best companies across market capitalisation and sectors (using a bottom-up approach) that would potentially stand to benefit from the India growth story. Thus, it makes sense to own a worthy value fund in your core mutual fund portfolio.

Quantum Long Term Equity Value Fund has completed 16 years on Mar 13, 2022 and has given since inception CAGR return of 13.32%.

| Fund/Index | Return |

| Quantum Long Term Equity Value Fund | 13.32% |

| BSE 30 | 12.51% |

| S&P BSE 500 | 12.38% |

| World | 10.91% |

| Emerging Markets | 8.5% |

| Gold | 12.07% |

Data since QLTEVF inception in Mar 2006. Past performance may or may not be sustained in the future. The performance to be read in conjunction with the complete performance given below.

4) 15% - Strengthen your portfolio with an ESG fund: ESG stands for the environmental, social, and governance factors that has started playing a significant role in investment processes and decision-making. The true to label ESG Fund - Quantum India ESG Equity fund uses in-house proprietary ESG scoring metrics comprising of qualitative and quantitative parameters. We subjectively evaluate over 200 parameters and go beyond the desk to give a comprehensively researched portfolio.

|

|

|

|

|---|

In Conclusion...

“Successful investing is about managing risk, not avoiding it,” said Benjamin Graham (the father of value investing).

Also, what matters is your perseverance, financial discipline, and ‘time in the market’ while you endeavour to create wealth and accomplish the envisioned financial goals.

Markets will always be steered by both positive and negative events as they have in the past. Therefore, uncertainty will always be integral to the equity markets. It is how you manage the uncertainty by taking a calculated risk and devising a sensible approach that decides your investment success.

Happy Investing!

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Data as of February 28, 2022.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier 1 benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier 2 benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Fund is managed by Mr. Sorbh Gupta and Mr. Nilesh Shetty. Mr. Sorbh Gupta has been managing the fund since Dec 01, 2016. Mr. Nilesh Shetty has been managing the fund since Mar 28, 2011.

Click here to view other funds managed by them.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund (An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2022.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on February 28, 2022.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on February 28, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More