Add Value to Your Portfolio with This Tax Saving Fund

Posted On Tuesday, Jan 18, 2022

Today the dynamic market movements have made more and more investors understand the potential of equity investment to reach their financial goals, choosing ELSS funds for tax saving has become one of the preferred route. As ELSS funds are market-linked instruments, they allow investors to save tax and also helps to create long-term wealth. However, not choosing the right ELSS fund can have a detrimental effect on your portfolio performance.

The differentiator

The two main reasons one would choose an ELSS over other traditional tax saving options such as FD, PPF and NPS, etc. are:

• Shortest lock-in period

• Potential to earn market-linked returns

However, you need to be well-aware of 2 important points before choosing a right ELSS.

- Returns under ELSS, just like any other Equity Mutual Fund, are not guaranteed.

Since you are parking your money with a 3-year lock-in period, you need to carefully analyze and weigh on options that can lower impact of a downturn.

The Solution to Grow Your Wealth

1. Choose an equity scheme that has a low portfolio turnover ratio:

All you need is a fund that not only has the potential to deliver risk-adjusted returns but, more importantly, has a low portfolio turnover ratio. This means that your fund manager has a long-term approach towards the stocks in the fund since you will also be investing for a minimum of 3-years.

Choosing a Low Portfolio Turnover ratio

The portfolio churning is reduced if stocks are held over a longer period. This in turn, means such a fund will have a low expense ratio owing to low transaction costs. If the portfolio turnover is high, it indicates high transaction or trading costs and therefore impacts the returns for the investor.

Low portfolio turnover also indicates the fund manager’s ability to gauge the potential of the stock over the long term. It signifies the confidence; the fund manager has in his stock-picking ability.

One such fund with a low portfolio turnover ratio is Quantum Tax Saving Fund (QTSF).

As per the latest factsheet data, the portfolio turnover ratio of QTSF for December 2021 is as low as 8.41%. Generally, anything less than 30% is considered to be low. As a result, QTSF has one of the lowest turnover ratios in the ELSS segment.

2. Choose a well-researched and diversified portfolio:

Quantum Tax Saving Fund consists of a well-balanced portfolio - typically 25 to 40 stocks, across various sectors. The value-driven approach ensures a disciplined research process. The weights assigned to a stock in a value-based fund aim at the stock quality.

Weights assigned to the stocks in QTSF are a function of:

1. Reliability of management

2. Quality of earnings

3. Stability of earnings

4. Upside potential

5. Alternative/Cash

3. Finally, choose a fund that has potential to mitigate downside risk:

Launched in December 2008, Quantum Tax Saving Fund follows the value-based strategy and hence invests in quality stocks for the long term. The fund manager carefully selects quality companies and management that have over time proven their mettle at the stock market.

At the beginning of the pandemic, when markets saw a huge correction in February and March 2020, the fund added high-quality stocks in its portfolio which were then available at reasonable valuations. They look comfortable after the stress test and have a strong balance sheet or strong parentage to last the downturn. This becomes pertinent when markets are facing sharp swings and a low PE value fund could be your answer for long-term wealth building!

As Warren Buffet rightly said “In the short run, the market is a voting machine, but in the long run, it is a weighing machine”

Investment in QTSF further makes sense for wealth creators as it has a lock-in period of 3 years. The lock-in period ensures an enforced discipline amongst the investors. Therefore, units issued under the fund cannot be redeemed until the expiry of 3 years from the date of their allotment. However, this does not mean you should redeem once your lock-in period ends. Ideally, investors need to stay invested for 5 years or longer.

What should you do?

Look no further, this year for your tax saving and wealth building needs, choose Quantum Tax Saving Fund. Save tax under section 80 C and aim for the long-term growth of your portfolio.

How Can You Start Investing in QTSF?

A good tax saving fund is an investment first and a tax saving scheme second. And since ELSS is an equity investment, like other equity mutual funds, it should help you achieve your long-term goals. So, you can get a head start to plan your equity investments and earn tax benefits in the process.

As specified in the benefits, Quantum Tax Saving Fund follows the value style of investment. Therefore, any additional equity fund that you consider needs to be diversified in term of investment style or theme.

You may invest up to 15% of your equity allocation or up to Rs. 1,50,000 to a tax saving scheme (whichever is higher) to be eligible for tax savings up to Rs.46,800, provided you are under the highest tax bracket.

So, what about the rest of the Equity Allocation?

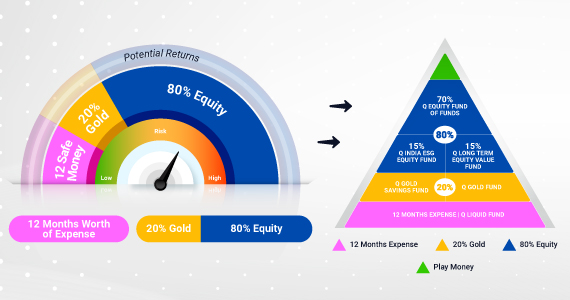

Use Quantum’s tried and tested 12-20-80 Asset Allocation Strategy to see how to build your portfolio with Equity, Debt and Gold.

Kindly note allocation to QTSF to be generally in a similar proportion as that of QLTEVF.

**Please note that the above is a suggested fund allocation and not to be considered as an investment advice/recommendation

Asset Allocation Strategy Building Blocks

1. Foundation Block: Emergency funds should be at the foundation of your portfolio. Set aside safe money worth 12 months of expenses in Quantum Liquid Fund that helps you prepare for emergencies and offers you the option to liquidate (up to Rs.50K) whenever you need.

2. Risk Reducing Block: You can capitalize on Gold’s risk-reducing characteristics and allocate 20% of your portfolio to the yellow metal. Though Gold prices have corrected from the highs touched in 2020, you can use the correction to build your allocation to gold.

3. Equity Block: Diversify the balance 80% across an equity bucket that is market cap, sector, or style agnostic.

| Sr. No | Fund | Allocation | Benefit |

| Equity Fund 1 | Quantum Equity Fund of Funds | 70% | 1 Fund = 5-10 well researched performing Equity schemes |

| Equity Fund 2 | Quantum India ESG Fund | 15% | Shortlists funds based on environmental, social and governance parameters |

| Equity Fund 3 | Quantum Tax Saving Fund or Quantum Long Term Equity Value Fund | 15% | Follows value style lowering downside risks and helps achieve long term goals |

Please note that the above is a suggested fund allocation and not to be considered as an investment advice/recommendation.

Now that you know the right ways to select an ELSS fund, get a head start to your tax saving needs with the Quantum Tax Saving Fund by investing as low as Rs 500 a month.

Watch this video on ELSS, where our fund manager Sorbh Gupta shares insights on how to select an ELSS mutual fund.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on January 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More