Tax Saving Fund An Addition To Your Portfolio

Posted On Wednesday, Nov 17, 2021

While managing our investments, we research & invest in different asset classes to create a robust portfolio. However, when it comes to tax saving, many of us rely on traditional instruments like NPS (National Pension Scheme), PPF (Public Provident Fund), Fixed Deposits, etc.

However, these come with a long lock-in period. A good tax-saving investment must be an investment first and a tax saver second. This is why investors have been increasingly preferring ELSS schemes to other options.

ELSS tax saving funds offer the dual benefit of tax exemption and wealth accumulation with a potential to outperform other tax saving options u/s 80 C over the long term.

What is an ELSS tax-saving mutual fund? ✓ An Equity Linked Saving Scheme (ELSS) is an open-ended tax-saving equity mutual fund that invests at least 80% of the scheme’s assets in equities and equity-related products. ✓ ELSS funds offer a tax deduction of up to Rs 150,000 under Section 80C of the Income Tax Act and come with a lock-in of 3 years, the lowest among the category of tax-saving investments. |

Why QTSF has the Edge Over Other Tax Saving Options?

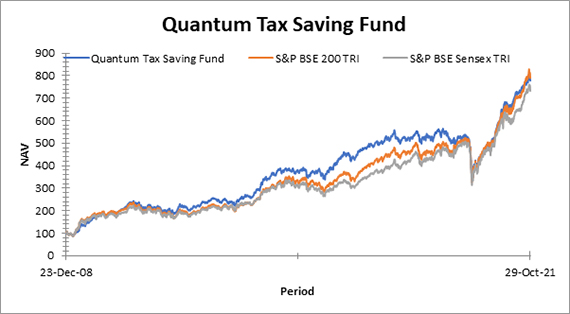

If you are looking for a sensibly valued portfolio offering with potential to outperform other tax saving options over the long term, you can add Quantum Tax Saving Fund to complement your Equity Portfolio. Quantum Tax Saving Fund helps to minimize the downside risk by adopting value investing style and gives you the potential to achieve your long-term goals, such as your child’s education or a dream retirement.

The Scheme has the potential to generate risk-adjusted returns over the long term and reduce downside risk across market cycles.

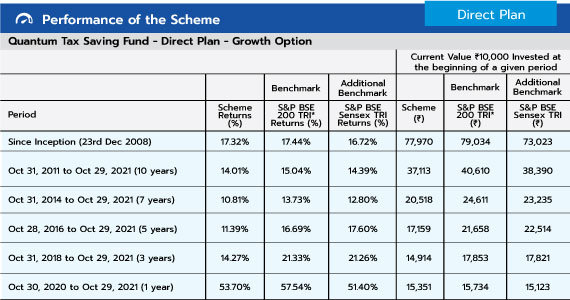

View our performance as on October 29, 2021

Past performance may or may not be sustained in the future.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

*with effect from February 01, 2020 benchmark has been changed from S&P Sensex TRI to S&P BSE 200 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

Mr. Sorbh Gupta has been managing the fund since Dec 23, 2008. Click here to view other funds managed by him.

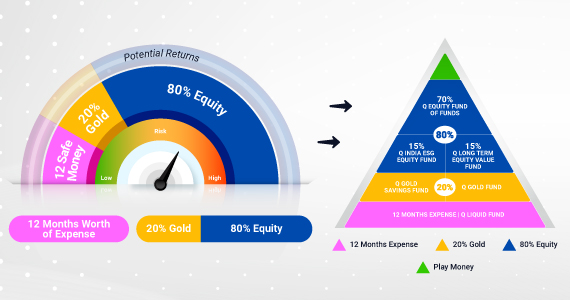

How Much to Allocate?

Your Quantum Tax Saving Fund forms a part of your equity allocation and any additional fund that you consider needs to be diversified in terms of investment style or theme.

70-15-15 Diversified Equity Allocation

Use our easy diversified equity allocation to simplify your equity fund selection.

Kindly note allocation to QTSF to be generally in the similar proportion as that of QLTEVF. Please note that the above suggested fund allocation only and is not to be considered as investment advice / recommendation, please seek independent professional advice, and arrive at an informed investment decision before making any investments.

• Invest up to 15% of your equity allocation or up to Rs. 1,50,000 of your allocation to a tax saving plan (whichever is higher). Thereafter, you can invest another 15% of your portfolio to the Quantum India ESG Equity Fund that incorporates Environmental, Social and Governance criteria in shortlisting companies, translating to long-term risk-adjusted returns.

• Invest the balance 70% in the Quantum Equity Fund of Funds. By doing so, your investment is diversified across 7-9 top-performing equity schemes that have been selected based on extensive qualitative-quantitative research and proven track record. We offer the convenience of getting this exposure through a single fund.

Read more on how this equity allocation forms a part of our overarching 12-20-80 Asset Allocation that incorporates assets of equity, debt and gold assets.

How to invest?

You have the flexibility to invest using an SIP (Systematic Investment Plan) or as a lump sum amount.

An SIP will free you from the need to time the market and offers a disciplined way to get ahead on your financial goals. Irrespective of the mode of investment, earn risk-adjusted returns over the long term with Quantum Tax Saving Fund.

Get ahead of your tax saving goals and complement your wealth creation goals with the Quantum Tax Saving Fund.

Watch this video on ELSS, where our fund manager Sorbh Gupta shares insights on how to select an ELSS mutual fund.

Product Labeling

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Benchmark |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Moderate Risk |  The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on Oct 31, 2021. |

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on October 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More